ICSE Commercial Studies Previous Year Question Paper 2016 Solved for Class 10

ICSE Paper 2016

COMMERCIAL STUDIES

(Two Hours)

Answers to this Paper must be written on the paper provided separately.

You will not be allowed to write during the first 15 minutes.

This time is to be spent in reading the Question Paper.

The time given at the head of this Paper is the time allowed for writing the answers.

Attempt all questions from Section A and any four questions from Section B.

The intended marks for questions or parts of questions are given in brackets [ ].

Section-A (40 Marks)

(Attempt all questions from this Section)

Question 1:

Distinguish between:

(a) Verbal Communication and Non-verbal communication. [2]

(b) Budget and Forecast. [2]

(c) Fixed Cost and Variable Cost. [2]

(d) Coupons and Premiums. [2]

(e) Sales Promotion and Advertising. [2]

Answer:

(a)

Verbal Communication | Non-verbal Communication |

1. It is a transmission of message through spoken words. | 1. It is a transmission of message through written words. |

2. It is appropriate during emergent situations as it takes less time in transmitting. | 2. It is inappropriate for urgent messages as it takes more time for transmission. |

| 3. It is economical as no use of stationery is there. | 3. Usage of stationery makes it costlier. |

4. Use of body language facial expressions makes it more impressive. | 4. Use of body language is not possible. |

| 5. It is more flexible as changes can be made anytime and immediate feedback is possible. | 5. To make changes it takes time which makes it less flexible and immediate feedback is not possible. (any two) |

(b)

Budget | Forecast |

1. Budget shows the policy and programme to be follows in a future period under planned conditions. | 1. Forecast is a mere estimate of what is likely to happen. It is a statement of probable events which are likely to happen under anticipated conditions during a specified period of time. |

| 2. It is usually planned separately for each accounting period. | 2. It may cover a long period or years. |

(c)

Fixed Cost | Variable Cost |

1. Fixed costs are those costs which remain fixed in amount irrespective of changes in the volume of output during a given period of time. | 1. Variable costs are those costs which vary in amount with changes in the level of output or activity. |

| 2. Fixed costs do not change with changes (increase or decrease) in the level of activity upto a certain limit. | 2. Variable costs increase and decrease in the same proportion in which the level of output increases or decreases. Variable costs vary in total amount but remain constant per unit of production. |

(d)

Coupons | Premiums |

| A coupon is a certificate that entitles its holder to a specified saving or discount. They are used to introduce new products and to increase sales of established products. | Premium is the offer of an article free of cost or at a nominal price on the purchase of a specified products. |

(e)

Sales Promotion | Advertising |

1. Sales promotion is all marketing activities which stimulate consumer buying and dealer effectiveness. | 1. Advertising is any paid form of impersonal presentation and promotion of a product, service or idea by an identified sponsor. |

| 2. The aim of sales promotion is to increase immediate sales. | 2. The aim of advertising is to build image of producer and his product. |

Question 2:

(a) What is a ‘Cash Budget’? [2]

(b) What do you understand by ‘Formal Communication’? [2]

(c) What does a pay-in-slip contain? [2]

(d) Write a short note on ATM. [2]

(e) What do you understand by ‘Brand Promotion’? [2]

Answer:

(a) Cash Budget: Cash Budget is a summary statement of the firm’s expected inflows and outflows of cash over a future time period. It involves a projection of future cash receipts and cash payments over different time intervals. A cash budget is helpful in:

- Determining the future cash requirements of the firm.

- Planning for financing of those requirements.

- Exercising control over cost and liquidity of the firm.

(b) Formal Communication: Formal communication refers to the flow of information along the lines of authority deliberately and consciously established by the management in the organisation structure. It takes place from one position to another in the formal organisation. For example, the marketing manager of a company may send a revised price list to branch managers. Formal communication occurs both in writing mid orally. Orders, policy manuals, news bulletins, official meetings, interviews, etc., are main forms of formal communication. It is used for the transmission of official messages. Formal communication is authorised and well planned.

