ICSE Economics Previous Year Question Paper 2009 Solved for Class 10

ICSE Paper 2009

ECONOMICS

(Two Hours)

Answers to this Paper must be written on the paper provided separately.

You will not be allowed to write during the first 15 minutes.

This time is to be spent in reading the Question Paper.

The time given at the head of this Paper is the time allowed for writing the answers.

Section I is compulsory. Attempt any four questions from Section II.

The intended marks for questions or parts of questions are given in brackets [ ].

SECTION-I (40 Marks)

(Attempt all questions from this Section)

Question 1:

(a) Explain two factors on which supply of labour depends. [2]

(b) Mention two functions of capital. [2]

(c) Explain one contribution of land to production. [2]

(d) What is the Bandwagon effect? [2]

(e) How does division of labour help in production? [2]

Answer:

(a) The two factors on which supply of labour depends are:

- Population: The most important factor affecting the supply of labour in a country is its population. The larger the population, the larger will be die number of persons who will have the capacity to perform physical or mental work. Hence, the larger will be the supply of labour.

- migration (Out-migration) and Immigration (in-migration): Growth of population, is determined not only by its natural growth but also by the out migration and in migration of people. If some people leave the country, the population goes down, and if some people enter the country from outside, the population goes up. In India, the in-migration of refugees after the partition in 1947 and the Bangladesh war of 1971 led to substantial increase in the supply of labour.

(b) Two functions of capital are:

- It helps the process of division of labour: Capital makes the system of division of labour more refined. It is only when there is an abundance of capital that is possible to assemble a large number of workers at one place.

- It expands employment: Since capital expands production, it also expands employment. Thus, if we are to reduce the volume of unemployment in the country, we must pay attention to capital formation in a country.

(c) Determines the agricultural output: The agricultural output of a country is determined by the availability of cultivable land in a country. The production of food grains, cash crops, forest products, horticulture crops, etc. are determined by the supply of cultivable land in a country.

(d) Bandwagon effect: The consumer’s demand for a good may be affected by the tastes and preferences of the social class to which he belongs. If playing golf is fashionable among successful businessmen, then, as the price of golf ball rises, businessmen may increase his demand for the golf balls in order to show that he is a successful businessmen. This is known as Bandwagon Effect.

(e) Division of labour makes large scale production possible. Indeed, large scale production requires division of labour. If a car manufacturing company, for instance, wishes to make 10,000 cars in a year, but does not introduce division of labour in its factory it will have to hire so many workers that it will not be an economic decision for company. It is by virtue of division of labour that the company can produce 10,000 cars per year with a reasonable number of workers.

Question 2:

(a) How is supply of labour different from supply of other goods? [2]

(b) What is a central bank? [2]

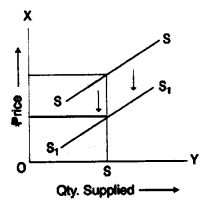

(c) Government allows a subsidy to a seller. Show its impact on the supply curve. [2]

(d) Differentiate between an entrepreneur and an organizer. [2]

(e) State two factors affecting market demand for a commodity. [2]

Answer:

(a) There is a difference between the supply of labour and that of other goods. An individual’s supply of labour may increase at first with the increase in wage rate i.e., the price of labour. In that case, the worker prefers income to leisure. However, man is not a machine. So with further increase in the wage rate (per hour), the worker may prefer leisure to income. Thus, the individual labour supply curve may be backward bending in nature. However, in case of other goods, the quantity supplied increases with an increase in product price. In that case, supply curve will be upward rising.

(b) The bank which is given the responsibility of supervising the activities of all other banks in the economy, as well as the entire monetary system of the country, is called the central bank of the country. The Reserve Bank of India is the central bank in India. In England the Bank of England is the central bank.

(c) By providing government subsidy to seller, supply increases because seller will be able to produce commodities at a cheaper price thus the supply curve will shift rightward.

(d) The differences between an entrepreneur and the organiser or capitalist are:

- A organiser provides loan to firm so he is only a creditor whereas the entrepreneur’s job is to set up the business.

- An entrepreneur bears loss of gain of the business while the organiser has no link with the profit and loss.

(e) Two important factors which affect the market element for a commodity are as follows:

- Pattern of income distribution: If income distribution moves in favour of the poor people, then market demand for the mass consumption items will increase.

- Total number of consumers: If the total number of consumers of any commodity rises, it would lead to an increase in the market demand for that commodity [2]

Question 3:

(a) Mention two points of distinction between tax on income and tax on commodity. [2]

(b) Name the most popular tax system. Give one reason. [2]

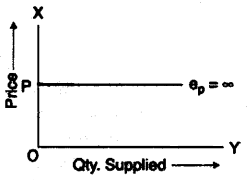

(c) Draw a perfectly elastic demand curve. [2]

(d) Differentiate between productive and unproductive debt. [2]

(e) What is demand pull inflation? [2]

Answer:

(a)

- In case of a tax on income, the tax payer can not shift the burden of tax on anybody else. Here, the initial impact and the final incidence of tax burden are on the same person.

- However, in case of a tax on commodity, the tax payer can easily shift the burden of tax. Here, the initial impact and the final incidence of tax fall on different persons. For instance, in case of sales tax, the seller can shift the burden of tax on the consumer, by rising the product price.

- Tax on income is progressive tax whereas tax on commodity is regressive tax.

Some people are exempted from tax on income whereas none is exempted from tax on commodity.

(b) The degressive tax system which is a mixture of proportional and progressive tax system is the most popular tax system. Under this system, rate of tax increases upto a certain limit but after that a uniform rate is charged. By this higher income groups makes less sacrifices than lower income group.

(c) Perfectly elastic demand curve:

(d) Refer Ans. 10(b) (ii), 2016.

(e) Demand pull’ inflation means inflation generated by the pressure of excess demand in the economy. If there is an excess of aggregate demand in the economy over aggregate supply, the general price level will tend to increase i.e., there will be inflation.

Question 4:

(a) Name the current Five Year Plan. Mention two of its objectives. ** [2]

(b) How does fixation of margin required on secured loans affect the flow of credit in India? ** [2]

(c) What is debt trap? [2]

(d) What is meant by plan strategy? ** [2]

(e) What is a normal good? [2]

** Answer has not given due to out of present syllabus.

Answer:

(c) By ‘Debt trap’ we mean a situation where the Government has to incur new public debt for the purpose of meeting the interest obligations on old debts. The Government falls into the debt trap if the outstanding amount of public debts becomes so huge that current tax revenue does not enable the Government to pay interest on public debt after meeting other current expenditure obligations.

(e) Normal goods are those goods for which the income elasticity of demand become positive (i.e. > 0). It implies that the demand for such goods increases with the increase in money income of the consumer.

SECTION-II (40 Marks)

(Answer any four questions from this section)

Question 5:

(a) Discuss five causes of elasticity of demand. [5]

(b) Explain five determinants of shift in the supply curve. [5]

Answer:

(a) Five causes of Elasticity of demand:

- Nature of the commodity: An important determinant of Elasticity of demand for a commodity is the nature of the commodity itself. If the commodity is a necessity of life, its demand will not change much when its price changes. The Elasticity of demand will be low. In our country the demands for rice, salt, edible oil, etc., are relatively inelastic.

- Multiple uses: The demand for a commodity, which can be put to a variety of uses, will be relatively elastic demand for instance, electricity can be used for cooking, heating, lighting, washing etc. When the price of services rises, the consumers can cut down on some of the uses of electricity, confining themselves to the more urgent uses. The demand for electricity will, therefore, be elastic.

- Role of habits: Habits also play a role in the determination of elasticities For instance, if a person has developed the habits of smoking, he may not be able to reduce his consumption of cigarettes even when the price of cigarettes’ goes up. His demand for cigarettes will be inelastic.

- Durability of the goods: In case of a durable goods (for instance, a piece of furniture), a change in price would not affect demand very much. Because most of the consumers will not buy a new piece of furniture until the old one is totally worn out. For this reason, durable goods usually have low elasticities of demand.

- Availability of substitutes: The commodities, for which other substitutes are available in the market, have more elastic demands as compared to commodities without proper substitutes. A good example is that of tea, for which coffee is generally available as a substitute. A change in the price of tea, causes almost proportional change in its demand.

(b) Five determinants of shift in the supply curves:

- Change in price of inputs: The supply of a commodity is also affected by change in price of inputs used in the production of good. If the price of inputs (Wages of labour, prices of raw materials and fuel) goes up, the gross cost of production will rise and as a result the supply of the commodity decreases. On the other hand, if the price of inputs declines, unit cost of production declines and as a result the supply of the commodity increases.

- Change in Technology: The supply of a commodity depends on the production technology used by the firm. If there is an improvement in the production technology used by the firm, the cost of production declines. Lower cost of production increases the supply of a commodity. The use of obsolete technology raises the cost of production and consequently supply of a commodity decreases.

- Change in Goals of Hie firm: The supply of a commodity also depends upon the goals of firms. Their goals may be profit maximization or sales maximisation. If their goal is to maximise profits, more quantity will be supplied only at high price. But if the firms want to maximise their sales more quantity will be supplied even at the same price. Thus, change in the goals of the producers also influences the supply.

- Change in Government policy: The Government policy also affects the supply of a commodify. If there is an increase in excise duties and heavy taxes are imposed, the producers will be discouraged and the supply will decrease.

- Number of Producers: If no. of firms producing a particular commodity increases market supply of the commodity will increase. When the existing firms of an industry are making huge profits, the new firms may enter the industry and the total production and supply will, thus, increase. On the other hand, in the event of losses, some firms of the industry start leaving it, the supply of the product will decline.

Question 6:

(a) Explain the importance of Public debt in India. [5]

(b) Mention three merits and two demerits of indirect taxes. [5]

Answer:

(a) Importance of Public Debt in India:

- Covering the gap between expenditure and Tax Revenue: If the Govemment’s revenue from taxes falls short of expenditure, public borrowings becomes a necessity. The excess of Government expenditure over its revenue creates a deficit in the Government Budget. The growing deficit in the Government budget has been the principal reason for public borrowings in India.

- Controlling Inflation: At times of inflation, the Government tries to reduce the purchasing power of consumers, so that the pressure of excess demand may be reduced. Like taxes, public debt also takes money away from people’s hand. Hence, public debt is used, side by side with taxes, as an instrument of inflation control.

- Controlling recessions: During recessions, people do not want to invest their money. As a result, the levels of output and employment are stagnant. The Government may borrow money from the public and invest the money in various projects.

- Development financing: In a less developed economy like India, the Government often has to play a leading role in economic development. For raising the necessary funds, the Government takes recourse to borrowing from public. In India, public debt has been the major source of financing the development plans.

- Social development: Financing is needed not only for economic but also for social development projects like education, health care etc. For this purpose also, the Government borrows from the public.

(b) Merits of Indirect taxes:

- Broad Coverage: When a sales tax is imposed on a commodity, all buyers of the commodity ultimately have to pay a higher price. Hence, all consumers, irrespective of whether they are rich or poor, pay tax under this system. For this reason, it is said that indirect taxes have a broader coverage than direct taxes.

- Not unpopular: Indirect taxes are taxes in the dark. When a common man purchases a commodity in the market, he considers the tax inclusive price to be the price of the commodity. In other words, he is not often aware that he is paying a tax. As a result, indirect taxes are not as unpopular as direct taxes.

- Regulate Consumption: Indirect taxes at stiff rates can be imposed on commodities whose consumption is judged to be socially harmful (for instance liquor, drugs etc.). The prices of these commodities will then increase and the consumers will buy less of them.

Demerits of Indirect Taxes:

- Not always equitable: As both the rich and the poor pay indirect taxes at the same rate, the indirect taxes often tend to be regressive. Since a poor person earns less than a rich one, the proportional tax burden on the poor is greater than that on the rich when they pay the same absolute amount in taxes.

- Inelasticity: Indirect taxes are less elastic than direct taxes. When an indirect tax is imposed, the Government’s revenue does not go up very much because the tax will increase the price of the commodity and the quantity transacted in the market will, therefore, decline.

Question 7:

(a) Enumerate two economic and two social objectives of economic planning.** [5]

(b) Define land. Explain four characteristics of land. [5]

** Answer has not given due to out of present syllabus.

Answer:

(b) In economics, the word ‘land’ is defined to include not only the surface of the earth but also all other free gifts of nature. For instance, mineral resources, forest resources and, indeed, anything that helps us to carry out the production of goods and services, but is provided by nature, free of cost. In fact, ‘Land is a stock of free gifts of nature,’

The features of land are as follows:

- Supply of land is fixed: The supply of land is fixed. It is given by nature. It is true that, from time to time, we can increase the quantity of operational land available in the country by clearing forests. However, the potentially available amount of land in the country is fixed.

- Production of land is costless: Another peculiarity of land is that, it does not have any cost of production. It is already there, ready to be used. All other agents of production have to be produced at a cost. For instance, labour has to meet his cost of living and his cost of training and education has also to be accounted for. Land, however, is a free gift of nature.

- Land is immobile: A third peculiarity of land is that, it is immobile. Land can not move in the sense in which labour or capital can. Therefore, there are persistent differences between the rent of land in different regions. Such differences may be caused by differences in fertility, location etc.

- Land is heterogeneous: Different types of land indicate wide variations in productive capacity. It depends on the chemical composition of the soil, availability of irrigation facilities, climatic conditions etc. Hence, some plots of land may be so infertile that cultivation is not worthwhile in such cases, while some other plots of land may be very fertile.

Question 8:

(a) What is meant by efficiency of labour? State four factors which determine efficiency of labour. [5]

(b) Explain briefly the quantitative measures adopted by the Reserve Bank of India to control credit. [5]

Answer:

(a) Efficiency of labour implies the quality and quantity of goods and services which can be produced within a given time and under certain conditions. In other words, productive capacity of a worker is termed as efficiency of labour.

