ISC Economics Previous Year Question Paper 2011 Solved for Class 12

Maximum Marks: 80

Time allowed: 3 hours

- Candidates are allowed additional 15 minutes for only reading the paper.

- They must NOT start writing during this time.

- Answer Question 1 (Compulsory) from Part I and five questions from Part II.

- The intended marks for questions or parts of questions are given in brackets [ ].

Part – I (20 Marks)

Answer all questions.

Question 1.

Answer briefly each of the questions (0 to (xv): [15 × 2]

(i) State any two assumptions of Law of the Diminishing Marginal Utility.

(ii) What is meant by macroeconomics?

(iii) If demand increases by 50% due to an increase in income by 75%, calculate the income elasticity of demand.

(iv) Draw the supply curve of a perishable commodity. Give a reason for the shape of the supply curve.

(v) What is meant by increasing returns to a variable factor?

(vi) What would be the elasticity of demand for a commodity when:

(a) Price and total expenditure move in the same direction?

(b) Price and total expenditure move in the opposite direction?

(vii) Identify the type of market which has a characteristic of perfect substitutes. Give one reason for your answer.

(viii) What is meant by supernormal profit?

(ix) How is personal income calculated from private income?

(x) What is the variable cost? Give two examples.

(xi) Differentiate between economic and non-economic services.

(xii) Is deficit financing inflationary? Justify your answer.

(xiii) What is a trade union?

(xiv) How can an increase in public expenditure create more employment in the country?

(xv) What is meant by an unfavourable balance of payment?

Answer:

(i) Two assumptions of Law of the Diminishing Marginal Utility are:

(a) Every unit of a commodity must be same in-all respects-in size, colour, quality, design etc. For example, if the quality of the second apple is superior to the first, the consumer may desire to mix utility from the second apple than from the first.

(b) The unit of the good must be standard, E.g. a cup of water, a bottle of cold drink, a pair of shoes, a full orange, a glass of lime juice. The units of the commodity should not be too small or too large. Otherwise, the law will not be applicable.

(ii) Macroeconomics is the study of the behaviour of the economy as a whole. Macroeconomics deals with national income, employment, savings, investment, exports and imports of a country etc.

(iii) \(\frac { 50 }{ 75 }\) = 0.67

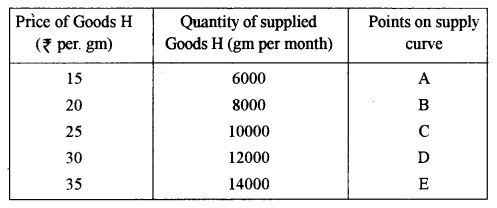

(iv) Individual supply of schedule of Good X

The positively sloping supply curve SS shows the direct relationship between the price and the quantity supplied.

(v) When a firm increases only one variable factor of production keeping other factors unchanged and if the rate of change of output becomes more than that of the variable factor, we call it increasing returns to the variable factor.

(vi) (a) Inelastic (ep < 1) (b) Elastic (ep > 1)

(vii) Perfectly competitive market. .

(viii) When revenue is more than costs (including normal profits) is what we call pure profits or economic profits in economics. Pure profit is also known as ‘super normal profit’.

(ix) Private income is the total of factor income from all sources and current transfers from the government and the rest of the world added to the private sector. Personal disposable income is that part of the personal income which is available to the individuals to be used the way they like for consumption and savings.

(x) Variable cost is that cost which is incurred on variable factors.

Example: expenditure on raw materials, wages and salaries paid to workers who are not permanent.

(xi) Economic services are services rendered to create earning and non-economic services are services which do not create earnings.

(xii) When the process of deficit financing is undertaken, the supply of money increases. In fact, the supply of cash money increases. In India, for example, if the Govt, decides to issue new money, it will print one rupee notes and/or issue small coins. This increases the cash money supply. If the Government decides to borrow from the Reserve Bank of India (which is India’s central bank) it transfers its securities to the Reserve Bank. On the weight of securities, the Reserve Bank issues currency notes of ₹ 2/- or higher denomination. This is how the Govt, gets the extra money. In both cases, the amount of cash money is the economy and, therefore, the total money supply (i.e. cash plus demand deposits in banks) increases. It means extra purchasing power in the hands of the general people. This may create excess demand conditions in the economy. So there will be upward pressure on the general price level.

(xiii) A trade union or labour union is an organization of workers that have bonded together to achieve common goals such as better working conditions. The trade union through its leadership, bargains with the employer on behalf of union members and negotiates labour contracts with employers.

(xiv) Public Expenditure increases the level of employment: Public expenditure leads to increase in the level of employment in the country; especially in the underdeveloped countries like India. For example, Rural Public Works Programmes have been launched to provide employment in rural areas like irrigation scheme, construction work and flood control etc. In this way through public expenditure, the government can create additional employment opportunities and increase the level of income also.

(xv) Usually, in the accounting sense, the total receipts in the balance of payments account must be equal to the total payments. Thus the balance of payment is always balanced. But this account may or may not be balanced. If total autonomous receipts exceed the total spendings of foreign exchange in a given year, there arises a ‘surplus’ in the transaction account of the balance of payments. On the other hand, if receipts fall short of spending, there occurs a ‘deficit’ in the autonomous account of the balance of payments. In both cases, the balance of payments is out of equilibrium, i.e., there will be an unfavourable balance of payment.

Part – II

(Answer Any Five Questions)

Question 2.

(a) Discuss two reasons for the downward slope of the demand curve. [4]

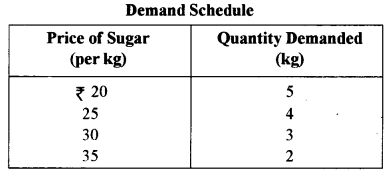

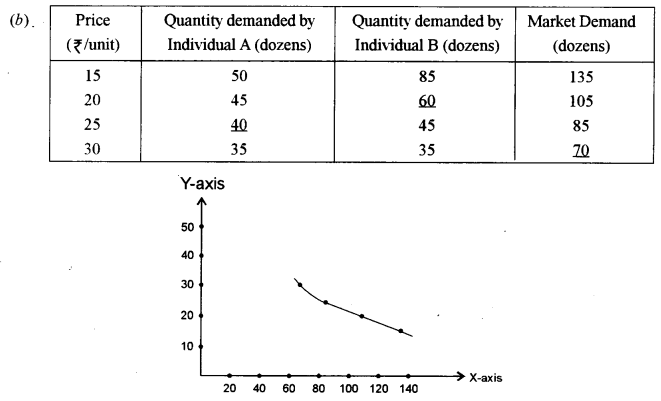

(b) Complete the demand schedule for commodity X: [4]

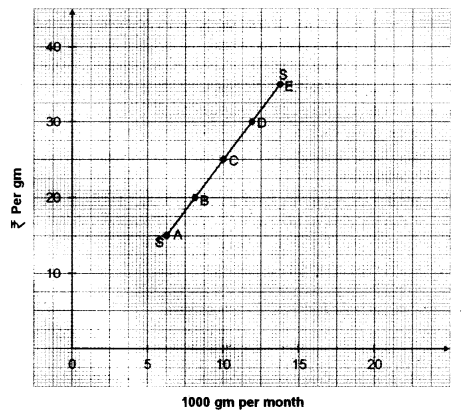

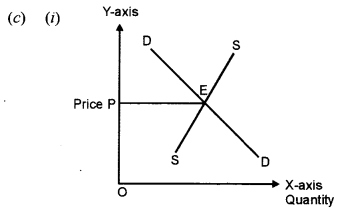

In the graph above, DD is the demand curve and SS is the market supply curve.

(i) On the y-axis, mark any price P, showing excess demand.

(ii) How will equilibrium be restored from a situation of excess demand?

(iii) Show how equilibrium price will be affected when the increase in demand is equal to the decrease in the supply of a commodity.

Answer:

Two reasons for the downward slope of the demand curve are:

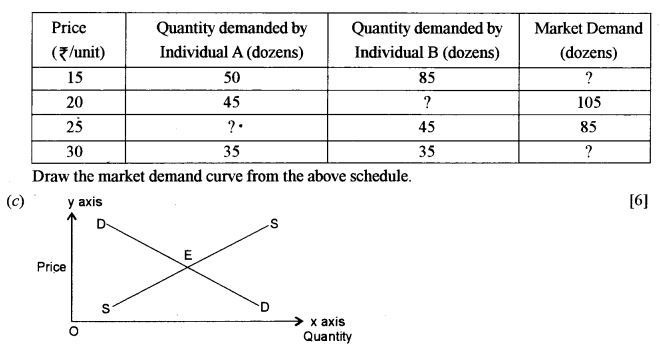

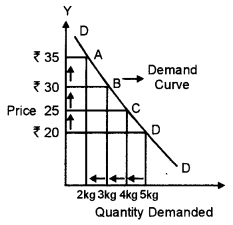

(a) Demand schedule: Tabular representation of price and demand relationship is called demand schedule.

This table depicts that as the price of sugar increases, its demand decreases continuously. Explanation of the law of demand with the help of a graph.

This graph shows the inverse relationship between price and demand. A, B, C, D are the points showing the relationship between price and demand. By joining these points we can draw the demand curve DD.

A demand curve is the graphic presentation of the demand schedule.

DD demand curve has a negative slope which shows the inverse relationship between price and demand.

In brief the law of demand states.

D = f(P)

D = Demand

f = Function

p = Price

Demand is a function of price. If other things remain constant, with an increase in price the demand falls and with fall in price the demand increases.

Two reasons for the downward slope.

1. The law of diminishing marginal utility.

2. Income effect

(ii) If the supply and demand of units are brought to the same levels.

(iii) Price rises

Question 3.

(a) Explain the supply function. [4]

(b) State the Law of Supply. Discuss how a change of technology affects the supply of a commodity. [4]

(c) Discuss the relationship between Average product and Marginal product with the help of a diagram. [6]

Answer:

(a) The supply function is a statement which states the relationship between the quantity supplied of a commodity and its determinants. The supply function may be written as

\(\mathrm{S}_{n}=f\left(\mathrm{P}_{n}, \mathrm{P}_{1}, \ldots \mathrm{P}_{n}-1 . \mathrm{Cu}_{f}, \mathrm{F}_{i} \ldots \mathrm{F}_{n}, \mathrm{T} . \text { E. } \mathrm{Cu}_{\ldots}, \mathrm{N}, \mathrm{N}_{-} \ldots\right)\)

where Sn is the quantity, supplied of a commodity ‘n’; If is a symbol showing the relationship between the supply of a commodity ‘n’ and all its determinants, Pn is the price of commodity ‘n’ : P1 … Pn-1 are the prices of commodities other than n. Cuf is the goal of the firms; Fi … Fn; is an expression of prices of different factors of production; T is the technique of production; E is a symbol of expectation of future prices, Cu+ is the taxation policy of the government; N is the natural factors and N- stands for means of transportation.

(b) The Law of supply states a positive relationship between the price of the commodity and the quantity supplied. It is indicated by a positively sloping curve. It rests on the celeries paribus’ (i.e., other things affecting the supply function remain unchanged) assumption. So the normal supply curves are called the ceteris paribus’ supply curve.

This Law assumes that.

- Prices of the factors of production remain unchanged.

- Production technology remains the same.

- The policies of the government (sav the tax and subsidy policy) remain unchanged.

- The goals of the firm remain unattended.

- The number of firms in the industry remains the same.

Improvement in techniques of production results in an increase in supply (rightward shift of supply curve) and use of inferior techniques of production results in a decrease in supply (leftward shift of supply curve.

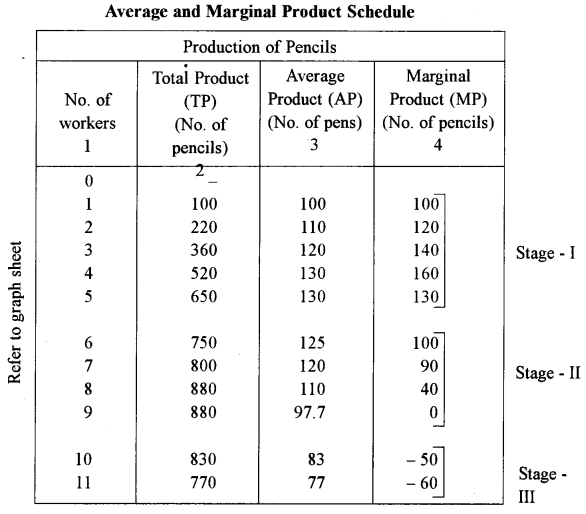

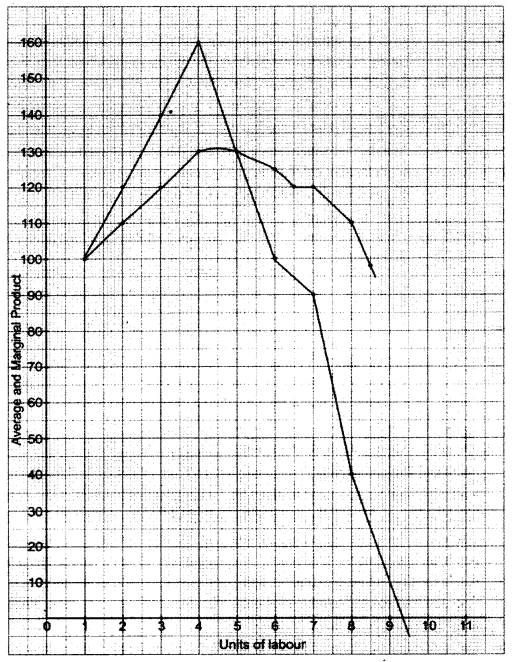

(c) The relationship between Average (AP) product and Marginal product (MP) is as follows:

The relationship between MP and AP is as follows:

- When MP > AP, this means that AP is rising. This is the care up to 4 units of labour in the above table.

- When MP = AP, this means that AP is constant. This occurs in our example when 5 workers are employed.

- When MP < AP, this means that AP is falling. This phase starts from 6th worker.

Diagrammatically, the relationship between the MP curve and the AP curve is as follows:

- So long as the MP curve lies above the AP curve the AP curve is the positively sloping curve. This can be seen in the diagram before point A.

- When the MP curve intersects AP curve, this is the maximum point on the AP curve, where AP is at maximum. This happens at point A in the diagram.

- When the MP curve is below the AP curve, the AP curve slopes downwards. This happens after point A.

Question 4.

(a) Explain one cause each for increasing and diminishing returns to scale. [4]

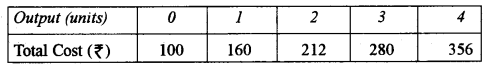

(b) A cost function is given below: [4]

Calculate:

(i) Total Fixed Cost

(ii) Total Variable Cost

(iii) Marginal Cost

(c) Discuss four determinants of elasticity of demand. [6]

Answer:

(a) One cause for increasing returns to scale is greater degree of specialisation of labour and machinery. As the scale of production increases the efficiency of labour increases due to division of Labour and specialisation of labour. Similarly, when the scale of production increases it becomes possible to use specialised machines and the services of specialised and efficient management. This occurs in the rise in productivity of inputs leading to increasing returns to scale. One cause for decreasing returns to scale is a rise in the scale of production beyond a point may create the problem of efficient management leading to decrease in managerial efficiency. A large scale of production causes the problem of lack of proper coordination, inverse bureaucracy, red-tapism, the long chain of communication and command between the higher management and on the production line. As a result of all this, the total efficiency of management diminishes.

(c) 4 determinants of elasticity of demand are:

(i) Nature of the commodity:

An important determinant of the elasticity of demand for a good is the nature of the goods itself. If the goods is a necessity, its demand will remain unchanged with price changes. There will be a low elasticity of demand. In our country, the demands for rice, salt, edible oil are relatively inelastic. The demands for luxury items on the other hand, elastic. When the price of the air conditioner increases, people can do in the absence of air conditioner. The demand for the air conditioner will, therefore, fall sharply. The. elasticity of demand will, therefore, be high.

(ii) The elasticity of demand for a commodity also depends on the existence of substitute commodities. If substitutes exist, these will be used in place of the commodity in question when its price rises. The demand for this commodity will come down. In other words, demand will be elastic. This shows how the existence of tea makes the demand for coffee elastic.

(iii) No. of uses: The demand for a commodity which can be used for a no. of uses will be relatively elastic. For example, electricity can be used for cooking, heating, lighting, washing etc. When the price of electricity rises, the consumers can reduce some uses of electricity. The demand for electricity will be elastic.

(iv) Income of the purchaser: The elasticity of demand is also influenced by the income of the purchaser. A rich purchaser will not be bothered by small changes in prices. Such changes will lead to his demands being unaffected. The demands of this consumer for different types of commodities will be relatively inelastic. A not so rich consumer will be affected by lesser changes in prices. His demand, therefore, will be elastic.

Question 5.

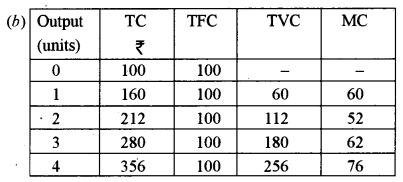

(a) Using diagrams, distinguish between the shapes of the Total Revenue curve under perfect and imperfect competition. [4]

(b) Discuss the shape of the Average Fixed Cost Curve. [4]

(c) Explain how a perfectly competitive firm in equilibrium incurs losses in the short run. [6]

Show the same with the help of a diagram.

Answer:

(a) Total Revenue explained numerically in Table (1) and graphically in fig. (1).

Total Revenue under Perfect Competition

Total revenue changes with a change in output. Since price under perfect competition is constant it follows that the total revenue varies in direct proportion to output. Column 3 in Table (1) shows that the total revenue is increasing all through at all levels of output, and it is increasing at a constant rate. Figure (2) shows that the TR curve is a straight line from the origin and its slope is constant as determined by the price. The curve must pass through the origin because at zero output TR is zero. It is a straight line with a constant slope.

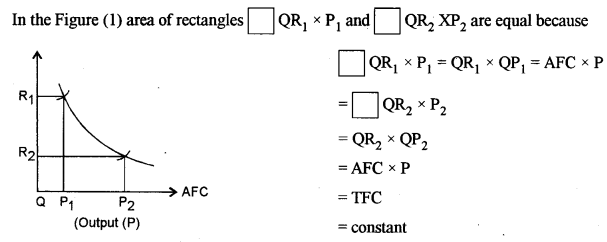

(b) TFC is constant at all levels of Q, so with a gradual increase in Q, there will be a continuous fall in AFC. Thus AFC will be much closer to zero (0) but it will never be zero (0). It is to be noted that AFC. Q = TFC = Constant. Here, the AFC curve will be a rectangular hyperbola. This is shown in Figure (1).

As AFC ≠ So the AFC curve will never touch or cut the horizontal axis.

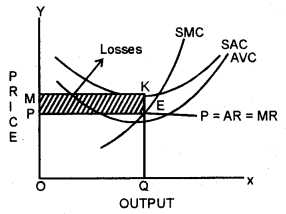

(c) A firm incurring a loss: In the short run firm may continue production even if it is incurring losses because it cannot leave the industry. In the situation of a loss, a firm would be in equilibrium at the level of output where it gets minimum losses. This can be shown with the help of a diagram.

In the fig. short-run marginal cost curve cuts the marginal revenue from below at point E. At OQ level of output firms, AR is EQ and Average cost is KQ. It is clear from the diagram that AR is less than average cost. Hence the firm’s per unit loss is equal to KE (KQ – EQ). The firm’s total loss will be KEPM.

Question 6.

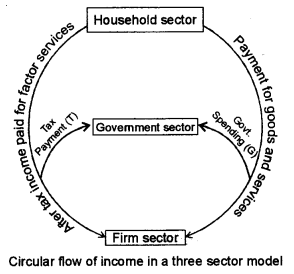

(a) With the help of a well-labelled diagram, show the circular flow of income in a three-sector model. [4]

(b) Define compensation of employees and mention its components. [4]

(c) From the data given below, calculate Gross Domestic Product at market price and National Income (NNPFC) using the Value Added Method: [6]

| (i) Gross Value of output in the primary sector (at factor cost) | 950 Crores |

| (ii) Gross Value of output in the secondary sector (at factor cost) | 470 Crores |

| (iii) Gross Value of output in the tertiary sector (at factor cost) | 500 Crores |

| (iv) Value of intermediate product in the primary sector | 360 Crores |

| (v) Value of intermediate product in the secondary sector | 200 Crores |

| (vi) Value of intermediate product in the tertiary sector | 175 Crores |

| (vii) Depreciation | 20 Crores |

| (viii) Indirect tax | 35 Crores |

| (ix) Subsidy | 10 Crores |

| (x) Net Factor Income from Abroad | 4 Crores |

Answer:

(a)

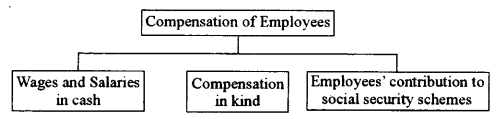

(b) Compensation of employees is also known as labour income, is income from work for others.” It is the remuneration to the workers for their labour. It is the payment made by producers to their employees in the form of wages and salaries and other payments in cash and kind and social security benefits.

Its components consist of:

(i) Wages and salaries in cash, including bonus, commission, dearness allowance, house rent allowance, travelling allowance, leave travel concession, sick leave allowance etc.

(ii) Supplementary labour income in the form of employer’s contribution (not of employees) towards social security schemes for employees, such as provision for pension, product field, group insurance, gratuity etc. The contributions made by employees towards social security schemes are not included in the social security contribution while education compensation of employees since they are paid out of wages and salaries.

(iii) Payment to employees in kind like rent-free accommodation, free medical, free educational facilities, free or subsidised food, uniform, free transport, recreation, creches for children of employees, free provision of goods and services produced by the employees.

Thus:

(c) NVA (at factor cost value of gross output)

The gross value of output in the primary sector (at factor cost) = 950

The gross value of output in the secondary sector (at factor cost) = 470

The gross value of output in the tertiary sector (at factor cost) = 500

Total = 1920

Less value of the intermediate product in the primary sector + secondary sector + tertiary sector

= 360 + 200 + 175

= 735

Less depreciation = 20

Less net indirect tax

Direct tax = 35

Less subsidy = 10

NVA = 1145

National Income = NVA + Net Factor Income from abroad = 1145 + 4 = 1149 (in crore)

Question 7.

(a) What is meant by selling cost? Which kind of market does not need selling cost and why? [4]

(b) Define interest. In calculating gross interest, what is payment for risk? [4]

(c) Discuss how under perfect competition, a firm is a price taker and an industry a price maker.

Answer:

(a) Selling cost is any selling expenses incurred by the firm (particularly expenses for advertisement) under monopolistic competition. The firm desires to accentuate the differences between its own brand and other brands of the product available through its advertising and selling expenses. Thus selling cost have a positive role in strengthening the preferences of the consumers for the advertised product and making the demand for the product relatively inelastic.

(b) Interest is the price paid to the owner of capital for using the services of capital per period. Often the lender has to bear several other costs. He will lose if the borrower does not return the money in time. This may happen for several reasons-the borrowers may become bankrupt or he may try to deceive the lender. For these reasons the borrower may due, he may become bankrupt on be may try to decide the lender. For these reasons, the lender has to take a risk. As a price for this risk-taking, he extracts an amount from the borrower. This is added to the net interest.

(c) There are a large number of buyers and sellers of the commodity under perfect competition each too small to influence the price of the commodity by his actions. Under perfect competition a firm produces such a small part of the total market output that a change in its output will have no significant effect on the market supply and hence price of the commodity. A firm under perfect competition cannot influence the market price by increasing or decreasing the quality of output it produces.

Question 8.

(a) Balance of Payment always balances in the accounting sense. Explain briefly. [4]

(b) Discuss two causes of disequilibrium of the balance of payments. [4]

(c) “A country which has an absolute disadvantage in the production of any two goods can still have a comparative advantage in the production of one of those goods, which it can produce efficiently and export.’’ Explain the underlying theory with an example. [6]

Answer:

(a) The total receipts in the BOP account are equal to the aggregate payments. Hence, there is neither any surplus nor any deficit in the BOP account. In fact, the bookkeeping or accounting sense every credit. Entry must have a corresponding ‘debit’ entry. The golden rule of double-entry bookkeeping is Debit what comes in and Credit what goes out. The aggregate ‘credit balance’ of all credit accounts must be equal to the aggregate ‘debit balance’. So in the accounting sense, the BOP account is always balanced.

(b) Two causes of disequilibrium of the balance of payments are:

(i) Lack of development of production system: In an underdeveloped country where the production system is not developed enough all the necessities of life have to be imported. There are very few things that such a country can export and that too in small quantities. These countries encounter an adverse balance of payment.

(ii) When a backward economy tries to develop it takes the balance of payments difficulties again. The various development schemes usually necessitate the imports of machines, raw material. These push up the import bill. Exports can be raised only when these schemes are completed and output in the country increases. Until then the balance of payments remains adverse.

(c) International trade based on the principle of Ricardian comparative advantages:

According to this theory, a country has a comparative advantage in the production of one commodity, will produce that commodity and export conversely import that commodity in which the country has comparative disadvantages.

Country A and B. Suppose country A produces cotton and wheat. Another country B also produces cotton and wheat. Let country A produce 100 units of cotton by 10 days of labour, also country A produce wheat by 100 units of wheat by 10 days of labour. Country B produces 60 units of cotton.

Or

120 units of wheat by using 10 days of labour.

In-country A: the cost ratio is 100 units of cotton =100 units of wheat.

Or

1 unit of cotton = 1 unit of wheat

In-country B: the cost ratio is 6d units of cotton = 120 units of wheat.

Or

1 unit of cotton = 2 units of wheat

These differences in cost ratio will enable the two countries benefits from trade.

In the above example country A has a comparative advantage of cotton and country A has a disadvantage of wheat.

Similarly, country B has a comparative advantage in wheat and disadvantage in cotton. So country A exports cotton and imports wheat from country B. In this way, international trade takes place between countries.

Question 9.

(a) What is a Performance Budget? Differentiate between Revenue Expenditure and Capital Expenditure. [4]

(b) In a situation of income inequality, give two ways in which Fiscal Policy can be used to bring about equity. [4]

(e) Discuss four methods of repayment of public debt. [6]

Answer:

(a) Since 1973-74 the idea of Performance Budget was introduced by the fiscal authorities in India. Performance budgeting aims at monitoring the progress of projects in terms of their actual physical achievements against the given goals. Hence, evaluation of the expenditure involves the assessment of the progress of the programmes included in the project.

The expenditure which does not result in the creation of assets is revenue expenditure. The capital expenditure consists of expenditure on acquisition of assets like land, buildings, machinery, equipment, investment in shares, loans and advances granted by Central / Union Govt, to states and Union Territories.

(b) In a situation of income inequality two ways in which Fiscal Policy can be used to bring about equity are:

(i) The types of income and other taxes designed by the Govt should be such that an equitable distribution of the society’s income and wealth occurs.

(ii) The regional balance should be maintained. If particular regards of the country are not taken into account in the process of development, this will accentuate the problem of inequality’ of income distribution in a society. The public projects must be distributed over all the regions in the country is a fairway.

(c) Four methods of repayment of public debt are:

(i) Terminable annuities: Government may pay the bondholders a certain fixed amount for a number of years to meet his debt obligations. These annual payments are called annuities.

(ii) Purchase of Government bonds in the security market. The Government may also purchase its own stock in the security market.

(iii) Budgetary surplus: A surplus increased in the Government surplus of aggregate revenue exceeds aggregate expenditure of the Government during any particular year. This budgetary surplus can be used by the Govt, to meet its debt obligation.

(iv) Export Surplus: If the export income of a country becomes more than its import payments then an export surplus is created. This leads to greater inflow of foreign exchange into the exchequer of the Govt. The Govt can use this foreign exchange reserves to meet its external debt obligation.