ICSE Economic Applications Previous Year Question Paper 2014 Solved for Class 10

ICSE Paper 2014

ECONOMIC APPLICATIONS

(Two Hours)

Answers to this Paper must be written on the paper provided separately.

You will not be allowed to write during the first 15 minutes.

This time is to be spent in reading the Question Paper.

The time given at the head of this Paper is the time allowed for writing the answers.

Section I is compulsory. Attempt any four questions from Section II.

The intended marks for questions or parts of questions are given in brackets [ ].

SECTION-I (40 Marks)

(Attempt all questions from this Section)

Question 1:

State whether the following statements are true or false. Give reasons.

(a) The price elasticity of demand, for commodities, having close substitutes is relatively high. [2]

(b) Rate of taxation depends upon the income groups in a progressive tax structure. [2]

(c) The price level in a perfectly competitive market is determined by an individual seller. [2]

(d) Efficiency of labour is influenced by working conditions. [2]

(e) Supply and price are inversely proportional. [2]

Answer:

(a) True

If a good has close substitutes, the price elasticity of demand for a commodity will be very elastic as some other commodities can be used for it. A small rise in the price of such a commodity will induce consumers to switch their consumption to its substitutes.

(b) True

Rate of taxation depends upon the income groups in a progressive tax structure, where people with more income pay a higher percentage of that income in tax than do those with less income. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability-to-pay.

(c) False

The price level in a perfectly competitive market is not determined by an individual seller as there are large number of sellers i.e. there are large number of firms. Every firm in the industry is thus, a price taker. It can sell any quantity of its own product at the going price. The demand for its product is perfectly elastic.

(d) True

Efficiency of labour is determined by good working conditions. Good lighting, ventilations, sanitations, artistic structure of the building, clean and quite atmosphere have a substantial bearing on the efficiency of workers.

(e) False

There is a direct relationship between price and quantity supplied. In this statement, change in price is the cause and change in supply is the effect. It may be noted that at higher prices, there is greater incentive to the producers or firms to produce and sell more.

Question 2:

(a) Draw and briefly explain a perfectly inelastic supply curve. [2]

(b) How does the practice of shifting cultivation affect the environment adversely? [2]

(c) In which form of market do producers and consumers have perfect knowledge about the market conditions? [2]

(d) State two measures taken by the Government to reduce income inequality in an economy. [2]

(e) Mention two features of Monopoly. [2]

Answer:

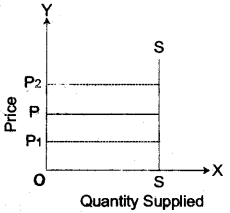

(a) Perfectly Inelastic Supply: The supply is said to be perfectly inelastic when a change in price produces no change in the quantity supplied of a commodity. In such a case, quantity supplied remains constant regardless g of change in price. The supply curve in such a situation a is a vertical line, parallel to y-axis. Numerically, elasticity of supply is said to be equal to zero. (ELASTICITY OF SUPPLY = 0)

(b) The evil effects of shifting cultivation are devastating and far-reaching in degrading the environment and ecology. This has resulted in large scale deforestation, soil and nutrient loss, and invasion of weeds and other species. The indigenous biodiversity has been affected to a large extent.

(c) In perfect competition market every producer and every consumer is assumed to have perfect knowledge of price, utility, quality and production methods of products. They have full knowledge of the prevailing price of the product, as also the prices being asked by the sellers and being offered to the buyers.

(d) The two measures taken by the government to reduce the income inequality in the economy are:

- Progressive taxation reduces absolute income inequality when the higher rates on higher-income individuals are imposed.

- Luxuries items or those items which are consumed by the rich section of the society are heavily taxed in comparison to necessity items.

(e) The two features of monopoly are:

- In monopoly, monopolist may charge a separate price for each unit sold by him. This is known as the price discrimination.

- A monopoly firm faces a negatively sloped demand curve for his product.

Question 3:

(a) How does the Central Bank act as a ‘lender of the last resort’? [2]

(b) The quantity of a commodity supplied increases by 25% when its price rises by 10%. Calculate price elasticity of supply. [2]

(c) State an adverse impact of urbanization on the eco system. [2]

(d) An Indirect tax is not always equitable. Give two reasons to support your answer. [2]

(e) State two characteristics of Capital as a factor of production. [2]

Answer:

(a) The central bank is the lender (provider of liquidity) of last resort (if there is no other way to increase the supply of liquidity when there is a lack thereof). The goal is to prevent financial pains and bank runs spreading from one bank to the next due to a lack of liquidity.

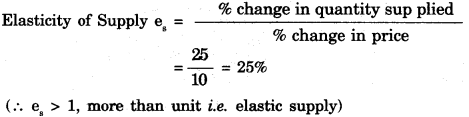

(b)

(c) Urbanization is adversely affecting the ecosystem. Due to this the loss of native plant, animal species, the disruption of the natural drainage system, and the decline of visual quality takes place. As the growth of mankind, increase in the pollution and cutting of the trees will disbalance the entire ecosystem as well as the environment.

(d)

- Indirect taxes are regressive. Every consumer of a taxed commodity rich or poor pays the tax at the same rate. The real burden of the tax on the poor is greater than on the rich.

- Large administrative staff is required to administer such taxes. It tumsout to be a costly affair.

(e) The two characteristics of capital as a factor of production are:

- Capital is not a gift of nature. It is manmade, secondary, as well as an artificial factor of production.

- Capital has a social cost. Capital as a resource has alternative uses. It can be put to either of the uses. The society in order to have one of them sacrifices another; accounting it as social cost another; accounting it as social cost.

Question 4:

(a) Suggest two measures to improve the efficiency of labour in India. [2]

(b) What is meant by product differentiation? [2]

(c) State the Law of Supply. Explain it with the help of a diagram. [2]

(d) How does money act as a standard of deferred payment? [2]

(e) State an important difference between Demand deposits and Time deposits. [2]

Answer:

(a) The two measures to improve the efficiency of labour in India are:

- The labour market should he flexible, and its complex regulations should not hinder dynamic job growth.

- New and improved programs should be monitored to enhance the performance and skills of each labour in the market.

(b) Product differentiation is the policy in which products are not the perfect substitutes but may be close substitutes. The products may differ as regards quality, size, colour, packaging, etc.

Under monopolistic competition, firm produces a product that is somewhat different from the products of its competitors, but it is not entirely distinct. These products are not homogeneous, but they are not altogether different as well.

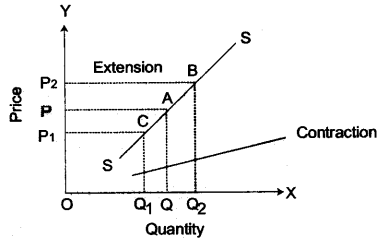

(c) The Law of Supply states that a firm will produce and offer to sell greater quantity of a product or service as the price of that product or services rises, other things being equal. There is a direct relationship between price and quantity supplied.

(d) With the help of money, people can buy & sell goods and services only on commitment and payment can be made sifter a lapse of time in the form of PD cheques, Bill of exchange, etc.

(e) Demand Deposit: It is a type of an account from which deposited funds can be withdrawn immediately at any time without any notice to the depository institution.

Time Deposit: It is a type of deposit which is in contrast to demand deposits and funds are not available immediately. These are also known as term deposits.

SECTION-II (60 Marks)

(Answer any four questions from this section)

Question 5:

(a) Define Elasticity of supply. Explain any four of its determinants. [7]

(b) Define a tax. Explain the following with example:

- Regressive tax

- Proportional tax

- Degressive tax. [8]

Answer:

(a) The elasticity of supply is the relative measure of the degree of responsiveness of quantity supplied of a commodity to a change in its price.

The, greater the responsiveness of quantity supplied of a commodity to the change in its price, the greater is its elasticity of supply. To be more precise, the elasticity of supply is defined as a percentage change in the quantity supplied of a product divided by the percentage change in price. It may be noted that the elasticity of supply has a positive sign because of the direction of change (positive slope). However, it may vary between zero and infinity.

The four determinants of Elasticity of Supply are:

- Ability to store Output: The goods which can be safely stored have relatively elastic supply over the goods which are perishable and do not have storage facilities.

- Factor Mobility: If the factors of production can be easily moved from one use to another, it will affect elasticity of supply. The higher the mobility of factors, the greater is the elasticity of supply of the goods mid vice versa.

- Excess Supply: When there is excess capacity and the producer can increase output easily to take advantage of the rising prices, the supply is more elastic. In case the production is already up to the maximum from the existing resources, the rising prices will not affect supply. The supply will be more inelastic.

- Cost Relationships: If costs rise rapidly as output is increased, then any increase in profitability caused by a rise in the price of the good is balanced by increased costs as supply increases. If this is so, supply will be relatively inelastic. On the other hand, if costs rise slowly as output increases, supply is likely to be relatively elastic.

(b)

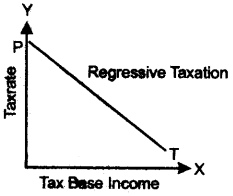

- Regressive Tax: A regressive tax is one in which the rate of taxation decreases as the tax-payer’s income increases. In this system the rate of tax falls with increase in income. Lower income is taxed at a higher rate, whereas higher income is taxed at a lower rate.

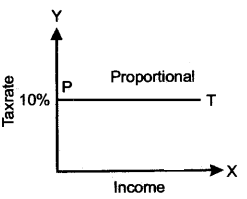

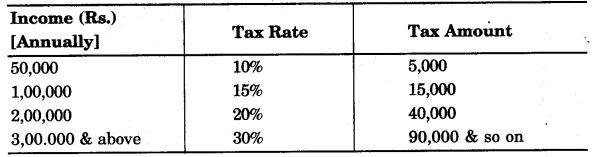

For Ex: Income between Rs. 50,000 a year may be taxed at a rate of 20% & income between Rs. 50,000 – Rs. 1,00,000 a year may be taxed at a rate of 15% & so on. However absolute tax liability may increase. - Proportional Tax: A tax is called proportional when the rate of taxation remains constant as the income of the tax payer increases. In this tax system, all incomes are taxed at a single uniform rate irrespective of whether tax-payer’s income is high or low.

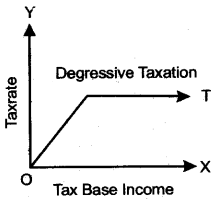

For Ex: If the rate of income tax is 10%, every person will be taxed at the same rate of 10%, whether he earns Rs. 1,00,000 per year or Rs. 20,00,000 per year. In this case, tax liability increases in the same proportion as the increase in income. The tax liability increases in absolute terms, but the proportion of income taxed remains the same. - Degressive Tax: A tax is called degressive when the rate of progression in taxation does not increase in the same proportion as the increase in income. In this case, the rate of tax increases upto a certain limit after that a uniform rate is charged.

Question 6:

(a) What is meant by industrialization? Explain four impacts of industrialisation on the environment. [7]

(b) Define Joint demand. With the help of diagrams explain the difference between Individual demand and Market demand. [8]

Answer:

(a) Industrialisation is the period of social and economic change that transforms a human group from an agrarian society into an industrial one. It is a part of a wider modernisation process, where social change and economic development are closely related with technological innovation, particularly with the development of large-scale energy and metallurgy production. It is the extensive organisation of an economy for the purpose of manufacturing. Industrialisation also introduces a form of philosophical change where people obtain a different attitude towards their perception of nature, and a sociological process of ubiquitous rationalisation. As industrial worker’s incomes rise, markets for consumer goods and services of all kinds tend to expand and provide a further stimulus to industrial investment: and economic growth.

The first country to industrialise was the United Kingdom during the Industrial Revolution commencing in the 18th century.

The four impacts of industrialisation on the environment are:

- The use of factories and mass production has led to depletion of certain natural resources, leaving the environment permanently damaged. One example of this is deforestation, which is the clearing of forest trees for use in production. When the trees are cleared, the wildlife in the forest also becomes uprooted.

- Factories are emitting poisonous emissions and eliminating the source of oxygen. The pollution that has resulted from factories involves not only airborne emissions but land and water pollution as well.

- The primary issue resulting from pollution and carbon emissions from industries is that of global warming. As the temperature rises, the glaciers are melting and oceans are rising. More animal species are becoming endangered or extinct as a result of global warming.

- The human health problems that have resulted directly from the industrial revolution’s accomplishments have only been disastrous for the world environment. The mass production of man-made and chemically altered food has also contributed to worldwide obesity and health problems.

(b) Joint Demand is a kind of a demand that occurs when the demand for two or more products (or services) are interdependent, normally because they are used together. The demand for razor blades may depend upon the number of razors in use; this is why razors have sometimes been sold as loss leaders, to increase demand for the associated blades. While the quantity demanded of both will increase or decrease together, their prices may change at a different rate depending on the availability of substitutes.

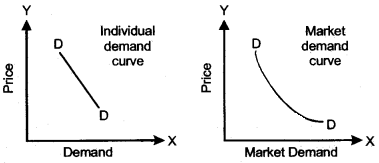

Difference between Individual Demand and Market Demand:

- The market demand gives the total quantity demanded by all consumers. The individual demand is the demand of one individual or firm.

- An individual demand schedule shows different quantities of a commodity bought by an individual consumer at different possible prices. A market demand schedule is the summation of innumerable individual demand schedules for a definite commodity. Each individual consumer has got his own quantity at a particular going price.

- The relationship between market demand and market prices lead to the market demand curve.

The relationship between individual demand and individual price leads to the individual demand curve.

Question 7:

(a) State one difference between an entrepreneur and other factors of production. Explain any four qualities in an individual to be a successful entrepreneur. [7]

(b) Define a Commercial Bank. Explain three ways by which Commercial Bank advance loans to the public. [8]

Answer:

(a) Factors of production viz. land, labour, and capital are scattered at different places. These cannot produce economic goods and services by themselves. They have to be brought together and, in a coordinated way, made to pass through a productive process to create output. This work is done by enterprise through entrepreneur. Entrepreneur is an independent factor of production. It is a function of an entrepreneur to bring the required factors together and making them work harmoniously.

The four qualities in an individual to be a successful entrepreneur are:

- Entrepreneur should be able to plan, organize, manage and allocate other primary factors of production efficiently.

- Entrepreneur should be able to take decisions promptly. Quick decisions are expected but hasty decisions may be avoided. At the same time, delay in decisions may increase cost of project and reduce the profits.

- Entrepreneur should be able to incorporate innovation and adopt modem techniques of production.

- Entrepreneur should be able to deal with numerous risks involved in entrepreneurship.

(b) Definition: “A bank collects money from those who have it to spare or who are saving it out of their incomes & it lends this money to those who reqiure it.” —Crowther

A commercial bank is a financial institution authorised to provide a variety of financial services, including consumer and business loans, savings accounts etc. Earlier commercial banks were limited to accepting deposits of money or valuables for safekeeping and verifying coinage or exchanging one jurisdiction coins for another. By the 17th century, most of the essentials of modem banking, including foreign exchange, the payment of interest, and the granting of loans, were in place.

The three ways in which a commercial bank advances loan to public are:

- Cash Credit: A cash credit is an arrangement whereby the bank agrees to lend money to the borrower up to a certain limit. The bank puts this amount of money to the credit of the borrower. The borrower draws the money as and when he needs. Interest is charged only on the amount actually. Cash credit is generally granted on a bond of credit or certain other securities. This is a very popular method of lending in our country.

- Loans: A specified amount sanctioned by a bank to the customer is called a “loan”. It is granted for a fixed period, say six months, or a year. The specified amount is put on the credit of the borrower’s account. He can withdraw this amount in lump sum or can draw cheques against this sum for any amount. Interest is charged on the full amount even if the borrower does not utilize it. The rate of interest is lower on loans in comparison to cash credit. The loan is generally granted’against the security of property or personal security.

- Bank Overdraft: Overdraft facility is more or less similar to cash credit facility. Overdraft facility is the result of an agreement with the bank by which a current account holder is allowed to withdraw a specified amount over and above the credit balance in his/her account. It is a short term facility. The customer is permitted to withdraw the amount as and when he/she needs it and repays it through deposits in his account as and when it is convenient to him/her. Overdraft facility is generally granted by bank on the basis of a written request by the customer.

Question 8:

(a) Define labour as a factor of production. Explain in brief three characteristics of labour. [7]

(b) With the help of an example explain the meaning of Price Discrimination. To which market is it relevant? Explain any two similarities between a Perfect Market and a Monopolistically Competitive Market. [8]

Answer:

(a) Definition: “Lobour consists of all human efforts of body or mind, undertaken in expectation of a reward”. —Thomas

The term labour is used to mean several things and can be a source of great deal of vagueness and imprecise statements. The term labour refers to only human effort (or activity) which can be physical, mental or a mixture of the two. It does not include the work performed by animals or machines or nature. Labour lately is known as human resource. All companies freed labour in order to carry out production. Everyone from the manual workers, to the owner of the company falls under the classification of human resources. Without this factor, there would be no production because nobody would be working.

The three characteristics of labour are:

- Labour is heterogeneous. No two persons possess the same quality of labour. Skills and efficiency differs from person to person. So, some workers are more efficient and productive than others in the same job.

- Labour cannot be stored. Once the labour is lost, it cannot be made up. Unemployed workers cannot store their labour for future employment.

- The amount of labour is the product of (1) duration of time over which it is performed and (2) the intensity with which it is performed.

(b) Price discrimination refers to a situation when a producer sells the same product to different buyers at two or more different prices for reasons not associated with difference in the costjof supplying the product to different consumers.

For Ex:

- Many hospitals charge lower operation fees from the poor patients & higher fess from the rich patients.

- Indian Railways charge lower freight rates for transporting essential product like food products, coal, etc. as compared to other products.

In simple words, charging different price for the same product or service from the different consumers on the basis of personal, situational and trade considerations is termed as price discrimination.

In Monopoly, it is relevant. In order to maximise his profit the monopolist adopts the policy of price discrimination. The idea behind this policy is the inability of the monopolist to charge higher price for the same goods or services from all the consumers, because in such situation a large number of persons with limited means will not be able to purchase the commodity and consequently the demand, output and profit will fall. This is why in order to maximise his profit the monopolist discriminates among buyers in respect of price.

The two similarities between a Perfect Market and a Monopolistically Competitive Market are:

- All of these markets systems must produce at the quantity of maximum profit if they want to make the most amount of money.

- The price maximization condition of both the markets is marginal cost equals to marginal revenue (MC=MR).

Question 9:

(a) Define,money. How does money perform its role as a:

- Medium of Exchange

- Store of Value. [7]

(b) What are Public Sector Undertakings? Explain four reasons for the privatization of Public Sector Undertakings. [8]

Answer:

(a) Roberston defined money as “anything which is widely accepted in payment for goods, or in discharge of other kinds of business obligations.”

Money is any object or reward that is generally accepted as payment for goods and services and repayment of debts in a given socio-economic context. The evolution of money has proved to be an unending and continuous process which can be seen from the fact that apart from the commodity money and metallic money, lately there is an emergence of paper money and a variety of other financial instruments. Money was brought into existence to over come the difficulties of barter, but in the process it has helped Economy in such a manner that its use has become indispensable. It has helped the economy in acquiring those complex features without which the latter could not develop.

Money perform its role as a:

- Medium of Exchange: This medium of exchange function is one of the most important and oldest functions of money. Money works as a medium of exchange. Money has a generalized purchasing power. Money is used as medium of exchange; where it is earned by selling ones goods and services and used to buy another set of goods and services.

- Store of Value: Money serves as a store of value because it is easy to spend and easy to store. By performing the function of store of value, the money provides security to individuals to meet unpredictable contingencies and to pay debt that are in terms of money. Money has a unique nature of durability and stability in value; thus it can be stored for a long time. This has introduced in people, a trend of making savings from the incomes for future purposes.

(b) In India, a government-owned corporation is termed as a Public Sector Undertaking (PSU). This term is used to refer to companies in which the government (either the federal Union Government or many state or territorial governments, or both) own a majority (51 percent or more) of the company equity. Navratna was the title given originally to 9 Public Sector Enterprises (PSEs) identified by the Government of India in 1997 as “public sector companies that have comparative advantages”, giving them greater autonomy to compete in the global market so as to “support [them] in their drive to become global giants”. It is a legal entity created by a government to undertake commercial activities on behalf of an owner government. Their legal status varies from being a part of government to stock companies with a state as a tegular stockholder. Government-owned corporations are common with natural monopolies and infrastructure such as railways and telecommunications, strategic goods and services (mail, weapons), natural resources and energy, politically Sensitive business, broadcasting, demerit goods (alcohol) and merit goods (healthcare).

The four reasons for which privatization of public sector undertakings was divested are:

- Economic Recession: The level of unemployment is simply unacceptable. Apparently, the economy can no longer sustain the level of wastages associated with public enterprises. Also, as a step to get out of this malaise, a solution has to be found on how to reduce wastages. Privatization and commercialization are one of such solutions.

- Restructuring the Economy: Privatization helps public by providing fund to efficient users, create a self sustaining culture, attract foreign investors, and services will reflect real values.

- Inefficiency of Government Enterprises: Over the years, government enterprises have become so inefficient as epitomized by the services they render to the public. Despite, the fact that the-government has and still continues to pump a lot of money into the enterprise.

- Revival of Sick Units: A number of public-sector enterprises have been incurring losses for a long time. They have become, more or less, sick units. Privatization may help in reviving sick emits, which have become a liability on the government.

Question 10:

Read the extract given below and answer the questions that follow:

TNN, 15th August, 2013

Rising vegetable prices and the impact of a weak rupee pushed inflation to a five month high of 5.79% in July 2013, posing yet another challenge for Asia’s third largest economy battling to defend the rupee and boost growth.

Official data released on Wednesday showed inflation as measured by the wholesale price index, jumped to 5.79% in July from previous months 4.86%. Easing wholesale price inflation had fuelled expectations of a moderation in tight monetary policy but the slide of the rupee against the dollar has dashed those hopes for now.

- What is meant by running inflation? [2]

- Mention two fiscal measures to control inflation. [1]

- Briefly explain the effect of a high level of inflation on the following:

- Fixed income groups. [2]

- Producers. [2]

- Creditors and debtors. [2]

- Explain three monetary policies of the Reserve Bank of India to control credit. [6]

Answer:

- Running Inflation: It refers to the situation where the price level rises very fast. In case, price level doubles up every 3 years. It is, generally, succeeded by galloping inflation.

- The two fiscal measures to control inflation are:

- Decrease in public expenditure: One of the main reasons of inflation is excess public expenditure like building of roads, bridges etc. Government should drastically scale down its non essential expenditure.

- Increase in taxes: Government should levy some new direct taxes and raise rates of old taxes.

- Over valuation of money: To control the over valuation of money it is essential to encourage imports and discourage exports.

- The effect, of high level inflation on the following is:

- Effect on Fixed Income Groups: This group includes government servants, pensioners, etc. who get a fixed monthly income. This class is warst affected by inflation because the purchasing power of their fixed income goes on decreasing with rising prices.

- Effect on Producers: In short run, they earn artificial margin of profit as the cost of production does not rise as fast as the price of their product. But in long run, the price level goes on increasing, the total consumption of their product would fall. The reduced consumption will ultimately raise the cost of production per unit and reduce the profits.

- Effect on Debtors and Creditors: Debtors gain when they pay back their debt during inflation. It is because the value of money was high when they borrowed but came down when they repaid their debts.

Creditors are losers during inflation because of the above said reasons.

- The three monetary policies of the Reserve bank of India to control credit are:

- Bank Rate Policy: It is the interest rate at which a central bank provides loans to banks. It is the rate at which the central bank discounts the bills and other instruments of commercial banks which are redeemable at par.

- Open Market Operations: When use of bank rate is not effective enough in regulating the volume of money and credit, the central bank can resort to the use of open market operations. This instrument refers to the practice of sale and purchase of commercial paper and government securities by the central bank in the market on its own initiative in order to control the volume of credit.

- Variable Cash Reserve Requirements: The traditional instruments of quantitative credit control, bank rate policy and open market operations, suffer from certain inherent defects and have been found unsuitable to serve the interests of underdeveloped countries