ISC Accounts Previous Year Question Paper 2012 Solved for Class 12

Maximum Marks: 80

Time allowed: Three hours

- Candidates are allowed additional 15 minutes for only reading the paper. They must NOT start writing during this time.

- Answer Question 1 (Compulsory) from Part I and five questions from Part II, choosing two questions from Section A, two questions from Section B and one question from either Section A or Section B.

- The intended marks for questions or parts of questions are given in brackets [ ].

- Transactions should be recorded in the answer book.

- All calculations should be shown clearly.

- All working, including rough work, should be done on the same page as, and adjacent to the rest of the answer.

Part -1

Question 1.

Answer each of the following questions briefly: [10 x 2]

(i) State any two uses of Securities Premium as stated in Section 78 of the Companies Act, 1956.

(ii) In a Cost Sheet, how would you treat :

(a) Primary packing material.

(b) Secondary packing material.

(iii) Give two differences between Sacrificing Ratio and Gaining Ratio.

(iv) In case of a Joint Venture business, how is abnormal loss of goods which have been insured, treated in the books of accounts ?

(v) List two instances when a partner ‘s Fixed Capital may change.

(vi) List any two objectives of stock valuation.

(vii) Why is a Journal Ledger Adjustment Account opened ?

(viii) Assuming that the Debt-Equity Ratio of a company is 2 : 1, state whether this ratio would increase, decrease or not change in the following cases :

(a) Issue of new shares for cash.

(b) Repayment of a long-term bank loan.

(ix) What are trade investments ?

(x) The firm with X. Y and Z as partners earned a profit of ? 3,00,000 during the year ended 31st March. 2011. 20% of this profit w as to be transferred to General Reserve. Pass the necessary- journal entry for the same.

Answer:

(i) Two uses of securities premium as stated in Section 78 of the Companies Act, 1956 are :

(a) To issue fully paid bonus shares to the shareholders.

(b) To write off discount on issue of shares and debentures

(iii)

| Basis | Sacrificing Ratio | Gaining Ratio |

| (a) Meaning

| It is the ratio in which the old partners surrender a part of their share in favor of new partners. | It is the ratio in which remaining partners acquire the outgoing partners share. |

| (b) Purpose of calculation | New partner’s share of good-will is divided in sacrificing ratio. | Outgoing partner’s goodwill divided between remaining partners in gaining ratio. |

(iv) The total value of abnormal loss is not to be recorded in the Joint Venture Account. However, any claim received from the Insurance Company is to be credited to the Joint Venture Account.

(v) Following are the two instances when a partner’s fixed capital may change :

- When fresh or additional capital has been introduced by a partner.

- When an amount has been withdrawn by a partner to reduce his capital.

(viii) The following would be the effect: It would result in a decrease in the Debt-Equity Ratio.

(ix) Trade investments are long-term investments made by a company in the shares and debentures of another company (not including its subsidiaries).

(x) Profit and Loss Appropriation A/c Dr. 60,000

To General Reserve A/c 60,000

(Being 20% of profit transferred to General Reserve)

Question 2. [10]

Amit. Paw an and Suresh are partners in a firm, sharing profits in the ratio 2:3:1. Suresh retired on 1st April. 2011. At the time of his retirement:

(a) Goodw ill of the firm w as valued at ₹ 36.000.

(b) The Balance Sheet of the firm showed :

(i) A General Reserve of ₹ 1,20,000.

(ii) A debit balance of ₹ 48,000 in the Profit and Loss Account.

(iii) ₹ 48,000 each in the Joint Life Policy Account and Joint Life Policy Reserve Account. It was decided that the Joint Life Policy would be surrendered on the date of Suresh’s retirement.

Record necessary Journal entries for the above adjustments to be made in the books of the firm on the date of Suresh’s retirement.

