ICSE Economics Previous Year Question Paper 2016 Solved for Class 10

ICSE Paper 2016

ECONOMICS

(Two Hours)

Answers to this Paper must be written on the paper provided separately.

You will not be allowed to write during the first 15 minutes.

This time is to be spent in reading the Question Paper.

The time given at the head of this Paper is the time allowed for writing the answers.

Section I is compulsory. Attempt any four questions from Section II.

The intended marks for questions or parts of questions are given in brackets [ ].

SECTION-I (40 Marks)

(Attempt all questions from this Section)

Question 1:

(a) Define a Direct Tax. Give two examples. [2]

(b) State any two differences between an entrepreneur and other factors of production. [2]

(c) How does money help in maximizing utility? [2]

(d) Explain two rights of a consumer. [2]

(e) Mention one way by which the Government can reduce the inequalities of income and wealth in an economy. [2]

Answer:

(a) A direct tax is really paid by the person on whom it is legally imposed. A direct tax is one whose burden cannot be shifted. For example: income tax, wealth tax.

(b)

| Basis | Entrepreneur | Other factors of Production |

| Risk bearing | An entrepreneur assumes risk of economic uncertainty involved in the enterprise. | A manager or labourer does not assume or share any risk involved in the enterprise he is serving. |

| Reward | The reward of an entrepreneur for his risk bearing role is profits. It is not only uncertain and irregular but can at times be negative also. | The reward of a manager or labourer for rendering his services is salary and for land there is rent which unlike profits is fixed and regular and can never be negative. |

(c) Money enables consumers in making payments for goods and services of their needs.

It provides freedom of choice of consumption. On the basis of prices of various goods and services, consumers are able to allocate their income in such a way so that they can derive maximum utility from their consumption

(d) Rights of consumers:

- Right to be informed: Adequate and accurate information about the quality, quantity, purity, standard and price of goods and services must be provided to consumers. This information helps consumers while making the decision to buy and use a product.

- Right to seek redressal: Consumers have been given the right to redress their grievances relating to the performance, grade and quality of goods and services. The Consumer Protection Act has duly provided for a fair settlement of genuine grievances of consumers. It has also set up a proper mechanism for their redressal at the district, state and national levels.

(e) Revenue policy is one of the two measures undertaken by the government to reduce income inequality in an economy. The progressive and proportional system of taxation helps in reducing the gap between the rich and the poor.

Question 2:

(a) What is meant by contraction in demand? [2]

(b) Mention two ways by which producers benefit from division of labour. [2]

(c) Mention the degree of Price elasticity of demand for the following goods:

- cosmetics

- medicine

- school uniform

- air conditioners [2]

(d) Explain briefly two factors affecting the productivity of land. [2]

(e) A special virtue of Indirect Taxes is that, they sometimes help in Social reforms. Explain. [2]

Answer:

(a) When the quantity demanded decreases with the mcrease in price of the commodity, it is known as contraction in demand. There will be an upward movement.

(b) The division of labour helps the producers to earn more monetary benefits in their productive activities in the following ways:

- Increase in production: With the division of labour, the workers become more skilled and efficient. They acquire higher speed in work, which ultimately results in more production.

- Improvement in quality: As the worker acquires greater skill in performing the work, it increases quality of production. The good quality product becomes more and more popular and accetable to the consumer. This increases the overall turnover and the net profit of the producer.

(c) Degree of price elasticity of demand:

- Cosmetics: Relatively Elastic Demand.

- Medicine: Perfectly Inelastic Demand.

- School uniform: Relatively Inelastic Demand.

- Air conditioners: Relatively elastic demand.

(d) Two factors affecting productivity of land:

- Fertility of land: The productivity of land is determined by its natural qualities and its fertility. In agriculture, a flat and levelled land is comparatively more productive than an undulating one.

- The agricultural productivity can be improved by proper and extensive use of manure and fertilizers along with adoption of mechanized methods.

(e) Heavy indirect taxes on intoxicants, like wine or opium etc., serves a great social purpose because they limits the consumption of such harmful commodities and saves society.

Questions 3:

(a) Define Bank rate. [2]

(b) Mention two causes of increase in public expenditure in recent times. [2]

(c) Complete the following demand schedule: [2]

| Price (Rs.) | Qty. of Mangoes demanded (kgs) |

| 350.00 | 2 |

| 300.00 | |

| 250.00 | |

| 200.00 | |

| 150.00 | |

| 100.00 |

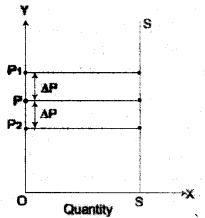

(d) Draw a perfectly inelastic supply curve. [2]

(e) Explain one cause for low capital formation in India. [2]

Answer:

(a) Bank rate is the rate at which the central bank provides credit to commercial banks. An increase or decrease in the bank rate leads to an increase or decrease in the market rate of interest, thereby the cost of credit changes in the market. During inflation, an increase in the bank rate increases the cost of capital which reduces the flow of credit.

(b) Two causes for increase in public expenditure in recent times:

- Developmental Work: Modern state has also taken up developmental work in addition to their primary functions of administration and defense and others benefits such as old age pension, free medical aid, free education etc. to improve the social-economic welfare of the country.

- Increase in Population: The government has to incur great expenditure to meet the requirements of increasing population. In fact, the public expenditure increases in the same ratio in which the population increases.

(c) Demand Schedule:

| Price (Rs.) | Qty. of Mangoes demanded (kgs) |

| 350.00 | 2 |

| 300.00 | 3 |

| 250.00 | 4 |

| 200.00 | 5 |

| 150.00 | 6 |

| 100.00 | 7 |

(d) Perfectly inelastic supply curve:

(e) Low saving ability is the main cause for low capital formation in India. The people in India have the desire to save and possess all those factors, which motivate the ‘will to save’ but they have lower per capita income. Hence the low rate of savings leads to a low rate of capital formation.

Question 4:

(a) What is the impact of the level of technology on supply? [2]

(b) Define creeping inflation? Why is it considered good for an economy? [2]

(c) Mention two differences between fixed deposits and demand deposits. [2]

(d) What is meant by a Degressive Tax system? [2]

(e) Define simple division of labour. [2]

Answer:

(a) Technolgical developments result in an increase in the supply. It brings down the costs of production and raises the profits of the producers. This naturally provides incentives to them to increase the supply of their products.

(b) Creeping inflation occurs when there is a sustained rise in price at a very slow rate of 2 to 3 percent per year.

It is considered good of an economy. It is generally known as safe and essential for economic progress and growth.

(c) Differences between demand deposits and fixed deposits:

- Interest rate on demand deposits is very low, whereas fixed deposits carry a higher interestrate.

- Demand deposits can be withdrawn at any time, whereas fixed deposits can be withdrawn only after the expiry of a specific period.

(d) Regressive tax system: The rate of the tax increases upto a certain limit but after that a uniform rate is charged. It is a mixture of proportional and progressive tax system.

(e) Simple Division of Labour: It is the system in which each individual takes up one specific job depending upon his ability and aptitude such as carpenter, dentists, etc. In this, the individual is responsible for whole job and remain less skilled. Therefore, more training period is required.

SECTION-II (40 marks)

(Answer any four questions from this section)

Question 5:

(a) Define demand. Explain clearly two factors which determine demand. [5]

(b) Explain four important characterisiicgvf labour as a factor of production. [5]

Answer:

(a) “Demand for a commodity is the quantity which a consumer is willing to buy at a particular price at a particular time.”

Two factors which determine demand are as follows:

- Price of the commodity: An increase in the price level reduces the purchasing power of consumers and the demand will be less. A fall in the price level increases the purchasing power of the consumers and the demand will be more.

- Population: An increase in population of a region will result in an increased demand of various goods. Also the composition of population determines the demand of certain goods proportionately. For example, an increased number of females in the region will generate more demand for sarees, ornaments etc.

- Pattern of income: With a rise in income, the purchasing power of people also increases which in turn encourages the people to demand more of luxuries and comforts.

(b) Four characteristics of labour as a factor of production:

- Labour is an active factor of production. Without labour, other factors of production such as land and capital cannot produce anything. Labour is a living organism which requires sympathetic treatment.

- Labour cannot be separated form the labourer, because the labourer will have to be present at a workplace where work is going on. The worker and the service rendered by a worker go together. She/he cannot sell labour like land and capital.

- Labour is Perishable which cannot be stored. If a worker does not work on a particular day, her/his labour is wasted. The labourer has to sell his labour immediately, irrespective of the prices paid in terms of wages. Hence, labour has a weak bargaining power.

- All labourers are not equally efficient. Labour can improve its efficiency by investing capital on worker’s education and training and providing proper working environment and incentives.

Question 6:

(a) Define Public expenditure. Explain two ways by which it promotes economic development. [5]

(b) What is meant by efficiency of labour? Explain three causes of low efficiency of labour in India. [5]

Answer:

(a) Public expenditure refers to the expenses of the public authorities—Central, State and Local Government—either in protecting the citizens or in promoting their economic and social welfare and promoting economic development.

Public expenditure promotes the economic development as follows:

- Public expenditure on infrastructural development such as power, irrigation, transport etc. improves the production efficiency of industries and increases employment opportunities.

- It encourages private enterprises by initialising state-owned financial and banking institutions to provide cheap credits.

(b) ‘Efficiency of labour’ implies the productive capacity of a worker to do more or better work or both during a specified period of time.

Causes of Low Efficiency of Indian Labour:

- Climate: The hot and humid climate of most of the states of India is a factor that deprives the people of the capacity to work hard and the ability to display Iiigh efficiency.

- Wages not determined by efficiency: Workers have the incentive to become more efficient only if higher efficiency leads to higher income. This is, in many cases, not true in India. Sometimes, the employers are to blame for this. They do not give to the efficient workers the higher incomes that they deserve.

- Inadequate Training facilities: There is also dearth of training facilities for the workers in India. Even the workers who wish to receive special training (or the employers who wish to send their workers to such training programmes) cannot do so in view of the limited facilities.

- Poor Working Conditions: The poor and unhealthy working conditions in

most of the Indian factories (specially in the unorganised sector) aggravates the problem of inefficiency of Indian workers. (any three)

Question 7:

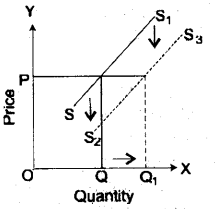

(a) With the help of a diagram explain the meaning of Increase in supply and Decrease in supply. [5]

(b) What is meant by consumer awarness? Explain briefly four ways by which consumers are exploited. [5]

Answer:

(a) Increase in supply: When larger quantity of a commodity is supplied due to change in. other factor like use of better techniques and processes of production but price remains constant, supply curve shifts rightward, it is called increase in supply.

It can be explained from the figure given:

In fig., horizontal OX-axis represents quantity supplied and vertical OY-axis represents price of the product. SS1 stands for the original supply curve and S2S3 stands for the hew supply curve after the conditions have changed. Here the price is OP, originally, producers supplied OQ quantity but are now more supply i.e. OQ1supply curve shifts downwards.

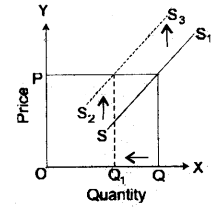

Decrease in Supply: When supply of a commodity decrease due to change in other factors like rise in cost of production, rise in wage rates, use of inferior technology but price remains constant, supply curve shifts left ward, it is called decrease in supply. It can be explained from the figure given:

A decrease in supply of a product is indicated by a higher supply curve. In the figure, SS1 is the original supply curve and S2S3 represents the new supply curve after the conditions have changed. Here the price OP is same but the supply decreases from OQ to OQ1, supply curve shifts leftward.

(b) Consumer Awareness: It is the knowledge that a consumer should have about his/her legal rights and duties. It is a must for a consumer to follow these rights. It is implemented for the protection of the consumer, so that the consumer is not exploited by the sellers in the market place.

Ways in which Consumers are Exploited:

- Underweight and Under Measurement: The goods being sold in the market are sometimes not measured or weighed correctly.

- High Prices: Very often the traders charge a price higher than the prescribed retail price.

- Duplicate Articles: In the name of genuine parts or goods, fake or duplicate items are being sold to the consumers.

- Artificial Scarcity: In order to make illegitimate profit, businessmen create artificial scarcity by hoarding. They sell the products at a later stage at higher prices.

- Adulteration and Impurity: In costly edible items such as oil, ghee and spices, adulteration is made in order to earn higher profits. Adulteration of foods causes heavy loss to the customers; they suffer from monetary loss as well as spoil their health.

Question 8:

(a) Define money. Explain the Primary functions of money. [5]

(b) Mention five differences between a Direct Tax and an Indirect Tax. [5]

Answer:

(a) Money: Anything which is widely accepted in payments for goods, or in discharge of other kinds of business obligations is called money.

Primary Functions of Money:

- Medium of Exchange: Money serves as a medium of exchange. Money is normally accepted as a medium through which all the sales and purchases takes place. As the money is accepted as a common medium of exchange, it has eliminated the difficulties of barter system.

- Measure of Value: Money acts as a common measure of value. Under the barter system, the value of a commodity is expressed in terms of other commodity. When we express the value of a commodity in terms of money, it is known as price. These money provides a language of economic communication.

(b) Five differences between a direct tax and an indirect tax:

| Direct Tax | Indirect Tax |

| 1. They are directly paid to the Government by the people on whom they are imposed. | They are paid to the Government by one person but their burden is borne by another person. |

| 2. They cannot be shifted i.e. impact and incidence is on the same person. | They can be shifted i.e. impact is on one person and incidence is on an another person. |

| 3. Taxes imposed on production or income | Taxes imposed on consumption are indirect taxes. |

| 4. It is progressive because the tax rate increases with an increase in income. | It is regressive because the common people bear this tax. |

5. They generate social consciousness among people. Examples: Income Tax, Wealth tax. | They do not generate social consciousness as they are taxes in the dark. Examples: Sales Tax, Excise Duty. |

Question 9:

(a) Explain briefly the five agency functions of a Commercial Bank. [5]

(b) Define Capital. Differentiate the following, with examples: [5]

- Real Capital and Debt Capital

- Money Capital and Sunk Capital

Answer:

(a) Five agency functions of a Commercial Bank:

- Collection of payments: The commercial banks collect the payment of the bills of exchange, promissory notes, cheques, dividends etc. on behalf of its customers.

- Acts as trustee or executors agents: They act as trustees or executors and deal with the financial matter, relating to other institutions on behalf of the customers. They act as the agents or representatives of their customers for other hand banks and financial institutions, inside the country and abroad.

- Sale and Purchase of securities: The bank also buy and sell shares and securities, on behalf of their customers.

- Providing Guarantee: Bank serves as a guarantor on behalf of their customers. By giving guarantees, bank enable their customers to obtain credit and finance from other services.

- Making payments: The banks also transfer funds from one branch of the another branch and one place to another as per instructions of their customers.

- The bank on behalf of the customers, arrange for the payment of loan installments, interests, insurance premium, taxes, etc.

(b) Capital: Capital is defined as “All those man-made goods which are used in further production of wealth.” Thus, capital is a man-made resources of production.

1. Difference between Real Capital and Debt Capital:

| Real Capital | Debt Capital |

| 1. Real Capital refers to all those goods which are used for further productions of more goods. | Debt Capital represents the invested funds which yield income. |

| 2. Examples of Real Capital—Machines, tools, factory, buildings, transport equipments etc. | Examples of Debt Capital—Investment in shares, stocks, Government securities. |

2. Difference between Money Capital and Sunk Capital:

| Money Capital | Sunk Capital |

| Money capital is utilized by the producers for the purchase of tools, machines, buildings, raw materials etc. Money itself does not have any value, but it actually helps in purchasing capital goods which are utilized for producing different kinds of goods. | Sunk capital is one which can be used to produce only one type of commodity or service. For example, a cloth producing machine can be used in a textile mill only, it can not be used in producing any other good. |

Question 10:

(a) What is meant by Price elasticity of supply? Explain three factors which determine elasticity of supply. [5]

(b) Explain the following:

- Internal and External debt

- Productive and Unproductive debt [5]

Answer:

(a) Price Elasticity of supply: “It is the ratio of percentage change in quantity ’ supplied over the percentage change in price of the commodity.

Factors determining elasticity of supply:

- Chances of shifting from production: The size or degree of response depends on how easily producers can shift the production of another product to the one whose price has increased. When the producers can easily shift from one product to another, it means the supply would be more price elastic.

- Length of time: Producers cannot shift the production immediately because of a change in price of other products within the short duration. However, it may be possible to do so over a period of time. Hence, supply tends to be relatively inelastic in the short run and relatively elastic in the long run.

- Risk-taking: The elasticity of supply is determined based on the willingness of entrepreneurs to take risks. Supply is more elastic when entrepreneurs are willing to take risk and inelastic when they hesitate to take risk.

(b) Internal debt and external debt:

Internal debt means the government’s borrowings within the country. Individuals, banks, business firms and others are the various internal sources from which the government borrows. The various instruments of internal debt include market loans, bonds, treasury bills, ways and means and advances.

External debt means the government’s borrowings from abroad. External debts are multilateral borrowings, bilateral borrowings, loans from the World Bank and the Asian Development Bank. It helps for various developmental programmes.

Productive and unproductive debt:

A debt is called productive if the loan is financed for projects which bring revenue to the government; for example, irrigation and power projects. Productive debts are self liquidating in nature; this means the principal amount and interest are normally paid out of the revenue generated from the projects for which the loans were used.

A debt is called unproductive if the loan is financed for war and other relief operations in case of emergencies. Unproductive public loans are a net burden on the community. The government will have to resort to additional taxation for their servicing and repayment.