ISC Economics Previous Year Question Paper 2013 Solved for Class 12

Maximum Marks: 80

Time allowed: 3 hours

- Candidates are allowed additional 15 minutes for only reading the paper.

- They must NOT start writing during this time.

- Answer Question 1 (Compulsory) from Part I and five questions from Part II.

- The intended marks for questions or parts of questions are given in brackets [ ].

Part – I (20 Marks)

Answer All Questions

Question 1.

Answer briefly each of the following questions (i) to (xv).

(i) What does zero cross elasticity of demand between two goods imply? Give an example to explain.

(ii) Why is the marginal cost curve U shaped?

(iii) Differentiate between monopoly and monopsony. Give an example for each.

(iv) What is the market period? What is the shape of the supply curve in this period?

(v) Give two assumptions of the law of Variable Proportions.

(vi) Explain the meaning of price ceiling with the help of a diagram.

(vii) Why is the Central Bank considered to be the lender of the last resort?

(viii) What is the Vote-on-account budget?

(ix) Explain how taxation can be used to reduce inequality of income.

(x) What is meant by unlimited legal tender?

(xi) Distinguish between CRR and SLR.

(xii) Calculate the value of multiplier if MPC is equal to MPS.

(xiii) Define GNP at factor cost. How is it different from national income?

(xiv) Explain with the help of an example, how inflation affects the debtors.

(xv) How does an increase in the price of a commodity affect its quantity demanded? Show it with the help of a diagram.

Answer:

(i) Zero cross elasticity of demand between goods implies that two goods are not related to each other. In other words, the change in the price of one commodity (Y) does not affect the demand for another commodity (X).

For example, a change in the price of sugar is not likely to influence the demand for a fan. So their cross elasticity of demand will be zero.

(ii) MC curve is ‘U’ shaped because of the law of variable proportions. As output increases, MC curve negatively slopes (due to increasing returns to the variable factor), reaches the minimum and then slopes positive or upwards due to decreasing returns to the variable factor.

(iii)

| Basis | Monopoly | Monopsony |

| 1. Meaning | It is a market structure in there exists only a single seller of a product who is the sole producer of the product which has no close substitutes. | It is a market structure in which there exists only a single buyer of a product in the market. |

| 2. Example | Indian Railways which is owned by the Government of India. | In a village one textile mill purchase cotton from the farmers of that village. So the textile mill is the monopsony firm which is the only buyer of cotton produced by the farmers of the village. |

(v) (a) The state of technology is given and remains unchanged.

(b) All the variable factors are equally efficient.

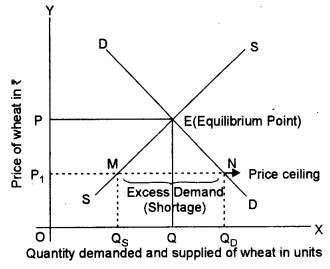

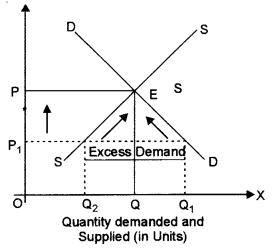

(vi) Price ceiling refers to fixing the maximum price of a commodity at a level lower the equilibrium price.

Let us clear this point by considering the commodity ‘wheat’ and its price determination in fig.

In the diagram, demand curve DD and supply curve SS of wheat intersect each other at point E and, as a result, the equilibrium price of OP is determined.

Suppose, the equilibrium price of OP is very high and many poor people are unable to afford wheat at this price.

As wheat is an essential commodity, the government interferes and fixes the maximum price (known as Price ceiling) at OP1 which is less than the equilibrium price OP.

(vii) Lender of the Last Resort:

The Central Bank acts as the lender of the last resort.

When commercial banks fail to meet their financial requirements from other sources, they can approach the Central Bank which provides them with loan and advances as lender of the last resort.

The Central Bank provides this facility to protect the interest of the depositors and to prevent possible failure of the bank.

(ix) By imposing direct taxes which are progressive in nature, rich people are subjected to a higher rate of taxation as compared to poor people. Higher taxes on luxuries and low taxes on essential commodities also helps in removing inequalities of income. Inequality of income can be further reduced by using the tax proceeds in providing social services which benefit poor people.

(x) Unlimited legal tender is the money, which a person has to accept without any maximum limit. In our country, currency notes of all denominations and coins of 50 paise and higher denominations are unlimited legal tender.

(xi) CRR is the certain percentage of deposits accepted by Commercial Banks which they are required by law to keep with Central Bank in the form of cash reserves. Whereas, Statutory Liquidity Ratio refers to a fixed percentage of the assets of the Commercial Bank which they are required by law to keep with themselves in the form of cash or other liquid assets.

(xii) We know,

MPC + MPS = 1 and K = \(\frac { 1 }{ MPS }\)

When MPC = MPS

MPS + MPS = 1

⇒ 2MPS = 1

⇒ MPS = \(\frac { 1 }{ 2 }\)

⇒ K = \(\frac { 1 }{ MPS }\) = 2

(xiii) GNPFC is the sum total of factor income earned by normal residents of a country, inclusive of depreciation during an accounting year.

GNPFC = NNPFC + Depreciation Whereas, National Income (NNPFC) is the sum total of factor income earned by normal residents of a country during an accounting year.

NNP FC = NDP FC + Net factor income from abroad GNP FC includes depreciation but NNPFC (National Income) does not include depreciation.

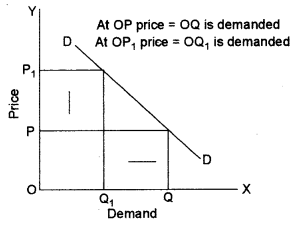

(xv) Keeping other things constant an increase in the price of a commodity will inversely affect its quantity demanded. In other words, an increase in the price of say X commodity will reduce or decrease its quantity demanded. The adjacent diagram shows this relationship.

Part – II

(Answer Any Five Questions)

Question 2.

(a) Explain with the help of a well-labelled diagram how a perfectly competitive firm earns normal profit in short-run equilibrium.

(b) Why does the TC curve start from the Y-axis and the TVC curve from the Origin?

(c) Discuss four features of Oligopoly.

Answer:

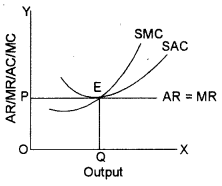

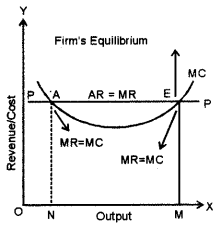

(a) Under perfect competition a firm’s, average revenue curve is equal to the marginal revenue curve due to uniform prices for homogeneous goods. In short-run, a competitive firm can earn supernormal profits, normal profits can suffer losses also. Figure (A) shows a perfectly competitive firm earning normal profits. Since the firm is price taker, it has to decide the amount of output it should produce at the given price so as to maximise the profits following the equilibrium conditions.

SMC = MR and AR = AC

In the given diagram OQ is equilibrium output where SMC is equal to MR. Since SAC is tangent to P = AR = MR line, the firm covers only its SAC which includes normal profits.

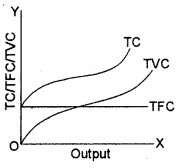

(b) TC (Total cost) curve is the sum total of the total fixed cost and the total variable cost incurred in producing a given amount of output. In other words TC = TFC + TVC. Since Total Fixed Cost (TFC) remains constant regardless of the quantity of output and Total Variable Cost changes with the change in level of output, so at zero levels of output TFC exists but TVC is zero, therefore, TC curve originate not from origin ‘O’ but from the point on OY axis where TFC intersects (refer to the diagram). Since TVC is zero when output is zero, so it starts from the origin as shown in the adjacent diagram.

(c) (i) Few firms: Under oligopoly, there are few large firms each producing a significant portion of the total output. For example, the market for automobiles in India is an oligopolist structure as there are only a few producers of automobiles. The number of firms is so small that action by anyone firm is likely to affect the rival firms. So, every firm keeps a close watch on the activities of rival firms.

(ii) Interdependence: Due to few large firms under oligopoly are interdependent with respect to their price/output policy. Interdependence means that actions of one firm affect the actions of other firms. A firm considers the action and reaction of the rival firms while determining its price and output levels.

(iii) Non-Price Competition: Firms try to avoid price competition for the fear of price war. They use other methods like advertising, better services to customers, etc. to com¬pete with each other. Under oligopoly, firms are in a position to influence the prices. However, they follow the policy of price rigidity. Price rigidity refers to a situation in which price tends to stay fixed irrespective of changes in demand and supply conditions.

(iv) Role of Selling Costs: Due to severe competition and interdependence of the firms, various sales promotion techniques are used. Selling costs are very important and oligopolistic firms spend much on advertisement and customer services in order to promote sales of its product. Advertisement is in full swing under oligopoly, and many times advertisement can become a matter of life-and-death. For example, T.V. commercials war between Coke and Pepsi. It relies more on non-price competition. Therefore, selling costs are more important under oligopoly than under monopolistic competition.

Question 3.

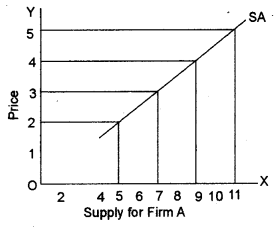

(a) Complete the following table and draw a supply curve for the firm A:

| Price per Unit | Supply by firm A | Supply by firm B | Market Supply |

| 2 | 5 | 5 | ? |

| 3 | ? | 10 | 17 |

| 4 | 9 | ? | 24 |

| 5 | 11 | 20 | ? |

(b) Explain what happens when the market price is less than the equilibrium price.

(c) Explain the four determinants of supply of a commodity.

Answer:

(a) Complete the following table and draw a supply curve for the firm A:

| Price per Unit | Supply by firm A | Supply by firm B | Market Supply |

| 2 | 5 | 5 | 10 |

| 3 | 7 | 10 | 17 |

| 4 | 9 | 15 | 24 |

| 5 | 11 | 20 | 31 |

(b) (i) If the market price is lower (P2) than equilibrium price (P0), this will create a situation of excess demand.

(ii) The excess demand will put pressure on price. The price would move upward.

(iii) Due to higher price demand will contract and quantity supplied will expand.

(iv) The expansion of quantity supplied and the contraction of demand will continue till the original equilibrium price is restored.

(c) (i) Price of the Commodity: There is a direct relationship between price of a commodity and its supply. Generally, the higher the price, higher the quantity supplied, and lower the price, lower the quantity supplied.

(ii) Price of Related Goods: The supply of a good depends upon the price of related goods. Examples: Consider a firm selling tea. If price of coffee rises in the market, the firm will be willing to sell less tea at its existing price. Or, it will be willing to sell the same quantity only at a higher price.

(iii) Number of Firms: Market supply of a commodity depends upon the number of firms in the market. If there is an increase in the number of firms market supply will increase and if the number of firms decreases market supply will fall.

(iv) The goal of the Firm: If the goal of the firm is to maximise profits, more quantity of the commodity will be offered at a higher price. On the other hand, if the goal of the firm is to maximise sales (or maximise output or employment) more will be supplied even at the same price.

Question 4.

(a) Explain the nature of the AR and MR curves under perfect and imperfect competition.

(b) Explain any one internal and anyone external economy of scale.

(c) How does a producer attain equilibrium under perfect competition through the MR and MC approach?

Answer:

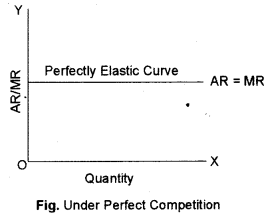

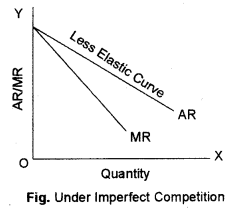

(a) AR and MR curves, under perfect competition, are equal to each other and parallel to OX-axis. The price at AR is constant as it is fixed by industry with every additional sale of unit MR will be equal to AR.

Under imperfect competition, a firm is the price maker having control over the price but it has to lower down its price in order to sell more. So revenue curves (AR and MR) are downward sloping from left to right indicating that more units of output can be sold at a lower price. Therefore AR > MR.

(c) In order to know the position of maximum profit, a firm compares the marginal cost with marginal revenue: So, the first condition of a firm’s equilibrium is that marginal cost must be equal to marginal revenue (MC = MR). It is necessary, but not sufficient condition of equilibrium. A firm may not get maximum profit even when its marginal cost is equal to marginal revenue. So it must fulfil the second condition of equilibrium as well. i.e., the marginal cost curve must cut the marginal revenue curve from below or the slope of the MC curve must be steeper than the slope of the MR curve. According to marginal analysis, a firm would, therefore, be in equilibrium when the following two conditions are fulfilled.

1. MC = MR.

2. MC curve cuts the MR curve from below.

Both these conditions of firm’s equilibrium are explained with the help of Fig. In this figure, PP is average revenue (price per unit) as well as the marginal revenue curve. It is clear from this figure, that MC curve is cutting MR curve PP at two points ‘A’ and ‘E’. Point ‘A’ cannot indicate the position of equilibrium of the firm as at point A Marginal cost of the firm is still falling or we can say MC is not cutting MR from below.

On the other hand, point E shows that the firm is producing OM units of output. If the firm produces more than OM units of output, its marginal cost (MC) will exceed marginal revenue (MR) and it will have to incur losses. Thus point ‘E’ will represent the equilibrium of the firm. At this point, both the conditions of equilibrium are being fulfilled

(1) Marginal cost is equal to marginal revenue (MC = MR) and

(2) The marginal cost curve is cutting a marginal revenue curve from below. At point ‘E’ i.e., equilibrium position, firm is getting maximum profit. In case, the firm produces more or less than OM output, then its profits will be less than the maximum. So the firm, at OM level of output, will have no tendency either to increase or decrease its output from this level. It will, therefore, be in equilibrium at point E.

Question 5.

(a) Explain how the income effect and the substitution effect are the reasons for the downward slope of the demand curve.

(b) Price elasticity of demand for a product is unity. A household buys 50 units of this product when its price is ₹ 10 per unit. If its price rises to ₹ 12 per unit how much quantity of the product will be bought by the household?

(c) A marginal utility schedule of a person is given below. Discuss the law underlying the given schedule:

| Pen (units) | 1 | 2 | 3 | 4 | 5 |

| MU (units) | 25 | 20 | 15 | 10 | 5 |

Answer:

(a) Income effect: It occurs when the price change affects consumer purchasing power and thus lead to a change in quantity demanded. When the price of a commodity falls, the real income of the consumer increases, a part of increased real income may be used to buy more of the commodity under question. Thus, a fall in price of a commodity increases the demand for it. Substitution effect: When the price of a commodity falls and prices of its substitutes remain unchanged, it becomes relatively cheaper in comparison to the other commodities. Thus demand for relatively cheaper commodity increases as consumers normally like to substitute cheaper goods for costlier ones.

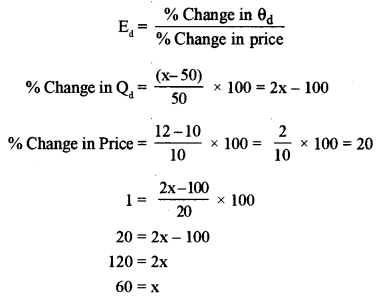

(b) Ed = 1, Q = 50, P = ₹ 10, Q1 = x, P1 = ₹ 12

(c) The law underlying the given schedule is the Law of Diminishing Marginal Utility. As per the law of diminishing marginal utility, the level of satisfaction obtained from each additional unit of a commodity consumed keeps on declining as more and more units of a commodity are consumed. This law was formulated by the famous economist. Alfred Marshall. It is based on the following assumptions.

- All the units of a commodity consumed must be same in all respect-in size, colour, quality etc.

- The unit of the good must be the standard unit.

- No change in taste and preference of the consumer.

- No time break in consumption of every successive unit of the commodity.

- No change in the price of a substitute good.

As the schedule illustrates that when the first unit of Pen is consumed, the marginal utility derived is maximum. But with every successive unit pen used, the marginal utility goes on decreasing from 25 utils to 5 utils when 5th unit of pen is used.

Question 6.

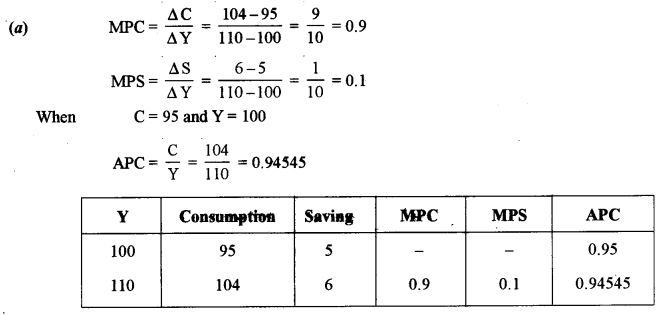

(a) Calculate MPC, MPS and APC from the following data:

| Income (Y) | Consumption |

| 100 | 95 |

| 110 | 104 |

(b) Discuss the fiscal measures used to solve the situation of deficient demand.

(c) Explain how the equilibrium level of income can be determined by aggregate demand and aggregate supply.

Answer:

(b) (1) Increase in government expenditure and investment.

(2) Increase in transfer payments and subsidies.

(3) Reduction in taxes to increase the disposable income of the people.

(4) More use of deficit financing to increase the flow of money.

(5) Repayment of public debts.

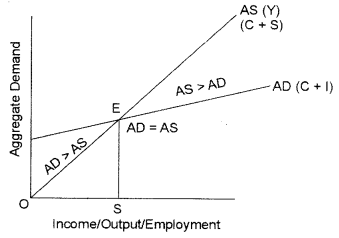

(c) According to the modern theory of income and employment determination, in any economy at any given time, income and employment are determined at that level where aggregate demand is equal to aggregate supply.

AD = AS

- In the given figure AS represents Aggregate Supply Curve. It forms 45° angle, signifying’ that each point on it expresses the equal value of income and receipts whereas AD represents Aggregate Demand.

- Both i. e., AD and AS intersect each other at the point which is known as the equilibrium point.

- Point E shows that in equilibrium. position level of employment/output/income is OQ and expected receipts are OP.

- When AD > AS

Now suppose the economy is operating at any point before (left of) the equilibrium point.

As the planned spending (AD) is more than planned output (AS) this means consumers and firms together would be buying more goods than the firms are willing to produce.

As a result, the planned inventory would fall below the desired level.

Firms would be induced to increase production which will lead to an increase in the level of employment/output/income.

The firms will keep on increasing production until AD = AS.

When AS > AD, Under such a situation the economy will be operating beyond E.

As the planned spending is less than planned output (AS) this means consumers and firms together would be buying fewer goods than the firms are willing to produce.

As a result, the planned inventory would rise.

Firms would be induced to decrease production which will lead to decrease in the level of employment/output/income.

The firms will keep on decreasing production till AD = AS.

Question 7.

(a) Explain the following functions of money:

(i) Medium of exchange

(ii) Store of value

(b) Explain bow hank rate and open market operations can be used by the Central Bank to control credit.

(c) How do commercial banks create credit? Explain with the help of an example.

Answer:

(a) Money is an instrument that serves as:

- a medium of exchange

- a measure of value

- a store of value

- a standard for deferred payments.

Functions of Money

1. Medium of exchange: Most important function of money is as a medium of exchange to facilitate transactions. Without money, all transactions would have to be conducted by barter, which involves direct exchange of one good or service for another. Money effectively eliminates the double coincidence of wants problem by serving as a medium of exchange that is accepted in all transactions, by all parties, regardless of whether they desired each other’s goods and services. Use of money has separated the process of sale and purchase.

2. Store of value: In order to be a medium of exchange, money must hold its value over time; that is, it must be a store of value. If money could not be stored for some period of time and still remain valuable in exchange, it would not solve the double coincidence of wants problem and therefore would not be adopted as a medium of exchange. As a store of value, money is not unique; many other stores of value exist, such as land, works of art, and even baseball cards and stamps. Money may not even be the best store of value because it depreciates with inflation. However, still, money is used as a store of value as:

- It is more liquid than most other stores of value.

- It is readily accepted everywhere.

- It is easy and economical to store as its storage does not require much space.

3. Unit of account: Money also functions as a unit of account, providing a common measure of the value of goods and services being exchanged. Knowing the value of the price of a good, in terms of money, enables both the supplier and the purchaser of the good to make decisions about how much of the good to supply and how much of the good to purchase.

In the absence of the common measure, the seller has to express the value of his good in all other goods. For example, if you want to sell your horse you have to express its value.

1. Horse = 2 cows

1. Horse = 5 bags of wheat

1. Horse = 20 kg of iron

4. Standard of deferred payment

(i) Money is accepted as a standard of deferred payments because

- its price remains relatively stable compared to other commodities,

- it has the merit of general acceptability,

- it is more durable compared to other commodities.

It is because of this function of money that there has been a significant expansion of trade.

(ii) Using money as a standard of deferred payments is a direct consequence of the unit of account and store of value functions of money.

(iii) Serving as a standard of deferred payments, money has stimulated the process of capital formation. It is because of this function of money that there has been a considerable growth of the money market as well as the capital market.

(b) (i) Bank rate refers to the rate at which the central bank lends money to commercial banks as the leader of the resort.

(ii) During inflation, the bank rate is increased to suck excess liquidity from the economy or to reduce the money supply.

(iii) During deflection, the bank rate is reduced to increase the money supply.

(c) (i) Buying and selling of government securities in the market is known as open market operations.

(ii) Open market operations have an impact on the lending capacity of the banks.

(iii) It is an important means of controlling the money supply.

(iv) During inflation or excess demand situation the main motive of the Central Bank is to reduce the money supply. To suck excess liquidity from the market the Central Bank sells bonds, government securities and treasury bills.

(v) Due to low money supply, there is a fall in the volume of investment, income and employment resulting in lower demand.

(vi) During deflation, the main motive of the Central bank is to increase the money supply and to increase the money supply the Central Bank buys bonds, government securities and treasury bills.

Question 8.

(a) Explain any two objectives of the fiscal policy in a developing economy.

(b) What are the primary deficit and fiscal deficit in a government budget? What is the implication of the primary deficit on the economy?

(c) Explain cost-push inflation with the help of a diagram.

Answer:

(a) Objectives of fiscal policy are as follows:

Economic Stability: Developing countries face the problem of inflationary rise in prices in the course of economic development reducing the purchasing power of the people through taxes, compulsory savings and public borrowings, increasing public expenditure/investment on production of essential commodities are some of the fiscal measures to contain inflation to bring economic stability.

To achieve full employment: It is the leading objective of fiscal policy. In addition to accelerating economic growth, specific fiscal measures like tax concessions in the use of labour-intensive techniques, subsidisation of labour-intensive products, increased government expenditure on labour-intensive public works like roads, dams: undertaking special employment generation projects etc. will help in increasing the level of employment in developing countries.

(b) Primary deficit is that part of fiscal deficit which indicates borrowing requirement to make up the shortfall in receipts on account of expenditure other than the interest payments. In other words.

Primary Deficit = Fiscal Deficit – Interest payment

Implications of Primary Deficit

- It indicates how much is government borrowing under compulsion to meet expenses other than interest payments.

- A lower or zero primary deficit indicates that the interest payment of earlier loans has forced the government to borrow.

Fiscal Deficit: Refers to the excess of “Total expenditure” over the “sum of Revenue Receipts and non-debt capital receipts. It is calculated as:

Fiscal Deficit = Total Budget Expenditure (Revenue + Capital Exp.) – Revenue Receipts – Non debt Capital Receipt.

It indicates borrowing requirements of the government during the budget year.

Question 9.

(a) Classify the following as final or intermediate goods. Give reasons for your answer.

(i) A car purchased by a company for business purposes.

(ii) Pen or paper purchased by a consumer.

(b) Discuss two reasons why the per capita real income is considered to be a better index of economic welfare than gross domestic product.

(c) Calculate national income and GDPMP by the income method using the following information:

| Items | ₹ in Crores |

| (i) Private final consumption expenditure | 1300 |

| (ii) Net factor income earned from abroad | 50 |

| (iii) Mixed-income of self-employed | 500 |

| (iv) Subsidies | 100 |

| (v) Indirect tax | 200 |

| (vi) Consumption of fixed capital | 1000 |

| (vii) Operating surplus | 5000 |

| (viii) Compensation of employees | 1500 |

Answer:

(b) Per capita Real income is considered to be a better index of economic welfare than GDP because of following ing reasons:

(i) Only per capita, real income shows a change in per capita av ailability1 of goods and sen ices to the people of a country which leads to an improvement in the living standard of people as well as economic development.

(ii) Change in Level of Economic Activity: Increase in per capita real income implies an increase in the level of economic activity (in terms of increase in level production not in terms of an increase in market prices).

(c) National Income (NNPFC) = Compensation of Employees + Operating Surplus + Mixed-Income + NFIA

So, NNPFC = viii + vii + iii + ii

= 1500 + 5000 + 500 + 50

= 7050

GDPMP = NNPFC + Depreciation – NFIA + NIT (Net indirect tax)

8100 = 7050 + 1000 – 50 + 100

NNPFC = ₹ 7050

GDPMP = ₹ 8100.