ICSE Economic Applications Previous Year Question Paper 2009 Solved for Class 10

ICSE Paper 2009

ECONOMIC APPLICATIONS

(Two Hours)

Answers to this Paper must be written on the paper provided separately.

You will not be allowed to write during the first 15 minutes.

This time is to be spent in reading the Question Paper.

The time given at the head of this Paper is the time allowed for writing the answers.

Section I is compulsory. Attempt any four questions from Section II.

The intended marks for questions or parts of questions are given in brackets [ ].

SECTION-I (40 Marks)

(Attempt all questions from this Section)

Question 1:

(a) Explain two functions of land. [2]

(b) Differentiate between Giffen good and inferior good. [2]

(c) Why is the Reserve Bank of India known as the Lender of the last Resort? [2]

(d) State two reasons for the shift of the demand curve to the left. [2]

(e) Can Direct Taxes reduce income inequality? [2]

Answer:

(a)

- The Supply of land resources in a country determines the level of agricultural production of that country.

- Supply of land also determines supply of mineral resources in a country.

(b) Giffen goods may be defined as those whose price effect is positive and income effect is negative. All Giffen goods are inferior goods, but all inferior goods are not Giffen goods.

Inferior goods are those whose income effect is negative. In case of Giffen negative income effect is always stronger than substitution while in case of inferior, it may or may not be.

(c) The central bank is called lender of last resort because just as the public can borrow from commercial bank, it can borrow from Central bank, in case of need. The central bank is under the obligation to provide funds to commercial bank by rediscounting bills of exchange as and when they need financial help.

(d)

- If the price of substitute good falls, consumers will be attracted to this substitute good, this implies shift to the left.

- When the consumer develop a taste for a commodity.

(e) Yes, tax policy can be used to reduce economic status of the rich to the level desired. Direct taxes on wealth and capital gains be increased. Taxes on rich agriculturists and on the land values may also be considered. Through laws, no company be allowed to possess more assets than the maximum permitted. Only those big industrialists be allowed some concession who establish industries in backward regions to help the poor.

Question 2:

(a) The nature of a commodity determines its price elasticity of demand. Explain. [2]

(b) Why do we deposit money with Commercial Banks? [2]

(c) State two ways in which the public sector is important even at the present times. [2]

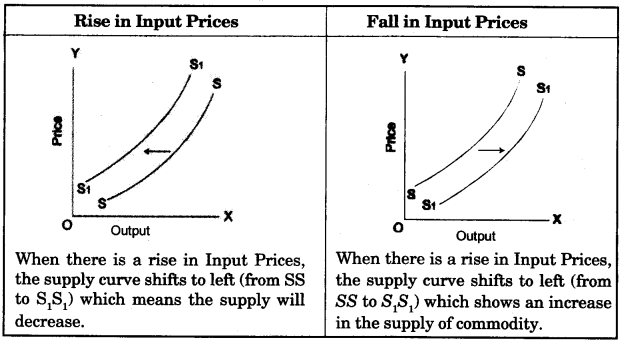

(d) What effect does increased input prices have on the supply of a commodity? Draw a diagram to explain your answer. [2]

(e) Which of the following will be treated as labour in Economics? Give a reason for each:

- Preparation of food by a housewife.

- Singing for ones own pleasure.

- Driving his master’s car by a driver.

- Playing cricket by Mahendra Singh Dhoni. [2]

Answer:

(a) Elasticity of demand is the degree of responsiveness of demand for a commodity to change in its price. Generally, necessaries like salt, sugar, seasonal vegetables etc. have less elastic demand whereas luxuries like A.C., T.V., Car, have elastic demand.

(b) We kept money in bank for its safe custody and to enjoy interest on our savings and to use the facilities like overdraft, cheque etc.

(c) Investment in the infrastructure sector like power, irrigation, transport etc. has helped in agricultural and industrial development.

Contributed a lot towards the growth of export oriented industries and foreign exchange earnings.

(d) Supply of commodity is also affected by the price of factors used for the production of the commodity. If the factor price decreases, cost of production also reduces, accordingly supply increases. Conversely if the factor price increases, cost of production also increases and supply tends to decrease.

(e)

- It is not treated as a labour in economics, as it is not a occupational division of labour. It is done for social obligation and self satisfaction and does not earn wages for services.

- It is not treated as labour in Economics as it is being done for its own pleasure not with the motive of earning money.

- It is treated as a labour in economics as it is a occupational division of labour, it refers to a system when one performs any particular occupation.

- It is not treated as a labour in economics as it is not a occupation division of labour. It is done for self satisfaction and pleasure and does not earn money.

Question 3:

(a) An entrepreneur is an organizer but an organizer need not be an entrepreneur. Explain. [2]

(b) State two important characteristics of monopoly. [2]

(c) What are savings bank accounts? Compare the rate of interest given to such an account to that of a Current account and a Fixed Deposit. ** [2]

(d) Differentiate between direct and indirect tax. [2]

(e) With the help of an example explain the process of creation of form utility. [2]

** Answer has not given due to out of present syllabus.

Answer:

(a) An entrepreneur is a person or a group of persons who owns the enterprise and gets profits, whereas, an organizer is a person who organises the business and gets a fixed salary. He does not perform the other functions of an entrepreneur like risk taking and bearing uncertainty etc.

(b) Two characteristics of monopoly:

- Single Seller and Many buyers: In the monopoly market, the single fim consists the whole industry. The supply made by this firm means the supply of the whole industry. But, there are many buyers of the product sold in the market.

- Types of the product: The products may be homogeneous or non- homogeneous but no close substitutes are available in the market.

(d) A direct tax is that tax whose burden is borne by the same person on whom it is levied. He cannot shift or transfer the burden of tax on some other person; he has to pay it himself. For example, income-tax is a direct tax as it has to be paid by the person on whom it is levied.

An indirect tax is that tax which is initially paid by one individual but the burden of which is passed once to some other individual who ultimately bears it.

(e) It is created when the shape or size of things are changed to give them a new utility.

Example: When a carpenter converts timber into chairs, he gives it a form utility. Form utility is created, when the form of existing matter is changed to make it more useful or more acceptable.

Question 4:

(a) Distinguish between Fiscal Policy and Monetary Policy. [2]

(b) How do commercial banks invest their surplus funds? [2]

(c) How does increased money supply affect prices in an economy? [2]

(d) What is meant by the income effect of a fall in the prices of a commodity? [2]

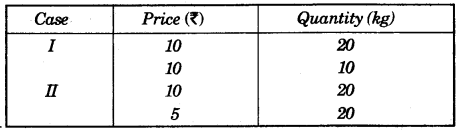

(e) The following table shows a change in the demand. Read the table carefully and answer the question that follows: [2]

What type of change is it—decrease in demand or contraction in demand? Give reason.

Answer:

(a) Refer Ans. 4 (c), 2013.

(b) Commercial banks, firstly keep certain amount to RBI as a cash Reserve. Then the banks lend loans to their customers, invest in production houses as well as invest in Gilt edged markets i.e. Govt. Bonds, Debentures etc. to increase their profits.

(c) Money supply refers to the amount of money held by the public in an economy at any given time.

Increased money supply results in increased purchasing power thereby increasing the aggregate demand, which in turn increases the prices of the goods and services.

(d) When the price of a commodity falls, the consumer can buy a larger amount of the commodity with his given money income. Or, he can buy the same amount of the commodity as before and at the same time he would be able to save some money. In other words, a fall in the price of the commodity results in an increase in real income i.e. purchasing power of the given money income increases.

(e) There is a contraction in demand.

In case I, there is a fall in demand as same price.

In case II, there is a same demand at fall in price.

SECTION-II (60 Marks)

(Answer any four questions from this section)

Question 5:

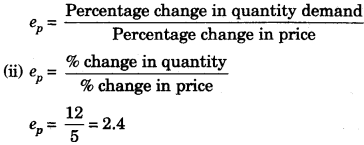

(a) (i) Define price elasticity of demand. Give the percentage formula of price elasticity of demand.

(ii) As a result of 5% fall in the price of a good, its demand rises by 12%. Find the price elasticity of demand.

(iii) What type of good is this? Give reasons.

(iv) Give two examples of such a good. [7]

(b) Give reasons for the following:

- Product differentiation is practiced in monopolistic competition.

- Creeping inflation is regarded essential for economic growth. [8]

Answer:

(a)

(i) Price elasticity of demand may be defined as the degree of responsiveness of quantity demanded of a commodity in response to change in its price.

(iii) Relative elastic Demand i.e. Normal good.

This type of good is highly price elastic demand because a small change in price leads to high change in demand.

(iv) (a) Television as consumer durable.

(b) Milk as consumer non-durable.

(b)

- Product differentiation is the key element in monopolistic competition. Under monopolistic competition firms produce differentiated products. The products produced by different firms are similar but not identical. They are substitutes for each other, but not perfect substitutes. These products are not homogeneous, but they are not altogether different as well. They are similar enough to be regarded as same commodity, but are sufficiently different so that consumers tend to regard them different from each other.

- When the price level increases at a very slow rate, say at the rate of only 2% to 2.5% per annum, it is called creeping inflation. This type of inflation is not of much concern so it is not essential for economic growth.

Question 6:

(a) Which of the following statements are correct and which are incorrect? Give reasons to support your answer.

- To control inflation, the central bank lowers the bank rate.

- Uniform price is a key feature of a perfectly competitive market. [7]

(b)

- Define money.

- What is legal tender money? **

- Explain how money facilitates production and trade. ** [8]

Answer:

(a)

- Bank rate is that discount rate at which the central bank of any country rediscounts the bills of exchange submitted by any commercial bank to take loans from the central bank. To check inflationary pressures, the RBI increases the bank rate. This discourages the investors to take loans from commercial banks, resulting in fall in investment in the economy, leading to a control on inflation. Similarly the RBI keeps the Bank rate at a low level to check the deflationary situation.

- In perfectly competitive market, the price is determined by the industry i.e. by all the firms taken together, by the forces of market demand and supply. An individual firm takes the price as given and he has to take decision about the amount of output to be sold on that price. Thus the firm under perfect competition is assumed to be price taker rather than price maker.

(b) 1. In any country, the commodity which acts as a medium of exchange, the measure of value, the standard of deferred payments and as a store of value, is defined as money.

Question 7:

(a) State one important function of capital.

Differentiate between:

- Capital and wealth. **

- Capital and income. **

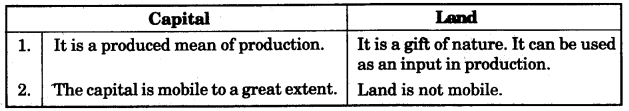

- Capital and land. [7]

(b) In less developed countries, the state has an active role to play in establishing social justice. Explain four methods adopted by the Government to fulfil this objective. [8]

Answer:

(a) It expands employment: Since capital expands production, it also expands employment. Thus, if we are to reduce the volume of unemployment in the country, we must pay attention to capital formation in a country.

Differentiate between:

(b)

- Various poverty alleviation programmes to generate income and income earning assets for the rural and Urban poor people.

- Redistribution of agricultural lands among the landless farmers through the implementation of Land Ceiling Acts.

- Redistribution of Income, by charging high Income tax on rich people and spending on poor people by providing facilities like schools, hospitals and employment.

- By providing law and order in the country so as to develop confidence in the minds of domestic and foreign Investors for the purpose of providing development of the economy.

Question 8:

(a) What is meant by economic depression? **

For each of the following measures, state whether they are taken during inflation or depression. Give reasons for your answer.

- Direct taxes are reduced and public expenditure is increased.

- Government securities are sold by the central’ bank in the open market operations.

- Credit rationing. [7]

(b) Monopolistic competition is a perfect blending of monopoly and perfect competition. Explain. [8]

Answer:

(b) Monopolistic competition is a market situation where there is a large number of buyers and sellers selling closely related goods but surely not homogeneous. For example, take the case of tooth-paste, most commonly used commodity. There are many tooth pastes in the market, such as Colgate, Cibaca, Close-up, Pepsodent, etc. These are all closely related goods but there may be difference in quality, colour, size, taste etc. which separate them from one another. Each producer has a monopoly control over his own product but competition exists between them. Thus, we find a combination of monopoly and competitive elements. Similarly, we can take another example of toilet soap. There is a large number of firms producing different brands or varieties of soap, e.g. Hamam, Pears, Lifebuoy, Lux, Nirma etc. Each firm enjoys monopoly over its brand. For instance, Hindustan Lever Ltd. has monopoly over the trademark Lux. But there is a competition among these firms producing soap. Similarly, markets of so many products like tea, shoes, shampoo, watches, clothes, fans, bulbs, T.V. sets, pens, sewing machines, washing machines, etc. are example of monopolistic competition.

In real life, neither perfect competition nor monopoly are seen. Almost, every market seems to have the features of both perfect competition and monopoly, Economists call such a market as monopolistic competition or imperfect competition. The concept of monopolistic competition was developed by an American economist Prof. Chamberlin while Mrs. Joan Robinson gave the concept of imperfect competition. According to Leftwitch, “Monopolistic competition is a market situation in which there are many sellers of a particular product, but the product of each seller is in some way differentiated in the minds of consumers from the product of every other seller.”

Thus, monopolistic competition is the blending of two extreme markets viz. perfect competition and monopoly.

Question 9:

(a) Read the extract given below and answer the questions that follow:

Business Telegraph, 23rd July 2008.

Inflation is already at a 13 year high of 11.91%. Any further hike in fuel prices could trigger more price pressures and cause widespread discontent. The Government raised the price of petrol by Rs. 5 per litre, diesel by Rs. 3 per litre and domestic LPG cylinder by Rs. 50.

- How does a rise in fuel price create inflation in a country?

- What is cost push inflation?

- Explain the effect of inflation on the following:

- Fixed income group in the economy.

- Distribution of income.

- Capital formation.

- Producers. [10]

(b) What is meant by privatization of public sector units?

Explain four benefits of privatization. [5]

Answer:

(a)

- Fuel is a commodity used in the production of any commodity directly or indirectly. Fuel can be used directly as raw material and indirectly for transporting goods. Therefore rise in fuel price means, increase in cost of production of all the commodities and hence it creates inflation.

- The price level rises because of increasing cost of production. Rise in prices of factors of production like wage cost, rent etc. are the cost push factors.

- Effect of inflation:

- Fixed income group in the economy: Real income means purchasing power of the money income. Fixed income group includes pensioners, Government servants etc. who get a fixed money income. This class is worst affected by inflation because the purchasing power of their fixed income goes on decreasing with rising prices.

- Distribution of income: The profit incomes of the businessmen entrepreneurs increase during inflation, while the real income of the common salaried people declines. Thus, the pattern of income distribution in the economy or society becomes unequal.

- Capital Formation: A majority of the governments of under developed countries have to take to deficit financing so as to make up for the growing expenditure on economic development. As a result, there is a lot of increase in prices.

- Producers: This class gains by inflation because: (1) They produce more to meet rising demand (2) They stock large quantity of raw material bought at pre-inflation prices (3) Wages increases less than the prices. (4) Those entrepreneurs and traders who repay the loans borrowed earlier stand to gain.

(b) Privatization means the transfer of managerial control of any public sector units to any private enterprises or to any private corporate body.

Benefits of Privatization:

- Creation of Competitive Environment: It is argued that if the ownership of public sector enterprises is transferred to private sector, then the monopoly of public sector enterprises will come to an end. But in fact, it will create a competitive environment which is must for industrial development of a country.

- Clarity of objectives: In several PSUs, there is no clarity in corporate objectives. There exists a high degree of confusion among the managers of PSUs regarding the profit objectives as well as social responsibility. Many PSUs failed on both fronts. Thus, after privatization profit becomes the foremost social responsibility of PSUs.

- Reduction of Budgetary Deficits: There would be no question of budgetary deficit, if the PSUs yield a 10% return on investment. But in reality it is not so. The budgetary deficit have risen sharply from year to year. For instance, the budgetary deficit which was Rs. 1417 crores in 1983-84, has increased to Rs. 1,51,000 crores in 2005-06. Therefore, the Government can control its staggering budgetary deficit by using the sale proceeds on the shares in PSUs.

- Reduction in Public Debt: Prof. Hoouer has rightly observed, “Blessed are the young for they shall inherit the national debt.” A very common dictum is, “Be not be made a beggar by banqueting upon borrowing.” The public debt has increased in astronomical proportions. “In 1950-61 public debt was of Rs. 290 crores which in 2004-05 increased to Rs. 19,86,167 crores. This rapid increase in public debt is an alarming problem and if such a increase in public debt is not drastically reduced, India will have to face economic retardation.

Question 10:

(a)

- Explain three important functions of a Commercial Bank.

- What is meant by Cash Reserve Ratio? [7]

(b)

- Explain four factors on which efficiency of labour depends.

- Give two causes of inefficiency ofIndian labour. [8]

Answer:

(a)

- Acceptance of deposits: The principal function of any commercial bank is to accept deposits from different individuals and institutions. The commercial banks open an account for this purpose.

Generally, commercial banks keep three types of deposits:

(a) Fixed or time deposits: Here the depositors keep their money for specified period of time and earn a given rate of interest (per annum).

(b) Savings deposits: Though the depositors get interest on the deposited amount interest is relatively less as compared to that in fixed deposits.

(c) Current deposits: Here the depositor does not get any interest on their deposits but get the ‘overdraft’ facilities (i.e., withdrawal of deposits in excess of the deposited amount). - Providing loans: Commercial banks also give short and medium-term loans against some collateral, securities or by mortgaging of some assets and charge interest on such loans.

These loans can be divided into four categories:

(a) Ordinary loans: In these cases, the commercial banks give loans for purchasing consumer durables for building ‘own house’, etc.

(b) Cash credit: This type of loan is given to any business firm. The bank fixes certain ‘credit limit’ determined on the basis of the value of stocks/sales of that firm. The firm is allowed to withdraw money from its account within that credit limit.

(c) Overdraft facility: In this case, the bank allows the depositor to withdraw money in excess of the deposited amount in its account.

(d) Discounting bill of exchange: Commercial Banks also given loans by rediscounting the bill of exchange submitted by the debtors for this purpose. - Transfer of funds: Commercial Banks help the customers in transforming funds from one place to another through different credit instruments such as bank drafts, mail transfers etc.

- Acceptance of deposits: The principal function of any commercial bank is to accept deposits from different individuals and institutions. The commercial banks open an account for this purpose.

- Cash Reserve Ratio refers to cash reserves of the commercial banks with RBI, as a percentage of their total deposits. During inflation, the Central Bank increases the cash reserve ratio. As a result, the amount of loanable funds with the commercial banks decline and the process of credit creation by the commercial bank is checked.

(b)

- Factors on which efficiency of labour depends

- Racial Characteristics: The efficiency of labour to a great extent depends upon the racial stock to which it belongs and the heredity of labour. People of some regions are physically sturdy and hard working as compared to other places. As such they are very enterprising and comparatively more efficient in jobs where physical labour is involved.

- Climatic Conditions: It has been found that climatic conditions greater influences the efficiency of workers. Generally, cold climate is more conductive to hard work than the hotter one. The workers of the temperate regions are more hard working than those of tropical regions. However, extremely cold climate is also unfavourable for human activities. Accordingly the productivity of worker is influenced by the climatic conditions to a considerable extent.

- General and Technical Education: The general education broadens the knowledge, develops the intellect and improves the skill of a person. The technical education provides knowledge to a worker concerning different systems of work of the productive units. All these make an educated person more efficient and better in skills, as compared to an uneducated and untrained person.

- Personal Qualities and Character: The workers possessing good moral character and having qualities like honesty, intelligence, preserverance, resourcefulness, sense of responsibility and ability to take correct decision will definitely be more efficient than those who do not possess the above qualities. Personal qualities of willingness to work and to progress in life, makes a worker more ambitious and he becomes more and more hard working and efficient. Such workers do not remain satisfied with their present position and always remain active for further progress in life.

- Causes of Inefficiency of Indian Labour:

- Low Wages: If higher efficiency leads to higher income, then only the workers have the incentive to become more efficient. But generally the wages of labour in India are low and so is the standard of living. As such, the workers are not in a positive mood to keep themselves physically and mentally fit and in sound health, and they have little leisure time for recreation. This is also a cause of low efficiency.

- Migratory Character: A very high proportion of worker usually come to . work in factories from villages when their agricultural activities are minimum. During the period when the agricultural activities start, these workers take leave or remain absent from work. This type of migratory behaviour lowers the efficiency of workers and productivity of industrial units.