By ‘efficiency of labour’ means the productive capacity or productivity of labour.

The efficiency of labour depends on the following factors:

- Climatic Factors: Climatic differences also affect the efficiency of labour. Working under extreme climatic conditions is always more difficult than working in the temperate zones.

- Geographical differences: Locational differences also sometimes play a significant role. A person who has been born and brought up in the plains, will find it hard to display much efficiency if he is forced to work at high altitudes hilly areas.

- Intellectual attributes: Mental attributes are also important. General education helps a worker in assimilating new skills and technical knowledge. Moral qualities also play a role in this connection. A worker is likely to be more efficient, the greater is his sense of discipline, self respect, self-sufficiency, punctuality etc.

- Working conditions: A healthy and conducive work environment increases the level of efficiency. The facilities enjoyed by the worker determine labour efficiency to a significant extent. Employer-employee relations are also an important part of the work-environment. An employer, therefore, can contribute to labour efficiency by building a cordial relationship with his workers.

(b) Some of the quantitative credit control instruments adopted by the RBI are as follows:

- Bank Rate Policy: Theoretically, the bank rate is that discount rate at which the central bank of any country rediscounts any bill of exchange submitted by any commercial bank to take loans from the central bank. In case of India, it generally indicates the interest rate at which the commercial hanks borrow credit money from the RBI.

- Open Market Operations: This indicates the purchase and sale of Government securities or treasury bills by the RBI. At the time of inflation, the RBI sells Government securities in the open market to pump out some amount of money from circulation. Most of these securities are purchased by commercial banks and other financial institutions.

- Cash Reserve Ratio Requirement: According to the RBI Act 1934, every commercial bank has to keep a certain minimum cash reserve with the RBI. The RBI is empowered to vary the CRR between 3 to 15 percent of total deposits of commercial bank. The RBI increases this CRR during inflation.

- Statutory Liquidity Ratio [SLR]: Apart from the CRR, all commercial banks under the Banking Regulation Act 1949, are to maintain liquid asset in the form of cash in hand, cash with other banks, gold and unencumbered approved securities equal to not less than 20% of their total time and demand deposits with the RBI. This is known as statutory liquidity ratio. The RBI is empowered to raise this ratio upto 40% when the SLR is raised, the amount of loanable funds with the commercial banks declines. So, the process of credit creation by the commercial bank is checked.

Question 9.**

(a) Define economic planning. Stale any three achievements of economic planning in India. [5]

(b) Explain different ways in which commercial hanks advance loans to the public. [5]

** Answer has not given due to out of present syllabus.

Question 10:

(a) Briefly explain two favourable and two unfavourable impacts of inflation. [5]

(b) Explain two primary and three secondary functions of money. [5]

Answer:

(a) Two favourable impacts of inflation are as follows:

- Higher profits and Higher investment: Profit incomes of the producers are generally favourably affected by inflation, because they can sell their products at higher prices. The entrepreneurs and investors get added incentives to invest in productive’activities during inflation, since they can earn higher profits from such investments.

- Possibility of higher income for Shareholders: During inflationary periods, if the companies earn higher profits, they can declare dividends for their shareholders. Hence, the dividend income of the shareholders may also rise during inflation.

Two unfavourable impacts of inflation are as follows:

- Fall in the real income of fixed income groups: Real income means purchasing power of money income. Given the money income of the fixed income groups, the real income will fall during inflation. Hence, inflation affects workers, salaried people and pension earners adversely.

- Inequality in the distribution of Income: The profit incomes of businessmen and entrepreneurs increase during inflation, while the real income of the common salaried people declines. So, the inequality of income and wealth becomes acute during inflation.

(b) Primary Functions of Money:

- Medium of Exchange: Money acts as the most reliable medium of exchange. The major function of money is to facilitate the process of exchange by removing the defects of the barter system. Money has general acceptability and has purchasing power so everyone accepts it willingly in exchange for goods and services. It enables people to purchase anything that they want in exchange for money.

- Measure of Value: In modem economies, money acts as a measure of value as the value of everything can be expressed in terms of money. The value of anything expressed in terms of money is known as its price. When we say that the price of a piece of cloth is Rs. 15, we mean that in order to obtain one piece of cloth we have to give up 15 units of money.

Secondary Functions of Money:

- Store of Value: Wealth is usually kept in the form of money because money is the most liquid form of wealth. Since savings is usually done with a view to use the savings for purchasing some commodities or services, it is as if the values of commodities are being stored. Hence, money is called the store of value.

- Transfer of Value: Money is also a means for transferring a given value from one individual to another. If any person purchases a commodity (say, wheat from the shopkeeper and pays Rs. 10 per kg of wheat purchased) then the value of that commodity can easily be transferred from the buyer to the seller through a payment in terms of money.