ICSE Economics Previous Year Question Paper 2019 Solved for Class 10

- Answers to this Paper must be written on the paper provided separately.

- You will not be allowed to write during the first 15 minutes.

- This time is to be spent in reading the Question Paper.

- The time given at the head of this Paper is the time allowed for writing the answers.

- Section I is compulsory. Attempt any four questions from Section II.

- The intended marks for questions or parts of questions are given in brackets [ ].

SECTION – I [40 Marks]

(Attempt all questions from this Section)

Question 1.

(a) What are normal goods ? Give two examples. [2]

(b) State any two features of the Consumer Protection Act. [2]

(c) A businessman stocks potatoes in the cold storage during the winter and releases that stock during summer. Will this be considered as production ? Give a reason for your answer. [2]

(d) Mention two ways by which a worker benefits from division of labour. [2]

(e) Give two assumptions of the law of supply. [2]

Answer :

(a) Normal goods are those goods, the demand for which increases with the increase in income of the consumers. For example, a consumer increases his demand for milk, clothes, furniture, refrigerators and TV sets as his income increases. A consumer purchases 2 litres of milk daily when his monthly income is ? 10,000 and purchases 3 litres of milk when his income rises to ? 12,000 per month.

(b) (i) The Consumer Protection Act provides for six rights of consumers.

(ii) The Consumer Protection Councils set up under the Act are intended to promote and protect the various rights of consumers.

(c) Yes, the product was produced in the same financial year.

(d) (i) Right Man at the Right Job : Since work is divided into a number of parts or sub-parts, each worker can be given a job according to his taste and preference.

(ii) Increase in Efficiency of Labour : When a worker does the same work again and again, he gets specialisation in it. In this way, the division of labour leads to a great increase in . efficiency and hence production,

(e) (i) Price of related goods should not change.

(ii) Cost of factors of production should remain the same.

Question 2.

(a) Briefly explain any two merits of direct taxes. [2]

(b) Expand the term RTI. How does this help a citizen of India ? [2]

(c) ‘Define price elasticity of demand. [2]

(d) What is food adulteration ? Mention any one harmful effect of food adulteration. [2]

(e) What is degressive tax ? [2]

Answer.

(a) (i) Equitable : A direct tax is an equitable tax as it is levied according to the tax paying capacity of the people. Under progessive taxation system, tax rate increase as the income increases.

(ii) Economical : Direct taxes are economical in the sense that cost of collecting them is low. They are usually collected ‘at the source’.

(b) RTI is Right Information Act which empower citizens to find out what is happening in government. The citizens have the right to seek any information from any public office.

(c) Price elasticity of demand means the change in the quantity demanded of a commodity in response to change in its price. In other words, it measures the degree of change of demand in response to change in price.

(d) Food adulteration is the act of intentionally debasing the quality of food offered for sale either by substitution of inferior substances or by the removal of some valuable ingredients.

Example : Addition of melamine into milk, addition ot Vanaspati into Ghee. Honey is adulterated with sugar, brick powder in chilly powder.

Harmful effects of food adulteration are :

(i) Food adulteration reduces the quality of the food and this weakens the health of the one who consumes them, thereby increasing the cost of health care.

(ii) It can also cause heart diseases, loss of eye-sight or tumour.

(e) Under the system rate of tax increases upto a certain limit but after that a uniform rate is charged.

Question 3.

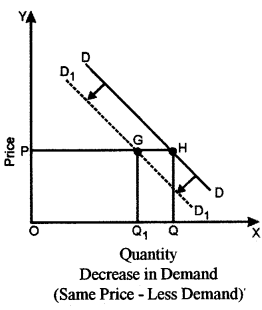

(a) If a buyer buys less of a commodity when his income falls, how will his demand curve change? