ICSE Economics Previous Year Question Paper 2012 Solved for Class 10

ICSE Paper 2012

ECONOMICS

(Two Hours)

Answers to this Paper must be written on the paper provided separately.

You will not be allowed to write during the first 15 minutes.

This time is to be spent in reading the Question Paper.

The time given at the head of this Paper is the time allowed for writing the answers.

Section I is compulsory. Attempt any four questions from Section II.

The intended marks for questions or parts of questions are given in brackets [ ].

SECTION-I (40 Marks)

(Attempt all questions from this Section)

Question 1:

(a) Explain in brief the characteristics of land with respect to its supply and use. [2]

(b) Briefly explain the percentage method of calculating elasticity of demand. [2]

(c) State two differences between labour services provided by a surgeon and a farmer. [2]

(d) State two reasons for consumer exploitation in India. [2]

(e) How does use of money solve, the problem of‘lack of double coincidence of wants’ that existed under the barter system? [2]

Answer:

(a)

- The supply of land is fixed as neither land can be stretched nor anything can be added to it to increase its availability.

- Land is used for alternative purposes like cultivation, dairy or poultry farms, f sheep rearing, building etc. The use of land for any particular purpose depends not only on the return from that particular use, but also its returns from alternative uses.

(b) If the percentage change in demand is proportional to percentage change in price, the elasticity is said to be unity. If the percentage change in demand is more than the percentage change in price, the elasticity is more than one, and if the percentage change in demand is less than percentage change in price, the elasticity of demand is less than unity. Mathematically,

\(\text{Elasticity of demand}=\frac{\text{Percentage change in demand}}{\text{Percentage change in price}}\)

(c) Two differences are:

| 1. Labour services of a surgeon is highly paid as it is a skilled labour. | Labour services of a farmer are lowly paid as it is an unskilled labour. |

| 2. It requires specialized studies and training. | It does not require any specialised studies and training. |

(d) The two reasons for consumers, exploitation in India are:

- Most of the consumers are not aware of their legitimate rights.

- The consumers are not properly organised to raise their voice against such exploitation.

(e) Suppose a person possess rice and wants to exchange it for wheat. Under the barter system he had to find out a person who not only had wheat but also wants rice. But such a double coincidence was a rare-possibility. But With the use of money all the commodities can be easily exchanged and you do not need double coincidence of wants.

Question 2:

(a) Distinguish between stock of capital goods and capital formation using a suitable example. [2]

(b) State two circumstances under which the demand curve slopes upward to the right. [2]

(c) How does the central bank act as a fiscal agent to the Government? [2]

(d) A mild inflation is beneficial for economic growth. Justify the statement. [2]

(e) How can taxes be used for promoting economic growth? [2]

Answer:

(a) The stock of capital goods is the stock of those goods which are used for more production (eg. machines, equipments, buildings, means of transport, factories etc.) whereas the capital formation is the increase or net addition in the stock of capital goods.

(b) The two circumstances are:

- Status symbol goods with prestige value. More of these goods are demanded only when they are priced high. eg. diamonds, high priced shoes, jackets etc.

- ‘Giffen goods’. Less of these is demanded at a lower price. Under these circumstances the demand curve slopes upwards to the right.

(c) As a fiscal agent to the government, it advises the govt, in matters relating to the fiscal, monetary and banking policies such as deficit financing devaluation, trade policy, foreign exchange policy, reduction in public expenditures, increase in taxes, public borrowings, policy of surplus budget etc.

(d) A mild inflation occurs when there is sustained rise in prices over time at a mild rate, say around 2% to 3% per year which helps in increasing the public revenue and thus helps the govt, to incur public expenditure for welfare of the people. Thus, it is beneficial for economic growth.

(e) Taxes are used to interact in the market, so as to induce a greater output of goods and services, resulting in the higher growth of economy.

Question 3:

(a) Classify the following into Fixed capital and Circulating capital: [2]

- building

- tailors

- sewing machines

- tailoring accessories.

(b) State two examples of direct tax imposed by Central Government in India. [2]

(c) What is meant by CRR? Briefly examine its role in credit control. [2]

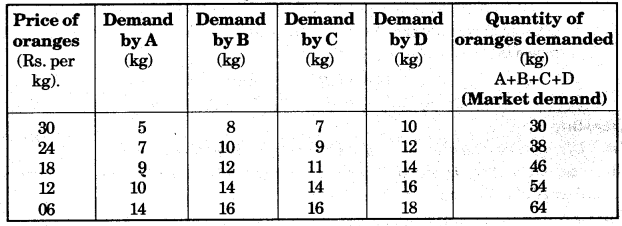

(d) Using hypothetical data show a market demand schedule. [2]

(e) How does money act as a store of value? [2]

Answer:

(a)

- building—Fixed capital

- tailors — Circulating Capital

- sewing machines — Fixed capital

- tailoring accessories — Circulating capital

(b)

- Income tax; which is imposed on the income of the earners.

- Profit tax; which is levied on the profit of the entrepreneurs.

(c)

CRR [Cash Reserve Ratio]: According to RBI act, each commercial bank has to keep a certain ratio of cash reserves (deposits) with the central bank or RBI. The RBI is empowered to vary this CRR between 3% to 15%.

By increasing the CRR, the excess reserve of commercial bank is reduced, which restricts the credit granting capacity of the commercial banks. Similarly, the reduction in CRR, increases the capacity of commercial banks to expand credits.

(d) Hypothetical market demand schedule:

(e) Money acts as a store of value. It means people can store their wealth in the form of money. Money is the most liquid form of wealth and it can foe stored without loss in value. Money enables people to save a part of their current income and store it for future use.

Question 4:

(a) State the difference between redeemable debt and irredeemable debt. [2]

(b) State two ways through which an entrepreneur contributes towards economic development. [2]

(c) How does proportional tax differs from progressive tax. [2]

(d) Distinguish between a tax and a subsidy. [2]

(e) Explain two methods of accepting deposits by commercial banks. [2]

Answer:

(a) Refer Ans. 4 (a), 2015.

(b)

- When the entrepreneurs introduce cost reducing or demand creating innovations in various industries, the industrial production helps in economic development.

- Different types of innovations result in higher profits for the entrepreneurs. They generally spend a greater portion, of their profits in new-ventures or for productive purposes. Thus higher investment can create greater employment and income opportunities within the country.

(c)

| Proportional tax | Progressive tax |

| 1. The rate of tax remains constant though the tax base changes. | The rate of tax increases as the tax base increases. |

| 2. It is inequitable, as it falls relatively heavily on poor incomes. | It is equitable as a large part is taxed on higher incomes. |

(d)

| Tax | Subsidy |

| A tax is a compulsory contribution from a person to the Government to defray the expenses incurred in the common interest of all without reference to special benefits incurred. Ex. Income tax, sales tax etc. | A subsidy is privileged made by the Government to bridge the gap between the price paid by the consumer of the product or service and the average cost of production of that product. Ex. subsidy given to sugarcane farmers. |

(e)

- Fixed deposit Account: In such deposits the deposited amount can be withdrawn only after the maturity period. The interest rates are higher in case of such deposits.

- Savings account: It is opened by the bank with the objective of collecting small savings from the people who have small earnings. But withdrawal is allowed thrice a week. However, the rate of interest is less than that of fixed deposits.

SECTION-II (40 Marks)

(Answer any four questions from this section)

Question 5:

(a) Discuss five characteristics of capital as a factor of production. [5]

(b) State the Law of Demand. Briefly explain any three determinants for the negative slope of the demand curve? [5]

Answer:

(a) Five characteristics of capital as a factor of production are as follows:

- It is a passive factor of production. This is so because it becomes ineffective without co-operation of labour.

- Capital is man-inade and is born out of savings done by man. Its supply is increased or diminished by the efforts of man. Thus, capital is man-made factor of production.

- Capital is not an indispensable factor of production. Production can be possible even without capital whereas land and labour are the original and indispensable. factors of production.

- Capital has the highest mobility amongst all the factors of production. The land is immobile, labour has low mobility, whereas capital has both ‘place mobility’ and ‘occupational mobility’.

- The supply of capital is elastic and can be adjusted easily and quickly according to demand. Capital depreciates gradually if capital is used again and again. For example, if any machine is used for a considerable period, then it may not be suitable for further use due to depreciation. Hence, capital is productive. Hence, production can be increased to a large extent if workers work with adequate capital.

(b) The law of demand states that other things being equal, “A rise in the price of a commodity is followed by a fall in demand and a fall in price is followed by rise in demand. In other words, it states that there is an inverse relationship between the price of a commodity and its demand.

