ICSE Economic Applications Previous Year Question Paper 2010 Solved for Class 10

ICSE Paper 2010

ECONOMIC APPLICATIONS

(Two Hours)

Answers to this Paper must be written on the paper provided separately.

You will not be allowed to write during the first 15 minutes.

This time is to be spent in reading the Question Paper.

The time given at the head of this Paper is the time allowed for writing the answers.

Section I is compulsory. Attempt any four questions from Section II.

The intended marks for questions or parts of questions are given in brackets [ ].

SECTION-I (40 Marks)

(Attempt all questions from this Section)

Question 1:

(a) Give two reasons for the positive slope of the supply curve. [2]

(b) Would the elasticity of demand in the following cases be unity, less than unity or greater than unity?

- A rise in the price of a commodity reduces the total expenditure.

- A rise in the price of a commodity decreases total expenditure.

- A fall in the price of a commodity increases total expenditure

- A fall in the price of a commodity, the total expenditure remains the same. [2]

(c) Mention two assumptions of the law of Supply. [2]

(d) If commodity X and Y are complementary goods, what will be the cross elasticity of demand? [2]

(e) With the help of a suitable diagram explain extension in demand. [2]

Answer:

(a) The two reasons for the positive slope of the supply curve are as follows:

- Profit motive of Individual firm—Levels of price determine the amount of profits. Higher is the price of the commodity, the greater is the incentive for the producer to produce and supply in the market, other things remaining the same.

- Rise in marginal cost of production—Marginal cost of production increases with an increase in the amount of production. This implies that the producer would be prepared to produce and supply a larger quantity of a commodity only at a higher price, so as to cover higher cost of production.

(b)

- Elasticity of Demand would be greater than unity (eP > 1)

- Elasticity of Demand would be less than unity (eP < 1)

- Elasticity of Demand would be greater than unity (eP > 1)

- Elasticity of Demand would be unity (eP = 1)

(d) If commodity X and Y are complementary goods, cross elasticity of demand would be negative. It means that an increase in the price of X would lead to a fall in the demand for Y and vice versa.

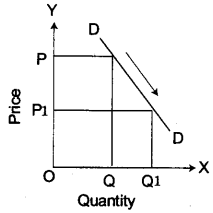

(e) A rise in quantity demanded of a commodity due to a fall in its own price is known as extension of demand. It causes a downward movement along the same demand curve.

In this Fig. OP is the original price and OQ is the original quantity demanded. When the price falls to OP1 Quantity demanded rises to OQ1 thus leading to a downward movement along the demand curve. This is known as extension of demand.

Question 2:

(a) What is regarded as a factor of production and why?

(i) capital (ii) interest

(iii) profit (iv) rent [2]

(b) Suggest two methods to enhance the productivity of land. [2]

(c) Mention one feature each of a monopoly market and of a perfect market present in a monopolistically competitive market. [2]

(d) Define wage policy. Mention two of its objectives. ** [2]

(e) Suggest two measures to improve efficiency of labour in the unorganized sector in India. [2]

** Answer has not given due to out of present syllabus.

Answer:

(a) (i) Capital is regarded as a factor of production as it is a produced means of production. It is first produced by man and then helps in the further production of goods.

(b) Two methods to enhance the productivity of land:

- Investment on Land—Productivity of Land can be enhanced by undertaking investment on land. Construction of irrigation facilities is an example of investment on land. Higher the investment on land, higher will be the productivity of land in future.

- Scientific way of cultivation—Productivity of Land can be increased by using scientific techniques of cultivation on land. If the farmers use HYV seeds, adequate amount of fertilisers/manure, pesticides, improved agricultural tools and implements, etc. then yield of crop per hectare can be increased to a great extent.

(c) One feature of a monopoly market in a monopolistically competitive market is that to differentiate their products, different sellers sell their products under different brand names. It is this which gives an individual firm some monopoly of its own differentiated product—its own brand name. This is monopoly component of monopolistic competition.

(e) Two measures to improve efficiency of labour in the unorganized sector in India are:

- Training facilities for workers should be arranged on a big scale; proper infrastructure need be arranged for this.

- A social security network should be put in place, this will ignite confidence among the workers, and will make them more responsible towards their work.

Question 3:

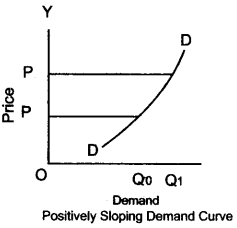

(a) Explain the following diagram: [2]

(b) What is meant by monopsny? Give an example. [2]

(c) Why are selling costs not required in a perfectly competitive market? [2]

(d) Mention two ways in which the Reserve Bank of India assists the commercial banks. [2]

(e) Mention one way by which Fiscal Policy can be used to control economic recession. [2]

Answer:

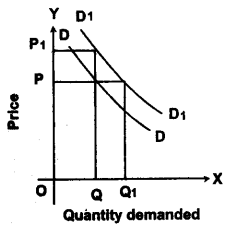

(a) The given diagram illustrates the concept of Increase in Demand which may be defined as a situation when “more is demanded at the same price or same qty. is demanded at a higher price.” In the given diagram, the price OP remaining the same, the qty. demanded has increased from OQ to OQ1 The demand curve has shifted to the right. It also shows that when price rises from OP to OP1 Quantity demanded remains the same at the level of OQ. This is also a case of increase in demand.

(c) Selling costs are not required in a perfectly competitive market because every producer is selling a totally identical product, and competition is so intense that every producer has to make all possible efforts to keep his cost of production in check. Selling costs will only add to the cost of production without bringing in any gain to the producer.

(d) Two ways in which the Reserve Bank of India assists the commercial banks are:

- Central bank advances loans to commercial banks by rediscounting their bills of exchange and for this facility, central bank charges interest from them.

- Central bank acts as a lender of last resort’. If the commercial bank is facing with a financial crisis, the only institution that can finally come to rescue it, is the central bank.

(e) One way by which Fiscal Policy can be used to control economic recession is by increasing Government expenditure for productive purposes. This will give a boost to the economy and help it to come out of recession. If the national output will increase, it will raise the level of employment and income for the people.

Question 4:

(a) How does money resolve the problem of double co-incidence of wants? [2]

(b) Give two advantages of depositing money with Commercial Banks. [2]

(c) Mention one way by which the Government can reduce the disparity in income and wealth distribution of its citizens in a developing economy. [2]

(d) What is meant by product differentiation? To which market is it relevant? [2]

(e) How is budget deficit financed in India? ** [2]

Answer:

(a) Refer Ans. 8 (a) (i), 2016.

(b) Two advantages of depositing money with the commercial banks are:

- Money remains safe in the bank.

- We earn interest on the money deposited with the banks.

(c) The Government can reduce the disparity in income and wealth distribution of its citizens in a developing economy by using progressive system of taxation under which the rich are made to pay the taxes at a higher rate in comparison to the poor who pay at a lower rate.

(d) Product differentiation implies that a consumer perceives products of different producers as not being totally identical and as such less than perfect substitutes. The producers try to reinforce this impression by giving separate brand names and making use of such trade practices as packaging, colour, design, advertisement etc. Product differentiation is relevant to monopolistic competition.

SECTION-II (60 Marks)

(Answer any four questions from this section)

Question 5:

(a) Explain the law of demand with the help of assumptions, a diagram and a schedule. How does demand differ from want? [8]

(b) Public sector units made a commendable contribution, to the Indian economy in the early phase of planned development. What are public sector units? Explain any four contributions of PSUs to the Indian economy. [7]

Answer:

(a) Law of Demand states that “Other things remaining the same, quantity demanded is more at a lower price and less at a higher price” therefore has a inverse relationship.

Law of demand explains the inverse relationship between quantity demanded of a commodity and its price.

It is based on the following assumptions:

- There should be no change in the income of the consumer.

- There should be no change in the taste and preference of the consumer.

- Prices of the related commodities should remain unchanged.

- Size of population should not change.

- The distribution of income should not change.

- The commodity should tie a normal commodity.

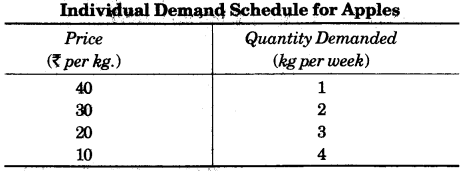

The above mentioned assumptions are the factors influencing demand (other than price) that should remain unchanged if the Law of Demand is to be proved true. Demand Schedule is a table that shows different quantities of a commodity that would be demanded at different prices.

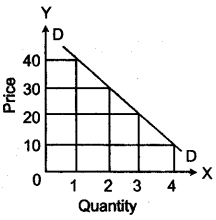

From the above table, we observe that quantity demanded of apples is increasing with a fall in the price of the apples. Thus it is clear that quantity demanded of a commodity is inversely related to its price.

Demand curve is a graphic presentation of the Law of Demand. It shows different quantities demanded at various alternative prices during a given period. Demand curve is negatively sloping i.e. it always slopes downward from left to right.

Difference between ‘Want’ and ‘Demand’

A consumer’s desire to have a commodity is his want for the commodity.

A demand is an effective desire. A want becomes an effective desire when it is backed by the following:

- Ability to pay

- Willingness to pay.

(b) Public Sector Units: The enterprises which are completely owned, controlled and regulated by the Government are known as public sector units or PSUs.

Public sector units made a commendable contribution to the Indian economy. Four contributions of PSUs to the Indian economy are as follows:

- Share in National Income—About one fourth of India’s National Income is generated in the public sector.

- Share in Capital formation—The share of the Public Sector in total capital formation reached a peak of 63.7 during the Third five Year Plan. Presently, it has been around 30 per cent.

- Public Sector Enterprises and Employment—The expansion of the public sector has witnessed a considerable increase in employment. Of the total employment in the organized segment, the public sector accounts for about 70 per cent and the private sector only 30 per cent.

- Command heights of the economy—The public sector is in command in almost all the strategic sectors of the economy like coal, oil refining, electricity, iron and steel, paper and newsprint etc. In all, it holds a dominating position in the production of 50 types of industrial commodities and services which are of decisive significance for the economic development of the country.

Question 6:

(a) Many a time the inverse relationship between price and the amount purchased does not hold good. Explain this statement giving four reasons. [8]

(b) Differentiate between mental and physical labour. State four ways in which division of labour will influence production in an economy. [7]

Answer:

(a) Many a times the inverse relationship between price and the amount purchased does not hold good.

This statement means that sometimes quantity demanded of a commodity does not fall with a rise in price and vice-versa. Sometimes a consumer may demand more of a commodity at a higher price and less at a lower price. Such situations are termed as exceptions to the law of demand. It leads to an abnormal demand curve which is positively sloping.

- Giffen Effect—Sir Robert Giffen observed that a typical inferior commodity consumed by the poor people may display an odd behaviour. When the price of such a commodity rises, the poor people may cut down on their purchases of other (more expansive) items and increase the purchases of this commodity. Example of Giffen goods Maize, Bajra.

- Conspicuous consumption—Some persons may consume a very expensive commodity just to show off and attract the attention of other people. In that case, its price and demand may more in the same direction. Diamond ornaments and expensive motor cars are examples of such goods.

- Snob effect—A consumer may try to show that he no longer belongs to a particular social class. This is known as snob effect. In case of a good typically consumed by the poor people, when its price falls, the consumer may decrease his purchase of this good in order to show that he no longer belongs to the class of the poor.

- Veblen Effect—Some people consider the price of a commodity as the true indicator of its quality. Hence, they purchase more of a commodity, with the increase in its price. They think that they are paying higher prices for having better quality goods. This is called the Veblen Effect.

(b) Labour which involves mainly physical effort and very little mental effort is categorized as physical labour.

On the other hand, labour requiring intensive mental or intellectual effort is categorized as mental labour.

The labour of a coolie (porter) is an example of physical labour, while that of a teacher or lawyer is mental labour.

The four ways in which Division of Labour will influence production in an economy are as follows:

- Quality of Production Improves—Division of Labour leads to an increase in the efficiency of Labour which further leads not only to an increase in the quantity of output but also to an improvement in the quality of the produced goods and services.

- Large Scale Production—Division of Labour makes large scale production possible. Indeed, large scale production requires division of labour. If a car manufacturing company, for instance wishes to make 10000 cars in a year but does not introduce division of labour in its factory, it will have to employ so many workers that it will not be an economically viable company. It is by virtue of division of labour that the company can produce 10000 cars per year with a reasonable number of workers.

- Reduced Average Cost—Since division of labour increases total output, even with an unchanged number of labourers, the average cost of producing a commodity falls. This is a social advantage. Society can produce goods by incurring lower average cost of production.

- Lower Prices of Output—The reduced average costs of the products leads to reduced prices of the outputs in the market. As a result, consumers are benefited.

Question 7:

(a) Define capital formation. Explain any four causes of low capital formation in a developing economy. [8]

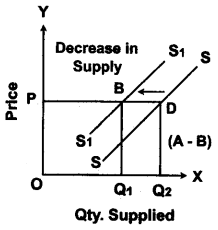

(b) With the help of a diagram define decrease in supply.

Discuss four factors which determine this phenomenon. [7]

Answer:

(a) Capital formation means the creation of capital. A change in the stock of capital in any economy during any particular time period is called capital formation.

Four causes of low capital formation in a developing economy:

- Lack of Ability to Save: The chief cause of the low rate of capital formation is the low rate of savings. The low rate of saving, in turn, is explained by a number of factors. Among these, the inability to save is the most important. Because of the problem of poverty, the vast majority of the people of India are not in a position to save more than a negligible part of their incomes.

- Lack of Willingness to Save: It is true that a significant part of the Indian population does not have the willingness to save. Even today there are parts of the Indian economy where a feudal types of economic system prevails. Under this system even those who have the ability to save (for instance, the landlords) spend most of their incomes on consumption or on conspicuous consumption.

- Insufficient Opportunity to Save: In some cases people in India also do not have sufficient opportunity to save. Inadequate expansion of the public sector banks and other financial institutions in the rural areas, lack of faith of the people upon the indigenous bankers, lack of knowledge of the people regarding the secured savings opportunities, etc. are borne of the reasons for such insufficient savings opportunity in India.

- Inadequate Mobilization of Savings: India also suffers from the problem of inadequate mobilization of savings. The savings that are made by the people are not always used for capital formation. People often keep their savings in the form of cash and gold at home. These are not productively used. This is partly due to inadequate development of the banking habits of the people and partly due to the underdeveloped state of the banking and financial network particularly in the rural areas.

(b) Decrease in supply may be defined as a situation when less is demanded at the same price or same quantity is demanded at a higher price. In this diagram SS is the original supply curve and S1S1 is the new supply curve showing a leftward shift in the supply curve which indicates a decrease in supply.

Four factors causing decrease in supply:

- Change in Prices of Inputs: If the prices of inputs will rise, the profit from making of that product will fall due to a rise in the cost of production. Hence, if there is a rise in the price of inputs the producers will produce and sell relatively less amounts of X at a given price. This would cause a decrease in supply.

- Changes in Technology: At any time, what is produced and how it is produced depends on the technology in use. A degradation in production technology, will lead to a rise in the average cost of production and reduce a firm’s profit. So the firms will supply less at a given price. This will cause a decrease in supply.

- Changes in the Goals of the Firm: The main goal of a firm is to maximise its profits. However, different firms may have other goals also. For example, some firms may want to avert risk and they may follow some safer lines of activity, although these lines promise lower probable profits. In this case, at each level of price, they may produce less than before causing the supply to decrease.

- Changes in the number of firms: If the number of firms supplying similar products increases in the market, then at each price level, the share of each firm in the market supply may fall. In that case, the individual supply curve would shift in a leftward direction.

Question 8:

(a)

- Define a tax. State two differences between income tax and commodity tax.

- Explain how tax can be used as an instrument to regulate consumption and production in any economy. [8]

(b) Define the terms liberalization and globalization. Discuss any two measures adopted by the state to promote economic development. [7]

Answer:

(a)

1. A tax may be defined as a compulsory payment made by the citizens to the Govt, to defray the common expenses incurred for all, without reference to special benefit conferred.

Two differences between income tax and commodity taxes:

| Income tax | Commodity tax |

| 1. It is a direct tax. Its impact and incidence is on the same person. | It is an indirect tax. Its impact falls on the producer and incidence falls on the consumer. |

| 2. It can be evaded by filing false returns. | It cannot be evaded. One has to give up the consumption of the commodity in order to evade the tax. |

2. Taxes can be used as an instrument to regulate consumption and production in an economy in the following manner:

Consumption—Taxes are sometimes used to discourage the consumption of harmful goods like liquors, tobacco etc. Government imposes high rates of taxes on such commodities thus causing their prices to increase and their consumption to fall.

Production—A decrease in the consumption of commodities due to imposition of higher rates of indirect taxes also discourages their production. Thus resources are diverted from the production of non-essential goods to essential goods. Resources are diverted from the production of luxury goods to the production of necessity goods which are consumed by the masses.

(b) Liberalization may be defined as the liberalized view of the Government in respect of trade policies, industrial policies, fiscal and monetary policies etc. It wants to minimise state intervention in economic activities.

‘Globalization’ means integration of the domestic economy with the world economy mainly by allowing free flow of goods and services between countries and withdrawing of all types of unnecessary restrictions trade, especially import controls.

Two measures to promote economic development:

- Development of Social and Economic Infra-structure: Government is responsible for the development of economic infrastructure like roads, railways, dams, electricity, irrigation etc. and also social infra-structure like education, health services, etc.

- To control Economic Fluctuations: The market forces of demand and supply are not able to control economic fluctuations in the country because the production and prices fluctuates on accounts of changes in demand and supply. Fluctuations in production and prices cause economic unstability which is not conducive to economic development. Therefore, state intervention is required to control economic fluctuations for proper development of the country.

Question 9:

(a) Read the extract given below and answer the questions that follow:

Annual food price inflation inched up to 13.39% in the week ended October 24 from 12.8% in the week before, a statement by the Ministry of Commerce on Thursday showed. The weakest monsoon rains in the last seven years and floods in parts of the country have hurt farm output and pushed up the food prices, reports Our Bureau from New Delhi. —The Economic Times, 28th October, 2009

- Briefly explain walking inflation and running inflation.

- Give two reasons for soaring food prices.

- Suggest two measures to combat inflation. [8]

(b) Discuss the role of the Central Bank as the banker and fiscal agent to the Government. [7]

Answer:

(a)

- Walking Inflation—If the general price level of the economy increases at rate of about 5-6 per cent per annum, it is called walking inflation.

Running Inflation—When the price level rises a bit faster and the rate of growth of the price level is about 10 per cent per annum, it is called running inflation. At this stage, the inflation rate just becomes double digited. Here, the price movements are compared with the trotting of a horse. - Two reasons for soaring food prices are:

- The weakest monsoon rains in the last seven years and

- Floods in parts of the country have hurt the farm output.

- Two measures to combat inflation are:

- Increasing Growth Rate of Agricultural and Industrial Output—

This can be achieved by providing the necessary raw materials and the infra-structural facilities needed for the growth of agriculture and industry. - Control Money Supply—Demand-pull inflation is caused by increase in money supply so the money supply can be kept under control by the commercial banks through restricting the flow of credit into the economy. This will reduce the purchasing power of the people and hence their demand for goods and services thus help to curb inflation.

- Increasing Growth Rate of Agricultural and Industrial Output—

(b) The central bank acts as the banker to the Government. The Government maintains an account with the central bank just as individuals keep their accounts in the commercial banks. All incomes of the Government are deposited into this account. All the expenses of the Government are incurred out of this account. If necessary, the Government can borrow from the Central Bank.

As a fiscal agent, the central bank is in charge of managing the Government’s public debt i.e. it sells Government’s bonds to the public, pays regular interest and repays the loan after the maturity date.

Question 10:

(a) The main functions of a commercial hank are to accept deposits and advance loans.

Explain two types of deposits accepted and two types of loans given by commercial banks. [8]

(b) Distinguish between Fiat money and Bank money.

Explain two primary functions of money. [7]

Answer:

(a) Two types of deposits accepted by a commercial bank are:

- Fixed deposits—These deposits are accepted for a fixed period of time. The depositors cannot withdraw their money before the fixed period of time. The rate of interest is the highest on the fixed deposits. The depositors are not given a cheque book or a pass book. They are given a fixed deposit receipt which contains the details of the deposit. The depositors can even avail of the loan facility against their fixed deposit.

- Recurring Deposit—In this deposit, a fixed amount of money has to be deposited regularly, at fixed intervals for a fixed period of time. The rate of interest is higher than savings deposit but less than the fixed deposits. The money can be withdrawn only on the maturity date. No cheque book is issued to the customer.

Two types of loans given by commercial banks:

- Term Loans or Outright Loans—In this case, a lump sum is sanctioned to the borrower and the entire sum is credited to the current account of the borrowers. The borrower has to pay interest on the entire amount.

- Overdraft Facility—When any account holder is allowed to withdraw a sum of money in excess of the amount deposited with the bank, it is called an overdraft facility. Here, the borrower who has received this facility, has to pay interest on the amount overdrawn.

(b) Fiat Money defers to that money which is issued by order/authority of the government. It includes all notes and coins which the people in a country are legally bound to accept.

Bank Money consists of optional money which may or may not be accepted in the discharge of debts. Bank money represents claims on deposits left with banks. People keep part of their cash as deposits with banks which they can withdraw anytime they like or transfer to some one else.

Examples—cheques, bank drafts, credit cards etc.

Two primary functions of money: Refer Ans. 2 (c), 2015.