ISC Accounts Previous Year Question Paper 2015 Solved for Class 12

Maximum Marks: 80

Time allowed: Three hours

- Candidates are allowed additional 15 minutes for only reading the paper. They must NOT start writing during this time.

- Answer Question 1 (Compulsory) from Part I and five questions from Part II, choosing two questions from Section A, two questions from Section B and one question from either Section A or Section B.

- The intended marks for questions or parts of questions are given in brackets [ ].

- Transactions should be recorded in the answer book.

- All calculations should be shown clearly.

- All working, including rough work, should be done on the same page as, and adjacent to the rest of the answer.

Section – A

Part – I (12 Marks)

(Answer all questions)

Question 1.

Answer the following questions very briefly and to the point: [6 x 2]

(i) What is meant by an operating cycle ?

(ii) State one difference between partner’s loan account and partner’s capital account.

(iii) Give the adjusting entry and the closing entry for recording commission allowed to a partner, when the firm follows the fixed capital method. ,

(iv) How will the firm record the payment of realization expenses which were to be borne by a partner, but paid by the firm on his behalf ?

(v) Give the accounting treatment in the books of a co-venturer under the Memorandum Joint | Venture Method, when he takes over the unsold stock.

(vi) What is the minimum price at which a company can reissue its forfeited shares which were originally issued at par ?

Answer:

(i) The operating cycle is the average period of time required for a business to make an initial outlay . of cash to produce goods, sell the goods, and receive cash from customers in exchange for the goods.

(ii) Partner’s capital account is his contribution (equity) towards partnership. It is initial and, subsequent contributions by partner to the partnership, in the form of either cash or the market value of other types of assets.

While running a business, one or more of the owners or partners will lend the business money to keep it afloat during a rough time or to increase cash flow and fund growth. This is treated as Partner’s loan account. Interest may also be paid on this account as per the agreement of partnership contract.

(iii) Commission allowed to” a partner is recorded in the newly opened Current Accounts. Commission Account Dr. To Partner’s Current Account

(iv) When the actual expenses are paid by the firm on behalf of a partner the following entry will be recorded:

Partner’s capital A/c Dr

To Bank A/c

(v) Goods Sent on Joint Venturer A/c Dc

To Joint Venture with …. A/c

(vi) When the forfeited shares are reissued at a discount, the amount of discount should not exceed the amount credited to Share Forfeited Account. If the discount allowed on reissue of shares is less than the forfeited amount, there will be some balance left in the Forfeited Account, which should be transferred to capital reserve, because it is a profit of capital nature.

Part – II (48 Marks)

(Answer any four)

Question 2. [12]

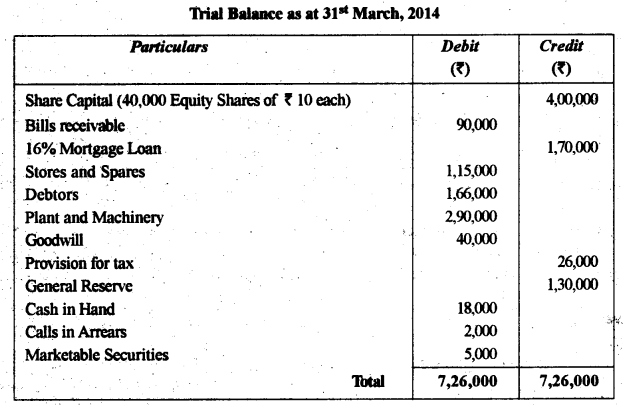

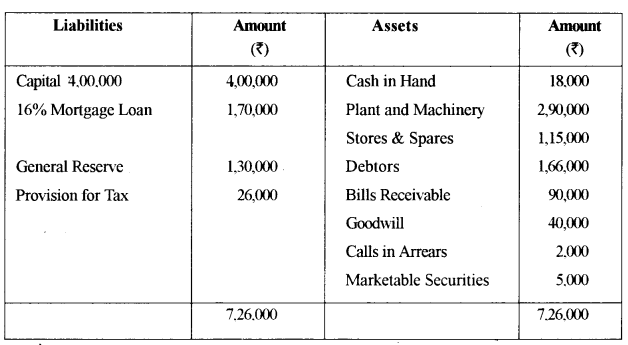

From the given trail Balance, prepare the Balance Sheet of Moonlight Limited as at 31st March, 2014.

Answer:

Question 3. [12]

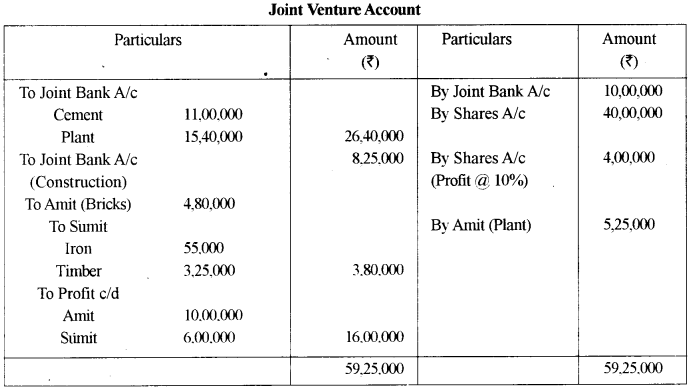

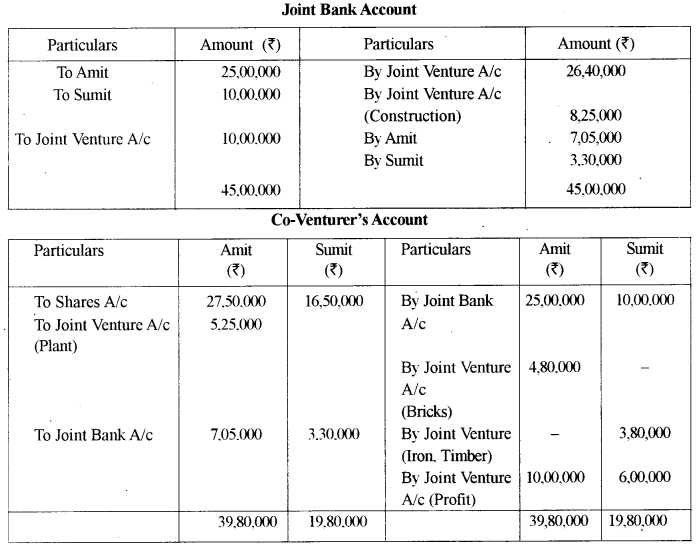

Amit and Sumit entered into a joint venture to construct a shopping mall. They agreed to share the profits and losses in the ratio 5:3.

The contract price was agreed upon at ₹ 50.00,000, payable as ₹ 10,00,000 in cash and 40,00,000 in the form of shares of ₹ 10 each.

A Joint Bank Account was opened in which the co-ventures, Amit and Sumit, deposited their contributions of ₹ 25.00.000 and ₹ 10.00,000, respectively.

Amit also contributed bricks worth ₹ 4,80,000.

Sumit too contributed iron worth ₹ 55,000 and timber worth ₹ 3,25,000.

They acquired cement for ₹ 11,00,000 and plant for ₹ 15,40,000, from the funds of the venture.

Construction expenses amounted to ₹ 8,25,000.

The contract was completed and the contract price was received.

Amit took over the plant at ₹ 5,25,000.

The co-venturers sold the shares in the open market at a profit of 10%.

You are required to prepare:

(i) Joint Bank Account

(ii) Joint Venture Account

(iii) Co-venturers’Accounts.

Answer:

Question 4.

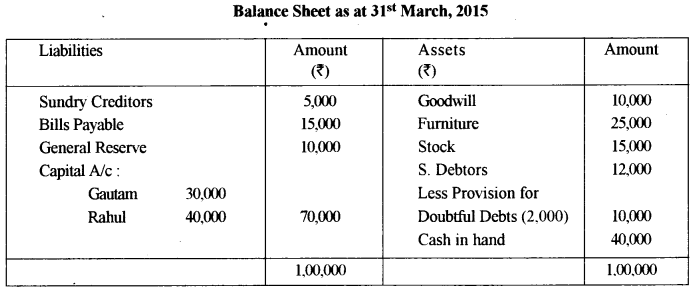

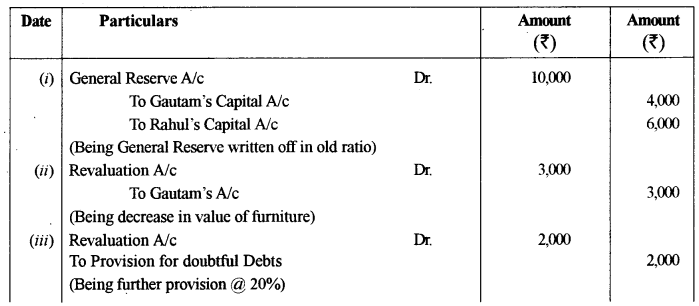

Gautam and Rahul are partners in a firm, sharing profits and losses in the ratio of 2 : 3. Their Balance Sheet as at 31sl March, 2014, was as follows : [12]

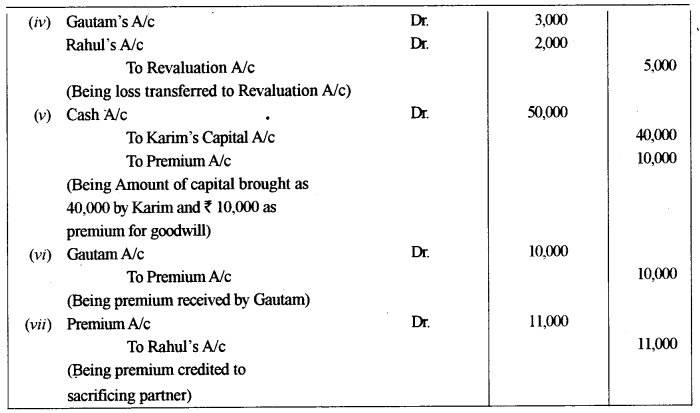

Karim was to be taken as a partner with effect from 1st April. 2014. on the following terms :

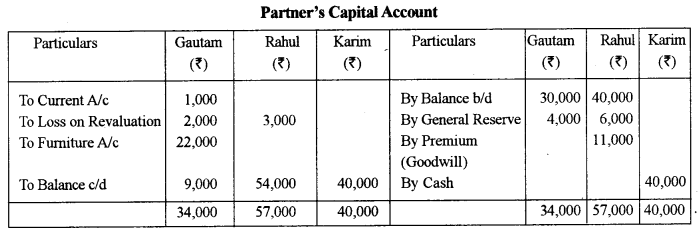

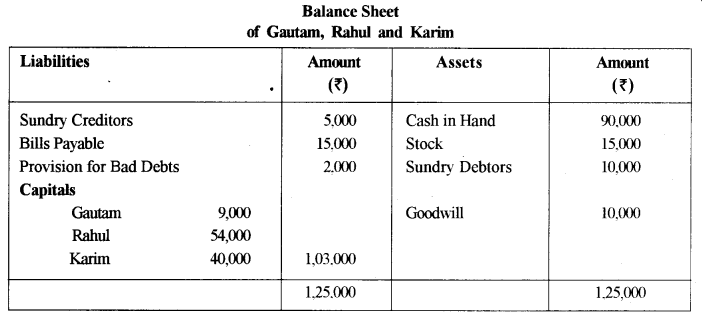

(a) The new profit sharing ratio of Gautam. Rahul and Karim would be 5 : 3 : 2.

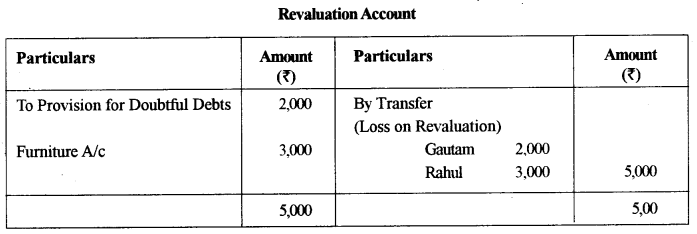

(b) Provision for Doubtful Debts would be raised to 20% of debtors.

(c) Karim would bring in cash, his share of capital of ₹ 40,000 and his share of goodwill valued at ₹ 10,000.

(d) Gautam would take over the furniture at ₹ 22,000.

You are required to:

(i) Pass journal entries at the time of Karim’s admission.

(ii) Prepare the Balance Sheet of the reconstituted firm.

Answer:

Question 5.

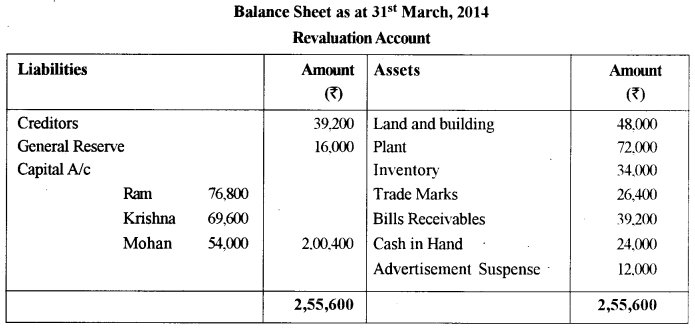

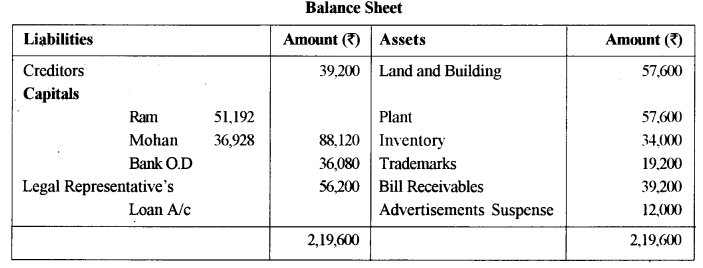

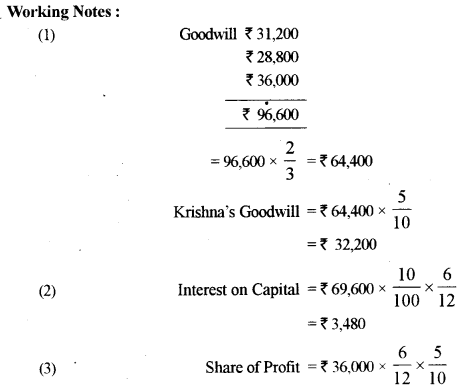

Ram, Krishna and Mohan are partners in a firm, sharing profits and losses m the ratio of 3 : 5 : 2. On 31st March, 2014, their Balance Sheet was as under :

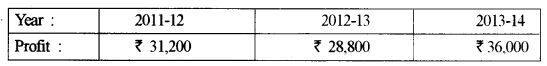

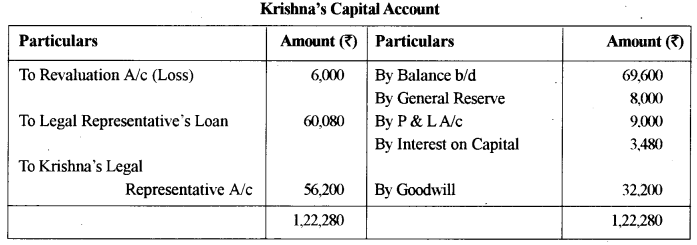

Krishna died on 30th September, 2014. An agreement was reached amongst Ram. Mohan and Krishna’s legal representative that:

(a) Goodwill to be valued at 2 years purchase of the average profits of the previous three years,

which were:

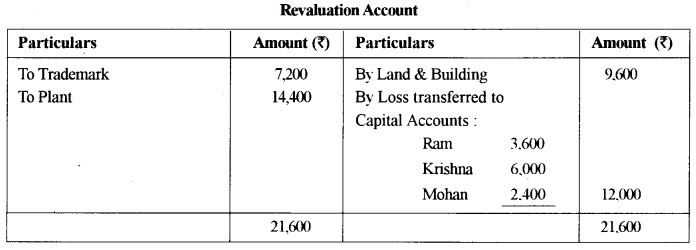

(b) Trade marks to be revalued at ₹ 19.200; plant at 80% of its book value and land building at ₹ 57,600.

(c) Krishna’s share of profit to the date of his death to be calculated on the basis of previous year’s profit.

(d) Interest on capital to be provided @ 10% per annum.

(e) ₹ 60,080 to be paid in cash to Krishna’s legal representative and balance to be transferred to the legal representative’s loan account.

You are required to prepare:

(i) Revaluation Account

(ii) Krishna’s Capital Account

(iii) Krishna’s Legal Representative’Account

Answer:

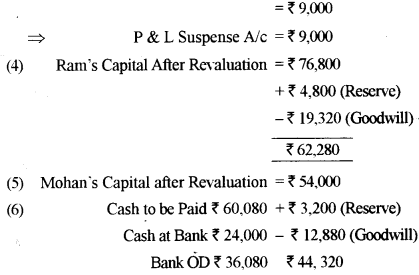

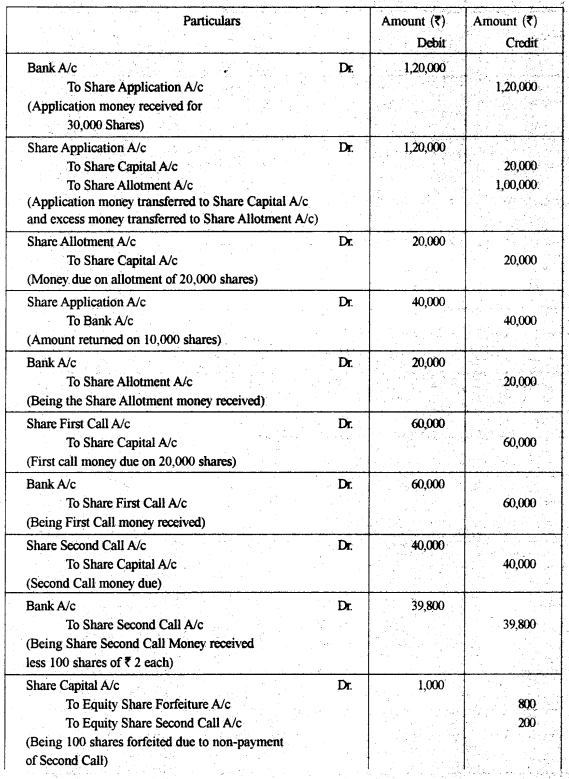

Question 6. [12]

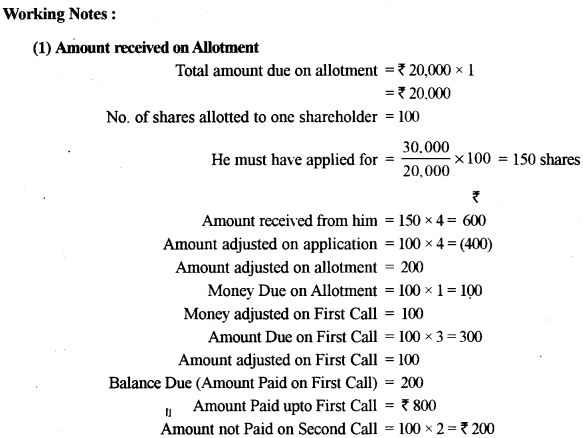

Pluto Ltd. issued 20,000 Equity shares of ₹ 10 each, payable as follows :

On Application — ₹ 4

On Allotment — ₹ 1

On 1st Call — ₹ 3

On 2nd and Final Call — ₹ 2

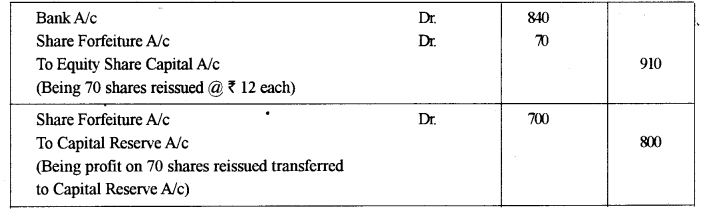

Applications were received for 30,000 shares and prorata allotment was made to all the applicants. Excess money received on application was utilized towards allotment and subsequent calls.One shareholder holding 100 shares did not pay the final call and his shares’were forfeited. Of the forfeited shares, the company reissued 70 shares as fully paid up at ₹ 12 per share.

You are required to pass journal entries in the books of the company for the year ending 31st March, 2014.

Answer:

Question 7. [10]

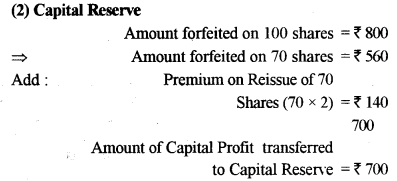

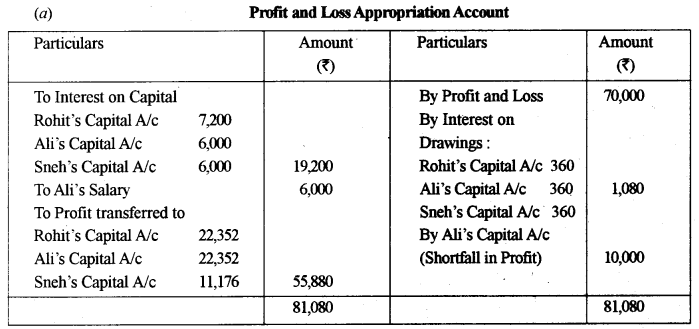

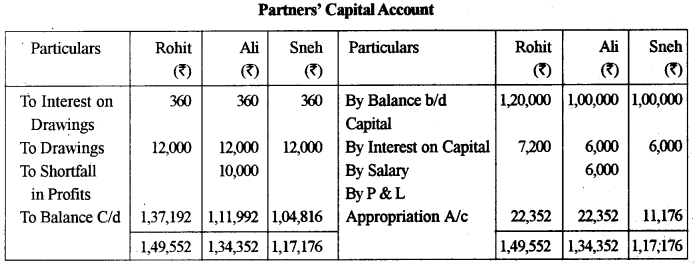

(a) The partnership agreement of Rohit, Ali and Sneh provides that:

1. Profits will be shared by them in the ratio of 2 : 2 : 1.

2. Interest on capital to be allowed at rate of 6% per annum.

3. Interest on drawings to be charged at the rate of 3% per annum.

4. Ali to be given a salary of ₹ 500 per month.

5. Ali’s guarantee to the firm that the firm would earn a net profit of at least ? 80,000 per annum and any shortfall in these profits would be personally met by him.

The capitals of the partners on 1st April, 2013, were :

Rohit: ₹ 1,20,000;

Ah: ₹ 1,00,000;

Sneh: ₹ 1,00,000.

During the financial year 2013-14, all the three partners withdrew ₹ 1,000 each at the beginning of every month.

The net profit of the firm for the year 2013-14 was ₹ 70,000.

You are required to prepare for the year 2013-13;

(i) Profit and Loss Appropriation Account

(ii) Partner’s Capital Accounts.

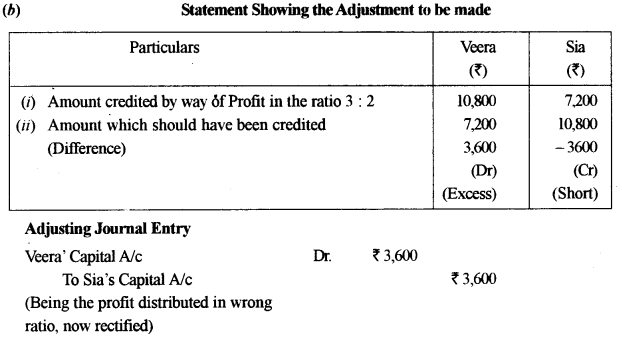

(b) Veera and Sia are partners, sharing profits in the ratio of 3 : 2. Profit for the year 2013-14, amounting to ₹ 18,000 was distributed wrongly in the ratio of 2 : 3.

You are required to rectify the error by passing an adjusting journal entry.

Answer:

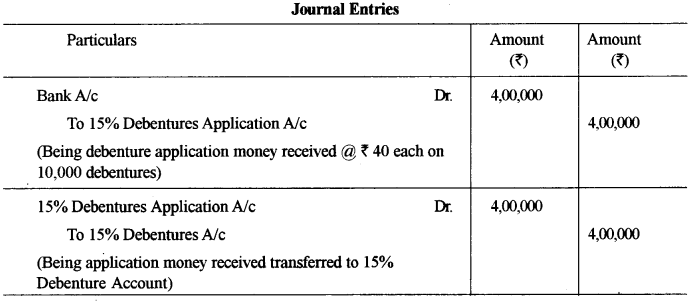

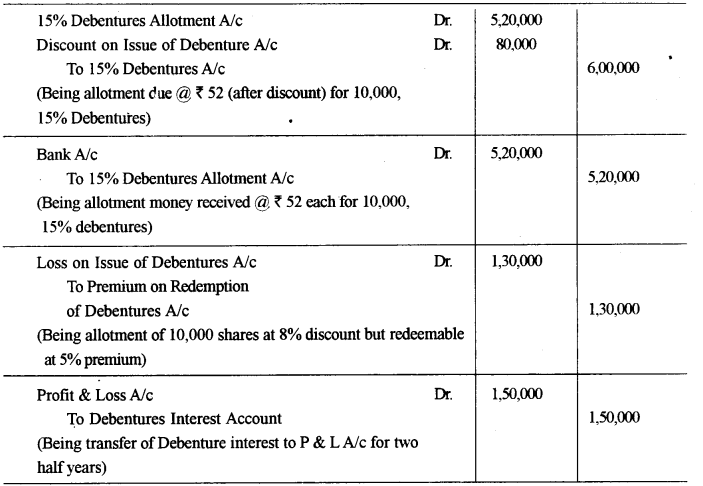

Question 8. [12]

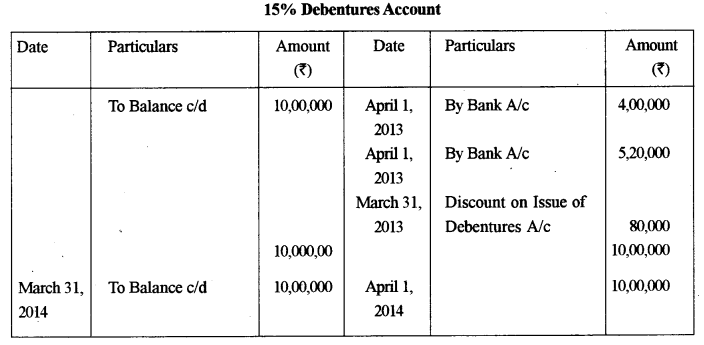

On 1st April, 2013, Sunshine Ltd. issued ₹ 10,00,000, 15% Debentures of ₹ 100 each at 8% discount payable :

₹ 40 on application.

The balance on allotment.

These debentures were to be redeemed at a premium of 5% after five years. All the debentures were subscribed for by the public.

Interest on these debentures was to be paid half-yearly which was duly paid by the company.

You are required to:

(i) Pass journal entries in the first year of debenture issue (including entries for debenture interest)

(ii) Prepare the 15% Debenture Account for the year ending 31st March,2014.

Answer:

Section – B

(Answer any two questions)

Question 9. [10]

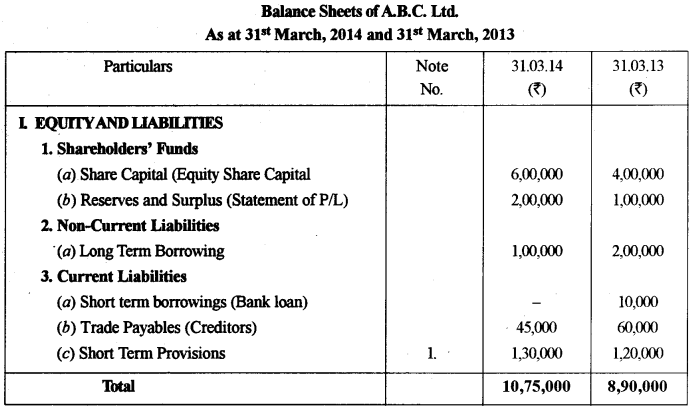

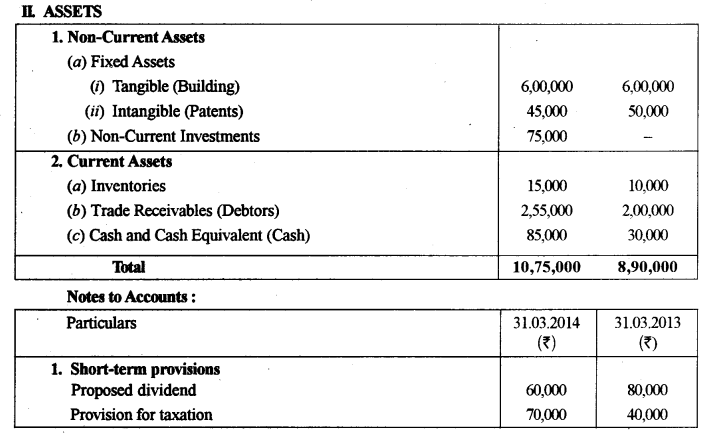

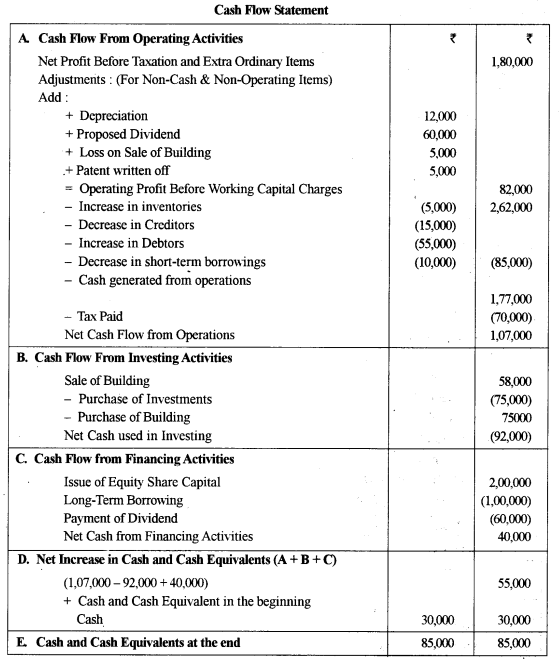

You are required to prepare a Cash-Flow Statement (as per AS-3) for the year 2013-14 from the following Balance Sheets.

Additional Information:

During the year 2013-14 :

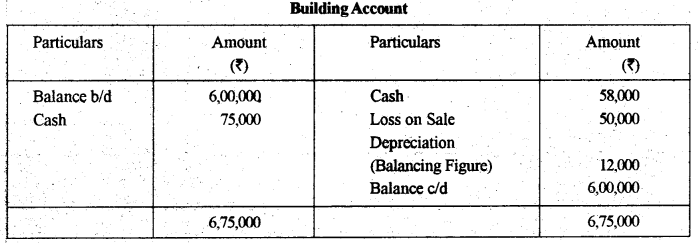

(i) Building costing ₹ 75,000 was purchased.

(ii) An old building, the book value of which was ₹ 63,000, was sold at a loss of ₹ 5,000.

(iii) Tax provided during the year was ₹ 80,000.

Answer:

Questions 10,

(a) Give any two objectives of preparing Common Size Statements. [2]

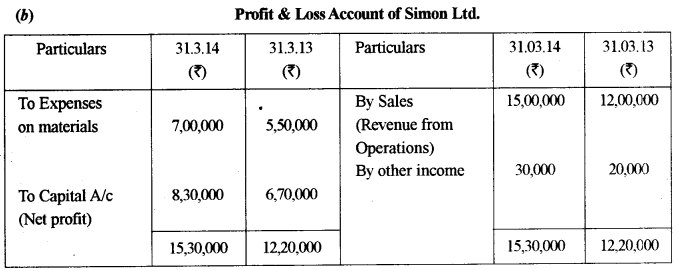

(b) From the following data, prepare a Comparative Statement of Profit and Loss of Simon Ltd. [4]

Particulars — 31.03.2014 — 31.03.2013

(i) Reyenue from Operations — ₹ 15,00,000 — ₹ 12,00,000

(ii) Other Income — ₹ 30,000 — ₹ 20,000

(iii) Cost of Materials consumed — ₹ 7.00.000 — ₹ 5,50.000

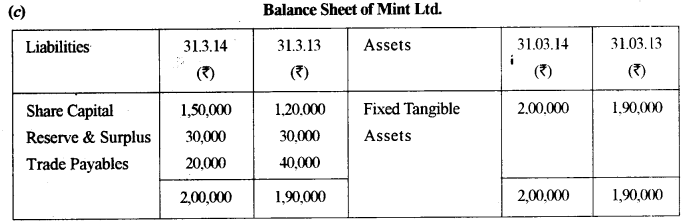

(c) From the following data, prepare Common Size Balance Sheet of Mini Lid. [4]

Particulars — 31.03.2014 — 31.03.2013

(i) Share Capital — ₹ 1,50,000 — ₹ 1,20,000

(ii) Reserves and Surplus — ₹ 30,000 — ₹ 30,000

(iii) Trade Payables — ₹ 20.000 — ₹ 40,000

(iv) Fixed Tangible Assets — ₹ 2,00,000 — ₹ 1,90,000

Answer:

(a) Objectives of preparing common size statements.

- Common size statement is a financial tool for studying key changes and trends in financial position.

- Comparison of company’s position with the related industry as a whole is possible with the help of common size statement.

Question 11.

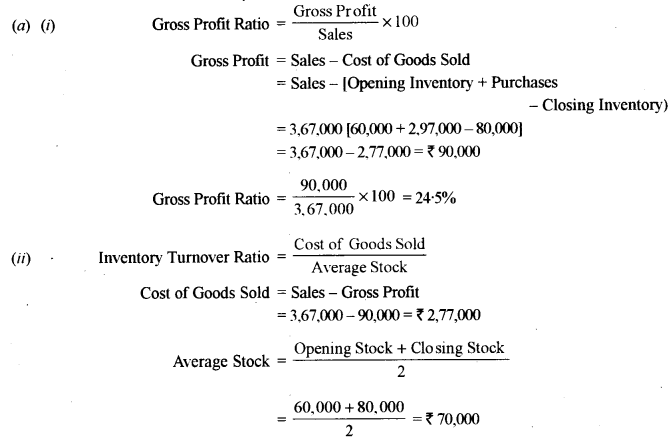

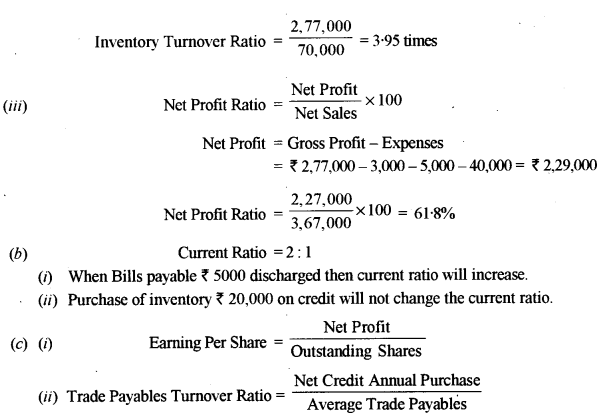

(a) From the following information calculate (up to two decimal places): [6]

(i) Gross Profit Ratio

(ii) Inventory Turnover Ratio

(iii) Net Profit Ratio

Cash Revenue from Operations — ₹ 70,000

Net Purchases — ₹ 2,97,000

Credit Revenue from Operations — ₹ 2,80,000

Closing Inventory — ₹ 80,000

Opening Inventory — ₹ 60,000

Carriage inward — ₹ 3,000

Selling expenses — ₹ 5,000

Administrative expenses — ₹ 40,000

Loss on sale of fixed asset — ₹ 10,000

Dividend received — ₹ 7,000

(b) The Current Ratio of a company is 2 : 1. State whether the following will increase, reduce or not change the ratio . [2]

(i) Bills Payable ? 5,000 discharged.

(ii) Purchase of inventory ₹ 20,000 on credit.

(c) Give the formulae for calculating : [2]

(i) Earning per share

(ii) Trade Payables Turnover Ratio

Answer: