ISC Commerce Previous Year Question Paper 2010 Solved for Class 12

- Candidates are allowed additional 15 minutes for only reading the paper. They must NOT start

writing during this time. - Answer Question 1 from Part I and seven questions from Part II.

- The intended marks for questions are given in brackets [ ].

Part – I (Compulsory)

Question 1.

Answer briefly each of the questions (i) to (xv). [15 × 2]

(i) List any two features of planning as a function of management.

(ii) HOW are the first directors of a company appointed?

(iii) Mention any two limitations of direct mail advertising.

(iv) What is meant by gangplank?

(v) Mention any two drawbacks of public deposits as a source of finance.

(vi) What is horizontal communication?

(vii) State two functions of exchange with reference to marketing.

(viii) What is the significance of the objects clause in the Memorandum of Association of a company?

(ix) What is staffing?

(x) What are Multinational Companies?

(xi) Give any two conditions under which a cheque is dishonoured by a banker.

(xii) Explain any two demerits of a joint-stock company.

(xiii) What are mutual funds?

(xiv) Who is an alternate director?

(xv) What are retained earnings?

Answer:

(i) Planning is selecting priorities and results (goals, objectives, etc.) and how those results will be achieved. Planning typically includes identifying goals, objectives, methods, resources needed to carry out methods, responsibilities and dates for completion of tasks.

(ii) First directors of a company are appointed by the original investors (members or subscribers) usually from among themselves and are named in the Articles of Association. However, mention in the Articles does not constitute a valid appointment until the person gives his or her signed consent to hold the office of the director, and is not disqualified (for any reason) from holding that office.

(iii) (a) There is a relatively high cost per contact.

(b) It may be difficult to obtain updated, accurate mailing lists.

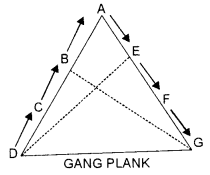

(iv) A Gang Plank is a temporary arrangement between two different points to facilitate quick and easy communication as explained below:

In the figure given, if D has to communicate with G he will first send the communication upwards with the help of C. B to A and then downwards with the help of E and F to G which will take quite some time and by that time, it may not be worth therefore a gangplank has been developed between the two.

Gang Plank clarifies that management principles are not rigid rather they are very flexible. They can be moulded and modified as per the requirements of situations.

(v) (i) Public deposits are an uncertain and unreliable source of finance.

(ii) Public deposits distort the interest rate pattern.

(iii) Public deposits are generally not available to new companies and those with uncertain earnings.

(vi) Horizontal communication is that communication which flows in the same level of management For example – communication between the manager of the sales department and manager of purchases department.

(vii) (a) Exchange helps in the process of marketing.

(b) Exchange creates utility.

(viii) The Objects clause is the most important clause of the company. It specifies the activities which a company can cany on and which activities it cannot carry on. The company cannot carry on any activity which is not authorised by its Memorandum of Association. This clause must be specified.

- Main objects of the company to be pursued by the company on its incorporation

- Objects incidental or ancillary to the attainment of the main objects

- Other objects of the company not included in (i) and (ii) above.

In case of the companies other than trading corporations whose objects are not confined to one state, the states to whose territories the objects of the company extend must be specified.

(ix) Staffing is the management function devoted to acquiring training, appraising and compensatin’- employees.

(x) A multinational company is a company having production and distribution centres located in more than one country. It carries on business not only in the country’ of its incorporation but also in other countries. For example-Sony, HP, etc.

(xi) A cheque can be dishonoured by a banker in the following conditions:

- When there is no sufficient balance in the account on which the cheque has been issued.

- If there is any alteration on the cheque and that alteration has not been authorized by the account holder.

- When the signatures put on the cheque do not match with the signatures stored in the records of the bank.

(xii) (a) Unsatisfactory management

(b) Difference of opinions

(c) Heavy expenses of formation.

(xiii) A mutual fund is a professionally managed type of collective investment scheme that pools money from many investors and invests it in stocks, bonds, short-term money market instruments, and/or other securities. The mutual fund will have a fund manager that trades the pooled money on a regular basis. Currently, the worldwide value of all mutual funds totals more than $30 trillion.

(xiv) An alternate director is a temporary’ director who can represent an elected director at a meeting of the board of directors, provided (1) the articles of association of the company allow for such arrangement and the other elected directors of the firm do not object.

(xv) Retained earnings are the undistributed profits of the company. These earnings help the company to avoid external borrowings.

Part – II

(Answer Any Seven Questions)

Question 2.

(a) Briefly explain any four demerits of a Government Company. [4]

(a) Briefly explain any four demerits of a Government Company. [4]

(b) What is a private limited company? State any eight privileges enjoyed by it. [6]

Answer:

(a) Demerits of Government Companies are:

- Lack of accountability: A government company is not fully responsive to the parliament or the general public. It enjoys special privileges. It may not act for the public interest.

- Political interference: In actual practice politicians and bureaucrats interfere in the functioning of Government companies. Such interference cause lack of ness in management and adverse effect in proficiency.

- Indifferent management: Government companies are generally managed by Government servants and other Government officers. They are not hard-working and take little personal interest in running the company on a sound business line. The efficiency of operations is low. Operational costs are high.

(b) Private Company means a company which by its articles of association.

- Restricts the right of members to transfer its shares.

- Limits the number of its members to fifty. In determining this number of 50 employee members and ex-employee members are not to be considered.

- Prohibits any invitation to the public to subscribe to any shares in or the debentures of the company.

If a private company contravenes any of the aforesaid three provisions, it ceases to be a private company and loses all the exemptions and privileges which private company is entitled.

Privileges:

- Limited liability,

- The simple and easy formation,

- Immediate commencement of business upon incorporation,

- Liberal payment of remuneration and loans to directors without any restrictions,

- Easier inter-corporate loans

- Lesser disclosure requirements

- Tremendous ease in operation

- Two directors are enough

- Two Shareholders are adequate

- Need not declare a dividend

Question 3.

(a) Explain any four factors which determine the working capital requirement of a business. [4]

(b) What are special financial institutions? Discuss any four advantages of obtaining funds from such institutions. [6]

Answer:

(a) Factors affecting Working Capital

- Type/Nature of Business: Working capital level is generally higher in manufacturing-based versus service-based organisations.

- Depends on the Volume of Sales: The higher the sale, the higher is the level of working capital required.

- Seasonality: Peak seasons like festive seasons require a higher level of working capital.

- Length of Operating And Cash Cycle: A longer operating and cash cycle increases the level of working capital.

(b) Special Financial Institutions: A wide variety of financial institutions have been set up at the national level. They cater to the diverse financial requirements of the entrepreneurs. They include all India development banks like IDBI, SIDBI, IFCI Ltd, UBI; specialised financial institutions like IVCF, ICICI Venture Funds Ltd, TFCI; investment institutions like LIC, GIC, UTI: etc.

Advantages of Special Financial Institutions are:

- They provide finance for the growth of the industry.

- They accelerate the growth of the industrial sector by encouraging them to have better industrial output.

Question 4.

(a) Explain the primary functions of commercial banks.

(b) What is a debenture? Explain any two advantages and any two disadvantages of debentures from the viewpoint of a company. [6]

Answer:

(a) Primary Functions of Commercial Banks

1. To Receive Deposits

Receiving deposits is the most important function of commercial banks. The deposits can be accepted in the form of the following types:

(i) Saving Deposits: The people of middle and lower classes who wish to save a part of their income can invest in Saving Bank Accounts. Deposit in these accounts also earns interest at the rate announce by the RBI from time to time.

(ii) Demand Deposits: These deposits are also called current deposits. The current accounts are meant for big customers. There is no limit on the number of withdrawals, amount, etc. in the current account deposits. There is no provision of paying interest on such type of deposits. These accounts are generally opened by the businessmen.

(iii) Time Deposits: These deposits are accepted by the banks in the form of fixed deposits. These deposits are accepted for a fixed time period. The minimum time period for accepting a time deposit is 14 days. These deposits earn a higher rate of interest as compared to saving deposits. Time deposits are accepted for the maturity period of 1 year, 2 years, 3 years and so on respectively. Customers can take loan up to 75% of their deposit against the security of Fixed Deposit Receipt (FDR).

2. Sanction of Loans and Advances

The income of the banks is generated by sanctioning loans and advances to the eligible persons. The interest is charged at a higher rate. This rate of interest is generally higher than the saving deposit or fixed deposit rate allowed to the customers.

Types of Facilities under Loans and Advances

(i) Overdraft Facility: Banks allow their genuine customers to withdraw up to a certain limit in excess of the borrower’s deposits.

(ii) Advances: Banks generally provide short term and medium-term advances. Short term advances are sanctioned for a period up to 1 year. Medium-term advances are sanctioned for a period of more than 1 year but not exceeding 3 years.

(iii) Discounting Bill of Exchange: Banks provide advances against the bills of exchange even before the customer receives money from the parties. These bills are discounted by the banks and payment is made to the customer. The bill is realised by the bank when a party sends money to it.

(b) A debenture is a document issued by a company as an evidence of a debt from the company with

or without a charge on the assets of the company.

Advantages of Debentures from View Point of a Company:

- Funds raised by the company by way of debentures are required to be repaid during the lifetime of the company at the time stipulated by the company. As such, debenture is not a source of permanent capital. It can be considered as a long term source.

- In financial terms, debentures prove to be a cheap source of funds from the company’s point of view.

Disadvantages of Debentures from View Point of Company:

(i) By issuing the debentures, a company is under two types of risks. These are payment of the interest at a fixed rate, irrespective of the non-availability of profits and repayment of the principal amount at the pre-decided time. If earnings of the company are not stable or if the demand for the products of the company is highly elastic, debentures prove to be a very risky proposition for the company. Any adverse change in the earnings or demand may prove to be fatal for the company.

(ii) Debentures are usually a secured source for raising the long term requirement of funds and usually the security offered to the investors is the fixed assets of the company. A company which requires less investment in fixed assets, may find debentures as a wrong source of raising the long term requirement of funds as it does not have sufficient fixed assets to offer as security.

Question 5.

(a) Write short notes on [4]

(i) Managing director

(ii) Manager

(b) State any six powers of the directors of a company. [6]

Answer:

(a) (i) A managing director means a director who is entrusted with substantial powers of management

which would not otherwise be exercisable by him. The “substantial powers” of management may be conferred upon him by virtue of an agreement with the company, or by a resolution of the company or the Board or by virtue of its memorandum and articles. The powers so conferred are alterable by the company.

A managing director occupies the dual capacity of being a director as well as an employee of the company. The day to day management is entrusted to the managing director who can exercise powers of management without referring to the Board.

(ii) A manager of a company is the in-charge of a team. He makes plans, directs his team, motivates them to achieve their goals. In a company, every department can have a manager, for example, Manager Marketing, Manager Accounts, etc. The duties of different managers may vary according to their assignments.

(b) The Board of Directors is entitled to exercise all such powers and do all such acts and things as the company is authorised to exercise by its Memorandum of Association and Articles of Association. In general, the Board of Directors has the power of superintendent, control and direction over the Managing Director and the Manager who are the persons entitled to manage the affairs of the company. The Board of Directors can exercise the following powers:

- Powers to be exercised at Board Meetings: The following powers must be exercised in a Board meeting and cannot be delegated to other managerial personnel:

- To issue debentures;

- To issue and allot shares;

- To fill up casual vacancies on the board;

- To sanction contracts in which one or more directors have an interest;

- To make calls on shareholders in respect of money unpaid on their shares;

- To forfeit shares;

- To recommend dividends;

- To decide the terms and conditions of issue of shares and debentures;

- Other powers:

- To borrow money by means other than through debentures say through public deposits.

- To invest the company’s funds properly.

- To make loans.

- To make contracts for the purchase and sale of the property on behalf of the company.

Question 6.

(a) Describe the importance of communication. [4]

(b) Explain any six differences between written and oral communication. [6]

Answer:

(a) Importance of Communication in Business is mentioned below:

- It can promote managerial efficiency and performance.

- It provides a necessary basis for direction and leadership.

- It is essential for decision-making and planning to achieve the goals.

- It is helpful in planning and coordinating the activities of the business.

- It plays a vital role in achieving maximum production with a minimum of cost.

- It is the foundation for democratic management in the organisation.

- It creates mutual trust and confidence between the management and the workers. Therefore, it is a basis of sound industrial relationships.

- It improves the morale of workers as they can easily communicate their grievances, troubles, problems, etc. to the management.

- It is a tool of effective control in the hands of management.

- It creates a good image of the business in society.

(b) Difference between Written and Oral Communication:

| Written Communication | Oral Communication |

| 1. Written communication covers larger distances. | 1. Oral communication does not cover larger distances. |

| 2. Speed of communication is low. | 2. Speed of communication is fast. |

| 3. Proper records of communication are available. | 3. Record is not. available except in a few cases |

| 4. Full secrecy cannot be maintained. | 4. Secrecy can be maintained. |

| 5. Responsibility of the sender can be fixed. | 5. Responsibility of the sender cannot be fixed. |

| 6. It supports legal evidence. | 6. It does not support legal evidence. |

| 7. It is formal in nature. | 7. It is informal in nature. |

| 8. Suitable for the lengthy message. | 8. Not suitable for lengthy messages. |

| 9. Personal touch not available. | 9. A personal touch is visible. |

| 10. Less suitable for group communications. | 10. More suitable for group communications. |

| 11. Immediate feedback not available. | 11. Immediate Feedback is available. |

| 12. It covers uniform costs irrespective of distances. An envelope costs Rs. 5 to send a message locally or nationally. | 12. Costs vary with an increase in distances. A local telephone call is very cheap as compared to calls made from one part of the country to the other part Same is the case while doing international calls. |

Question 7.

(a) Explain any four techniques of sales promotion. [4]

(b) What is salesmanship? Explain any four qualities a good salesman should possess. [6|

Answer:

(a) Techniques of Sales Promotion.

(i) Free samples: Distributing free samples is one of the most popular techniques of sales promotion. You might have received free samples of shampoo, coffee powder, etc. while purchasing various items from the market. Sometimes these free samples are also distributed by the shopkeeper even without purchasing any item from his shop. These are distributed to attract consumers to try out a new product and thereby create new customers.

(ii) Premium or Bonus offer: In such a technique, the free additional quantity of a product is given to the consumer in the same price of the product or some free related item is given. A milk shaker along with Nescafe, a toothbrush with 500 grams of toothpaste, 25% extra in a pack of one kg. are the examples of premium or bonus is given free with the purchase of a product They are effective in inducing consumers to buy a particular product.

(iii) Exchange scheme: This technique includes offering the exchange of old product for a new product at a price less than the original price of the product. This is useful for drawing attention to product improvement.

(iv) Price-off-offer: Under this offer, products are sold at a price lower than the original price. For Example-Rs. 5 off on purchase of 250 grams of Red Label Tea.

(v) Coupons: Sometimes, coupons are issued by manufacturers either in the packet of a product or through an advertisement printed in the newspaper or magazine or through the mail. These coupons can be presented to the retailer while buying the product. The holder of the coupon gets the product at a discount.

(b) Salesmanship is a personal action or effort on the part of an individual which is intended to bring about the sale of the goods for sale. More broadly speaking, salesmanship is the art of selling something to somebody, and everything which contributes to the consummation of this exchange is necessarily a part of salesmanship.

Qualities of a good salesman are:

- He should have self-confidence.

- He should be persuasive and not of critical temperament.

- He should have qualities of sincerity, maturity and produce a cheerful smile.

- He should be of an analytical mind.

Question 8.

State and explain any five principles of scientific management as laid down by Taylor. [10]

Answer:

The basic principles of scientific management are as follows :

(i) Science not Rule of Thumb: Each and every job and the method of doing it should be based on scientific study and analysis rather than on trial and error. The task to be performed should be scientifically planned. The materials, equipment and working condition should be standardised. The amount of work to be done should be decided through objective study.

(ii) Harmony not Discord: There should be healthy co-operation between employer and employees. Taylor advocated a complete mental revolution on the part of both management and workers. Management should adopt an enlightened attitude and share the gains of productivity’ with workers. Workers on their part should work with discipline and loyalty.

(iii) Maximum not Restricted Output: Conflict between management and workers arises mainly on the division of surplus. Taylor suggested that the best way to resolve the conflict is to increase the size of surplus so that each side can have a larger share. Management and w orkers have a common interest in increasing productivity.

(iv) Division of Work and Responsibility: Taylor suggested separation of planning from operational work. Management should concentrate on planning the job of workers and workers should concentrate on the performance of work.

(v) Scientific Selection, Training and Development of Workers: Workers should be selected and trained to keep in view the job requirements. Each and every worker should be encouraged to develop his full potential.

Question 9.

(a) Explain the steps involved in Organising as a function of management. [4]

(b) Discuss the importance of Management for the successful functioning of an organisation. [6]

Answer:

(a) Steps involved in organizing as a function of management:

1. Identification of activities: All the activities which have to be performed have to be identified first. For example, preparation of accounts, making sales, record keeping, quality’ control, inventory control, etc. All these activities have to be grouped and classified into units.

2. Departmentally organizing the activities: In this step, the manager tries to combine and group similar and related activities into units or departments.

3. Classifying the authority: Once the departments are made, the manager likes to classify the powers and its extent to the managers. This activity of giving a rank in order to the managerial positions is called hierarchy. This helps in achieving efficiency in the running of a concern. This helps in avoiding wastage of time, money, effort, in avoidance of duplication or overlapping of efforts.

4. Co-ordination between authority and responsibility: Relationships are established among various groups to enable smooth interaction toward the achievement of the organizational goal. Each individual is made aware of his authority and he/she knows who they have to take orders from and to whom they are accountable and to whom they have to report.

(b) 1. Management helps in Achieving Group Goals: It arranges the factors of production, assembles and organizes the resources, integrates the resources in an effective manner to achieve goals. It directs group efforts towards achievement of pre-determined goals.

2. Optimum Utilization of Resources: Management utilizes all the physical and human resources productively. This leads to efficacy in management. Management provides maximum utilization of scarce resources by selecting its best possible alternate use in industry from out of various uses. It makes use of experts, professional and these services leads to the use of their skills, knowledge, and proper utilization and avoids wastage.

3. Reduces Costs: Management gets maximum results through minimum input by proper planning and by using minimum input and getting maximum output. Management uses physical, human and financial resources in such a manner which results in the best combination. This helps in cost reduction.

4. Establishes Sound Organisation: To establish sound organisational structure is one of the objectives of management. Management fills up various positions with the right persons, having the right skills, training and qualification.

Question 10.

Write short notes on:

(a) Branding and labelling. [3]

(b) Turnkey Projects. [3]

(c) Role of Promoters. [4]

Answer:

(a) A brand is the idea or image of a specific product or service that consumers connect with, by identifying the name, logo, slogan or design of the company who owns the idea or image. Branding is when that idea or image is marketed so that it is recognizable by more and more people, and identified with a certain service or product when there are many other companies offering the same service or product. Branding is a way to build an important company asset, which is a good reputation. Branding can build an expectation about the company services or products and can encourage the company to maintain that expectation or exceed them, bringing better products and services to the market place.

A label gives the consumer the necessary information on the product he wants to buy. It includes the name of the product, the name of the firm producing it, the price the nutritional information, the ingredients, the instructions of use (if necessary), the date of production and that of minimum durability, and other particulars.

But product labels never give the consumer the whole story of information. The consumer is told what the item is made of, but no information is given about the people who worked on it and the machinery used. Nothing is known on the conditions endured by the workers or maybe the abusive treatment, or forced contraception. So when one thinks of it, no one really knows what he is buying.

Labelling is sometimes too much complicated for certain people to understand and it that is why we need to make it more user-friendly.

(b) Turn-key refers to something that is ready for immediate use, generally used in the sale or supply of goods or services. Since full responsibility for the project rests upon the contractor, the number of interfaces is reduced to the one point of contact instead of a multitude of subcontractors. This gives the customer much greater visibility into the project process as well as leaving the task of coordinating all the subcontractors to the one responsible primary contractor.

Turnkey projects tend to have short project execution times, rapid return on investment, and minimal delays.

(c) Promoters perform the following functions:

- Conceive a business opportunity or the idea of starting a new business.

- Conduct a preliminary analysis of the idea to determine its profitability and feasibility.

- Carry out a detailed investigation in order to determine the nature, scope and requirements of the proposition.

- Appoint brokers, underwriters, solicitors and bankers for the company.