ISC Economics Previous Year Question Paper 2017 Solved for Class 12

Maximum Marks: 80

Time allowed: 3 hours

- Candidates are allowed additional 15 minutes for only reading the paper.

- They must NOT start writing during this time.

- Answer Question 1 (Compulsory) from Part I and five questions from Part II.

- The intended marks for questions or parts of questions are given in brackets [ ].

Part – I (20 Marks)

Answer all questions.

Question 1.

Answer briefly each of the following questions (i) to (x): [10 × 2]

(i) What is meant by ex-ante demand and ex-post demand?

(ii) What is the short-run production function? Explain how is short-run production function different from the long-run production function.

(iii) Explain one main feature of each:

(a) Monopsony market.

(b) Monopoly market.

(iv) How is the elasticity of supply different from supply of a commodity?

(v) What is a direct tax?

(vi) Give two differences between a time deposit and demand deposit.

(vii) Explain with the help of an example, the problem of double-counting while calculating national income.

(viii) Give a reason for each of the following:

(a) The demand for a good increase when the income of the consumer increases.

(b) X and Y are substitute goods. A rise in the price of X results in the rightward shift of the demand curve of Y.

(ix) Write any two differences between the balance of trade and balance of payment.

(x) Explain the shape of the MC curve.

Answer:

(i) Ex-ante and Ex post Demand: Ex ante demand refers to the number of goods that consumers want to or willing to buy during a particular time period. It is the planned or desired amount of demand. Ex post demand, on the other hand, refers to the amount of the goods that the consumers actually purchase during a specific period. It is the number of goods actually bought. The number of goods actually bought is not the same as the amount that the consumers want (desire) to purchase. If the commodity is not available in adequate quantity, the quantity actually purchased (ex-post demand) will be less than the quantity that the consumers desire to purchase (ex-ante demand). Thus, consumers may end up buying more, or lesser quantity of goods that they had planned to buy.

(ii) Short-run is a period of time when production can be increased only by increasing the application of variable factor(s). Fixed factor, by definition, remains constant.

When one factor is a fixed factor and the other is a variable factor, production function may be specified as under:

Qx = f(L, K)

Here, Qx = Output of Good – X

L = Labour, a variable factor

K = Capital, a fixed factor

Difference:

1. Short run production function is ‘variable proportions type production function’ while the long period production function is ‘constant proportions type production function’.

2. Short run production function exhibits constant scale of output, while long run production function exhibits change in the scale of output.

(iii) (a) Single Buyer: Monoposony is a market structure where there is only one buyer of a commodity, service or input. It is a case of only one firm purchasing the entire product or factor service.

(b) Single Seller: Monopoly is a market situation where there is only one seller or producer, called monopolist of a commodity. It is a case of one firm or producer controlling the supply of the product. Since there is only one seller, any change in the amount of output produced by the monopolist would have significant influence over the market price. Because there is only one firm in monopoly, therefore the difference between the firm and the industry disappears.

(iv) Supply refers to the quantity of a commodity that a seller is willing to sell corresponding to a given price, at a given point of time. On the other hand, elasticity of supply measures the degree of responsiveness of the quantity supplied of a commodity to a change in its price. It measures the sensitivity of the quantity supplied to a change in the price.

(v) Direct taxes refer to taxes that are imposed on property and income of individuals and companies and are paid directly by them to the government.

- They are imposed on individuals and companies.

- The ‘liability to pay’ the tax (i.e. impact) and ‘actual burden’ of the tax (i.e, incidence) lie on the same person, i.e. its burden cannot be shifted to others.

- They directly affect the income level and purchasing power of people and help to change the level of aggregate demand in the economy.

- Examples: Income tax, Corporate tax, Interest tax, Wealth tax, Death duty, Capital gains tax, etc.

(vi) Demand deposits and time deposits:

- Demand deposits can be withdrawn at any time, whereas the time deposits can be with-drawn only after the expiry of a specific period.

- There is no interest rate on demand deposits, whereas the time deposits carry a higher interest rate.

- Demand deposits are chequeable and can be withdrawn through cheques, whereas time deposits are not chequeable.

(vii) To calculate national income overall value of goods and services produced by the country is taken into account. However, this method suffers from ‘double counting’, since the output of a production unit can be the input for another unit, it leads to double counting of a single variable. Only final goods are included when measuring national income. If intermediate goods were included too, this would lead to double counting; for example, the value of the tires would be counted once when they are sold to the car manufacturer, and again when the car is sold to the consumer. .

(viii) (a) The income of the consumer determines the purchasing power of the consumer. There is a direct relationship between the income of the consumer and his demand for a product. The demand for good increases when the income of the consumer increases because purchasing power of the consumer increases. Now he has more income to spend on different goods and services.

(b) X and Y are substitute goods. A rise in the price of X result in a rightward shift of the demand curve of Y because substitute goods are those goods which satisfy the same type of need and hence can be used in place of one another to satisfy the given want. If price of good X rise, the consumer will shift his demand from X to Y good because they can be used in place of one another.

(ix)

| Balance of Trade (BOT) | Balance of Payment (BOP) |

| 1. Balance of Trade refers to the difference between amounts of exports and imports of visible items. | 1. It is an accounting statement that provides a systematic record of all economic transactions, between residents of a country and the rest of the world in a given period of time. |

| 2. BOT includes only visible items. | 2. BOP includes visible items, invisible items, unilateral transfers and capital transfers. |

| 3. It does not record any transactions of capital nature. | 3. It records all transactions of capital nature. |

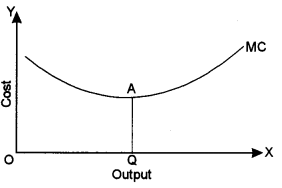

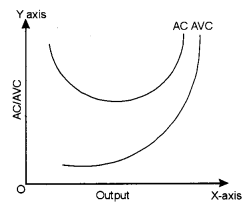

(x) MC curve is U-shaped. As output increases, MC curve slopes downward (up to OQ units), reaches the minimum (at point A) and then starts sloping upward beyond OQ level of output. (See Fig.) The U-shape of MC curve is because of the law of ( variable proportions. It is negatively sloped in the initial stage of production due to increasing returns to the variable factor and is positively sloped thereafter due to decreasing returns to the variable factor.

Part-II (60 Marks)

Answer any five questions.

Question 2.

(a) Explain with the help of a diagram the relationship between total utility and marginal utility. (3)

(b) Find the elasticity of demand of x and y on the basis of the demand schedule given below and specify which one is more elastic: (3)

| Good x | Good y | ||

| Px(₹) | Dx (units) | Py(₹) | Dy (units) |

| 8 | 10 | 8 | 10 |

| 4 | 12 | 6 | 25 |

(c) Explain any four reasons for the demand curve to be downward sloping. (6)

Answers:

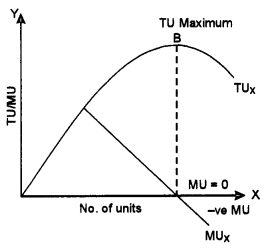

(a) (i) Total utility increases with an increase in consumption as long as MU is positive.

(ii) When TU reaches its maximum, MU becomes zero. This is known as point of satiety.

(iii) When consumption is increased beyond the point of satiety, TU starts falling as MU become negative.

(iv) MU curve has a negative slope, while TU curve has a positive slope upto point ‘B’.

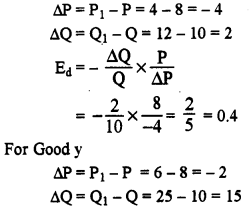

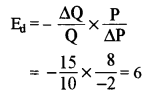

(b) For Good x

Elasticity of Demand in case of Good y is more elastic.

(c) Reasons for downward sloping demand curve:

- Law of Diminishing Marginal Utility: According to this law, as consumption of a commodity increases, marginal utility of each successive unit goes on diminishing to a consumer. Accordingly, for every additional unit to be purchased, the consumer is willing to pay less and less price.

- Income Effect: Income effect refers to change in quantity demanded when real income of the buyer changes owing to change in price of the commodity. With a fall in price, real income increases. Accordingly, demand for the commodity expands.

- Substitution Effect: Substitution effect refers to substitution of one commodity for the other when it becomes relatively cheaper. Thus, when own price of commodity-X falls, it becomes cheaper in relation to commodity-Y. Accordingly, X is substituted for Y. Tea and coffee are substitutes. With a fall in the price of tea, it is substituted in place of coffee. It is expansion of demand due to the substitution effect.

- Size of Consumer Group: When price of a commodity falls, many more buyers can afford to buy it. Accordingly, demand expands.

- Different Uses: A good may have several uses. Milk, for example, is used for making curd, cheese and butter. If the price of milk reduces it will be put to different uses. Accordingly, the demand for milk expands.

Question 3.

(a) The difference between AC curve and AVC curve decreases with increase in output but the two curves never touch each other. Justify the statement with the help of a diagram. [3]

(b) Explain any two characteristics of an indifference curve. [3]

(c) Discuss producer’s equilibrium in perfect competition, using MR and MC approach. [6]

Answers:

(a) The distance between the average total cost curve and the average variable cost curve gets smaller as production t increases. ATC curve is far above the AVC curve at early levels of output because the average fixed cost is a high percentage of the average total cost. But ATC curve tends o to come closer to AVC at higher levels of output because § the average fixed cost accounts for a relatively small percentage of the average total cost now. Notice that ATC curve never touches AVC curve because the average fixed cost is always positive. Thus, the distance between the 0 ATC curve and the AVC curve gets smaller as the level of output increases.

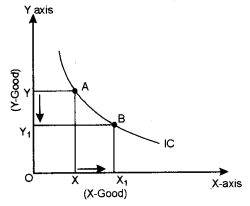

(b) (i) An indifference curve (IC) always slopes downward: This characteristic implies that to increase the consumption of X-good, the consumer has to reduce the consumption of Y-good, so as to remain at the same level of satisfaction as shown in i the given diagram:

To increase the quantity of ‘X’ good from OX to OX1 the consumer has to reduce quantity of good ‘Y’ from OY to OY1.

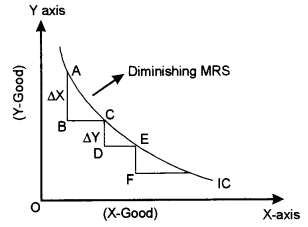

(ii) Indifference curves are convex to the origin: This property is based on the principle of diminishing marginal rate of substitution. It implies that as the consumer substitutes X for Y, the marginal rate of substitution between them goes on diminishing as shown in the following figure.

AB > CD > EF or Diminishing MRS

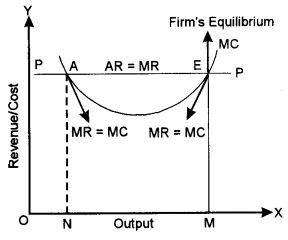

(c) In order to know the position of maximum profit, a firm compares the marginal cost with marginal revenue. So, the first condition of a firm’s equilibrium is that marginal cost must be equal to marginal revenue (MC = MR). It is necessary, but not sufficient condition of equilibrium. A firm may not get maximum profit even when its marginal cost is equal to marginal revenue. So, it must fulfil the second condition of equilibrium as well, i.e., marginal cost curve must cut marginal revenue curve from below or the slope of MC curve must be steeper than the slope of MR curve. According to marginal analysis, a firm would, therefore, be in equilibrium when the following two conditions are fulfilled:

1. MC = MR.

2. MC curve cuts the MR curve from below.

Both these conditions of firm’s equilibrium are explained with the help of Fig. In this figure, PP is average revenue (price per unit) as well as marginal Q revenue curve. It is clear from this figure, that MC curve is cutting MR curve PP at two points ‘A’ and a; ‘E’. Point A cannot indicate the position of equilibrium of the firm as at point A marginal cost of the firm is still falling or we can say MC is not cutting MR from below.

On the other hand, point E shows that firm is producing OM units of output. If the firm produces more than OM units of output, its marginal cost (MC) will exceed marginal revenue (MR) and it will have to incur losses. Thus, point ‘E’ will represent the equilibrium of the firm. At this point, both the conditions of equilibrium are being fulfilled:

(1) Marginal cost is equal to marginal revenue (MC = MR) and

(2) The marginal cost curve is cutting the marginal revenue curve from below. At point ‘E’ i.e., equilibrium position, firm is getting maximum profit. In case, the firm produces more or less than OM output, then its profits will be less than the maximum. So the firm, at OM level of output, will have no tendency either to increase or decrease its output from this level. It will, therefore, be in equilibrium at point E.

Question 4.

(a) Fill the blank in the table given below: [3]

| No.of Workers | T.P. | A.P. | M.P. |

| 1 | — | 150 | — |

| 2 | 230 | — | — |

| 3 | — | — | 120 |

(b) What is meant by floor price? Explain its impact on producers. [3]

(c) Explain any four features of an oligopoly market. [6]

Answers:

(a)

| No.of Workers | T.P. | A.P. | M.P. |

| 1 | 150 | 150 | 150 |

| 2 | 230 | 115 | 80 |

| 3 | 350 | 116.67 | 120 |

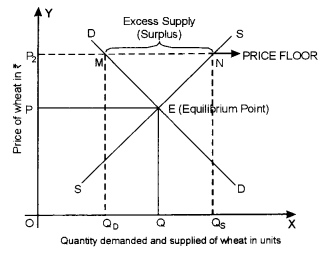

(b) Government intervenes in the process of price determination through Price Floor. Price Floor refers to the minimum price (above the equilibrium price), fixed by the government, which the producers must be paid for their produce.

- Many a time government feels that the price fixed by the market forces of demand and supply is not remunerative from the producer’s point of view, then it fixes a price (known as price floor) which is more than the equilibrium price.

- The minimum support price is one of the examples of a price ceiling.

- Indian Government maintains a variety of price support programmes for various agricultural products like wheat, sugar cane etc. and the floor is normally set at a level higher than the market-determined price for these goods.

As seen in the diagram, equilibrium is determined at point E when demand curve DD and supply curve SS of wheat intersect each other. The equilibrium price of OP is determined. - Suppose, to protect the producer’s interest and to provide an incentive for further production, , government declares OP2 as the minimum price (known as Price Floor) which is more than the equilibrium price of OP.

- The higher price lures the producers to produce more. This helps the government to maintain a buffer stock for exports.

(c) The principal features of oligopoly are as under:

(1) Small Number of Big Firms: Oligopoly market is the one in which a small number of big firms dominate the market for a product. Market dominance is retained through intense advertising. Advertising generates brand loyalty. Established brand loyalty enables the producer to exercise partial control over price. It makes demand for the product as relatively less elastic. Accordingly, firms are able to generate extra-normal profits.

(2) Difficult to Trace Firm’s Demand Curve: It is not possible to determine firm’s demand curve under oligopoly. This is because of high degree of interdependence among the competing firms. Thus, when a firm lowers its price, demand for its product may not increase, because the rival firms may lower the price more, because of which the buyers shift to the rival firms. Implying that there is no specific response of quantity demand to change in price. This makes it impossible to draw any specific demand curve for a firm under oligopoly.

(3) Entry Barriers: There are barriers to the entry of new firms. These are created largely through patent rights. Because of these barriers, the existing firms are not much worried about the entry of new firms in the market. They continue to earn extra-normal profits even in the long run.

(4) Non-price Competition: Under oligopoly, firms tend to avoid price competition. Instead, they focus on non-price competition. Example: In India, both Coke and Pepsi sell their product at the same price. But, in order to increase its share of the market, each firm takes to the aggressive non-price competition. Coke and Pepsi sponsor different games and sports; they also offer lucrative schemes (like of maintenance of school garden) if their product is patronised.

Question 5.

(a) Explain two causes of increasing returns to a factor. [3]

(b) Differentiate between real cost and money cost with the help of examples. [3]

(c) Discuss four determinants of supply of a commodity. [6]

Answers:

(a) Increasing returns to a factor occur because of the following factors:

1. Fuller Utilisation of the Fixed Factor: In the initial stages, fixed factor (such as machine) remains underutilised. Its fuller utilisation calls for greater application of the variable factor (Labour). Hence, initially (so long as fixed factor remains underutilised) additional units of the variable factor add more and more to total output, or marginal product of the variable factor tends to increase.

2. Division of Labour and Increase in Efficiency: Additional application of the variable factor (Labour) enables process based division of labour. Specialised workers may be used for different processes of production. This increases efficiency or productivity of the variable factor. Accordingly, marginal productivity tends to rise.

3. Better Coordination between the Factors: So long as fixed factor remains underutilised, an additional application of the variable factor tends to improve the degree of coordination between the fixed and variable factors. As a result, marginal product (MP) increases and total product (TP) increases at the increasing rate.

(b)

| Real Cost | Money Cost |

| 1. Real cost refers to the efforts and sacrifices made by the owners of factors of production used in the production of a commodity. | 1. Money cost refers to money expenses which the firm has to incur in purchasing or hiring the factor services. |

| 2. It includes the pain, sacrifice, discomfort and disutility involved in providing factor services required to produce a commodity. | 2. These expenses include the money expenditures of a firm on wages and salaries paid to labour, payment of interest on borrowings, rental payments, payment for raw material. |

| 3. The concept of real cost has no practical significance because it is a subjective concept that makes it difficult to estimate real cost. | 3. Accounting books of a firm record these actual money expenses made by the firm on the factors of production as the cost of production. |

(c) (i) Price of the Commodity: There is a direct relationship between price of a commodity and its supply. Generally, higher the price, higher the quantity supplied, and lower the price, lower the quantity supplied.

(ii) Price of Related Goods: The supply of a good depends upon the price of related goods. For example: Consider a firm selling tea. If price of coffee rises in the market, the firm will be willing to sell less tea at its existing price. Or, it will be willing to sell the same quantity only at a higher price.

(iii) Number of Firms: Market supply of a commodity depends upon number of firms in the market. If there is increase in the number of firms market supply will increase and if the number of firms decreases market supply will fall.

(iv) Goal of the Firm: If goal of the firm is to maximise profits, more quantity of the commodity will be offered at a higher price. On the other hand, if goal of the firm is to maximise sales (or maximise output or employment) more will be supplied even at the same price.

Question 6.

(a) Explain how fiscal policy measures can be used to reduce excess demand in an economy. [3]

(b) Define marginal propensity to consume. How is it different from marginal propensity to save? [3]

(c) Explain how equilibrium level of income can be determined with the help of aggregate demand curve and aggregate supply curve. [6]

Answer:

(a) Excess demand refers to a situation in which aggregate demand exceeds aggregate supply corresponding to fall employment. The two fiscal measures to reduce excess demand are as follows:

(i) Government Expenditure: It is the principal component of fiscal policy. When there is excess demand government expenditure on public works, education, defence, maintenance of law and order should be reduced. A reduction by government will reduce pressure on aggregate demand and which will shift downward.

(ii) Increase in taxes: The Government should levy new taxes and enhance the rate of the existing ones. This will reduce disposable income of the people and hence reduction in aggregate demand.

(iii) Public Borrowing/Public Debt: By borrowing from the public, the government creates public debt. When there is a situation of excess demand (or when AD needs to be reduced), the government steps up public borrowing by offering attractive rate of interest. This reduces liquidity with the people. Accordingly, aggregate expenditure also reduces.

(b) Marginal Propensity to Consume refers to the ratio of change in consumption to change in income.

Symbolically,

\(\mathrm{MPC}=\frac{\Delta \mathrm{C}}{\Delta \mathrm{Y}}\)

where ΔC refers to change in total consumption

ΔY refers to change in income.

Marginal Propensity to Save, on the other hand, is the ratio of the change in total desired saving to change in total income.

Symbolically,

\(\mathrm{MPC}=\frac{\Delta \mathrm{S}}{\Delta \mathrm{Y}}\)

where ΔS refers to change in total desired saving

ΔY refers to a change in income.

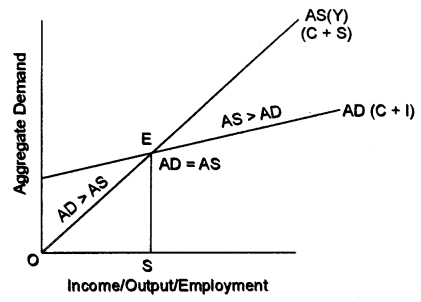

(c) According to the modern theory of income and employment determination, in any economy at any given time, income and employment are determined at that level where aggregate demand is equal to aggregate supply.

AD = AS

(i) In the given figure AS represents Aggregate Supply Curve. It forms 45 0 angles, signifying that each point on it expresses the equal value of income and receipts whereas AD represents Aggregate Demand.

(ii) Both i.e., AD and AS intersect each other at point E which is known as the equilibrium point.

(iii) Point E shows that in eqbm. position level of employment/output/income is OQ and expected receipts are OP.

(iv) When AD > AS

Now suppose the economy is operating at any point before (left of) the equilibrium point.

As the planned spending (AD) is more than planned output (AS) this means consumers and firms together would be buying more goods than the firms are willing to produce.

As a result, the planned inventory would Ml below the desired level.

Firms would be induced to increase production which will lead to an increase in the level of employment/output/income.

The firms will keep on increasing production till AD=AS.

(v) When AS > AD

Under such a situation the economy will be operating beyond E.

As the planned spending is less than planned output (AS) this means consumers and firms together would be buying fewer goods than the firms are willing to produce.

As a result, the planned inventory would rise.

Finns would be induced to decrease production which will lead to decrease in the level of emploxtnentOutput/income.

The firms will keep on decreasing production until AD = AS.

Question 7.

(a) What is meant by budget of tire government ? Give two differences between revenue expenditure and capital expenditure. [3]

(b) Discuss the following methods of debt redemption: [3]

(i) Refunding

(ii) Debt conversion

(c) Explain four measures fo correct disequilibrium in the balance of payment. [6]

Answer:

(a) Budget is a statement of expected receipts and expenditue of the governmentover the period of financial year(i.e, April 1st to 31st March).

| Basis | Revenue Expenditure | Capital Expenditure |

| Meaning | Revenue expenditure neither creates any asset nor reduces any liability of the government. | Capital expenditure either creates an asset or reduces the liability of the government. |

| Purpose | It is incurred for normal running of government departments and provision of various services. | It is incurred mainly for acquisition of assets and granting of loans and advances. |

| Nature | It is recurring in nature as such expenditure is spent by government on day-to-day activities. | It is non-recurring in nature. |

| Example | Salary, pension, interest etc. | Repayment of borrowings, expenditure on acquisition of capital asset, etc. |

(b) (i) Refunding: Refunding is the process by which the government raises new bonds to pay off the maturing bonds. Thus, the government takes a fresh loan to repay an old loan. In this case, the money burden of the debt is not liquidated but is postponed to some future date. Hence, the total burden of the debt continues to accumulate. Usually, this method is adopted when the government is not in a position to repay its outstanding loans at present.

(ii) Debt Conversion: Conversion of public debt means exchange of new debt for the old debt. In this method, the loan is actually not repaid, but the form of debt is changed. The process of conversion consists of converting a high-interest debt into a low-interest debt. The government might have borrowed at a time when the rate of interest was high. But if the market rate of interest falls, it may convert old high-interest loan into a new low-interest loan. The government is able to reduce the burden of debt thereby. This is possible only when the government enjoys good credit worthiness.

(c) A number of steps can be taken to solve the problem of deficits in the balance of payments. The main methods of correcting the adverse balance of payments are:

(i) Depreciation: Under the flexible exchange rate system, changes in the rate of exchange will automatically adjust the balance of payments. Depreciation of the country’s currency will wipe out deficits in the balance of payments. Depreciation of currency means rise in the price of foreign currency or, which is the same thing, fall in the price of domestic currency.

(ii) Devaluation: A country can devalue its currency to wipe out deficit in the balance of payments. This makes imports expensive to domestic consumers and its exports cheaper in foreign countries. If demand and supply elasticities are fairly high, this will definitely lead to a fall in imports and a rise in exports and thereby an elimination or reduction of balance of payments deficit.

(iii) Import Control: I reports may be kept in check through fhe adoption of a wide variety of import control measures such as quotas and tariffs. Quotas limit the volume of imports by applying quantitative restrictions. The government may for example, decide that only 90 per cent of last year’s volume of imports can be imported this year. The government may also increase the import duties or tariffs. This will raise the prices of imported goods and reduce imports. As a consequence, balance of payments deficit is reduced.

(iv) Production of Import Substitutes: Steps may be taken to encourage the production of import substitutes. This will save foreign exchange in the short- run by replacing the use of imports by their import substitutes. If the industries producing import substitutes develop ultimately because of various incentives provided to these industries, they may turn out to be export earners as well.

Question 8.

(a) What is meant by repo-rate and reverse repo-rate?

(b) Explain the following contingent functions of money

(i) Employment of factor inputs

(ii) Basis of the credit system.

(c) Discuss four qualitative measures of the Central Eiank to control credit in the economy. [6]

Answers:

(a) Repo rate, or repurchase rate, is the rate of interest at which RBI lends to the Commercial Banks for short periods against government bonds. This is done by RBI by buying government bonds from banks with an agreement to sell them back at a fixed rate. If RBI wants to make borrowing it more expensive, it increases the repo rate. Similarly, if RBI wants to make it cheaper for banks to borrow money from RBI, it reduces the repo rate.

Reverse repo rate is the rate of interest at which the RBI borrows from commerical banks for short period. This is done by selling government bonds to banks. Banks utilises the reverse repo rate facilities to deposit their short term excess funds with the RBI and earn interest on it.

(b) (i) Employment of Factor Inputs: Every producer aims at maximisation of his profits while employing various factors of production. A profit-maximising entrepreneur will equate marginal productivity (expressed in value terms) of a factor with its price (rate of remuneration). Since the rates of remuneration such as wage rate are expressed in money terms, it is money which helps the producer to arrive at decisions with regard to the units of a factor of production to be employed.

(ii) Basis of Credit System: Credit plays a crucial role in the modem credit system. In fact, commercial and business activities are highly dependent upon the credit system of a country. It is money which provides the basis of the entire credit system. Without the existence of money, important credit instruments like cheques, bills of exchange, etc. cannot be used.

(c) Qualitative methods of credit control aim at regulating and controlling the allocation of credit among various users rather than influencing the general availability of credit.

We discuss below the main selective credit control instruments:

(i) Margin Requirement: The margin requirement refers to the difference between the current value of the security offered for loan (called collateral) and the value of loan granted. Suppose, a person mortgages his house worth ₹ 1 crore with the bank for a loan of ₹ 80 lakh. The margin requirement in this case would be ₹ 20 lakh. The margin requirement is raised when the supply of credit needs to be curbed. The margin requirement is lowered when the supply of credit is to be increased. Often the margin requirement is kept high for speculative (trading) activities.

(ii) Rationing of Credit: Rationing of credit refers to fixation of credit quotas for different business activities. Rationing of credit is introduced when the flow of credit is to be checked particularly for speculative activities in the economy. The central bank fixes credit quota for different business activities. The commercial banks cannot exceed the quota limits while granting loans.

(iii) Moral Suasion: Sometimes, the central bank makes the member banks agree through persuasion (or pressure) to follow its directives. The member banks generally do not ignore the advice of the central bank. The banks are advised to restrict loans during inflation, and be liberal in lending during deflation.

(iv) Direct Action: Direct action refers to various directives issued by the central bank to commercial bank from time to time to regulate their lending and investment activities. The central banks in all countries pursue direct action against commercial banks. This policy may not be used against all banks, but against erring banks which do not follow the policies of the central bank. These direct actions may take the form of refusal of discounting facilities or refusal of loans from the central bank, charging of penal rate of interest, etc.

Question 9.

(a) Distinguish between real GDP and nominal GDP. Which of these is a better indicator of economic welfare and why? [3]

(b) Draw a diagram to show the circular flow of income in a two-sector model with leakage and injection. [3]

(c) Calculate GNP at FC from the following data by using income method and expenditure method: [6]

| Item | ₹ in crores |

| (i) Operating surplus | 600 |

| (ii) Exports | 30 |

| (iii) Imports | 60 |

| (iv) Private final consumption expenditure | 1000 |

| (v) Net indirect tax | 60 |

| (vi) Compensation of employees | 900 |

| (vii) Mixed-income of self-employed | 160 |

| (viii) Gross domestic capital formations | 330 |

| (ix) Depreciation | 30 |

| (x) Net factor income from abroad | -20 |

| (xi) Govt, final consumption expenditure | 450 |

Answers:

(a)

| National Income at Current Price (Nominal GDP) | National Income at Constant Price (Real GDP) |

| Under this, GDP is calculated at current prices prevailing in the market. For example, if we measure India’s National Income of 2011-12 at the same year’s prices then it is national income at the current price. | Under this, GDP is calculated at a base year price. For example, if we measure India’s National income of 2009-10 at 2001-2002 prices, then it is national income at a constant price. |

| This may give a misleading picture of economic growth of a country because an increase in National Income may be because of an increase in price rather than any physical output goods and services. | On the other hand, this gives true picture of economic growth of a country as it is affected by the change in only the physical quantities. |

| National Income at current price = P1 × Q1 Where P1 – Current Price and Q1 – Current Quantity |

National Income at Constant Price = P0 × Q1 Where P0 – Base Year Price Q1 – Current Quantity |

Real GDP is considered as an index of the welfare of the people. Welfare of the people is measured in terms of the availability of goods and services per person. Increase in real GDP means an increase in the level of output in the economy. Other things remaining constant, this means greater availability of goods per person. This leads to a higher level of welfare.

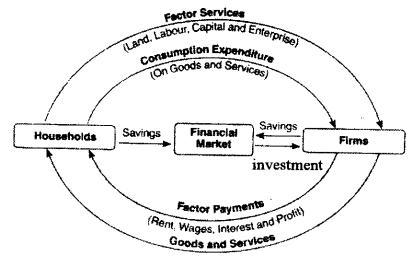

(b) The following diagram shows the circular flow of income in the two-sector model. Savings are leakages and investment is injection.

(c) Income Method:

GNPFC = Compensation of employees + Operating Surplus + Mixed incomes + Net factor income from abroad + Depreciation.

= 900 + 600 + 160 + (-20) + 30

= 1670

Expenditure Method:

GNPFC = Private final consumption expenditure + Govt, final consumption expenditure + Gross domestic capital formation + Net export (Export – Import) + Net factor income from abroad – Net Indirect tax

= 1000 + 450 + 330 + (30 – 60) + (-20) – 60

= 1670