ICSE Economic Applications Previous Year Question Paper 2013 Solved for Class 10

ICSE Paper 2013

ECONOMIC APPLICATIONS

(Two Hours)

Answers to this Paper must be written on the paper provided separately.

You will not be allowed to write during the first 15 minutes.

This time is to be spent in reading the Question Paper.

The time given at the head of this Paper is the time allowed for writing the answers.

Section I is compulsory. Attempt any four questions from Section II.

The intended marks for questions or parts of questions are given in brackets [ ].

SECTION-I (40 Marks)

(Attempt all questions from this Section)

Question 1:

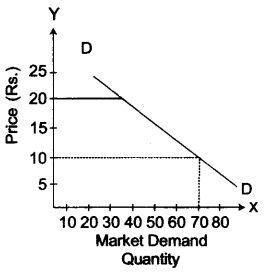

(a) With the help of a diagram show how a market demand curve can he obtained from individual demand curves. [2]

(b) Which section of society is worst affected during inflation? Briefly explain. [2]

(c) Mention one way by which Government policy can ensure social justice. [2]

(d) There ere no substitute goods in a Monopoly market. Give a reason to support your answer. [2]

(e) Briefly explain the impact of constructing dams on the ecosystem. [2]

Answer:

(a) The individual curve represents the demand of an individual for a commodity at different prices whereas in a market there are several such consumers having different taste, preference and income. Therefore, the market demand actually represents the demand of all the individuals (consumers) present in the market. In nut shell, when combined all the individual demands. You will get the market demand curve.

Example:

| Price (Rs.) | Demand | Market Demand | ||

| A | B | C | ||

| 20 | 20 | 10 | 5 | 35 |

| 10 | 40 | 20 | 10 | 70 |

(b) The Fixed Income Group is worst affected during inflation. This group includes pensioners, government servants, owners of government securities and others who get a fixed money income. They are known as renties. This class is worst affected because the purchasing power of their fixed income goes on decreasing with rising prices.

(c) In Fiscal Policy, social justice can be ensured through Progressive/higher rate to higher income level group and subsidies to lower income level group taxation.

(d) The term Monopoly has been derived from two Greek words i.e. Mono + Polus. Here ‘Mono’ means single and ‘Polus’ means seller/producer. Therefore Monopoly is a situation where there is single seller/producer having the sole right over the production of commodity which results into no availability of any other substitutes.

(e) The impact of constructing dams on the ecosystem are as follows:

- It changes a riverine habitat to a lake habitat, affecting the animal and plant communities living there.

- It results in loss of Biological diversity.

Question 2:

(a) Briefly explain why labour is considered to he the means and end of production. [2]

(b) Distinguish between Joint demand and Composite demand. [2]

(c) State two reasons for low capital formation in a developing economy. [2]

(d) State one difference between Monopsony and Monopolistic competition. [2]

(e) Classify the following capital goods: [2]

- Machines

- Cotton yarn

- Oil mill

- Bridge [2]

Answer:

(a) A Labour is considered to be the means and end of production because on one hand it is the most important factor of production and on other hand it triggers the production due to increased consumption.

(b) Joint Demand: When several goods are demanded for one same purpose such demand is known as joint demand.

e.g., If demand for furniture increases, the demand of wood, nails, etc. also increases.

Composite Demand: Demand for goods that have multiple uses is called composite demand.

e.g., Milk is used for making tea, coffee, butter, cheese, curd and sweets.

(c) Two reasons for low capital formation in a developing economy:

- State of Economy: Majority of people in India are agriculturists, who follow old methods and also have uneconomic agricultural holdings. All these factors leave very low or no surplus with them.

- Inflation: Due to inflationary trend, the price of commodity goes up very high and for middle class it becomes very difficult to save any amount for contributing to capital formation.

(d) Difference between Monopsony and Monopolistic competition:

| Basis | Monopsony | Monopolistic Competition |

| Number of buyers | There is a single buyer or a purchasing agency which buys the whole or nearly whole of commodity or service produced. | There are large number of buyers or sellers. |

(e)

- Machines—Production Capital

- Cotton yam—Working Capital

- Oil Mill—Sunk Capital

- Bridge—Social Capital

Question 3:

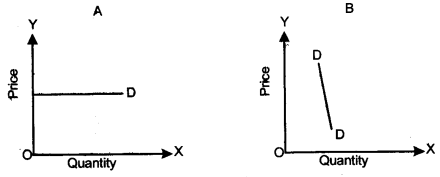

(a) Indicate the degree of elasticity of demand of the following demand curves: [2]

(b) What is meant by land use pattern? [2]

(c) What are indirect taxes? Give an example. [2]

(d) Define money. How does its act as a ‘measure of value’? [2]

(e) What is meant by an overdraft facility? [2]

Answer:

(a) (A) Perfectly elastic demand

(B) Less than unitary elastic demand.

(b) Land use pattern refers to the allocation of land for different purposes such as land cover under forest, for industries, for roads and transportation, etc.

(d) Definition of Money: “Anything which is widely accepted in payments for goods or in discharge of other kinds of business obligations.” —Robertson

Money is accepted as a common measure of value or unit of account. The goods in terms of which the prices of all other goods are expressed is called the measure of value or the Numeraire. In modern economies, it is money which acts as a Numeraire, i.e. prices of all goods are expressed in terms of money.

(e) An overdraft facility is a facility in which a borrower is allowed to withdraw more amount than what he has deposited in his account. The excess amount so withdrawn has to be repaid to the bank in a short period with interest. The rate of interest is usually more than that in case of loans.

Question 4:

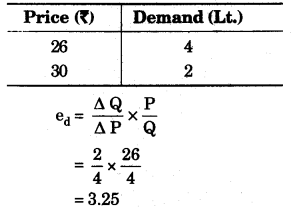

(a) The price of milk rises from Rs. 26.00 to Rs. 30.00 per litre and its demand falls from four litres per day to two liters per day. Calculate the elasticity of demand for milk. [2]

(b) Differentiate between an entrepreneur and labour on the basis of:

- Nature of work.

- Nature of risk involved. [2]

(c) Distinguish between the fiscal and monetary policy of the Government. [2]

(d) What are Public Sector Units? Mention one problem faced by Public Sector Units in India. [2]

(e) What is meant by Bank Rate? How does it help in controlling the flow of credit in the economy? [2]

Answer:

(a)

(b)

| Basis | Entrepreneur | Labour |

| 1. Nature of Work | They perform jobs like strategy formulation, decision making. | They perform task alloted to them. |

| 2. Nature of Risk | An entrepreneur has to bear all the risks in the business. | Labours are not involved in any kind of risk in the business. |

(c)

| Basis | Monetary Policy | Fiscal Policy |

| 1. Meaning | If refers to policy of the central bank of a country to control the supply of money and its cost i.e. rate of interest. | It is a policy under which the government implements to direct its revenue and expenditure programme to produce desired results. |

| 2. Instrument | Its main instruments are:

| Its main instruments are:

|

(d) Public sector unit is an enterprise which is owned, controlled and managed by the government. It may be Central Government, State Government or jointly by state and central government.

Problem faced by Public Sector Units

PSUs in general face the shortage of skilled, experienced and competent workers because of relatively lower salary and perquisites etc. This has led to the inefficient management of these enterprises.

(e) Bank Rate is the rate at which central bank rediscounts the first class bills of exchange of commercial banks. Simply speaking it is the rate of interest at which central bank lends money to the commercial banks. It is used as an instrument of the credit control policy of the central bank.

With the increase in bank rate, the market rates and other lending rates also go up and vice-versa. As a result, these changes affect the supply and demand of the money-in the market. When the market rates and lending rates are higher, the borrowing is discouraged and the credit becomes costly and there is contraction of credits. Similarly when bank rate decreases, the effect will be opposite. Thus, overall credit control can be manipulated by central bank by changing the bank rate.

SECTION-II (60 Marks)

(Answer any four questions from this section)

Question 5:

(a) Define capital and explain three important functions of capital. [7]

(b) ‘Land is the original source of all material wealth.’ In this context, explain four determinants that influence the productivity of land. [8]

Answer:

(a) Capital: “Capital is produced means of production.” — Bawerk

Capital is defined as “All those man-made wealth which are used in further production of goods.” Thus, capital is a man made resource of production. Machines, tools and equipments of all kinds, buildings, railways and all means of transport and communication, raw materials, etc. are included in capital. As such all capital is wealth but all wealth is not capital.

Three functions of Capital:

- Provision for Appliances: Capital is used to provide tools and implements for use by the workers. It is clear that these things are essential for production, without their aid, large scale production is impossible.

- Provision for raw materials: A part of the capital is used for arrangement of raw materials for production. Every concern must have, on hand, a sufficient supply of raw materials.

- Increases Employment opportunities: Since capital expands production, it also expands employment. Thus, if we are to reduce the volume of unemployment in a country, we must pay attention to capital formation in the country.

(b) Land includes all that is provided by nature as a free gift for use by mankind. No productive operation is possible without land. It is the original source of all material wealth.

Four factors that influence the productivity of land:

- Natural Factors: Productivity of land is largely determined by its natural qualities such as fertility, slope of land, climate, chemical and biological properties of the soil.

- Human Factors: Productivity of land also depends upon the knowledge and training of workers. A wise farmer can take more produce from the same land than an untrained farmer.

- Improvement on Land: Productivity of land is affected by land development measures like provision of well or tube-well irrigation, proper drainage, fencing, etc.

- Location of Land: The location of land also affects the productivity of land. Land located near the market is supposed to be more productive than land at a distant place, as it will not require extra amount to bring the produce to the market. If it is situated away from the market, farmer will have to pay more for transportation of the produce to the market.

Question 6:

(a) Explain the following functions of the central bank of a country:

- Acting as a ‘Banker to the Government.’

- Fixation of margin requirement on secured loans.

- Developmental functions. [8]

(b) What is meant by Ecosystem? Explain three adverse effects of mining on the ecosystem. [7]

Answer:

(a) The functions of the central bank are as under:

- Acting as a ‘Banker to the Government’: As a banker to the Government, the central bank issues and receives payments on behalf of the Government whenever it becomes necessary. It also floats public debts and manages it for a shorter or longer period as the case may be, for the Government.

- Fixation of Margin Requirements on Secured Loans: The margin is the difference between the ‘loan value’ and the ‘market value’ of securities offered by borrowers against secured loan. By prescribing the margin requirements on secured loans, the ‘central bank’ does not permit the commercial bank to lend to their customers the full value of securities offered by them but only a part of their market value.

- Development Functions: In an underdeveloped and developing nations, the ‘central bank’ performs developing and promotional functions also. For their objective, special financial institutions are established for the development and progress of different sectors like agriculture, industry and commerce and it maintains relation with international organization like World Bank.

In our country, the RBI has special department i.e. NABARD for agricultural credits.

(b) Ecosystem: An Ecosystem is a complex set of relationship among the living resources habitats and residents of an area but changing global pattern of land use have had a significant negative effect on ecosystem.

There is a biotic balance in an ecosystem, which makes it possible to sustain the various interdependent members (plant and animal life). Ecosystem maintains a very delicate balance. Various human activities have been done to disrupt this balance and destroy the world’s ecosystems.

Adverse effect of mining on ecosystem:

- It causes deforestation and removal of vegetation. In order to construct a mine large amount of land has to be cleared off trees and vegetation. This is bad for environment.

- The waste material remaining after the valuable minerals have been extracted is called tailing. These tailings are generally made up of hazardous material. Dust from these tailings causes air pollution.

- Chemical like arsenic and iron are very harmful. When it rains these chemicals find their way to ground water, surrounding water bodies and soil. This pollutes water bodies as well as affects agriculture.

Question 7:

(a) ‘Efficient labour force is an important economic ingredient’. In this context, define efficiency of labour.

Explain three factors that determine the efficiency of labour. [8]

(b) Define a Commercial Bank. Explain three methods adopted by Commercial Banks to mobilise funds from the public. [7]

Answer:

(a) ‘Efficiency of Labour’: The amount of work which a labourer can do within a given time. —Dr. Saxena

In other words, efficiency of labour refers to the quantity and quality of goods and services which can be produced during a given period under certain prevailing conditions. Three factors that determine the efficiency of labour:

- General and Technical Education: The general education broadens the knowledge, develops the intellect and improves the skill of a person. The technical education provides knowledge to a worker concerning different systems of work of the productive units. All these make an educated person more efficient and better in skill, as compared to an uneducated and untrained person.

- Experience: The practical experience of work is gained by the worker during the training period. After that, he becomes perfect by doing day-to-day work, regularly and repeatedly. Simultaneously his efficiency also goes on increasing. Thus, an experienced worker is usually more efficient than an inexperienced one.

- Climatic Factors: Climatic differences also affect the efficiency of labour Working under extreme climatic conditions is always more difficult than working in the temperate zones.

- Working Conditions: A healthy and conducive work environment increases the level of efficiency. The facilities enjoyed by the worker determine labour efficiency to a significant extent. Employer-employee relations are also an important part of the work-environment. An employer, therefore, can contribute to labour efficiency by building a cordial relationship with his workers. (any three)

Question 8:

(a) Define Privatisation. Discuss two arguments each in favour and against privatisatio. [8]

(b) Read the following extract and answer the questions that follow:

Economic Times, September 4th, 2012

Terming payment of taxes as a ‘mark of civilisation’, Finance Minister P. Chidambaram has assured that authorities will not “rashly” implement controversial retrospective tax rules while once again promising a non-adversarial tax regime for all taxpayers. It is the second time in less than a week that Chidambaram has given assurance of a stable and fair tax regime, after the tax department attracted criticism for ushering in what some have called a “raid raj” and for introducing a series of measures industry and investors have slammed as retrograde.

- Define direct tax. Give two examples.

- State how a direct tax can foster social consciousness.

- What is meant by a progressive direct tax? How does its imposition bring about equity?

- State two demerits of direct tax. [7]

Answer:

(a) Privatization: “Refers to the sale of all or parts of a government’s equity in state owned enterprises to the private sector.”

Privatization means the transfer of managerial control of any public sector units to any private entrepreneur or to any private corporate body is called privatization.

Arguments in favour of privatization

- Greater flexibility in making decisions: Sometimes PSUs suffer losses just due to inadequate autonomy in the ‘decision making power’ of the management. If the PSUs are privatised, then the production and investment decisions of the management would be free from any Government intervention, and they would be purely guided by profit motive.

- Improvement in Managerial Efficiency: Privatization is a means of improvement in managerial efficiency because the private sector is almost free from political interference.

When many areas of industial production are opened up for the private sector enterprises, then their investment in the industrial sector is expected to increase to a large extent. Higher investment would mean creation of greater employment and income opportunities within the economy.

Arguments against privatisation:

- Social welfare aspect is neglected: The private sector enterprises operate mainly for the maximisation of profit. Hence this measure does not guarantee the social welfare of the common people.

- Imbalanced regional development: Industries requiring huge investment but yielding low returns are not taken over by the private sector.

(b) Case Study

- The tax paid by the person on whom it is legally imposed is called direct tax. In other words, Taxes imposed on receipt of income are called direct taxes.

Example: 1. Income Tax. 2. Capital Gain Tax. - Direct tax can foster social consciousness as person knows that he is paying a tax he feels conscious towards his rights. He claims the right to know how the government uses his money. Civic sense is thus developed. He behaves as a responsible citizen.

- Taxes in which the rate of tax increases, with the increase in tax base are called progressive direct taxes.

Progressive tax: A tax is called progressive when the rate of taxation increases as the tax payer’s income increases. Exaniple: Income tax.

A direct tax is equitable in the sense that it is levied according to the taxable capacity of the people. The rate of direct taxes, like the income tax, can be fixed in such a way that the higher the income of a person, the greater is the tax rate. - Two demerits of direct tax:

- Inconvenient: The greatest drawbacks of direct taxes is that they put the taxpayer to a lot of botheration and inconvenience. Sometimes, the taxpayer is called to pay the entire tax in one installment.

- Evadable: By submitting false return of income, some people evade the tax. That is why a direct tax is called as ‘A Tax on Honesty’.

Question 9:

(a) Define price elasticity of demand. Explain how the following factors determine price elasticity of demand:

- Existence of substitute goods.

- Nature of the commodity.

- Proportion of expenditure incurred in a Household Budget. [7]

(b) State whether the following statements are true or false. Give reasons for each

- If prices are expected to fall in the future current demand rises.

- Slow growth rate in Indian agriculture has increased mobility of labour from rural to urban areas.

- In a developing country like India public expenditure should not be incurred on infrastructural development.

- An indirect tax can be made progressive by imposing higher tax rates on luxury goods. [8]

Answer:

(a) Price Elasticity of Demand

Price Elasticity of Demand may be defined as the percentage change in the quantity demanded of a commodity divided by the percentage change in the price of that commodity.

\(\text{Prince Elasticity of Demand}=\frac{\text{ Percentage }\text{change in demand}}{\text{ Percentage}\,\text{change in price}}\)

Factors determine Price Elasticity of Demand:

- Existence of substitute goods: The commodity for which close substitues are available in the market have more elastic demands as compared to commodities without proper substitutes.

eg., A change in the price of tea, causes almost proportional change in demand of coffee. Contrary, the common salt has no substitute and so any increase or decrease in the price of salt does not affect its demand. - Nature of the commodity: The demand for the items of necessities (i.e. food grains, medicine etc.) is generally less elastic. Such commodities are bought in certain fixed quantities irrespective of their prices. In the similar way, the demands for the items of comforts are relatively elastic whereas for luxuries, the demands are highly elastic.

- Proportion of total expenditure involved: When the expenditure to be incurred for a particular commodity (i.e., match box, shoe-laces etc.) in a small portion of the total expenditure, the demand will generally be inelastic or less elastic. Any change in price will not alter the demand of that commodity.

(b)

- False: If consumer is expecting that prices of commodities are going to fall in the future, then they decrease their current demand. They postponed their present demand/consumption in order to purchase in near future at decreased prices.

- True: The increased mobility of labour from rural to urban areas is due to slow growth rate in Indian agriculture results in low wages to labour. On other hand, Industrialization in urban areas attracts the labour from rural areas.

- False: The absence of economic infrastructure can retard economic development. Therefore, in developing countries, high public expenditure should be incurred on infrastructural development in order to accelerate the pace of agricultural and industrial development.

- True: A high tax rate on luxury goods as it is demanded by rich class of society and low tax rate can be imposed to basic necessities or even exemption from tax can be given as basic necessities can be met easily by lower income group person.

Question 10:

(a) Under which type of a market are producers price takers?

Explain three of its characteristics. [7]

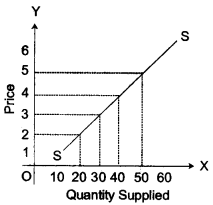

(b) With the help of a diagram state whether supply of a good is directly or inversely related to its price. Explain any four determinants of supply. [8]

Answer:

(a) Producers are price-takers under the perfect competition market. Perfect competition is a market structure in which there are a large number of producers producing a homogeneous product so that no individual firm can influence the price of the commodity.

In this type of market, the price is determined by the industry i.e. by all the firms taken together, by the forces of market demand and supply. The firm has no control over the product price. An individual firm takes the price as given and it has to take decision about the amount of output to be sold at that price. This means that the firm under perfect competition is assumed to be a price-taker rather than a price-maker.

Three Characteristics of Perfect Competition Market

- Homogeneous product: All sellers sell completely identical products, in respect of quality, colour, size etc. They are perfect substitutes of one another. The product sold by different firms in the market are equal in the eyes of buyers. All sellers are equal in the eyes of buyers. No seller can charge higher price otherwise he is liable to his customers.

- Perfect knowledge of Market: Both the sellers and buyers have perfect knowledge of market conditions which includes demand, supply and prices. If some firms decide to charge a price higher than the ruling market price, there will be a large substitution effect away from this firm.

- Free Entry and Exit of firms: There is no restriction upon the entry of a new firm in the market or the exit of an existing firm. Due to this characteristic, all the firms can get only normal profit in long run.

(b) Supply Schedule

| Price (Per Kg.) | Quantity Supplied |

| 2 | 20 |

| 3 | 30 |

| 4 | 40 |

| 5 | 50 |

The above figure shows the positive slope of supply curve which represent that there is a directly relationship between price and quantity supplied. In other words, high quantity will be supplied at higher prices and vice versa.

Four determinants of supply are:

- Prices of Related Commodities: Producers have always the possibility of shifting from the production of one commodity to the production of another commodity. If prices of other commodities are rising, while the price of the commodities remains constant, producers will find it more profitable to produce and sell other commodities. As a consequence, the supply of the commodity under question will fall.

- Techniques of Production: Techniques of production also exert a significant influence on the supply of a commodity. An improvement in the technique of production, the invention of new machines, etc. reduces the cost of production and increases the profit margin. Increased profitability induces the producers to produce more and increase the supply.

- Expectations of Future Prices: Producers’ expectations of future market prices affect the supply of any good. If the producers expect an increase in the price of a commodity in future, then they will supply less today and hoard it so as to offer a large quantity of the commodity in future at higher prices. Conversely expectations of fall in future prices tend to increase supply in the present period.

- Agreement among producers: Sometimes producers may form a pool and enter into some agreement to restrict the supply of a commodity to earn large profits. They will create artificial scarcity of the commodities and as a consequence supply will decrease.