(c) Whenever an account holder wants to deposit cash or cheque in his bank account, he has to fill in a form called pay-in-slip. Pay-in-slip has the name of the bank’s customer, account number, date, amount in words and figures, cheque number, bank’s name and branch, cashier’s signature etc.

(d) ATM stands for Automated Teller Machine. An ATM renders teller’s job 24 hours a day. It is a self-service terminal which renders the facility of withdrawal and deposit of money to the bank customers. Each customer is given a separate plastic card to avail the services at the ATM. The customer has to insert the plastic card into the terminal and enter his identification code. The machine Would then respond to the customer’s instruction of giving cash, taking deposit and handling other banking transactions.

(e) Brand Promotion: Brand promotion is a strategy that is commonly used in marketing in order to increase customer loyalty, awareness of products, and sales. Instead of focusing on a specific product or products, a company instead tries to focus on the promotion of its brand. This strategy has been proven to be very effective in marketing, and many companies currently employ it.

Companies have used brand promotion for many years, and it is still successful in today’s market. With this strategy, one of the primary objectives of the company is to increase brand awareness. Brand promotion also leads to increases in sales in many cases.

Question 3:

(a) How does financing facilitate the marketing activity? [2]

(b) Mention any four sources of external recruitment. [2]

(c) Explain any two modes of purchasing goods. [2]

(d) Explain any two disadvantages of Road Transport over Water Transport. [2]

(e) How does an ‘Organizational barrier’ affect Effective Communication? [2]

Answer:

(a) Financing is one of the important factor that can affect the marketing activity, For example, if finance department in any organisation limits the marketing budget, than it makes difficult to reach the target demographic. Hence, more financing will facilitate the marketing activities to reach more and more demographic.

(b) Four sources of external recruitment:

- Advertisements

- Placement Agencies

- Campus Interviews

- Employment Exchanges.

(c) Modes of Purchasing Goods:

- Purchase Cards: Purchase cards work well for medium-sized purchases that you need to track but that don’t necessitate a purchase order requisition.

- Purchase Orders: These are requisition forms that acts as a formal agreement between buyer and supplier regarding the prices and terms agreed upon for the purchase.

(d) Two disadvantages of Road Transport over Water Transport:

- In road transport maintenance charges are required therefore freight charges are not stable and uniform whereas rivers and oceans are natural tracks and no capital investment is required for their maintenance so water transport is stable and cheapest mode of transport.

- Road transport can carry only a small load and is not suitable for heavy and bulky goods in large quantity whereas water transport is extremely suitable for carrying heavy and bulky goods.

(e) Effective communication is essential at all stages in the functioning of an organisation. When the organisational structure of a firm is complex, consisting of several levels of authority, there are greater chances of distortion or breakdown in communication which tends to be slow and rigid and hence effective communication cannot take place.

Question 4:

(a) Give any fwo features of Consumer Protection Act 1986. [2]

(b) State any two functions of a Trade Union. [2]

(c) Explain ‘Marketing Research’. [2]

(d) What is Deferred Revenue expenditure? Give an example. [2]

(e) State any two advantages of Radio advertising. [2]

Answer:

(a) Two features of Consumer Protection Act 1986:

- It provides effective safeguards to the consumers against various types of exploitation and unfair trade practices.

- It is not obligatory to engage any advocate. No court free or any other charges is to be paid by the complainant. The complainant can write his grievance on a simple paper along with the name and address of the opposite party against whom the complaint is made.

- The Act covers both goods and services rendered for consideration by any person or organisation.

- It provides a speedy and simple redressal to consumer grievances. (any two)

(b) Following are the main functions of trade union:

- Trade unions ensure adequate wages, better working conditions, better treatment and a reasonable share and control in the profits and management of industry.

- Trade unions help the workers in case of sickness and accident and give them financial support during the period of unemployment strikes and lockouts.

(c) Marketing Research may be defined as systematic gathering, recording and analysing all facts about marketing problems to facilitate decision making. It involves a careful and objective study of all aspects of marketing. Marketing research is wider term than market research which is a study of only those who buy and distribute the products. Marketing research includes product study, consumer study, price study and distribution channels study.

