Internet Banking Advantages and Disadvantages: Internet banking is the method that allows customers to perform financial transactions with the bank and transfer funds to other accounts with the help of an internet connection from home or any location and at any time even beyond banking hours. The bank account holder accesses the portal of the bank with his/her unique customer id and password and performs activities such as deposits, fund transfer, balance checking, and other operations.

Internet banking enables customers to perform financial transactions on their own without the involvement of bank staff. The customers access the internet banking portal using a stable internet connection, login into it through customer id and password, and then perform the activities from the options as specified by the internet banking.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is Internet Banking? Advantages and Disadvantages of Internet Banking

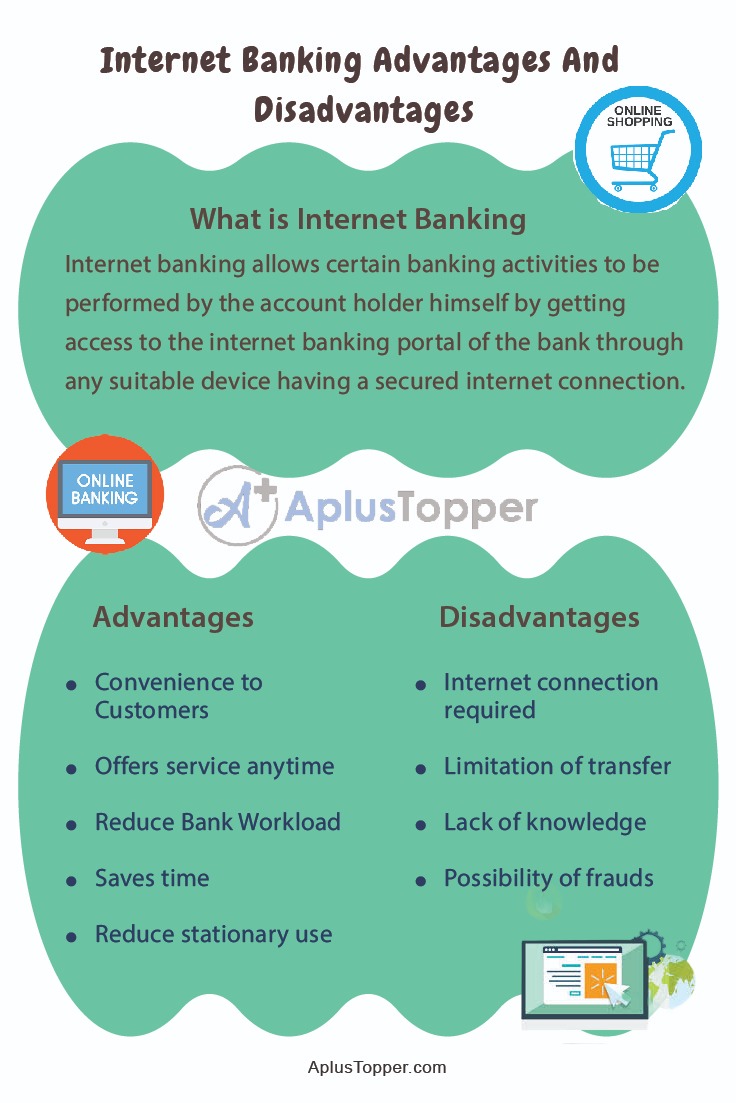

Internet banking allows certain banking activities to be performed by the account holder himself by getting access to the internet banking portal of the bank through any suitable device having a secured internet connection. A customer can check the account balance, download previous statements, give requisition for cheque book, and most importantly transfer money from his account to the account of any other person as required. It also allows payment to various online shopping platforms and food outlets while ordering from home.

When the customer login with the customer id and password, the portal verifies the customer information and if it matches then access is given for further processing and transactions. The user can select the appropriate activity from the options and the portal allows the electronic fund transfer within the bank accounts. The entire operation takes a few minutes thereby saving a lot of time and effort for the customer as well as for the banking staff.

- Advantages of Internet Banking

- Disadvantages of ATM

- Comparison Table for Advantages and Disadvantages of Internet Banking

- FAQ’s on Internet Banking Advantages And Disadvantages

Advantages of Internet Banking

- Convenience to Customers: Internet banking allows customers to do financial transactions at their convenience without visiting the bank. The bank account holder can avail of any of the various banking services online from any convenient location and with the flexibility of schedule even beyond banking hours. Customers don’t need to visit the bank and spend time performing certain banking operations that can be done through internet banking.

- Offers service anytime: The internet banking service is available round the clock and not limited by banking hours. So customers have access to their bank accounts all the time and they can perform the activities at any time as per their convenience or in case of any urgency.

- Reduce Bank Workload: Internet banking provides customers with the facilities that are available in banks so customers can avoid visiting the bank. As the customers avail the banking services by themselves without visiting a bank, there is a huge reduction in workload in banks. There is no requirement to attend to customers for balance checking, cheque deposit, or passbook update. Internet banking thus becomes an efficient tool in reducing the work pressure on banks and provides flexibility to the staff.

- Saves time: Customers can transfer funds to other accounts within minutes using internet banking facilities that would otherwise take a few days in case of cheque deposit and processing by the bank. It ensures immediate fund transfer to anyone across the world. Internet banking also allows the online purchase of products and services by making instant payments.

- Reduce stationary use: Internet banking helps in reducing the use of stationary like checkbooks and passbooks as fund transfer and balance checking is done online.

Disadvantages of ATM

- Internet connection required: Internet banking, as the name implies, can be used only through an internet connection. The customers living in areas with limited or no internet access don’t avail this facility.

- Limitation of transfer: There are certain restrictions on the amount of money transferred through internet banking as specified by banks. The limitation can be also on the time that is required for activation of details of beneficiary for which fund transfer is to be done.

- Lack of knowledge: Some customers are not very comfortable in handling internet banking or may not have proper knowledge about its operations so they find it inconvenient and feel hesitant to use it.

- Possibility of frauds: There are several reported incidents nowadays about fraud involving hacking into bank accounts through the internet. The hackers can get access to the account and transfer money.

Comparison Table for Advantages and Disadvantages of Internet Banking

| Advantages | Disadvantages |

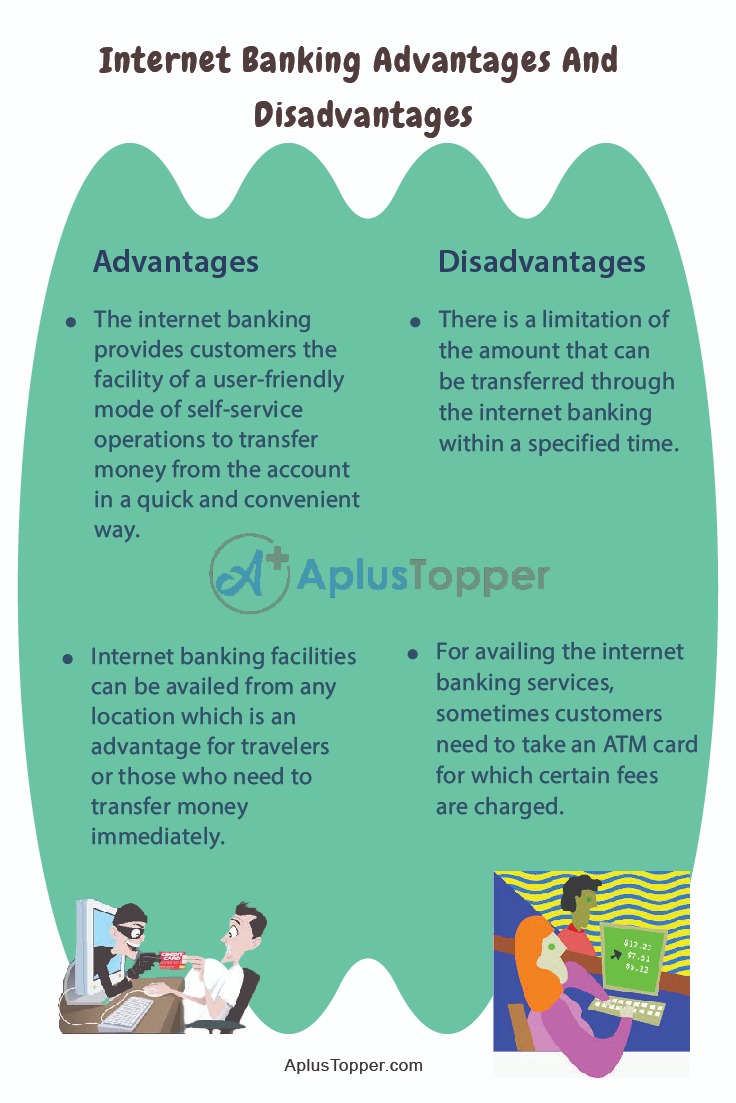

| The internet banking provides customers the facility of a user-friendly mode of self-service operations to transfer money from the account in a quick and convenient way. | Internet banking is not available in regions with no internet access. Moreover, a lot of people don’t have access to computerized devices for personal banking. |

| Customers can perform certain banking operations through the internet banking and no longer need to visit the bank to avail the service. This has allowed bank staff to handle fewer customers and has helped banks to reduce the workload to a great extent. | There is a limitation of the amount that can be transferred through the internet banking within a specified time. |

| Internet banking offers services at any time so one can perform the banking operations as per his/her convenience of time and location without visiting the bank or even beyond banking hours. | The customer id and the password are the only way to access the internet banking. There is a possibility of fraud and misuse if internet hacking is done by unauthorized personnel. |

| Internet banking facilities can be availed from any location which is an advantage for travelers or those who need to transfer money immediately. | Some customers who are not comfortable in handling the internet banking or may not have proper knowledge about its operations found it inconvenient and feel hesitant to use it. |

| The operations performed through internet banking do not involve any human intervention, so it saves a lot of time and allows less possibility of errors due to manual work. | The smooth functioning of internet banking requires a stable internet connection. If the connection is poor or lost, customers can no longer avail the internet banking facilities. |

| Internet banking helps in reducing the use of stationary like checkbooks and passbooks as fund transfer and balance checking is done online. | For availing the internet banking services, sometimes customers need to take an ATM card for which certain fees are charged. |

FAQ’s on Internet Banking Advantages And Disadvantages

Question 1.

How does internet banking help in saving time?

Answer:

Internet banking provides immediate information on balance and details of transactions so there is no need to update the passbook by visiting the bank branch. It also allows money transfer to other accounts immediately without involving the physical process of cheque deposit and process that takes much more time.

Question 2.

What is the most useful feature of internet banking?

Answer:

The most useful feature of internet banking is a money transfer and payment options with immediate effect.

Question 3.

What is the biggest disadvantage of internet banking?

Answer:

Internet banking requires devices with a stable internet connection to function properly. If the network connection is poor or lost, it doesn’t work. Moreover, people can’t use internet banking in areas with no internet connection.