Part – II

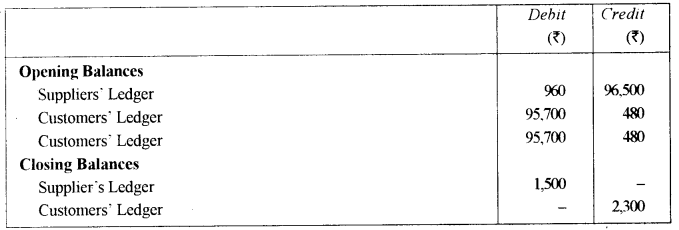

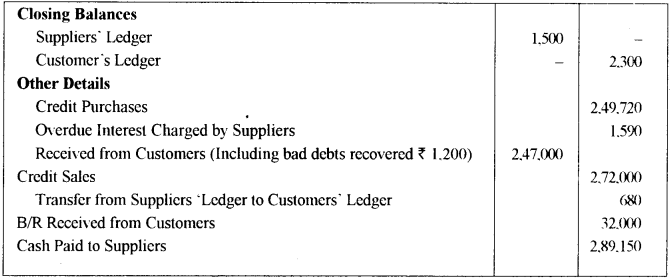

Question 3. [14]

Paula Fashioners Limited maintains its books under the Sectional Balancing System. From the particulars given below for the year ending 31 st December, 2011, you are required to prepare necessary Control Accounts in the Journal Ledger:

Question 4. [14]

The following extract of costing information relates to a commodity for the year ended 31st . March. 2007.

1st April, 2006 :

Raw materials — ₹ 50.000

Finished Products (1,000 tonnes) — ₹ 40,000

Work-in-Progress — ₹12,000

31st March, 2007:

Raw Materials — ₹ 55,600

Finished Products (2.000 tonnes) — ?

Work-in-Progress — ₹ 40,000

Transactions during the year:

Raw Materials Purchased — ₹ 3,00,000

Direct Wages — ₹ 25,000

Rent. Rates and Insurance of Factory — ₹ 1,00,000

Carriage Inwards — ₹ 3,600

Cost of Factory Supervision — ₹ 20,000

Sale of Finished Products — ₹ 7,50,000

Advertisement and selling expenses @ ₹ 2 per tonne sold.

16,000 tonnes were produced during the year. It was decided to value the closing stock as per FIFO.

Prepare a statement showing:

(a) Value of raw materials used.

(b) Cost of the output for the year.

(c) Value of closing stock.

(d) Profit made during the year.

Question 5.

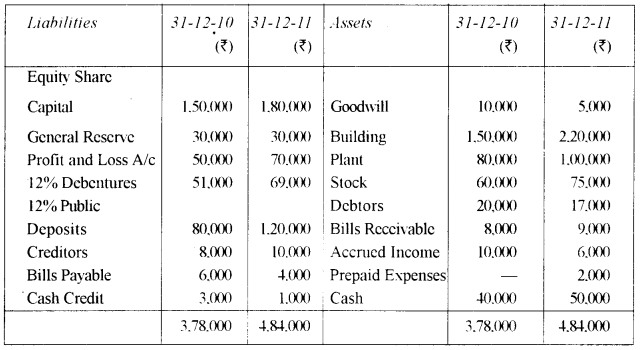

The Balance Sheet of Cooper and Company as on 31st December, 2010 and 31st December. 2011 arc given below:

Additional Information:

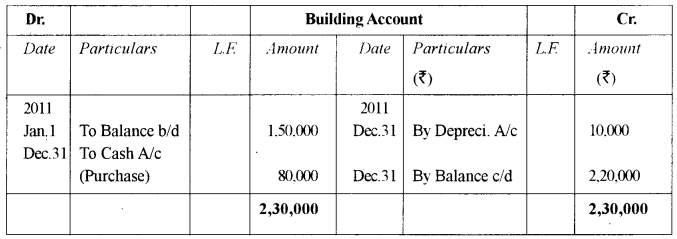

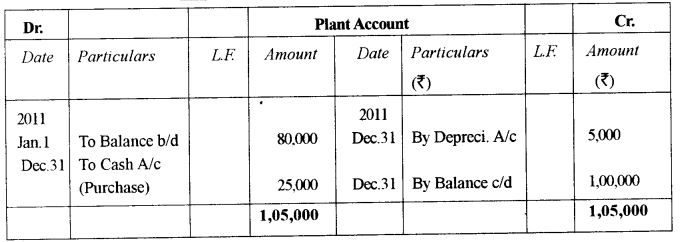

(a) Depreciation charged on building ₹ 10,000.

(b) Depreciation charged on plant ₹ 5,000.

(c) Interest paid on debentures ₹ 7,200 for the year.

(d) Interest paid on public deposit ₹ 9,600 for the year.

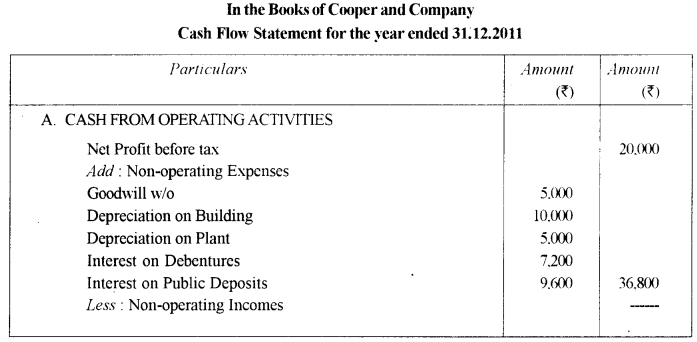

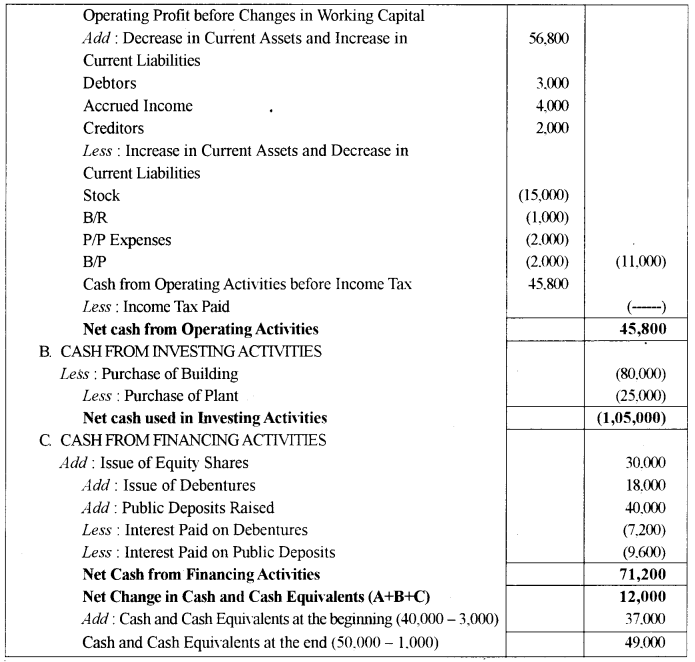

From the above information, prepare a Cash Flow Statement as per Accounting Standard-3 for the year ended 31st December, 2011.

Answer:

Working Notes:

1. Cash credit has been treated as cash equivalent.

Question 6.

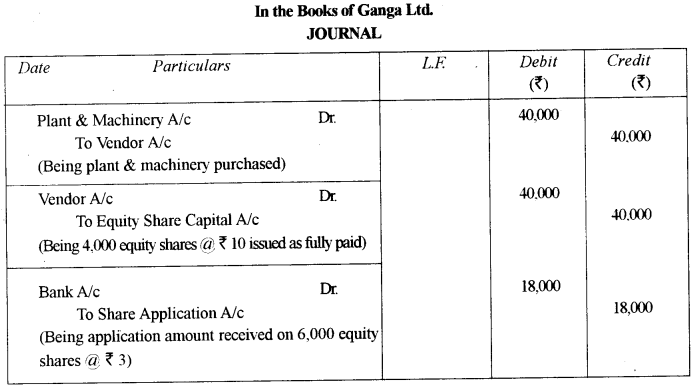

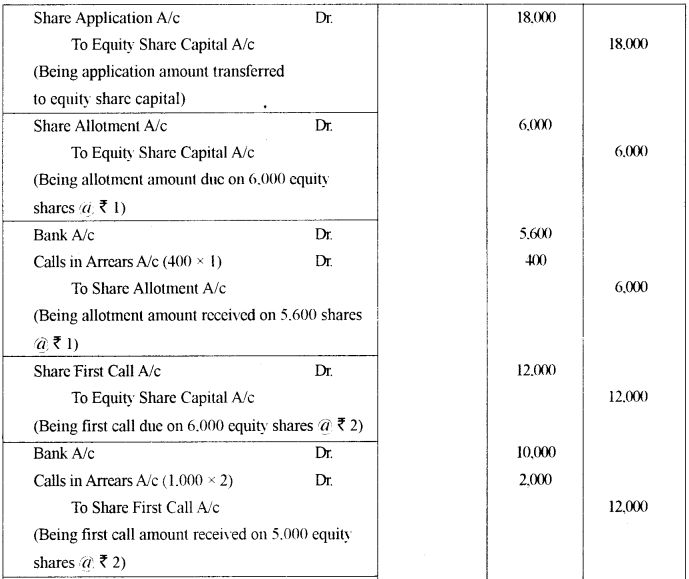

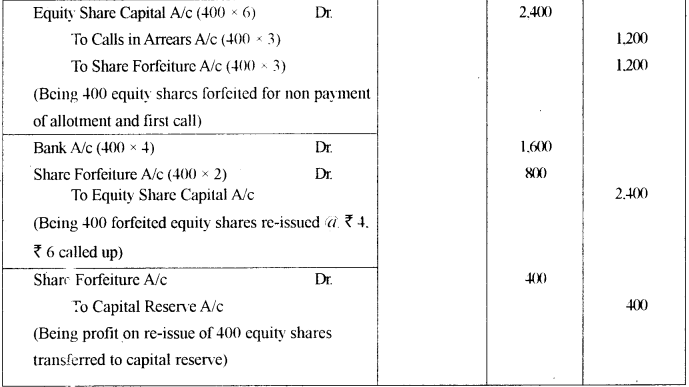

In 2010, Ganga Ltd. was registered with an authorized capital of ₹ 1,00,000 in Equity shares of ₹ 10 each. Of these, 4,000 equity shares were issued as fully paid to vendors for the purchase of Plant and Machinery and the remaining 6.000 shares were subscribed for, by the public for cash. During the first year, ? 6 per equity share was called up, on these 6.000 shares, payable ₹ 3 on application. ₹ 1 on allotment and ₹ 2 on the first call. [14]

The amount received in respect of these shares were as follows :

On 5,000 shares, the full amount called.

On 600 shares. ₹ 4 per share.

On 400 shares, ₹ 3 per share.

The company forfeited all those shares on which only ₹ 3 had been received and reissued them at ₹ 4 per share, ₹ 6 called up.

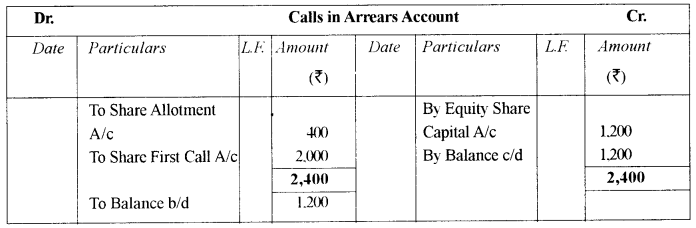

Journalize the transactions in the books of the company and prepare a Calls-in Arrear

Answer:

Question 7.

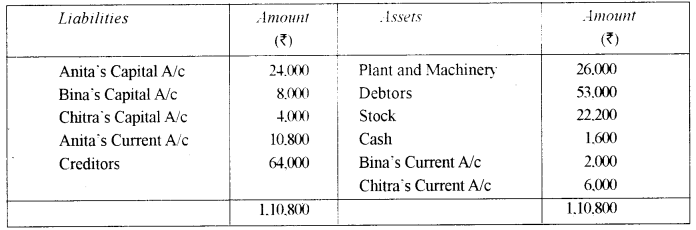

Anita. Bina and Chitra were in partnership, sharing profits and losses equally. The firm’s Balance Sheet as on 31st December, 2011 was as follows : [14]

It was decided to dissolve the firm on 31st December. 2011.

The plant and machinery, debtors and stock were sold by the firm for ₹ 70,000 and the creditors were paid off.

Chitra was declared insolvent and could not meet her liability towards the firm.

From the above, prepare the Realization Account, Partner’s Capital Account and Cash Account assuming that the firm applied the Garner Vs. Murray rule.

Question 8.

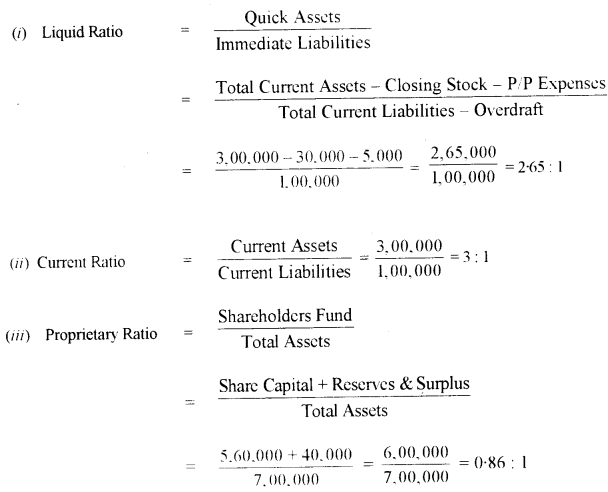

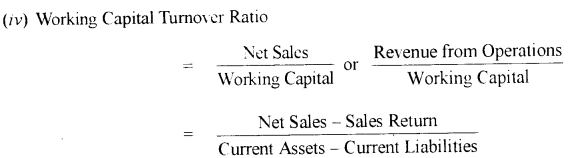

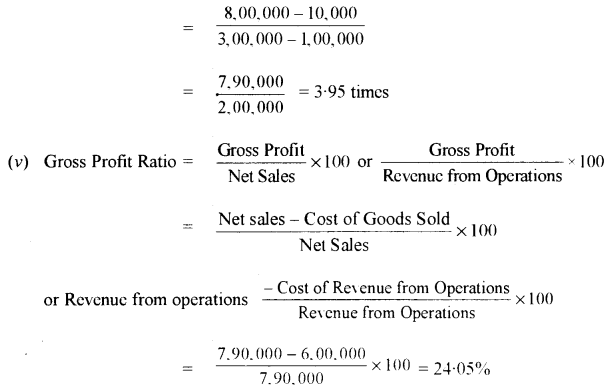

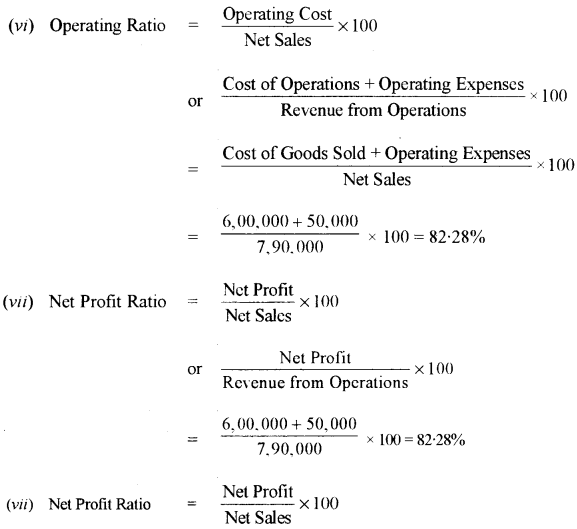

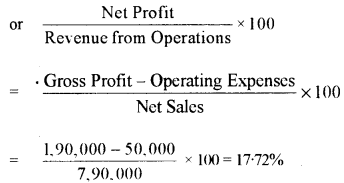

From the following information, calculate (up to two decimal places): [14]

(i) Liquid Ratio.

(ii) Current Ratio.

(iii) Proprietary Ratio.

(iv) Working Capital Turnover Ratio.

(v) Gross Profit Ratio.

(vi) Operating Ratio.

(vii) Net Profit Ratio.

Cost of Goods Sold — ₹ 6,00,000

Operating Expenses — ₹ 50,000

Gross Sales — ₹ 8,00,000

Sales Returns — ₹ 10,000

Total Current Assets — ₹ 3,00,000

Total Current Liabilities — ₹ 1,00,000

Total Assets — ₹ 7,00,000

Closing Stock — ₹ 30,000

Prepaid Insurance — ₹ 5,000

Prelim man, Expenses — ₹ 6,000

Share Capital — ₹ 5,60,000

Reserves and Surplus — ₹40,000

Answer:

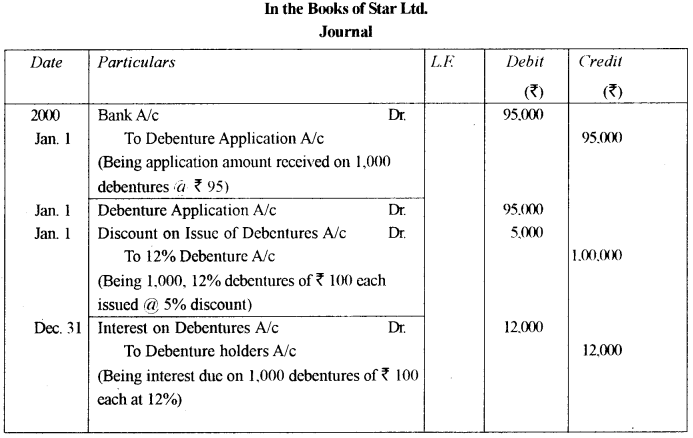

Question 9.

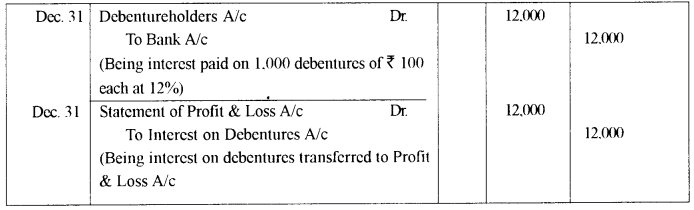

On 1st January, 2000, Star Ltd. issued 1.000. 12% Debentures of ₹ 100 each at a discount of 5%. repayable as follows : [14]

On 31st December, 2002 — ₹ 20,000

On 31st December, 2003 — ₹ 60,000

On 31 st December, 2004 — ₹ 20,000

The company pays interest on debentures annually.

You are required to:

(a) Pass the Journal entries (including interest) for the year beginning 1st January, 2000 to 31st December, 2000.

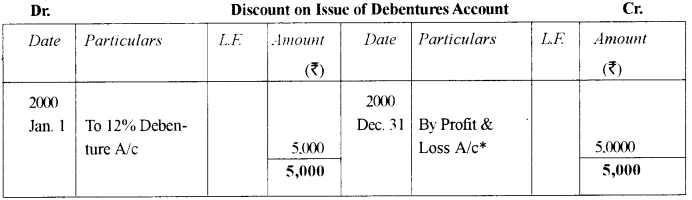

(b) Prepare the ‘Discount on issue of Debenture Account’, till it is finally closed

Answer:

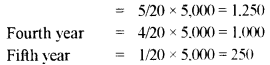

(b) Working Notes : The ratio for writing off discount on issue of debentures based on their redemption is calculated as follows:

1,00,000 : 1,00,000 : 1,00,000 : 80,000 : 20,000 = 5 : 5 : 5 : 4 : 1

Hence, discount to be written off during the first, second and third

As per latest guidelines, discount on issue of debentures is to be written off completely in the year of issue of debentures itself.

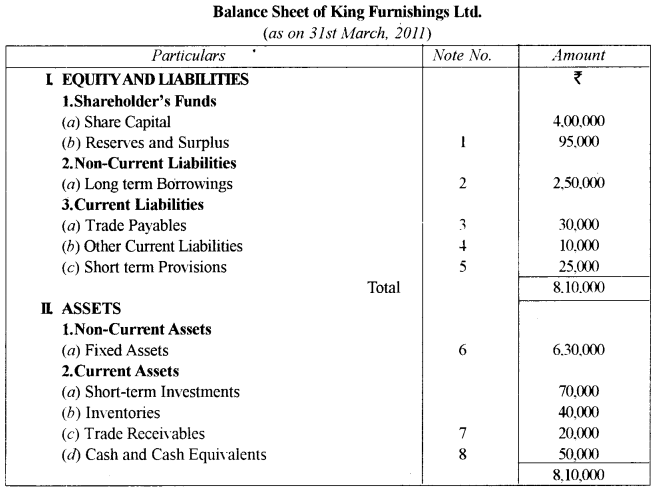

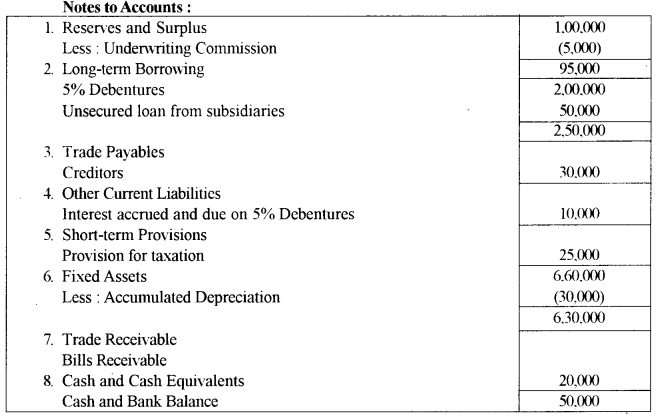

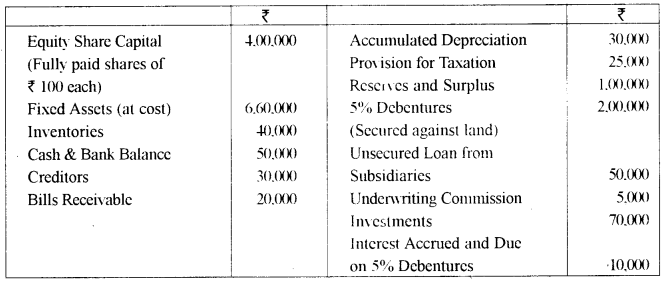

Question 10.

The following balances have been extracted from the books of King Furnishings Ltd. as on 31st March. 2011. [14]

You are required to prepare a Balance Sheet of King Furnishings Ltd. as on 31st March, 2011, in the Horizontal Form, as prescribed under Schedule VI of the Companies Act, 1956.

Answer: