ISC Economics Previous Year Question Paper 2015 Solved for Class 12

Maximum Marks: 80

Time allowed: 3 hours

- Candidates are allowed additional 15 minutes for only reading the paper.

- They must NOT start writing during this time.

- Answer Question 1 (Compulsory) from Part I and five questions from Part II.

- The intended marks for questions or parts of questions are given in brackets [ ].

Part – I (20 Marks)

Answer all questions.

Question 1.

Answer briefly each of the following questions (i) to (x): [10 × 2]

(i) Define marginal utility. When can it be negative?

(ii) What is meant by production function?

(iii) Name the market where average revenue is equal to marginal revenue. Give a reason for your answer.

(iv) Give one difference between accounting cost and opportunity cost.

(v) What is the reason for an indeterminate demand curve under Oligopoly?

(vi) What is meant by a propensity to consume?

(vii) Explain discounting bills of exchange as one of the functions of the banks.

(viii) Differentiate between revaluation of currency and appreciation of currency.

(ix) How can gross domestic product at factor cost be obtained from the gross national product at market price?

(x) What is meant by revenue deficit? Explain its implication.

Answer:

(i) Marginal utility is the net addition made to total utility by the consumption of an additional unit. Mun = Tun – Tun-1. when total utility is maximum, marginal utility is zero.

(ii) Production function studies the functional relationship between physical inputs and physical outputs.

(iii) Perfect Competition: Under perfect competition, AR or price remains fixed for the firm. So MR will also be constant. Hence AR = MR.

(iv) Accounting Cost: This is the actual, numeric dollar amount that a firm (company) pays to run their business.

Opportunity Cost: This is the cost of choosing one thing over another.

(v) The main reasons for the indeterminate price and output under oligopoly may be summarised as follows:

- Different Behaviour patterns: In oligopoly due to interdependence, a vast variety of behaviour patterns becomes possible.

- Indeterminate Demand Curve: Another cause of indeterminateness of price and output in an oligopoly is indeterminate demand curve.

(vi) The propensity to consume means the proportions of total income or of in increase an income that consumers tend to spend on goods and services rather than save.

(vii) Discounting of Bills of Exchange

Another important form of bank lending is through discounting or purchasing the bills of exchange. A bill of exchange is drawn by a creditor on the debtor specifying the amount of debt and also the date when it becomes payable. Such bills of exchange are normally issued for a period of 90 days. Thus, creditors cannot get it encashed from the debtors before the maturity period. However, if the creditor needs money before the maturity period (i.e., 90 days), he can get it discounted from the commercial bank. The bank makes payment to the creditor after deducting its commission. When the bill matures, the bank will get payment from the debtors.

(viii) Revaluation means a rise of domestic currency in relation to foreign currency in a fixed exchange rate whereas appreciation implies an increase in the external value of a currency.

Question 2.

(a) Discuss the relationship between the income of the consumer and demand for a commodity with respect to normal goods, inferior goods and necessities. [3]

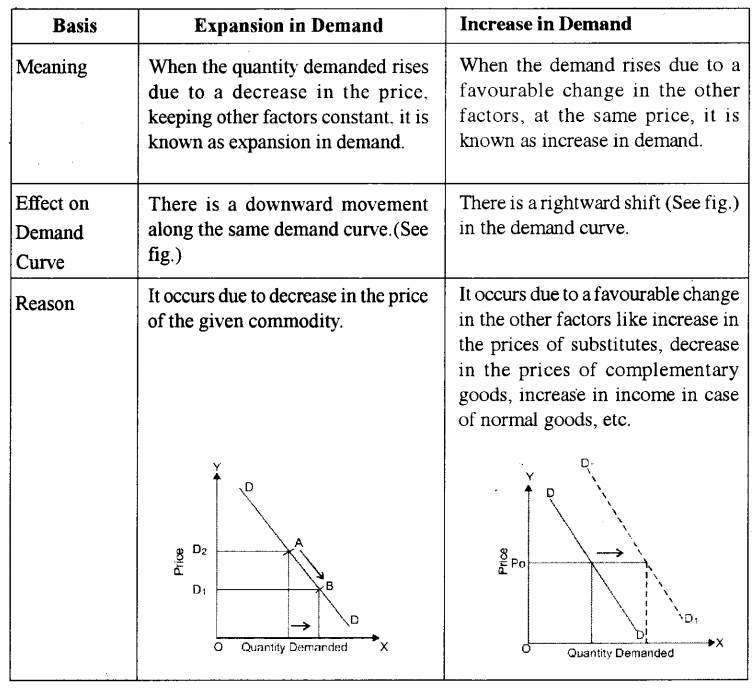

(b) Differentiate between the extension of demand and an increase in demand, using diagrams. [3]

(c) Explain with the help of a diagram the consumer’s equilibrium through utility approach. [6]

Answer:

(a) Normal good: Demand will increase and the demand curve will shift towards the right.

An inferior good: Demand will decrease and the demand curve will shift towards left.

(b)

(c) In the case of the consumer consumes two or more than two commodities his equilibrium will be determined by the Law of Equi-marginal utility.

According to the Law of Equi-marginal utility, the consumer spends his limited income on different goods in such a way that marginal utility derived by all commodities are equal.

MUX = MY = MUZ ………

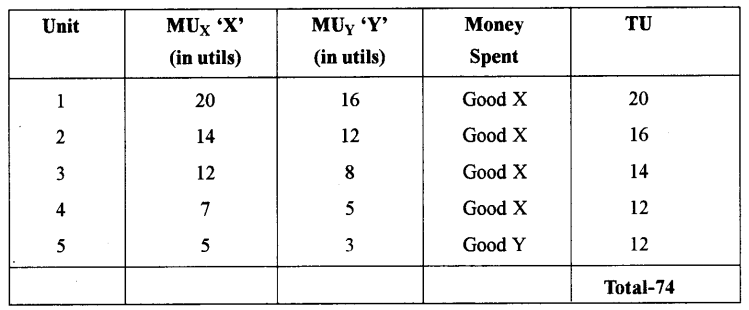

Explanation: Let us now discuss the Law of Equi-marginal Utility with the help of a numerical example: Suppose, the total money income of the consumer = ₹ 5.

Price of good X and Y = ₹ 1 per unit.

So, the consumer can buy a maximum of 5 units of ‘X’ or 5 units of Y. The given table shows the marginal utility which the consumer derives from various units of ‘X’ and ‘Y’.

Table – Consumer’s Equilibrium – 2 Commodities

From the table, it is obvious that the consumer will spend the first rupee on commodity ‘X’, which will provide him utility of 20 utils. The second rupee will be spent on commodity ‘ Y’ to get utility of 16 utils. To reach the equilibrium, a consumer should purchase that combination of both the goods, when

(i) MU of the last rupee spent on each commodity is same; and

(ii) MU falls as consumption increases.

It happens when a consumer buys 3 units of ‘X’ and 2 units of ‘ Y’ because:

MU from last rupee (i.e5th rupee) spent on commodity Y gives the same satisfaction of 12 utils as given by last rupee {i.e., 4th rupee) spent on commodity X; and

MU of each commodity falls as consumption increases.

The total satisfaction of 74 utils will be obtained when a consumer buys 3 utils of ‘X’ and 2 units of ‘ Y’. It reflects the state of the consumer’s equilibrium. If the consumer spends his income in any other order, total satisfaction will be less than 74 utils.

Question 3.

(a) Discuss any two properties of the indifference curve. [3]

(b) Draw diagrams to show the elasticity of demand when it is: [3]

(i) Greater than one

(ii) Less than one

(iii) Unity

(c) Explain the geometric method of calculating the elasticity of supply. [6]

Answer:

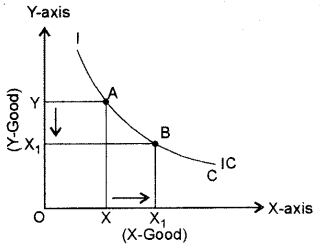

(a) (i) An indifference curve (IC) always slopes downward: This property implies that to increase the consumption of X-good, the consumer has to reduce the consumption of Y good so as to remain at the same level of satisfaction.

As shown in the given diagram:

To increase the quantity of ‘X’ good from OX to OX1, the consumer has to reduce good Y from OY to OY1.

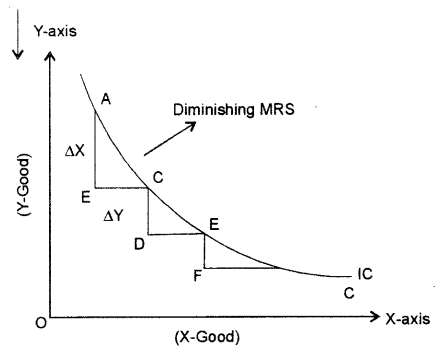

(ii) Indifference curves are convex to the origin: This property is based on the principle of diminishing marginal rate of substitution. It implies that as the consumer substitutes X for Y, the marginal rate of substitution between them goes on diminishing as shown in the following figure.

AB > CD > EF or Diminishing MRS

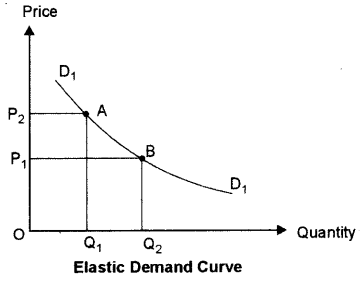

(b) (i) Greater than one

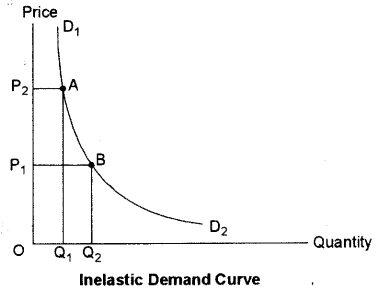

(ii) Less than one

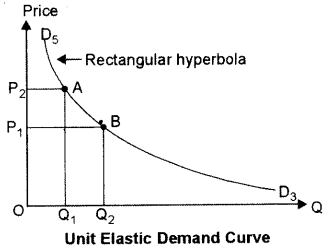

(iii) Unity

(c) According to the geometric method, elasticity is measured at a given point on the supply curve.

This method is also known as ‘Arc Method’ or ‘Point Method’.

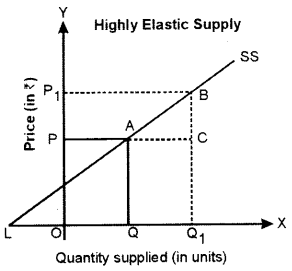

(i) Highly Elastic Supply (Es > 1): A supply curve, which passes through the Y-axis and meets the extended X-axis at some point. For example in fig. the supply is highly elastic.

Since LQ is greater than OQ, the elasticity of supply at point A will be greater than one (highly elastic).

In general, we can say that a straight line supply curve passing through the Y-axis or having a negative intercept on X-axis is highly elastic (Es > 1).

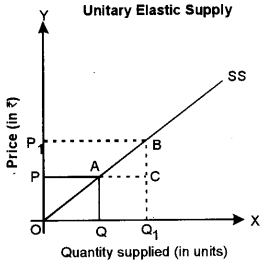

(ii) Unitary Elastic Supply (Es = 1): If the straight-line supply curve passes through the origin (supply curve SS in fig.), then elasticity of supply will be equal to one. In the diagram, Elasticity of Supply (Es) = \(\frac { OQ }{ OQ }\) = 1. Hence, the supply is unitary elastic.

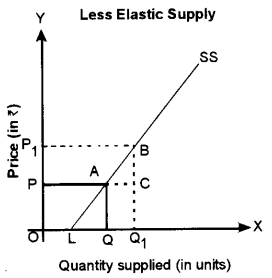

(iii) Less Elastic Supply (Es < 1): If a supply curve meets the X-axis at some point, say, L in Fig., then supply is inelastic. As seen in the fig., Es = \(\frac { LQ }{ OQ }\) and LQ < OQ. So, Es < 1, i.e. supply is less elastic.

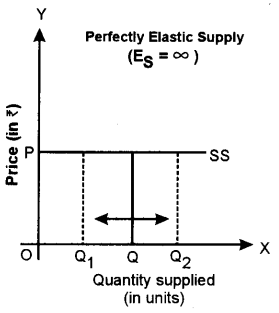

(iv) Perfectly Elastic Supply: When there is an infinite supply at a particular price and the supply becomes zero with a slight fall in price, then the supply of such a commodity is said to be perfectly elastic. In such a case Es = Y and the supply curve is a horizontal straight line parallel to the X-axis, as shown in fig.

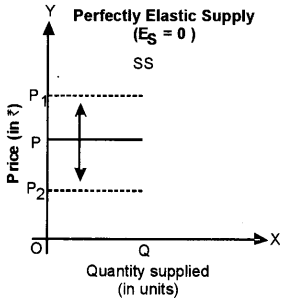

(v) Perfectly Inelastic Supply: When the supply does not change with change in price, then supply for such a commodity is said to be perfectly inelastic. In such a case, Es = 0 and the supply curve (SS) is a vertical straight line parallel to the Y-axis as shown in fig.

Question 4.

(a) Show with the help of diagrams, the effect on equilib¬rium price and quantity when

(i) There is a fall in the price of substitute goods.

(ii) There is a rise in the prices of inputs.

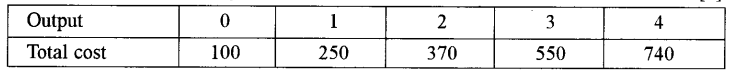

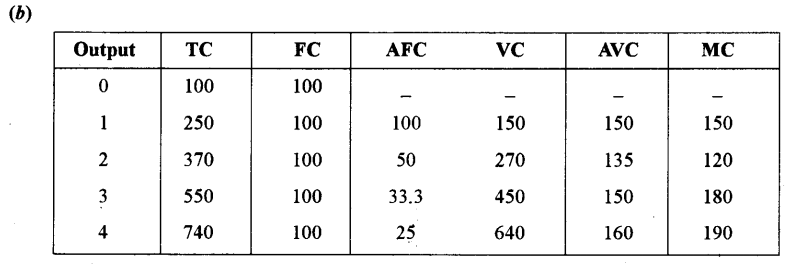

(b) The cost function of a firm is given below: [3]

Calculate:

(i) AFC

(ii) AVC

(iii) MC

(c) Explain the law of variable proportions with the help of a diagram.

Answer:

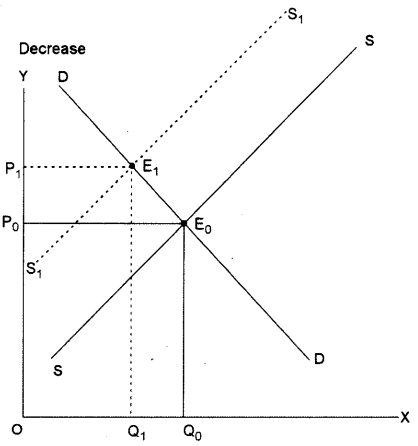

(a) (i) (a) A decrease in the price of a substitute good will disturb the equilibrium point and quantity of the commodity.

(b) Due to a decrease in the price of a substitute good (say coffee) demand for tea will fall because tea has become relatively costly.

(c) A decrease in the price of a substitute good will have a direct impact on the supply (supply will increase) of the good because produces of tea will like to clear their stock as fast as possible.

(d) The new equilibrium can be studied in three different cases.

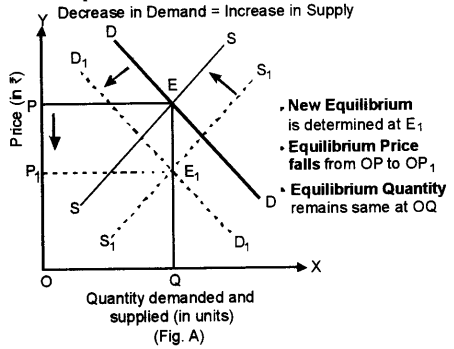

Case 1: Decrease in Demand = Increase in Supply

When the decrease in demand is proportionately equal to the increase in supply, then leftward shift in demand curve from DD to D1D1 is proportionately equal to a rightward shift in supply curve from SS to S1S1.

(Fig. A). The new equilibrium is determined at E1. As the decrease in demand is proportionately equal to the increase in supply, equilibrium quantity remains the same at OQ, but equilibrium price falls from OP to OP1.

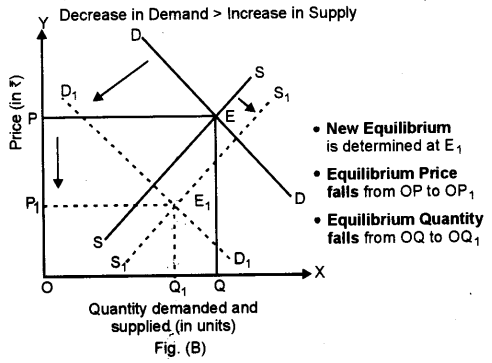

Case 2: Decrease in Demand > Increase in Supply

When a decrease in demand is proportionately more than an increase in supply, then leftward shift in demand curve from DD to D1D1 is proportionately more than the rightward shift in supply curve from SS to S1S1 (Fig. B). The new equilibrium is determined at E1. As the decrease in demand is proportionately more than the increase in supply, equilibrium quantity falls from OQ to OQ1 and equilibrium price falls from OP to OP1.

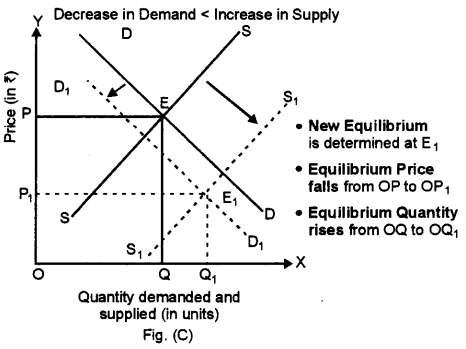

Case 3: Decrease in Demand < Increase in Supply

(i) When the decrease in demand is proportionately less than an increase in supply, then leftward shift in demand curve from DD to D1D1 is proportionately less than a rightward shift in supply curve from SS to S1S1 Fig. C). The new equilibrium is determined at E1. As the decrease in demand is proportionately less than the increase in supply, equilibrium quantity rises from OQ to OQ1 whereas, equilibrium price falls from OP to OP1.

(ii) With a rise in the price of the input, the cost of production will increase and profit will fall. With a fall in profit rate supply will decrease.

A new equilibrium will be established which will be at a higher price, lower quantity demand and lower supply.

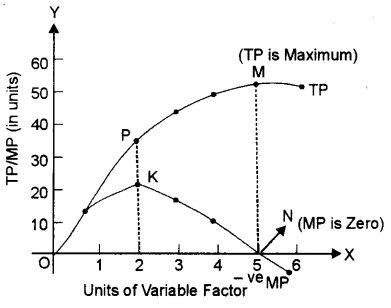

(c) Law of Variable proportion

Law of Variable Proportions (LVP) states that as we increase the quantity of only one input keeping other inputs fixed, total product (TP) initially increases at an increasing rate, then at a decreasing rate and finally at a negative rate.

In the given diagram, the quantity of the variable factor has been measured on X-axis and Y-axis measures the total product on Y-axis. The diagram indicates, how the total product and marginal product changes as a result of increases in the quantity of one factor to a fixed quantity of other factors.

The law can be better explained through three stages-

(a) First stage :

Increasing Return to a Factor: In the first stage, every additional variable factor adds more and more to the total output. It means TP increases at an increasing rate and MP of each variable factor rises. Better utilization of fixed factor and increases in the efficiency of a variable factor due to specialization are the major factors responsible for increasing returns. The increasing returns to a factor stage have been shown in the given diagram between O to P. It implies. TP increases at an increasing rate (till point ‘P’) and MP rises till it reaches its maximum point ‘K’. which marks the end of the first phase.

(b) Second stage:

Diminishing returns to a Factor: In the second stage, every additional variable factor adds a lesser and lesser amount of output. It means TP increases at a diminishing rate and MP falls with increase in a variable factor. The breaking of the optimum combination of a fixed and variable factor is the major factor responsible for diminishing returns. The second stage ends at point ‘S’ when MP is zero and TP is maximum (point ‘M’).

2 stage is very crucial as a rational producer will always aim to produce in this phase because TP is maximum and MP of each variable factor is positive.

(c) Third stage:

Negative Returns to a Factor: In the third stage the employment of additional variable factor causes TP to decline. MP now becomes negative. Therefore, this stage is known as negative returns to a factor. Poor coordination between variable and fixed factor is the basic cause for this stage. In fig. the third stage starts after point ‘N’ on MP curve and point ‘M’ on TP curve. MP of each variable factor is negative in the 3 stage. So, no firm would deliberately choose to operate in this stage.

Question 5.

(a) Discuss two features of monopoly. [3]

(b) Show with the help of a diagram, how a perfectly competitive firm earns normal profit in short-run equilibrium. [3]

(c) Explain how a producer can maximise profit by using MR and MC curves. [6]

Answer:

(a) (i) Restriction on Entry and Exit: There exist strong barriers to entry of new firms and exit of existing firms. As a result, a monopoly firm can earn abnormal profits in the long run. These barriers may be due to legal restrictions like licensing or patent rights or due to restrictions created by firms in the form of a cartel.

(ii) Price Discrimination: A monopolist may charge different prices for his product from different sets of consumers at the same time. It is known as ‘Price Discrimination’

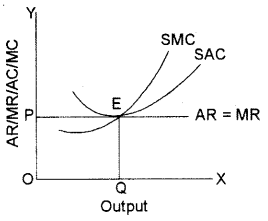

(b) Under perfect competition a firm’s, average revenue curve is equal to the marginal revenue curve due to uniform prices for homogeneous goods. In, short-run, a competitive firm can earn supernormal profits, normal profits can suffer losses also. Adjacent diagram shows a perfectly competitive firm earning normal profits. Since the firm is price taker, it has to decide the amount of output it should produce at the given price so as to maximise the profits following the equilibrium conditions.

SMC = MR and AR = AC

In the given diagram OQ is equilibrium output where SMC is equal to MR Since SAC is tangent to P = AR = MR line, the firm covers only its SAC which includes normal profits.

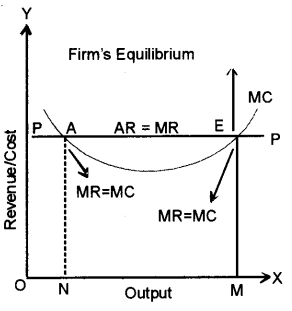

(c) In order to know the position of maximum profit, a firm compares the marginal cost with marginal revenue: So. the first condition of a firm’s equilibrium is that marginal cost must be equal to marginal revenue (MC = MR). It is necessary, but not sufficient condition of equilibrium. A firm may not get maximum profit even when its marginal cost is equal to marginal revenue. So it must fulfil the second condition of equilibrium as well, i.e., marginal cost curve must cut marginal revenue curve from below or the slope of MC curve must be steeper than the slope of MR curve. According to marginal analysis, a firm would, therefore, be in equilibrium when the following two conditions are fulfilled.

1. MC = MR.

2. MC curve cuts the MR curve from below.

Both these conditions of firm’s equilibrium are explained with the help of Fig. In this figure, PP is average revenue (price per unit) as well as marginal revenue curve. It is clear from this figure, that MC curve is cutting MR curve PP at two points ‘A’ and ‘E’. Point ‘A’ cannot indicate the position of equilibrium of the firm as at point A Marginal cost of the firm is still falling or we can say MC is not cutting MR from below.

On the other hand, point E show s that the firm is producing OM units of output. If the firm produces more than OM units of output, its marginal cost (MC) will exceed marginal revenue (MR) and it will have to incur losses. Thus point ‘E’ will represent the equilibrium of the firm. At this point, both the conditions of equilibrium are being fulfilled.

(1) Marginal cost is equal to marginal revenue (MC = MR) and

(2) Marginal cost curve is cutting the marginal revenue curve from below. At point ‘E’ i.e.,’ equilibrium position, the firm is getting maximum profit. In case, the firm produces more or less than OM output, then its profits will be less than the maximum. So the firm, at OM level of output, will have no tendency either to increase or decrease its output from this level. It will, therefore, be in equilibrium at point E.

Question 6.

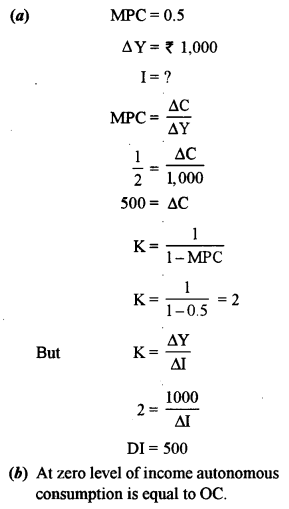

(a) Find the value of additional investment made by the government, when MPC 05 and the increase in income (ΔY) = ₹ 1000. [3]

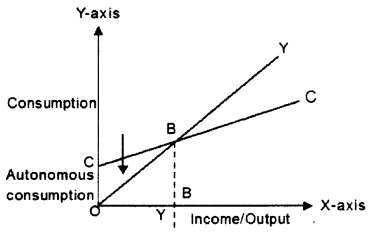

(b) What is meant by autonomous consumption? Explain with the help of a diagram. [3]

(c) Explain the concept of deficient demand with the help of aggregate demand and aggregate supply curves. Discuss one physical and one monetary measure to correct it. [6]

Answer:

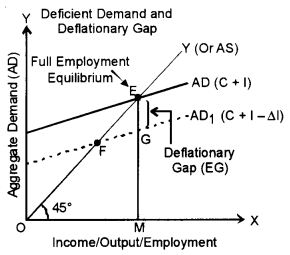

(c) Deficient demand refers to the situation when aggregate demand (AD) is less than the aggregate supply (AS) corresponding to the full employment level of output in the economy.

The situation of deficient demand arises when planned aggregate expenditure falls short of aggregate supply at the full employment level. It gives rise to the deflationary gap. A deflationary gap is a gap by which actual aggregate demand required to establish full employment equilibrium.

The concepts of deficient demand and deflationary gap are shown in Fig. (a)

(i) In the given diagram, income, output and employment are measured on the X-axis and aggregate demand is measured on the Y-axis.

(ii) Aggregate demand (AD) and aggregate supply (AS) curves intersect at point E, which indicates the full-employment equilibrium.

(iii) Due to a decrease in investment expenditure (ΔI), aggregate demand falls from AD to AD1. It denotes the situation of deficient demand and the gap between them, i.e., EG is termed as a deflationary gap.

(iv) Point F indicates the underemployment equilibrium.

Physical measure: Reduction in public expenditure.

Monetary Measure: Increase in money supply.

Question 7.

(a) Discuss two qualitative methods of credit control. [3]

(b) Explain any two secondary functions of money. [3]

(c) Discuss the various components of the current account of the balance of payment. [6]

Answer:

(a) (i) Credit Rationing: Rationing of credit is a method by which the Reserve Bank seeks to limit the maximum amount of loans and advances, and also in certain cases fix a ceiling for specific categories of loans and advances.

(ii) Moral Suasion: Moral suasion and credit monitoring arrangement are other methods of credit control. The policy of moral suasion will succeed only if the Reserve Bank is strong enough to influence the commercial banks.

(b) (i) Store of value: In order to be a medium of exchange,rtioney must hold its value over time; that is, it must be a store of value. If money could not be stored for some period of time and still remain valuable in exchange, it would not solve the double coincidence of wants problem and therefore would not be adopted as a medium of exchange. As a store of value, money is not unique; many other stores of value exist, such as land, works of art, and even baseball cards and stamps. Money may not even be the best store of value because it depreciates with inflation. However, still, money is used as a store of value as:

(i) It is more liquid than most other stores of value.

(ii) It is readily accepted everywhere.

(iii) It is easy and economical to store as its storage does not require much space.

(iv) Unit of account: Money also functions as a unit of account, providing a common measure of the value of goods and services being exchanged. Knowing the value of the price of a good, in terms of money, enables both the supplier and the purchaser of the good to make decisions about how much of the good to supply and how much of the good to purchase.

In the absence of the common measure, the seller has to express the value of his good in all other goods. For example, if you want to sell your horse you have to express its value.

1. Horse = 2 cows

1. Horse = 5 bags of wheat

1. Horse = 20 kg of iron

(c) (i) Merchandise: It refers to all such items of exports and imports which are visible and therefore also called Visible Trade’ relating to exports and imports. Current account showing export and import of visible is often referred to balance of trade account.

(ii) Invisible: It refers to all such items which are rendered to rest of the world or received from the rest of the world in the form of services they include the following principal services like travel, transport alias insurance asking and services rendered to the rest of the world are treated like exports and the services received from the rest of the world are treated as imports.

(iii) Transfers: It refers to unilateral transfers i.e., gifts or donations.

These are broadly divided as

(a) official transfers

(b) private transfers.

(iv) Investment income: It refers to income by way of rent, interest and profit. Income earned by our country is shown as receipts, while income earned from the rest of the world from our country is shown as payments.

(v) Compensation of employees: It refers to the income earned or paid to the rest of the world by way of wages and salaries.

Question 8.

(a) Highlight two differences between sales tax and income tax. [3]

(b) What is meant by [3]

(i) Union budget

(ii) State budget

(c) Explain four ways of Redemption of Public Debt. [6]

Answer:

(a)

| Sales Tax | Income Tax |

| (i) It is an indirect tax. | (i) It is a direct tax. |

| (ii) It is levied on goods and services. | (ii) It is levied on income. |

(b) (i) It is the budget prepared by the central government for the country as a whole. This budget is presented in two parts.

(1) Railway budget and

(2) Main Budget.

(ii) It is repaired by state govt, such as one budget of Punjab govt. UP govt. etc.

(c) (1) Sinking Fund Approach: The Government at the regular interval saves a certain amount of money from its budget to meet up the debt obligations and uses this fund for the same when they have accumulated enough money.

(2) Conversion Approach: Conversion of loans is another method of redemption of public debt. It means that an old loan is converted into a new loan. Under this system, 111 high-interest public debt is converted into a low-interest public debt. Prof. Dalton felt that debt conversion actually relaxes the debt burden.

(3) Utilization of Budgetary Surplus: When the Government earns surplus in the budget, it must be utilised for paying the debt. A surplus occurs when public revenue exceeds public expenditure. However, this method is rarely found.

(4) Terminal Annuity: In this method. The government pays off the public debt on a fee basis of a terminal annuity into equal annual instalments including interest along with the principal amount. This is the easiest way of paying off the public debt.

Question 9.

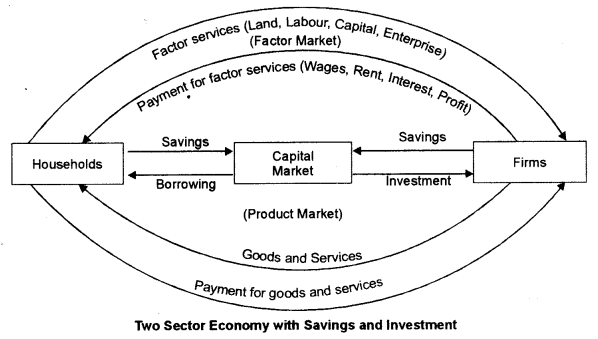

(a) With the help of a diagram, show the circular flow of income in a two-sector model with Savings and Investment. [3]

(A) The growth of the Gross Domestic Product is not a real indicator of economic welfare. Discuss two reasons to justify the given statement. [3]

(c) From the follow ing data, calculate GNPMP and NNPFC by Expenditure Method. [6]

| (i) Mixed-income of self-employed | 450 crores |

| (ii) Compensation of employees | 550 crores |

| (iii) Private final consumption expenditure | 1000 crores |

| (iv) Net factor income from abroad | -20 crores |

| (v) Net indirect taxes | 150 crores |

| (vi) Consumption of fixed capital | 170 crores |

| (vii) Net domestic capital formation | 380 crores |

| (viii) Net exports | -30 crores |

| (ix) Profits | 400 crores |

| (x) Rent | 150 crores |

| (xi) Interest | 200 crores |

| (xii) Government final consumption expenditure | 550 crores |

Answer:

(a)

In Fig. we have considered a two-sector economy with households and firms. It is assumed that the household sector and producing sector do not save at all. However, in reality, households save a portion of their income for many reasons like precautionary purposes, transaction purposes, etc. On the other way, they borrow money from the capital market for both development and as well as for even non-development purposes. Similarly, firms also save some part of their receipts for the expansion of business, transactional purposes, speculative purposes, precautionary purposes etc. Moreover, the firms also collect loans (i.e., investment) from both banks and non-banking financial institutions to generate capital in their business. Thus, the inclusion of saving (Leakage, i.e., an outflow of income) and investment (Injection, i.e., the inflow of income) in the two-sector economy with the capital market as shown in the Fig. have made the two-sector economy more meaningful and modernised.

(b) 1. Externalities:

(i) Externalities refer to benefits or harms of an activity caused by a firm or an individual, for which they are not paid or penalised.

(ii) Externalities occur outside the market i.e., they affect people not directly involved in the production and or consumption of a good or service. They are also known as spill-over effects. Externalities are not taken into account while calculating GDP.

(iii) For example, setting up industry in a town may add up to domestic product but while calculating GDP the pollution and its impact on society are not taken into account.

(iv) The industrial growth and urbanisation create problems like industrial slumps diseases and crime. The damage to the physical and social environment has an adverse impact on the health and welfare of the community. Thus despite an increase in GDP, no accurate conclusion can be drawn on the welfare level.

2. Distribution of GDP:

(i) GDP shows the total value of goods and services produced in a country. However, it does not exhibit how the GDP is distributed among the people. For example GDP of India is rising but it is not being equally distributed among all the strata of people. The major share of the increase is being grabbed only by the upper-middle class and share of poor of the poorer is decreasing.

(ii) If with every increase in the level of GDP, Distribution is getting more unequal, the welfare level of society may not rise.

(iii) No doubt, GDP is a useful measure of the overall productive activities in a country, yet no welfare implication, on it basis, can be derived, unless it is fairly divided among all the section of the society.

(c) Expenditure Method

GDPMP = Private final consumption expenditure + Government final consumption expenditure + Gross Domestic Capital Formation + Net Export

1000 + 550 + (380 + 170) + (-30) = ₹ 2,070

NNPFC = GDPMP – Depreciation + NFIA – NIT

2070 – 170 + (-20) – 150 = ₹ 1730