(d) Deferred Revenue Expenditure are those expenditures which have been incurred in an accounting period and they do not create any asset but their I benefit is spread in more than one accounting period. Example: Advertisement cost. The benefit of such expenditure is enjoyed over a number of years.

(e) Two Advantages of Radio Advertising:

- It is used as a mass-scale advertising medium.

- Because of its mass appeal, it has low cost per exposure.

Section – B (40 Marks)

(Attempt any four questions from this section)

Question 5:

(a) State any five expectations of employees from a business organization. [5]

(b) Explain any five interpersonal skills that are required for effective communication. [5]

Answer:

(a) Expectations of Employees:

- Security of job and continuity of service under congenial conditions.

- A fair remuneration in the form of wages and salaries.

- Safe and comfortable working environment.

- Various welfare facilities such as housing, medical care, social security (in the form of pension, gratuity, provident funds, etc.), health, recreation, etc.

- Opportunities for education, self-development, promotion and career growth.

- Quick and fair redressal of grievances.

- Protection of trade union rights. (any five)

(b) Interpersonal skills required for effective communication:

- Speaking Skills: Ability to speak well is a valuable skill. Speaking is an art and it can be mastered through training and practice.

- Listening Skills: Listening with complete attention and empathy is essential for success in communication. Communication cannot be realized unless a listener completes the loop’.

- Questioning: Questioning is an art that can serve many purposes. It is a great way to initiate a conversation. It demonstrate interest and can instantaneously draw someone into your desire to listen.

- Manners: Good manners tend to make many other interpersonal skills come naturally. With business becoming increasingly more global, even for small businesses, manners are more important than ever. A basic understanding of etiquette translates to other cultures and their expectations.

- Problem Solving: The key aspects of successful problem solving are being able to identify exactly what the problem is, dissecting the problem so that it is fully understood, examining all options pertaining to solutions, setting up a system of strategies and objectives to solve the problem, and finally putting this plan into effect and monitoring its progress.

Question 6:

(a) Explain the exchange functions of Marketing. [5]

(b) Explain any two methods of Marketing Research. [5]

Answer:

(a) Exchange functions of marketing include buying and selling of goods and services. These functions have a common feature in one respect, that they are directly concerned with the change in ownership of goods. Once the right type of product or service is developed, it must be transferred to customers. Products are bought from different sources to meet diverse needs of consumers. The products are sold in small lots over a period of time. Thus, buying and selling are the activities of exchange.

(b) The two methods of marketing research are as follows:

- Observation Method: Observation refers to the process of recognising and noting facts or events. Under this method, the behaviour of consumers is watched through personal observation or mechanical devices. It avoids the pitfalls of questioning such as interference in the consumer’s activity, bias of the interviewer and distortion due to the consciousness of being questioned.

- Experimentation method: Under this method, a control market is established in which all forces except those being tested are kept under check. It seeks to test a theory or to find consumer’s reactions. The method involves a large expenditure of time and money. It requires skilled investigators. Moreover, it is difficult to select test markets and to control the variables.

Question 7:

(a) Explain the main functions of a Commercial Bank. [5]

(b) Enumerate any five limitations of Television Advertising. [5]

Answer:

(a) Functions of the commercial banks:

- Receiving deposits: Receiving deposits is the primary function of a commercial bank. A commercial bank accepts deposits from the people for the purpose of making investments and loans. People deposit money for the sake of safety and also for the sake of interest, which is paid by the bank. The bank by accepting deposits, become indebted to the deposit holders to the extent of credit balance indicated by their account. Deposits are accepted by those banks in the form of following deposit accounts:

- Fixed deposit account.

- Current account.

- Savings bank account.

- Recurring deposit account.

- Lending of money: It is the most important function of a commercial bank. They lends out the money which they get in deposits from the public. A bank lends money to traders, businessmen, agriculturists, artists etc. usually for short periods. Commercial hanks usually lend money in the following ways:

- Cash credit.

- Loans and advances.

- Credit draft and overdraft.

- Discounting of bills.

- Agency functions: Commercial banks render services as the agent of their customer. These services are known as their agency functions. Some of the most important agency functions are as follows:

- They collect the payment of the bills of exchange, promissory notes etc. on behalf of their customers.

- They collect dividends, interest on shares, debentures, rent etc., on behalf of their customers.

- They buy and sell shares and securities on behalf of the customers as per their instructions.

- They transfer their funds from one branch of the bank to another and from one place to another as per instructions of their customers.

- They make payments of loan installments, interest, insurance premium etc. on behalf of their customers.

- Miscellaneous functions: Commercial banks also perform several general utility and miscellaneous services not only to their customers but to the public in general. These are described below:

- They provide safety vaults or lockers for the safe custody of jewellary, valuable documents and other precious possessions of their customers.

- They issue letters of credit, like circular notes, drafts and traveller’s cheques which facilitate the customers in affecting the purchase of goods in distant places.

- They give correct information to the customers about the credit of other customers.

- They give reference about the financial position of their customers, when it is so required.

- They supply various kinds of trade information which is useful to their customers.

(b) Limitations of Television Advertising:

- Television advertising is very costly and only well-established firms can afford it.

- Television advertisements have a very short life and back reference is not possible thus they do not express much about the product.

- It is not flexible as the immediate changes in advertisement are not possible.

- It involves complicated procedure. Producing the TV advertisement involves hiring advertising agency, video editors, actors and script writers.

- Television commercials have to abide by the broadcast code strictly.

Question 8:

(a) Explain any five steps in the Selection process of employees. [5]

(b) Describe the importance of training to employees and employers. [5]

Answer:

(a) Various stages of the Selection Process of Employees in an organisation are:

- Preliminary Interview: This is the first step in the process of selection which is conducted to know the minimum qualification, experience and age of the candidates.

- Application Form: After qualifying Preliminary interview the candidates are asked to fill in the prescribed application form to get the written details of the candidates.

- Employment Test: This is conducted to check the required skills in the candidates.

- Selection Interview: It is a method of checking the information obtained through application and employment test, through face to face communication with the candidates. It also helps the candidate to acquire knowledge about the job details and the company.

- Checking References: It is the process of verifying the names given by the candidate, of the people who knows about him, his previous job and his character.

- Medical Determination and Final Approval: A medical test is conducted to ensure the physical fitness of the candidate which leads to the final approval. The finally approved candidate are issued appointment letters. (any five)

(b) Importance of training: Training is necessary and useful for both employers and employees. A trained work force is a very valuable asset to an organization.

Main advantages of training are as under:

- Increased productivity: Training helps to improve the quantity and quality of work performance. Well trained employees produce more and better goods.

- Better utilization of resources: By training employees they learn new and better methods of doing jobs. They make better use of materials and machinery. As a result wastage of resources and cost of production are reduced.

- Better safety: Training helps to improve the job knowledge and skills of employees. Trained employeed operate machines and equipment more carefully and cause fewer accidents.

- Less supervision: Well trained employees are less dependent on supervision. They are more disciplined, self dependent and responsible. Therefore, need and cost of supervision are reduced.

- Higher Morale: Effective training improves the self confidence and job satisfaction of employees. They take greater interest in their work and feel and sense of security. Their chances of promotion also increase and they can make faster progress in the career.

Question 9:

(a) Explain the following principles of Insurance:

(i) Utmost good faith (Uberrimae fidei).

(ii) Doctrine of suborgation. [5]

(b) What is meant by recycle? How do environmental values help a common man? [5]

Answer:

(a)

- Utmost goods faith: An insurance contract is based on utmost good faith on the part of both the parties. It is the legal duty of the proposer to disclose all the material facts about the subject to be insured. If the proposer conceals any material facts the insurer can repudiate the contract of insurance. Thus good faith requires each party to disclose all the information at his command to the other party.

- Doctrine of Subrogation: It implies that after indemnifying the insured for his loss; the insurer becomes entitled to all the rights and remedies relating to the property insured. Doctrine of subrogation is applicable to all contracts of indemnity and is not applicable to life insurance. The insurer can recover only what the insured himself could recover. Subrogation applies only after the insurer has paid the claim to the insured.

(b) Recycling is the process of converting waste materials into reusable objects to prevent waste of potentially useful materials, and to redue the consumption of fresh raw materials.

Environmental values make people environmentally conscious. Teaching environmental values encourages people to carry cloth bags, use organic manure, keep surroundings clean, respect other people’s things, reuse of polybags, reuse plastic and glass containers and recycle paper to save trees and to plant more trees.

Question 10:

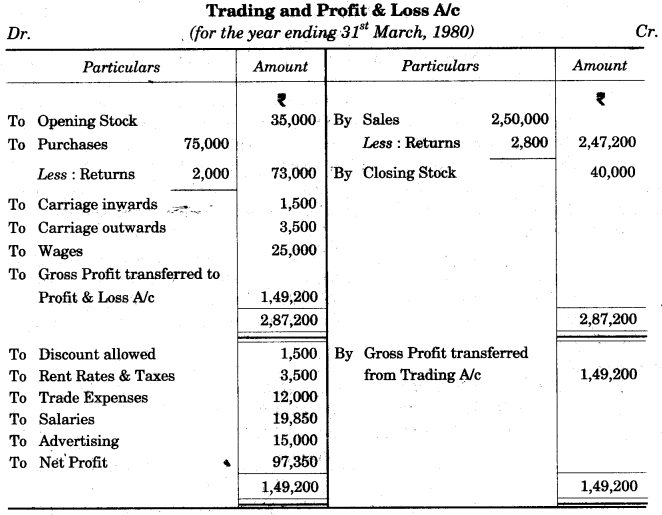

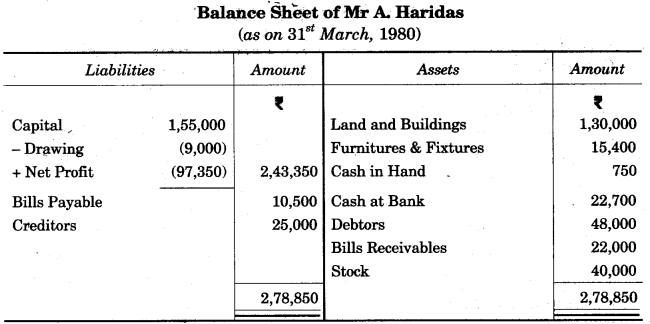

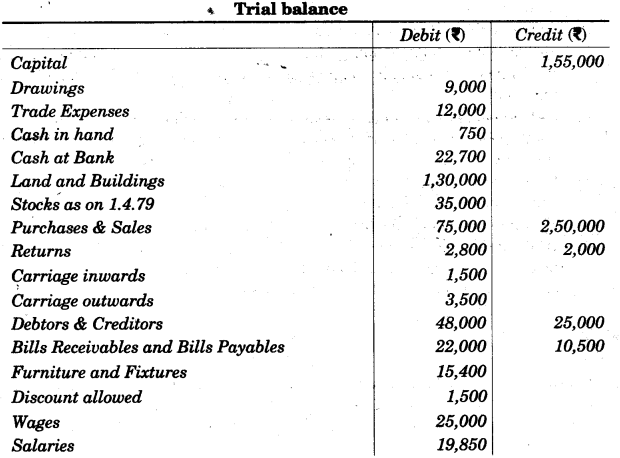

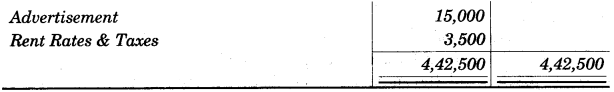

Prepare a Trading, Profit & Loss Ale and Balance Sheet of Mr. A. Haridas for the year ended 31st March 1980 from the following Trial Balance:

The Closing Stock on 31.03.08 was valued at Rs. 40,000 [10]

Answer: