ICSE Economics Previous Year Question Paper 2013 Solved for Class 10

ICSE Paper 2013

ECONOMICS

(Two Hours)

Answers to this Paper must be written on the paper provided separately.

You will not be allowed to write during the first 15 minutes.

This time is to be spent in reading the Question Paper.

The time given at the head of this Paper is the time allowed for writing the answers.

Section I is compulsory. Attempt any four questions from Section II.

The intended marks for questions or parts of questions are given in brackets [ ].

SECTION-I (40 Marks)

(Attempt all questions from this Section)

Question 1:

(a) State two advantages of opening a bank account. [2]

(b) What is the difference between impact of taxation and incidence of taxation? [2]

(c) Define cost-push inflation. State two factors causing it. [2]

(d) The bus fare between two cities is reduced. How will this affect the demand curve for bus travel between the two cities? [2]

(e) Distinguish between Real capital and Debt capital with the help of suitable examples. [2]

Answer:

(a) Two advantages of opening a bank account:

- Customers can keep their money safe with bank and can draw cheques on behalf of deposit money to anybody for making payments.

- Customers can earn interest on deposit money.

(b) Impact of a tax is different from the incidence of tax. Impact of taxation refers to the point of original assessment whereas incidence of tax means the ultimate point of tax burden.

Example: Suppose an excise duty is imposed on the producer of sugar. The producer then shifts this excise duty by charging extra price equal to the excise duty from the wholesalar and who in turn charges it from retailer and finally from the customers. This means the impact of the excise duty is upon the sugar producer who pays it to the Government but the incidence of tax is upon the consumers who actually bear the tax burden.

(c) Cost push Inflation: Cost push inflation refers to inflationary rise in prices which arises due to increase in costs.

Causes of Costs push inflation:

- Rise in wages of labour.

- Increases in profit margins.

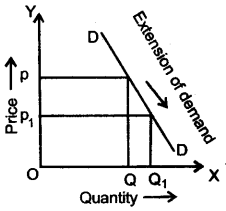

(d)

Here,

P → initial price

Q → initial quantity demanded

P1 → required price

Q1 → increased quantity demanded.

If bus fare falls then demand increases for between two cities. Along with same demand curve, it shifts downward which represents extension of demand.

(e) Refer Ans. 9 (b) (i), 2016.

Questions 2:

(a) Distinguish between simple division of labour and complex division of labour. [2]

(b) What is meant by expenditure tax? Give an example. [2]

(c) How does money solve the problem of lack of a common measure of value that existed under the barter system? [2]

(d) How does the nature of a good affect its elasticity of demand? [2]

(e) Mention two agency functions of a Commercial Bank. [2]

Answer:

(a)

| Simple Division of Labour | Complex Division of Labour |

| 1. It is the system in which each individual takes up one specific job depending upon his ability and aptitude such as carpenter, dentists etc. | In this, the total work is divided into small steps and individual is assigned a job according to his aptitude and qualifications. For example—Teacher of Physics. |

| 2. In this type, the individual is responsible for whole job. | Job is divided among many persons. |

3. The worker remains less skilled. | The worker becomes more skilled. |

| 4. More training period is required. | Less training period is required. |

(b) Expenditure tax is a taxation plan that replaces the income. Instead of applying a tax based on the income earned, tax is allocated based on the rate of spending. This is different from a sales tax which is applied at the time the goods or services are provided and is considered a consumption tax.

(c) Money is accepted as a common measure of value. Under the barter system, the value of a commodity were expressed in terms of other commodity. The value of rice could have been expressed in terms of piece of cloth but after the evolution of money, the problem get resolved as now price of any commodity can be expressed in terms of money.

(d) The nature of good affect its elasticity of demand in following manner—

- The demand for necessity items is generally less elastic. Such commodities are bought in certain fixed quantities irrespective of their prices.

- The demand for comfort items are relatively elastic.

- The demand for luxuries items are highly elastic.

(e) Two agency functions of a Commercial Bank—

- Collection and Making payments for credit Instruments—The bank collects the payment of the bills of exchange, promissory notes, cheques, etc. on behalf of its customers.

- Collection of Dividend—The bank collects the dividends, and interests on shares and debentures as per instructions of its customers.

Questions 3:

(a) Mention two causes of low efficiency of labour in India. [2]

(b) Mention any two forms of consumer exploitation. [2]

(c) Define Public debt. [2]

(d) Indirect taxes are regressive in nature. How can they be made progressive? [2]

(e) Distinguish between demand deposits and fixed deposits. [2]

Answer:

(a) Two causes of low efficiency of labour in India:

- Hot and Enervating Climate—India is a subtropical country and its climate is hot and enervating. It reduces the worker’s stamina for hard and continuous work for long hours.

- Low wages—The wages of labour in India are low in general and so is the standard of living. As such, the workers are not in a position to keep themselves physically and mentally fit and in sound health, this become a cause of low efficiency.

(b) Two forms of consumer exploitation:

- Underweight and Under-measurements—The goods being sold in the market are sometimes not measured or weighted correctly.

- Duplicate Articles—In the name of genuine parts or goods, fake or duplicate items are being sold to the customers.

(c) Public Debt—“National debt is a debt which a state owes to its subjects or to the nationals of other countries.” —Findlay Shirras

In simple words, Public Debt refers to the loan raised by the government within the country or outside the country. The government may borrow from individuals, business enterprises and banks, etc. when its expenditure exceeds its revenue. But it is not a source of revenue like tax.

(d) Indirect taxes are regressive in nature as it is generally imposed on the consumption of goods. They are indiscriminately in that sense the poor people have to pay as much as rich people.

It can be made progressive and equitable by imposing heavy taxes on luxury goods consumed by the rich consumers and low taxes on the essential commodities.

Question 4:

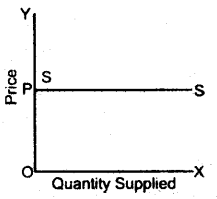

(a) Indicate the degree of elasticity of a supply curve parallel to the X-axis. [2]

(b) Distinguish between Creeping inflation and Running inflation. [2]

(c) How does money act as a standard of deferred payment? [2]

(d) Briefly explain the importance of public expenditure in the industrial development of developing countries. [2]

(e) Distinguish between Statutory Liquidity Ratio and Cash Reserve Ratio. [2]

Answer:

(a) Supply curve parallel to X-axis represents perfectly elastic supply, where quantity supplied is responded by an infinite amount to a very small change in price.

(b) Difference between Creeping Inflation and Running Inflation:

| Creeping Inflation | Running Inflation |

| 1. Creeping inflation occurs when there is a sustained rise in prices over time at a mild rate, say around 2 to 3% per year. It is also called mild inflation. | When the sustained rise in prices is over 8% and generally around 10% p.a. is called Running inflation. It normally shows 2 digit inflation. |

| 2. This type of inflation is not much of a problem and is good for healthy functioning of economy. | This type of inflation is a warning signal indicating the need for controlling it. |

(c) Money acts as a standard of deferred payment. It means payment to be made in future can be expressed in terms of money. Credit is given in terms of money. If a person needs 10 kilograms of rice but does not have the required amount of money with him at the time, he borrows this amount. The person needed rice, but he borrowed money. He did not borrow rice. He will return money to the lender, after the agreed period. That’s why money is called standard of deferred payments.

(d) The importance of public expenditure in the industrial development is in following manner—

- By building economic overheads, e.g., roads, railways, irrigation, power, etc. and undertaking of social overheads, such as hospitals, schools, etc. productive capacity of an economy is increased.

- Public expenditure is helpful in promoting and developing the basic and key industries, such as capital goods industries.

(e) SLR—Statutory Liquidity Ratio (SLR) refers to that portion of the total deposits of a commercial bank which it has to keep with itself in the form of cash reserves, gold and government securities.

CRR—Cash Reserve Ratio refers to that percentage of total deposits of commercial bank which it has to keep with the RBI in the form of cash reserves.

SECTION-II (40 Marks)

(Answer any four questions from this section)

Question 5:

(a) What is meant by increase in demand? Discuss any four factors affecting price elasticity of demand. [5]

(b) Define land. Explain the importance of land as a factor of production. [5]

Answer:

(a) Increase in Demand—Increase in demand refers to a situation when the consumers buy larger amount of a commodity at the same existing price. Increase in demand may take place due to rise in income, a change in taste, rise in the price of substitutes, a fall in prices of complementary goods, increase in population, redistribution of income, etc.

Factors Affecting Price Elasticity of Demand

- Availability of substitutesp—A commodity with more and close substitutes tends to have an elastic demand and one with a few weak substitutes has an inelastic demand.

For example: If price of Pepsi falls, a large number of consumers will switch over the Pepsi from Coke. On the other hand when the price of milk increases, the quantity demanded will not decrease much and vice versa. - Proportion of Income Spent—Smaller is the proportion of Income spent on a commodity, the smaller will be the elasticity of demand and vice-versa.

For example: The demand for soap, salt, matches, etc. is highly inelastic since the consumer spends a very small proportion of his income on them. - Habits of the consumer—Price elasticity of demand depends also upon whether or not the consumers are habitual of using a commodity. If consumers are habitual of consuming some commodities, they will continue to consume these even at higher prices. The demand for such commodities will be usually inelastic.

- Time Factor—Price Elasticity is generally low for the short period as compared to long period. This is for 2 reasons—

Firstly—It takes time for consumers to adjust their tastes, preferences and habits.

Secondly, new substitutes may be developed in the long run.

(b) “Land is a specific factor or that it is the specific element in a factor or again that it is the specific aspect of a thing.” —Prof. J. K. Mehta

The term ‘land’ generally refers to the surface of the earth. But in economics it includes all that, which is available free of cost from ‘nature’ as a gift to human being. Land stands for all nature, living and non living which is used by man in production.

Importance of Land as a factor of Production—In every kind of production, we have to use land. Therefore land is a basic factor of production.

- In industries, it helps to provide raw material.

- It provide space/surface for setting up the sites for industrial infrastructure.

- In Agriculture, land is considered as the main factor of production as crops are produced on land.

- All sources of power i.e. hydro electricity, thermal power, diesel, coal, oil, etc. emanate from land.

Fundamentally speaking, ‘land’ is the original source of all material wealth and it is of immense rise to mankind. Inspite of being a passive factor, it is an important factor of production. An overall economic prosperity of a country is directly related to the richness of its natural resources.

Question 6:

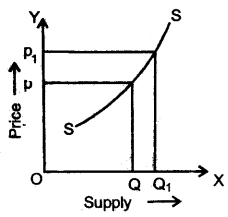

(a) Define supply. State the law of supply and explain it with the help of a diagram. [5]

(b) Define a consumer. Explain the importance of educating consumers of their rights. [5]

Answer:

(a) Supply: “Supply may defined as a schedule that shows the various amounts of a product for which a particular seller is willing and is able to produce and make it available for sale in the market at each specific price in a set of possible prices during some given period.” —Mc Connel

In simple words, supply means that quantity of a particular commodity which a seller is ready to sell at a given price.

Law of Supply: “The law of supply states that, other things being equal, the higher the price, the greater the quantity supplied or the lower the price, the smaller the quantity supplied.” —Dooley

It can be illustrated with the help of the following schedule and diagram:

| Price of Goods x (Rs. per kg) | Qty. supplied of Good x (kg. per month) |

| 10 | 5,000 |

| 15 | 10,000 |

| 20 | 16,000 |

| 25 | 25,000 |

| 30 | 35,000 |

In the above diagram price is Rs. 10 per kg., at this price supply is 5,000 kg. We observe that as the price increases the quantity supplied goes on increasing, making the supply curve upward sloping.

(b) Consumer—A person who has indicated his or her willingness to obtain goods and/or services from a supplier with the intention of paying for them is termed as consumer.

Importance of Educating Consumers of their rights—

- For the physical protection of consumer—To educate consumers of their rights is necessary so as to provide safeguard against the products that are unsafe or harmful to the health and welfare of a consumer.

- For protection against unfair trade practices—Consumer should know about his rights and in case of any exploitation, due to supply of substandard defective goods etc. he should know the means to redress against frauds.

- Protection against Environmental Hazards—Use of chemical fertilizers and certain refinery complexes pollute air, water and food and they cause a threat to human life. Thus, protection is needed for it.

- Protection from Deceptive Advertising—Some producers give incorrect information about their products and the consumer is misled by these fake advertisements which costs hard on their pockets. They should aware of deceptive advertising.

Question 7:

(a) Name the institution that enjoys the monopoly of note issue in India. Briefly explain two qualitative methods of credit control adopted by this institution. [5]

(b) Define labour. Explain four important characteristic of labour. [5]

Answer:

(a) The institution that enjoys the monopoly of note issue in India is RBI (Reserve Bank of India). It is the central bank of India.

Qualitative Methods of Credit Control—

- Credit Rationing—The RBI may also specify a ceiling limit on the maximum level of credit which can be given on the stocks of selected commodities to limit the quantum of credit given to a specific industry or sector of economy. For example—The RBI may prescribe the limit for food credit for each year. This will ensure that excess credit will not flow to this sector of economy.

- Moral Suasion—Suasion means to persuade, so it is a method of request and advice to the commercial banks by the central bank. Central bank requests the commercial banks not tdgrant credit for speculative and non essential activities.

Since, the ‘central bank’ is the symbol of financial authority and sovereignty, the commercial banks honour such requests. This method proves very effective under normal conditions of market and economy.

(b) “Any exertion of mind or body undergone partly or wholly with a view to some good other than the pleasure derived directly from the work is called labour.”

Characteristics of Labour—

- The Labourer sells his services (Labour) only—A labourer (worker) sells his services only and not himself. A labourer may or may not agree to do a work. The ‘labour’ factor comes into consideration when he agrees to offer his services on certain terms and conditions.

- Labour is highly perishable—If a labourer does not work for a day, his one da^s output will be lost forever. As such the labourer (worker) agrees to work even at a low wage when he feels that his labour is likely to be wasted. Because of this peculiarity, the labourer does not have the same bargaining power similar to his employer.

- Human factor—Labour is human factor. Hence, several human considerations are to be kept in mind while dealing with the labour, such as moral considerations, ethical considerations, devotion, motivation (including incentives), family background etc.

- Labour is less mobile—The mobility of labour is not so easy. Even the most remunerative employment opportunities do not attract many trained personnel from other countries. This is due to the labourers sentimental attachments to his home and surroundings. The problems of language, differences in living habits and social customs, etc. are some other important factors affecting mobility of labour.

Question 8:

(a) What is meant by food adulteration? Give an example. Mention two harmful effects of food adulteration. Name any one measure formulated to prevent the problem of food adulteration in India. [5]

(b) Explain two methods adopted by Commercial Banks to advance loans to the general public. [5]

Answer:

(a) Any substance added to a food item to reduce its quality in order to increase its quantity is called an adulterant. This act of addition of the adulterant in food item is known as food adulteration.

The addition of adulterant may be intentional or accidental. But generally the adulterant addition is intentional. The major reason for the intentional addition of these adulterants is for increasing the profit margin on the expense of the health of the public or consumer.

Example—

1. In the name of original ghee, it is adulterated with vanaspati.

2. Honey is adulterated with sugar.

Harmful effects of food adulteration

- It leads to serious health hazarding like cancer, cardiac problems, insomnia and paralysis and other neurological problems or even death as well.

- It reduces the quality of commodity as well as create economic loss to the consumer.

Measure formulated to prevent the problem of food Adulteration in India Prevention of Food Adulteration Act, 1954—It was enacted to eradicate rampant evil of food adulteration and to ensure purity in food articles so as to maintain public health.

(b) The two methods adopted by commercial banks to advance loans to the general public are as under—

- Overdraft—The overdraft facility is allowed to the depositor maintaining a current account with the bank. According to this facility a borrower is allowed to withdraw more amount than what he has deposited. The excess amount so withdrawn has to be repaid to the bank in a short period and that too with interest. The rate of interest is usually charged more than that charged in case of loans.

- Discounting of Bills of Exchange—The banks provide financial help to the merchants and exporters by way of discounting their bills of exchange. However, these merchants and exporters must be the customers of that bank. In such facility, the bank pays the amount of bill presented by the customer, after deducting the.usual hank discount. This way, the customer gets the amount of the bill before the date of its maturity. As such, the bank assists its customers to a great extent by accepting their bills and providing them with liquid assets. Usually a bill matures after 90 days or so and then the bank presents it to the acceptor and receives full amount of the bill.

Question 9:

(a) Why is the income of an entrepreneur residual in nature? Discuss any three functions of an entrepreneur. [5]

(b) Distinguish between:

(i) Voluntary debt and Compulsory debt.

(ii) Regressive tax and Degressive tax. [5]

Answer:

(a) Income of an entrepreneur is residual in nature as entrepreneur bear risk and reward of risk is profit. Profit is income remaining after deducting all the direct and indirect expenses.

Functions of an Entrepreneur

- Risk bearing functions—Every business involves some amount of risks. The production of goods and services is always related to future estimated demands. The future demand is uncertain and unpredictable because it is influenced by changes in fashion, taste, price structure, Govt, policies, etc. Since this upredictable task is undertaken by the entrepreneur. He has to bear the risk. If his estimations prove to be wrong, in the entire business sphere, no other factor of production shares the loss incurred by the entrepreneur.

- Originating—The entrepreneur conceives new ideas, new products and new processes. He also develops new techniques with a view to avail to better opportunities of maximizing profit ability in the business. Thus entrepreneur always looks, for changes and modification in business to further improvement.

- Policy Making—He is the one who makes plans on which the whole organization runs. He hold regular meetings and makes guideline and distributes the work.

(b) (i)

| Voluntary Debt | Compulsory Debt |

| It is a debt which is acquired from the people by government on a voluntary basis. In this people willingly subscribe to the government loans. | These are the loans which are forcibly taken from the people by the government. When government exercises its power for loans, they are known as complusory tax. |

(ii)

| Regressive Tax | Degressive Tax |

| 1. Regressive tax is one in which the rate of taxation decreases as the tax payers income increases. | A tax is called Degressive when the rate of progression in taxation does not increase in the same proportion as the income increases. |

| 2. A regressive tax takes a smaller percentage of people’s income the larger their income is. In this system, the rate of tax falls with increase in income. | In this case, the rate of tax increases up to certain limit, after that a uniform rate is charged and become constant. |

Question 10:

(a) Define a tax. Explain briefly two merits and two demerits of direct taxes. [5]

(b) What is inflation? Discuss the effects of inflation on:

- Fixed income groups.

- Producers. [5]

Answer:

(a) Tax: “A complusory contribution from a person to the government to defray the expenses incurred in the common interest of all without reference to special benefits conferred.” In other words, taxes are compulsory payments to government without any corresponding direct return of services or goods by the government to the tax payers.

Merits of Direct Taxes:

- Economical—Direct taxes are economical in the sense that cost of collecting these taxes is relatively low as they are usually collected at source and they are paid to the government directly by the taxpayers.

- Certanity—Direct taxes satisfy the canon of certainty. The tax payers know how much they have to pay and on what basis they have to pay. The government also knows fairly, definitely the amount of tax revenue it will receive. Thus, the direct taxes satisfy the canon of certanity.

Demerits of Direct Taxes:

- Unpopular—Direct taxes are directly imposed on individuals. They cannot be shifted. Tax payers feel their pinch directly consequently. They are not popular among the people.

- Possibility of Tax Evasion—Direct taxes encourage tax evasion. People conceal their income from the tax officials so as to pay less taxes. In India, there is large-scale evasion of income tax on the part of businessmen. They adopt fradulent practices to save themselves from paying taxes.

(b) Inflation: “A state in which the value of money is falling, i.e. price are rising.”

In other words, Inflation is a rise in price levels with additional characteristics or conditions. It is incompletely anticipated; it does not increase to further rises, it does not increase employment and real output; it is faster than some safe rate; it arises from the side of money, it is measured by prices net of indirect taxes and subsidies; and/or it is irreversible.

Effect of Inflation on:

- Fixed Income groups—This includes pensioners, government servants owners of government securities and promissory notes and others who get a fixed money income. They are known as rentiers. This class is worst affected by inflation because the purchasing power of their fixed income goes on decreasing with rising prices.

- Producers—During inflation, the producers and businessmen gain in the short period. Usually the cost of production does not rise as fast as the price of their product and so there is an artificial margin of profit. As against this they may also be effected adversely on the long run. If the price level goes on increasing, the total consumption of their product would fall. The reduced consumption will ultimately rise the cost of production per unit and reduce the profits.