MSME Certificate: MSME is an abbreviation for Micro, Small and Medium Enterprises. In countries such as India, it is crucial for economic growth and development. Hence, the MSME act was introduced to support these small scale businesses. On registration of such businesses, an MSME Certificate is provided; this certificate is officially called the Udyam Certificate. Though the Indian Government has not made it mandatory for such businesses to register, it is quite beneficial for the business in terms of taxation, loans and credit facilities.

Registration can be done entirely online, on the official government portal – udyam registration.gov.in. The Aadhar card is the only prerequisite to applying for an MSME certificate. However, PAN and GSTIN numbers will have to be updated before Jan-04-2021. Details such as GST and PAN are automatically retrieved from government databases on registration. Furthermore, the registration process and the portal is completely integrated with the Income Tax and GSTIN databases.

Students can find more about Certificates, explore the types used for academic purposes, professional purposes and more.

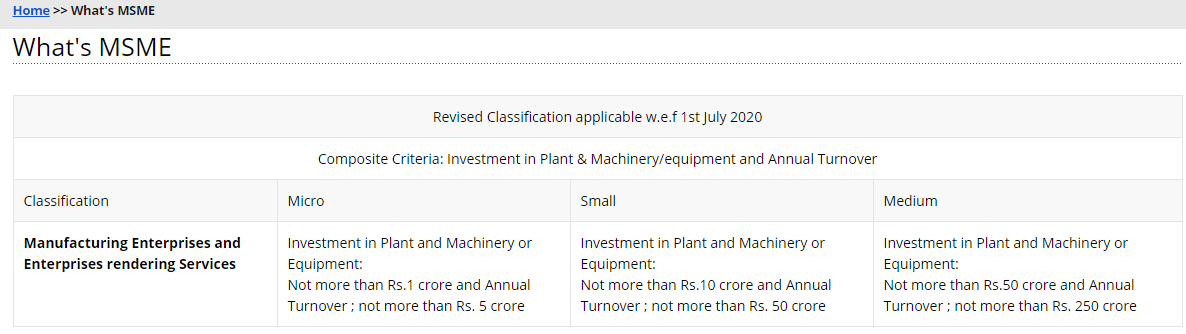

The following table classifies the type of business based on annual turnover and investment.

| MSME Classification (Revised) | |||

| Micro | Small | Medium | |

| Investment | INR 1 crore | INR 10 crore | INR 50 crore |

| Annual Turnover | INR 5 crore | INR 50 crore | INR 250 crore |

MSME Certificate Registration Process

New businesses can register themselves with the government to avail benefits. The registration process is online and is done on udyamregistration.gov.in. On successful registration, the business will be issued an MSME Certification (Udyam registration).

Prerequisites: Aadhar card, PAN card and GSTIN number

(Note: That applicants can register without PAN and GSTIN number, but they will have to update this information before 1/04/2021. Failure to do so might result in the suspension of the registration.)

Registration Process (If the applicant has a PAN card)

- Applicants must visit the udyamregistration.gov.in. and click on the link named “FOR NEW ENTREPRENEURS WHO ARE NOT REGISTERED AS MSME”.

- Doing so will lead the applicants to a new page where they will be required to enter their name and Aadhar number.

- Next, applicants will be asked to verify their details through an OTP, which will be sent to their registered mobile number.

- Once the OTP is entered, the PAN card detail page opens and it auto-populates the fields. The applicants will have to fill the ITR details.

- Fill any pending information on this page

- The applicant will then receive a message which states that the registration has been done through their PAN

- After verification of PAN, the applicant will be shown the Udyam Registration Window. Details of the plant/ industry will have to be filled in this window.

- Once all the details are provided, click the “Submit and get Final OTP” button.

- Applicants will be shown the status of their registration with a reference

number. - After verification, their MSME Certificate / Udyam Registration Certificate will be issued.

Registration Process (If the applicant does NOT have a PAN card)

The registration process is almost identical to the one stated above. However, when the page that asks if they possess a PAN card, the applicant is supposed to select the “NO” option. All the other processes and steps will be exactly the same as registration with PAN. Applicants can successfully register their business on the portal without their PAN or GSTIN number. However, they will have to update their PAN and GSTIN on the portal before 1/04/2021 to avoid suspension of their registration.

Registration Process (If the applicant already has EM-II or UAM)

- If the applicant possesses any of these two types of certificates, then they will have to select “FOR THOSE HAVING REGISTRATION AS EM-II or UAM” on the homepage of the registration portal.

- The applicant will then be taken to the page where they will have to enter their UDYOG Aadhar number and select the OTP option

- Applicants may also obtain OTP on email (as filled in UAM)

- After choosing the OTP options, applicants must select “Validate and Generate OTP”.

- Entering the OTP, their registration details are to be filled.

- The final step would be to submit these details and the applicant will be issued an MSME certificate after verification.

What are the Benefits of an MSME Registration

As stated before, it is not compulsory for MSME to be registered as per the MSME Act. However, it provides a host of benefits that may help the business to flourish and grow. Some of these benefits include:

- Cheaper bank loans – usually between 1% to 1.5% interest rates

- Easy accessibility to government tenders as the registration is integrated with Government e-Marketplace and other government portals from various states

- Introduces many concessions and rebates with respect to patents and setting up industries

- Provides the provision for minimum alternate tax (MAT) to be carried forward for up to 15 years instead of the standard 10 years

FAQ’s on MSME Certificate

Question 1.

What is an MSME Certificate?

Answer:

An MSME certificate is a certificate issued to micro, small and medium scale businesses on registration with the udyamregistration.gov.in. portal.

Question 2.

What are the documents required for registration?

Answer:

Applicants can register their businesses using only their Aadhar card. However, PAN cards and their GSTIN number are also required, but this is not needed at the time of initial registration. They will have to update these details in the portal before 1/04/2021 to avoid cancellation of the registration.

Question 3.

Is it compulsory for me to register my business? What are the benefits of having an MSME certificate?

Answer:

It is not compulsory, registering will be very beneficial for the business. Businesses will receive many financial and government aids to grow. For instance, businesses will have access to bank loans with very low-interest rates. Other benefits include easy access to government tenders. It also introduces many concessions and rebates on expenses that are involved in setting up and running a business.

Question 4.

Can an existing business apply?

Answer:

Yes, existing businesses can apply, provided their EM-II or UAM registration details will have to be provided.

Question 5.

Does the MSME certificate have an expiry date?

Answer:

No, these certificates do not have any expiration date.