The three determinants for the negative slope of the demand curve are:

- Income Effect: When the price of a commodity falls, a consumer has to spend less on the purchase of the same amount of the commodity. Thus, it increases his purchasing power or real income which inturn, enables him to purchase more of the commodity. Thus, the effect on demand for goods due to the change in the real income in the price of the commodity is known as the income effect. Therefore, income effect is related to change in income caused due to the change in price and not due to change in money income.

- Substitution Effect: Substitution effect means substitution of one commodity for other when it becomes relatively cheaper. If the price of one commodity rises, the consumer shifts to other commodity, which is a relatively cheaper. For example, tea and coffee may be termed as substitute to each other. If the price of coffee rises, the consumer may shift to tea thereby increase in demand of tea. This is called substitution effect.

- Law of Diminishing marginal utility: The law of diminishing marginal utility tells us that the marginal utility of the goods falls with increase in its quantity. That is why, this law is shown by a downward sloping demand curve. A consumer pays for a commodity because it possesses utility and he would purchase a commodity to the extent, where its marginal utility becomes equal to its price. From this, it follows that a consumer would purchase more of a commodity when its price falls. Thus, the diminishing marginal utility curve itself takes the form of a demand curve and that is why it is downward sloping.

- New Customers: It is possible that at a particular price some consumers may not be able or may not be willing to purchase the commodity. But as price falls some new customers start to purchase the commodity. Contrary to it, when price rises some old customers may stop to purchase the commodity.

Question 6:

(a) Define Inflation. Explain any two fiscal measures and two monetary measures to control it. [5]

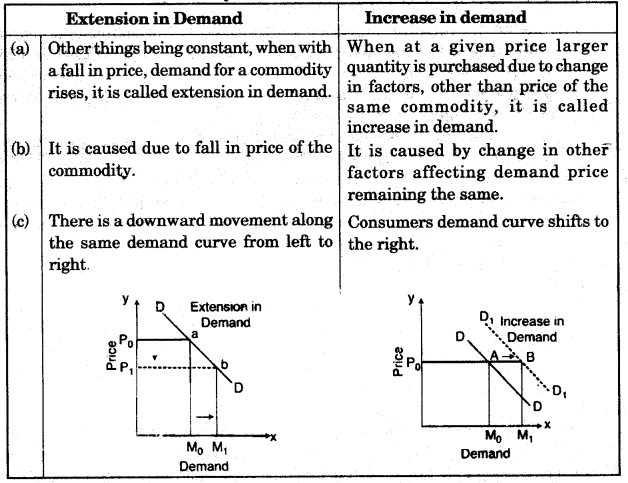

(b) Distinguish between the following:

(i) Extension and Increase in demand.

(ii) Normal goods and Inferior goods. [5]

Answer:

(a) Inflation is defined as “A sustained rising trend in general price level or a rate of expansion of money : income greater than the rate of growth of real output.” Under such circumstances, the general prices increases, and in turn the value of money decreases. Although, the circulation of money increases, the availability of goods is limited and this results in price rise.

Two fiscal and two monetary measures to control inflation are:

- Monetary Measures:

- Reduction in public expenditure: Since public expenditure is an important component of aggregate demand, steps should be taken to reduce unnecessary Government expenditures on non-developmental activities. For example, expenditure on defence and unproductive activities should be reduced.

- Increase in taxes: To cut private consumption expenditure, there should be an increase in taxes. Both direct and indirect taxes can be used for this purpose. Direct taxes (e.g. income tax, corporate tax etc.) reduce the disposable income of the tax-payers and thereby reduce the consumption expenditures. Likewise indirect taxes (e.g. sales tax, excise duties etc.) also reduce the aggregate demand by making the goods costlier. Moreover, the Government should also penalise the tax evaders by imposing heavy fine. Such measures are bound to be effective in controlling inflation.

- Fiscal Measures:

- Control over money supply: To check inflation, it is suggested that Government should impose strict restrictions on the issue of money by the central bank.

- Control on credit: The central bank of the country should take necessary steps to contract credit because credit forms a major part of money supply. More credit means more supply of money.

(b) (i)

| Normal goods | Inferior goods |

| 1. Demand for such goods increases with an increase in real income (after a price fall) of the consumer. | Demand for such goods decreases, with an increase in real income (after a price fall) of the consumer. |

| 2. Income elasticity of demand for these goods becomes positive | Income elasticity of demand for these goods becomes negative |

3. Goods to which law of demand applies. Ex. Good quality of wheat or rice. | Goods to which law of demand does not apply. Ex. Inferior quality of wheat or rice. |

(ii)

Question 7:

(a) With respect to division of labour state the following:

- An example each of vertical and horizontal division of labour.

- Two advantages to the producer.

- Two disadvantages to the worker. [5]

(b) Discuss five causes of the low rate of capital formation in India. [5]

Answer:

(a)

- An example each of vertical and horizontal division of labour:

- Vertical: The division of labour between workers in spinning departmtent and those in weaving department of a cotton textile factory is an example of a vertical division of labour.

- Horizontal: The different parts of an automobile can be manufactured simultaneously. The parts can be assembled together at the end.

- Two advantages to the producer:

- Increase in production: With the specialization (division of labour) the workers become more skilled and efficient. They acquire higher speed in work output, which ultimately results in more production quantitatively as well as qualitatively.

- Reduction in cost of production: The specialized worker with the help of machines produces more quantity of goods in less time with minimum wastage.

- Two disadvantages to the worker:

- Monotony of work: Under division of labour, a worker has to do the sarnie job again and again for the years together. Therefore, after some time, the worker feels bored or the work becomes dull for him.

- Lack of responsibility: Division of labour means division of responsibility. If the quality of the product is not upto the mark, none can be held responsible for it.

(b) The five causes of the low rate of capital formation in India are as follows:

- Lower saving power (Ability): The people in India have a desire to save and possess all those factors which motivate the ‘will to save’ like old age considerations, family affection, social and political influence, but they have lower per capita income. Moreover the margin between production and consumption is very narrow and so the saving capacity is very little. Ultimately, it results in lower rate of capital formation.

- State of economy: Majority of people in India are agriculturists, who follow old methods and also have uneconomic agricultural holdings. All these factors leave very little or no surplus with them.

- Habit of hoarding: Most of the illiterate people have very little capacity to save and are in the habit of hoarding their savings in their houses. But such savings are of no use as far as capital formation is concerned, because these hoardings cannot be utilized for any productive purposes.

- Inflation: Due to inflationary trend, the prices of commodities goes very high and the middle class people find it very difficult to save any amount.

- Inadequate investment channels: The banking and financial facilities are inadequate in India. The means of transport and communication are not fully developed. These inadequacies adversely affect the mobilization and investment of savings.

Question 8:

(a) Discuss the functions of the central hank as a ‘Banker to Banks’ and ‘Banker to the Government’. [5]

(b) Differentiate between the following:

- Limited legal tender and Unlimited Legal tender.

- Standard money and Bank money. [5]

Answer:

(a)

- Banker’s Bank: The central bank is the bank for all the commercial banks in the country. The relations of central bank with other banks are similar to those of a bank with its Customers. As a matter of legal obligation, the commercial banks have to keep certain portion of their deposits with the central bank as cash reserves. These cash reserves enable the central bank to exercise control of the issue of credits by the commercial banks, thereby keeping the entire credit-system elastic. The central hank also allows the facility of short-term loans and discounting of the bills to the commercial banks and it also advises the other banks related to their business like fixation of rate of interests on deposits and loan etc.

- Banker to the Government: The central bank makes and receives payments on behalf of the Government whenever it becomes necessary. It also floats public debt and manages it for a shorter or longer period as the case may be, for the Government. It supplies foreign exchange to the Government for repaying external debt or making other payments.

(b)

(i) Difference between Limited legal tender and unlimited legal tender:

| Limited legal tenders | Unlimited legal tenders |

| The coins of smaller denominations are considered as limited legal tenders (say 1/2/5 rupee -coins) because they are acceptable only for meeting financial transactions of lower value (say, meeting your short distance bus/auto fare.) | The rupee notes of higher denominations (say 100/500/1000 rupee notes) are considered as unlimited legal tenders because they can be used for settling claims relating to high- value transactions. |

(ii) Difference between Standard Money and Bank Money:

| Standard Money | Bank Money |

| Standard money is that money which represents the money of account. It is the unit by means of which values of all other media of exchange are measured. For Ex. Rupee is the standard money of India. Likewise every country has its own standard money. | Bank money represents claims on deposits left with banks. People keep part of their cash as deposits with banks which they can withdraw at any time they like or transfer to someone else. For Ex. Cheques, bank drafts, traveller’s cheques, credit cards etc. |

Question 9:

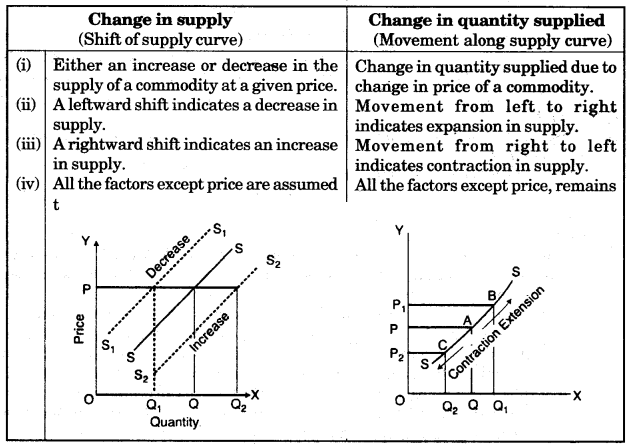

(a) Using graphs distinguish between change in supply and change in quantity supplied. [5]

(b) Briefly explain any five rights stated in the Consumer Protection Act.

Answer:

(a)

Right to safely: It implies the right to be protected against the marketing of such goods and services which are hazardous to our health and property. The goods and services purchased by any consumer should be safe. The producers should also strictly follow the safety rules and regulations while producing any goods or services. The consumer should preferably purchase branded products with ISI mark or Agmark or Hallmark.(b) The rights stated in the Consumer Protection Act are as follows:

Right to safely: It implies the right to be protected against the marketing of such goods and services which are hazardous to our health and property. The goods and services purchased by any consumer should be safe. The producers should also strictly follow the safety rules and regulations while producing any goods or services. The consumer should preferably purchase branded products with ISI mark or Agmark or Hallmark.(b) The rights stated in the Consumer Protection Act are as follows:

- Right to be informed: It implies the right of any consumer to be informed about the quality, quantity, purity, standard and price of the product so as to protect him/her against unfair trade practices.

- Right to choose: It implies that a consumer has the right to choose from among the variety of goods and services available before him/her at a competitive price.

- Right to be heard: It implies that the interests of the consumers will receive due considerations at appropriate forums. Thus any consumer has the right to raise his/her voice against unfair and restrictive trade practices. It also includes the right to be represented in various forums formed to protect the interests of the consumers and increase consumer’s welfare.

- Right to seek redressal: It implies the right of any consumer to seek redressal of his/her grievances against unfair trade practices or unscrupulous exploitation of consumers, by the traders. He/she also preserves the right to seek compensation for the damage (physical or mental) caused by the unfair trade practice.

Question 10:

(a) Discuss the reasons for the growth of public expenditure in India? [5]

(b) Explain three merits and two demerits of indirect taxes. [5]

Answer:

(a) Reasons for the growth of public expenditure in India:

- Development Programmes: Most of the underdeveloped countries have initiated various programmes of economic development i.e. provision of infrastructure of the economy such as transport, communication power etc. This has led to growth of public expenditure.

- Growing trend of Urbanisation: With the spread of urbanization, public expenditure has increased in modem times. Urbanization has led to increase in Government expenditures on civil administration, education, public health, water supply, parks etc.

- Rise in Price-level: As a result of the rise in the price-level, the public expenditure has gone up everywhere. The reason is that like the private individuals the Government also has to buy goods and services from the market at higher prices.

- Increase in Population: As a result, the Government has to incur great expenditure to meet the requirements of increasing population. In fact, the public expenditure increases in the same ratio in which the population increases.

- Welfare State: The modem state is a welfare state. It has to spend increasing amounts on such items as social insurance, unemployment relief, free medical aid, free education etc. to improve the socio-economic welfare of the country.

(b) Three merits of indirect taxes:

- Convenient: They are mostly levied on commodities and are paid by consumers when they buy them in the market; The amount of tax is included in the price of the commodity and the consumer pays the tax without experiencing its pinch.

- Equitable: Indirect taxes are equitable in the sense that they are paid by all the sections of the community at the time of making purchases of goods in the market, in the form of sales tax or custom duty.

- No possibility of evasion: No person can evade the indirect taxes, because they are collected in the form of higher prices of goods sold to the consumers.

Two demerits of indirect taxes:

- Absence of Civic Consciousness: Since the tax payer do not feel that they are paying a tax at the time of purchasing a commodity, these taxes do not promote civic consciousness among the citizens.

- Uneconomical: The cost of collection is quiet heavy. Every source of production has to be guarded. Large administrative staff is required to administer such taxes. This turns out to be a costly affair.