ISC Accounts Previous Year Question Paper 2016 Solved for Class 12

Maximum Marks: 80

Time allowed: Three hours

- Candidates are allowed additional 15 minutes for only reading the paper. They must NOT start writing during this time.

- Answer Question 1 (Compulsory) from Part I and five questions from Part II, choosing two questions from Section A, two questions from Section B and one question from either Section A or Section B.

- The intended marks for questions or parts of questions are given in brackets [ ].

- Transactions should be recorded in the answer book.

- All calculations should be shown clearly.

- All working, including rough work, should be done on the same page as, and adjacent to the rest of the answer.

Section – A

Part – I (12 Marks)

Answer all questions.

Question 1.

Answer briefly each of the following questions : [6 x 2]

(i) What is a contingent liability ? How are contingent liabilities shown in the Balance Sheet of a company prepared as per Schedule III of the Companies Act 2013 ?

(ii) Why is abnormal loss not recorded in the books of a Joint Venture ?

(iii) Give the formula for calculating the outgoing partner’s share in the interim profits of the firm, on the basis of sales made by the firm.

(iv) How is Workmen Compensation Fund, shown in the Balance Sheet of a partnership firm, treated at the time of its dissolution ?

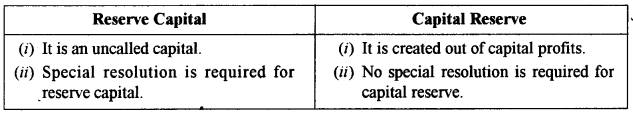

(v) Give any two differences between Reserve Capital and Capital Reserve.

(vi) Give the adjusting entry and closing entry for interest on debentures due to the debenture holders of a company.

Answer:

(i) A liability that might arise on happening of an event in future is known as contingent liability. They are separate shown in the Notes to Accounts’ not in the Balance Sheet.

(ii) Abnormal loss is not recorded in the Joint Venture because the loss automatically gets adjusted as the difference betw een sales and cost of the goods and if insurance claim is received then the loss is minimized.

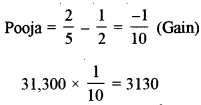

(iii)

(iv) It is distributed among the partners in their profit sharing ratio.

(v)

(vi) Interest on debentures a/c Dr.

To Debenture holders a/c

(Being Interest on debentures due)

Statement of Profit and Loss a/c Dr.

To Interest on debentures a/c

(Being interest on debentures transferred to statement of P/L a/c)

Part – II (48 Marks)

Answer any four questions.

Question 2. [12]

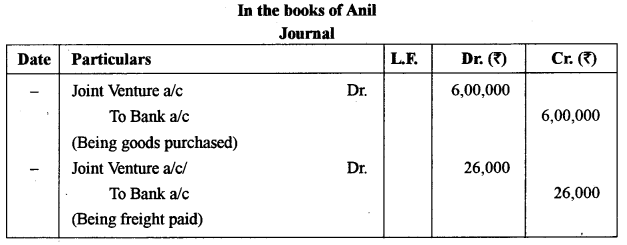

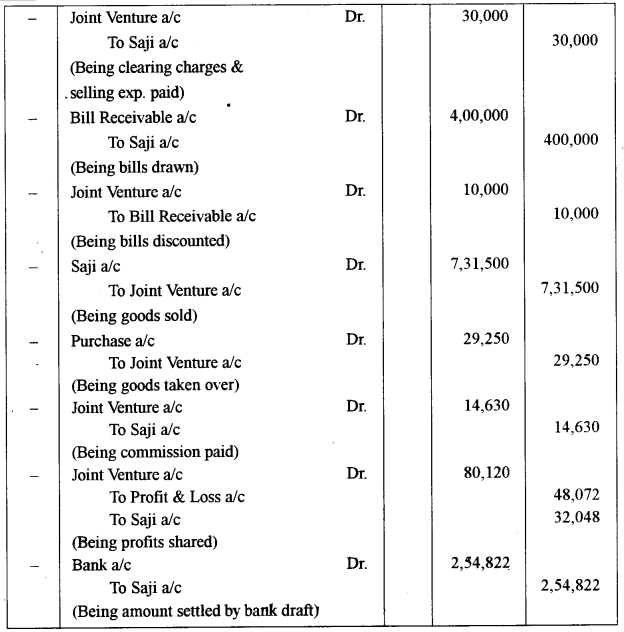

Anil and Saji entered into a joint venture to buy and sell old machines. They decided to share profit and losses in the ratio of 3:2.

Anil purchased 200 machines at ₹ 3,000 each and sent them to Saji for sale.

Anil incurred ₹ 26,000 on freight and transit insurance.

Saji took delivery of the machines and incurred ₹ 24,000 as clearing charges and ₹ 6,000 as selling expenses.

Anil drew a bill on Saji for ₹ 4,00,000 which was accepted by Saji. The bill was discounted by Anil for ₹ 3,90,000 with the bank.

Saji was able to sell 190 machines at ₹ 3,850 per machine.

The unsold machines were taken by Anil for his next venture at the original cost plus proportionate non-recurring expenses less 10%.

Saji was entitled to a commission of 2% on the sales made by him.

The co-ventures settled their accounts by means of a bank draft.

It was decided that Anil would maintain a record of all the transactions.

You are required to pass journal entries in the books of Anil.

Answer:

Question 3. [12]

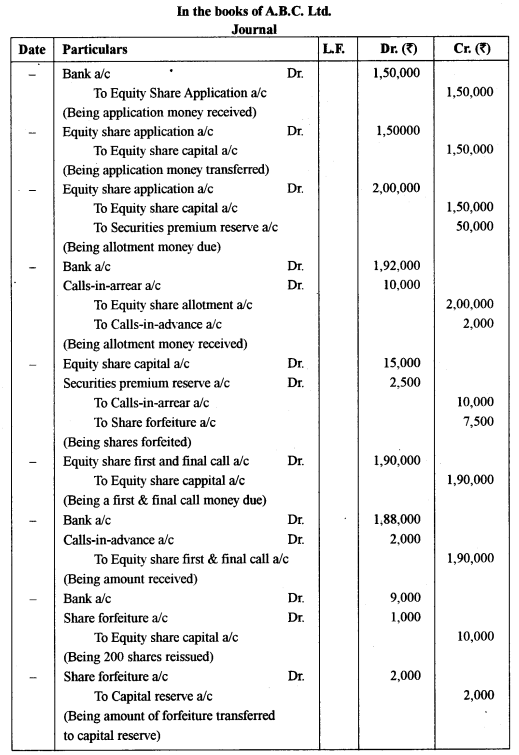

During the year 2014-15, A.B.C. Ltd. issued 10,000 Equity shares of ₹ 50 each at ₹ 55 per share, payable as follows:

On Application ₹ 15

On Allotment ₹ 20 (including premium ₹ 5)

On 1st and Final Call ₹ 20

All the issued shares were subscribed for by the public.

One shareholder holding 500 shares did not pay the amount due on allotment and his shares were immediately forfeited.

Another shareholder holding 100 shares paid the amount of the 1st and Final Call with allotment. After the company had made the 1st and Final Call, 200 of the forfeited shares were reissued as fully called up at ₹ 45 per share.

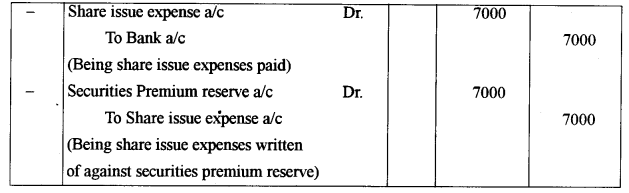

The share issue expenses were ₹ 7,000 which were written off at the end of the year.

You are required to pass journal entries in the books of the company for the year ending 31st March, 2015.

Answer:

Question 4. [12]

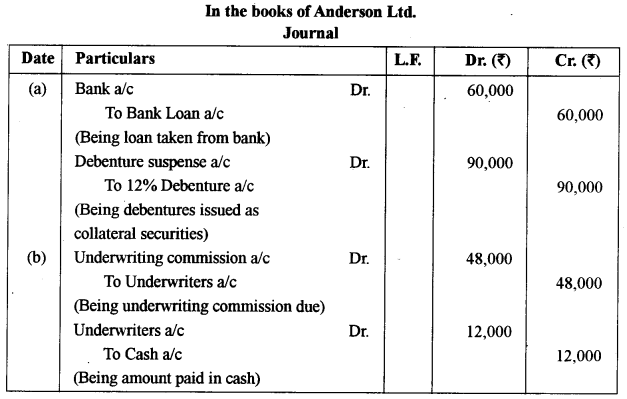

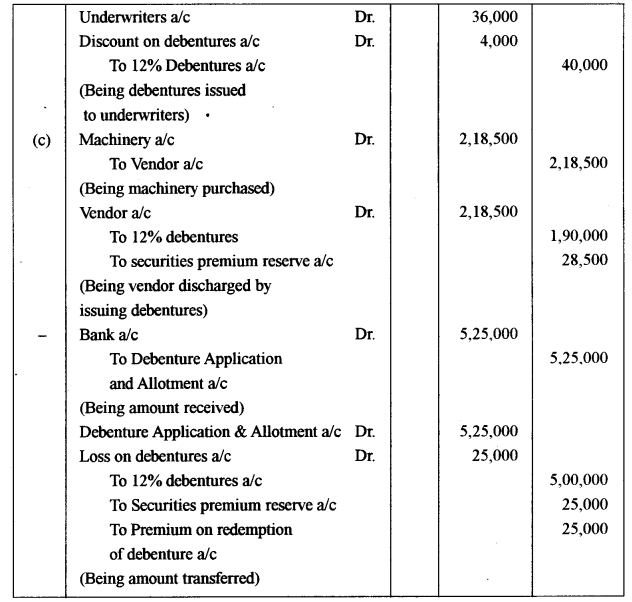

During the year 2014-15, Anderson Ltd. issued 12% Debentures of ₹ 100 each, as per the details given below:

(a) 900 Debentures issued as collateral security to a bank against a loan of ₹ 60,000.

(b) The underwriters were to be paid a commission of ₹ 48,000. 25% of the amount was paid to them in cash and the balance was paid by the issue of Debentures at a discount of 10%, to be redeemed at par.

(c) A machine was purchased for ₹ 2,18,500. The vendor was paid by the issue of Debentures at a premium of 15%, to be redeemed at par.

(d) 5,000 Debentures were issued to the public at 5% premium, to be redeemed at a premium of 5%.

The company wrote off all capital losses arising from the issue of Debentures at the end of the year from its capital profits and if need be from its revenue profits.

You are required to journalize the above transactions in the books of Anderson Ltd.

Answer:

Question 5. [12]

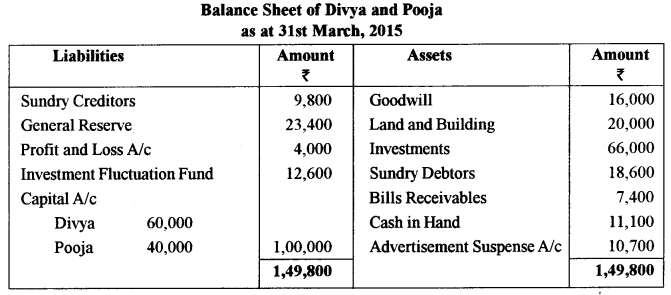

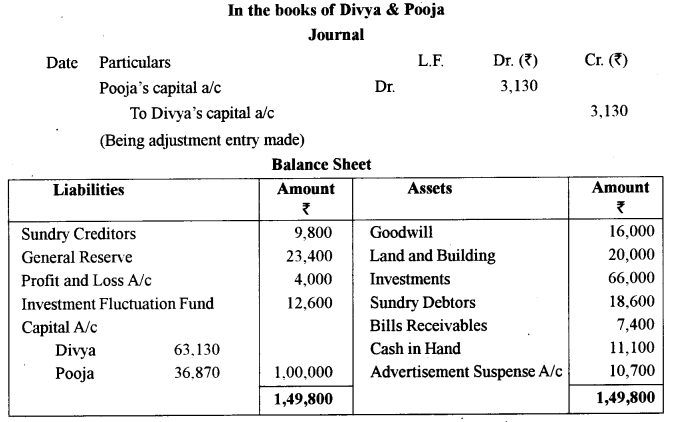

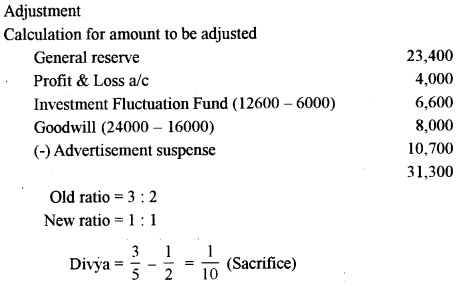

Divya and Pooja are partners in a firm, sharing profits and losses in the ratio of 3:2. On 31st March, 2015, their Balance Sheet was as under:

The partners decided that with effect from 1st April, 2015, they would share profits and losses equally.

For this purpose, they decided that:

(a) Investments to be valued at ₹ 60,000.

(b) Goodwill to be valued at ₹ 24,000.

(c) General Reserve not to be distributed between the partners.

You are required to :

(i) Pass journal entries

(ii) Prepare the revised Balance Sheet of the firm.

Answer:

Question 6.

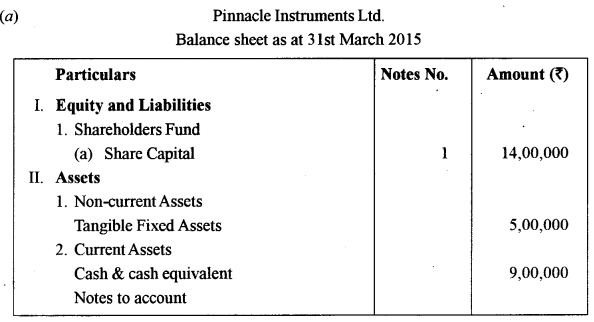

(a) Pinnacle Instruments Ltd. registered itself with a capital of? 20,00,000 divided into Equity Shares of ₹ 100 each. [9]

On 1st June, 2014, the company issued 5,000 Equity Shares as fully paid to Mila Herbals, as purchase consideration for the purchase of plant and machinery.

The remaining shares were issued to the public at par.

Till the date of the Balance Sheet, the Directors had called from the public,

60% of the nominal value of the shares.

The amount called was received by the company.

You are required to prepare as at 31st March, 2015 :

(i) The Balance Sheet of Pinnacle Instruments Ltd. as per Schedule III of the

Companies Act, 2013.

(ii) Notes to Accounts.

(b) Under which heads and sub-heads will the following items appear in the Balance Sheet of a company as per Schedule IE of the Companies Act, 2013. [3]

(i) Public Deposits

(ii) Calls-in-Advance

(iii) Building under construction

Answer:

(b) (i) Public Deposits → Non-current liabilities → Long term borrowings

(ii) Calls-in-Advance → Current liabilities → Other current liabilities

(iii) Building under construction → Non-current assets → Capital work-in progress

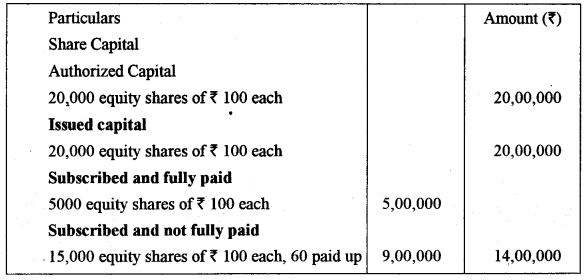

Question 7. [12]

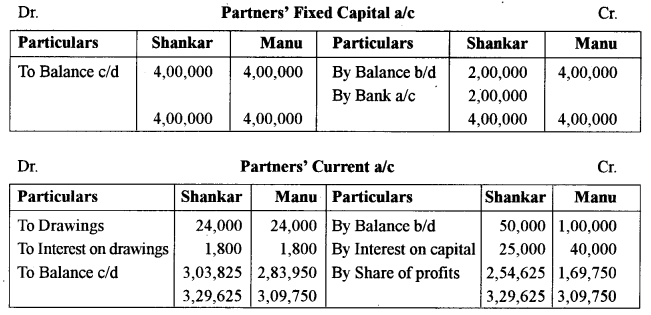

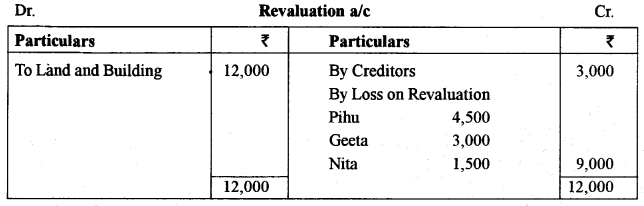

Shankar and Manu are partners in a firm. On 1st April, 2014, their fixed capital accounts showed a balance of ₹ 2,00,000 and ₹ 4,00,000 respectively.

On this date, their current account balances were ₹ 50,000 and ₹ 1,00,000 respectively.

On 1st January, 2015, Shankar introduced additional capital of ₹ 2,00,000 while Manu gave a loan of ₹ 1,50,000 to the firm.

The clauses of their partnership deed provided for :

(a) Interest on capital to be allowed at the rate of 10% per annum.

(b) Interest on drawings to be charged at the rate of 12% per annum.

(c) Profits to be shared by them in the ratio of 3:2.

(d) 10% of the correct net profit to be transferred to General Reserve.

During the financial year 2014-15, both partners withdrew ? 6,000 each at the beginning of every quarter.

The net profit of the firm, before any interest, for the financial year 2014-15 was ₹ 5,00,000.

You are required to prepare for the year 2014 – 15 :

(i) Profit and Loss Appropriation Account.

(u) Partners’Fixed Capital Accounts.

(iii) Partners’ Current Accounts.

(iv) Partner’s Loan Account.

Answer:

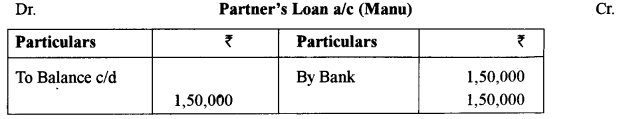

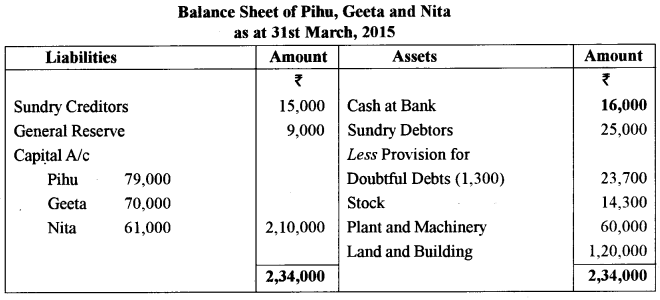

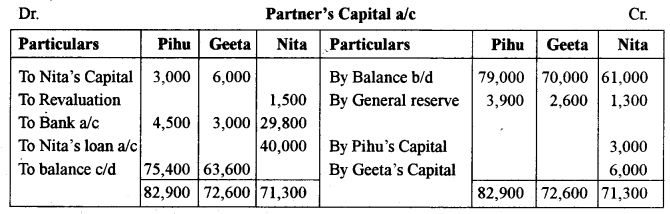

Question 8. [12]

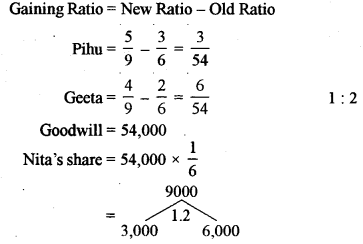

Pihu, Geeta and Nita are partners in a firm, sharing profits and losses in the ratio of 3:2:1. On 31st March, 2015, their Balance Sheet was as under :

Nita retires on 1st April, 2015, subject to the following adjustments:

(a) Land and building to be reduced by 10%.

(b) Goodwill to be valued at ₹ 54,000.

(c) Provision for Doubtful Debts to be raised to 10% of the debtors, the excess provision being created from General Reserve. The balance of the General Reserve to be distributed amongst the partners.

(d) Creditors of ₹ 3,000 were paid by Pihu for which she is not to be reimbursed.

(e) The continuing partners to share profits and losses in future in the ratio of 5:4.

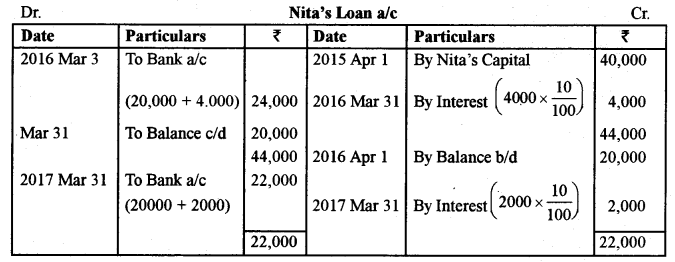

(J) Nita to be paid ₹ 29,800 on retirement and the remaining amount in two equal annual installments

together with interest @ 10% per annum on the outstanding balance. The first installment of Nita’s loan to be paid on 31st March, 2016.

You are required to prepare:

(i) Revaluation Account.

(ii) Partners’ Capital Accounts.

(iii) Nita’s Loan Account till it is finally closed.

Answer:

Section – B

(20 Marks)

Answer any two questions

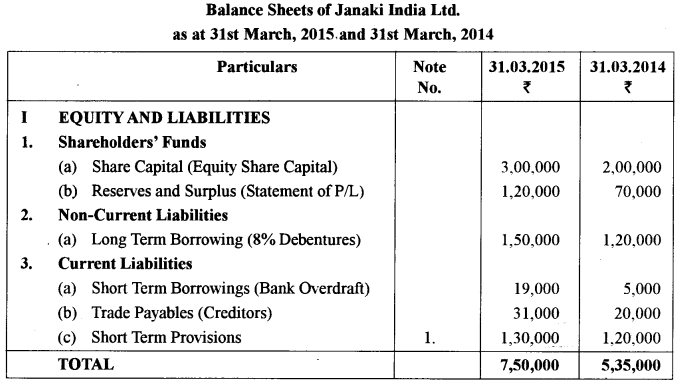

Question 9. [10]

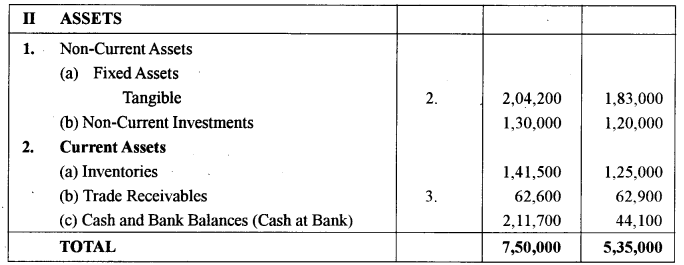

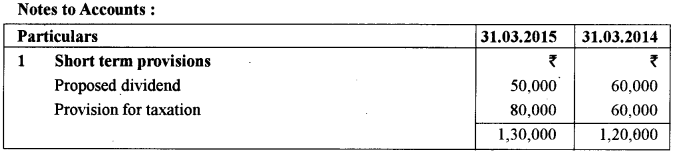

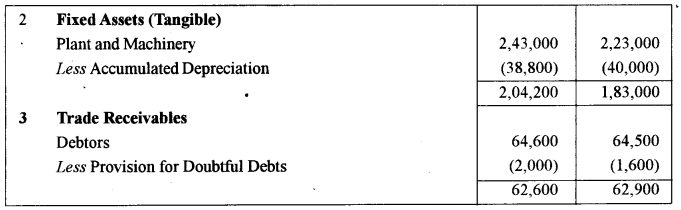

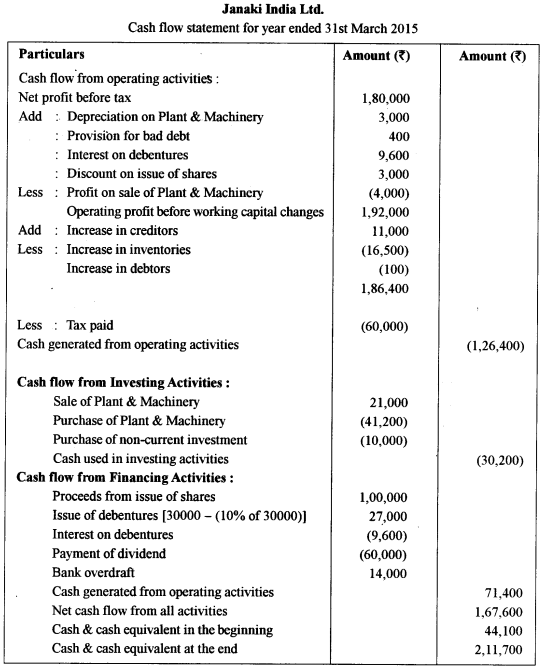

You are required to prepare a Cash-Flow Statement (as per AS-3) for the year 2014-15 from the following Balance Sheets.

Additional Information:

During the year 2014-15 :

(i) A part of the machine was sold for ₹ 21,000 at a profit of ₹ 4,000.

(ii) The company charged ₹ 3,000 as depreciation on its Plant and Machinery.

(iii) New Debentures were issued on 31st March, 2015. at a discount of 10%.

(iv) Interest of ₹ 9,600 was paid on Debentures.

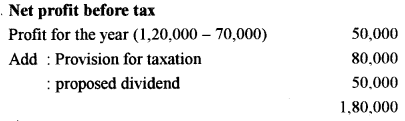

Answer:

Question 10.

(a) What is a Common Size Balance Sheet ? [2]

(b) While preparing a Cash How Statement, identify the following transactions as belonging to Operating Activities, Investing Activities, Financing Activities: [2]

(i) Goodwill written off.

(ii) Interest received by a company on its investments.

Answer:

(a) A common size balance sheet shows the percentage relationship of each assets/liability to total assets/total liabilities including capital.

(b) (i) Operating activities

(ii) Investing activities

Question 11.

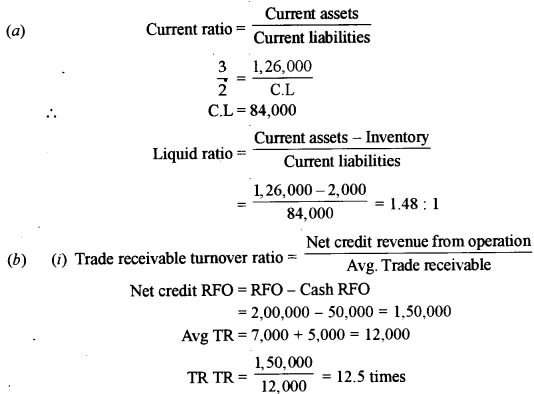

(a) Calculate Liquid Ratio from the following (up-to two decimal places): [2]

Current Assets ₹ 1,26,000

Inventories ₹ 2,000

Current Ratio 3:2

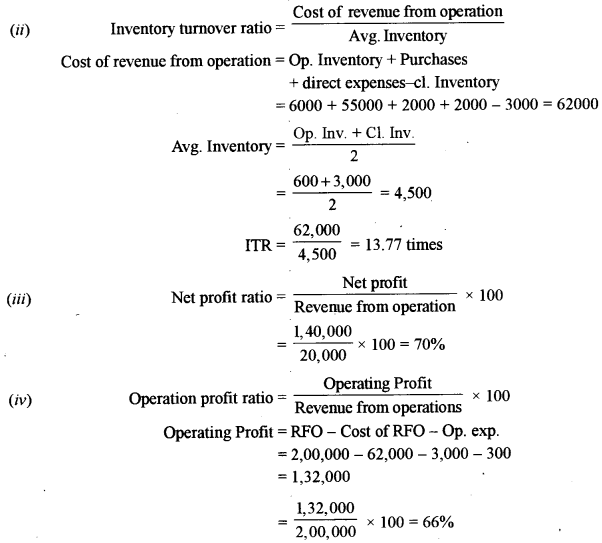

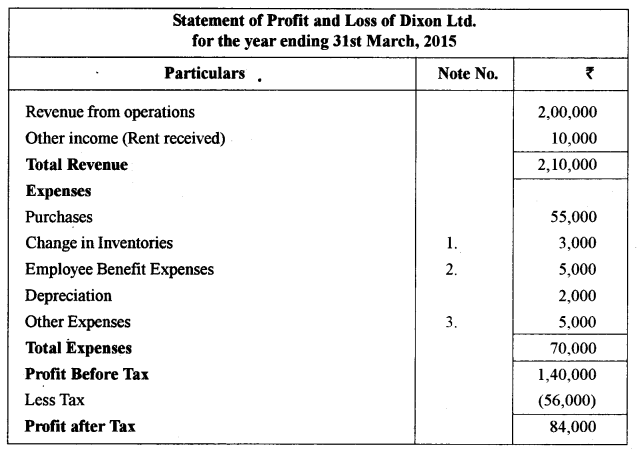

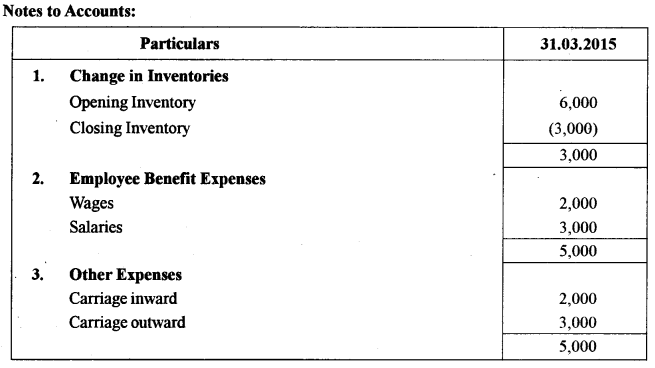

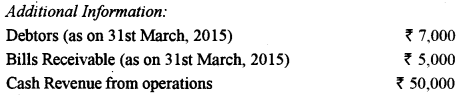

(b) From the following Statement of Profit and Loss of Dixon Ltd, for the year 2014 – 15, calculate (up to two decimal places): [8]

(i) Trade Receivables Turnover Ratio

(ii) Inventory Turnover Ratio

(iii) Net Profit Ratio

(iv) Operating Profit Ratio

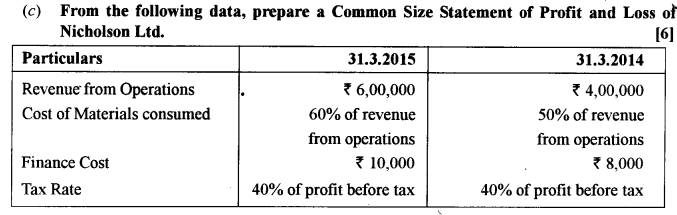

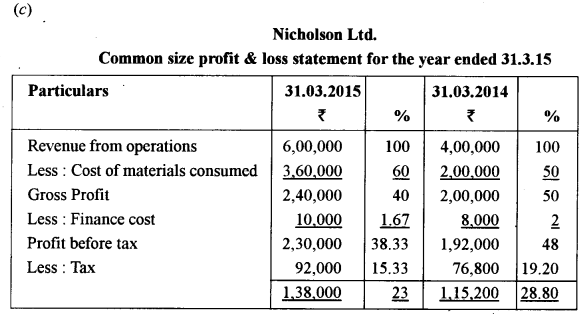

Answer: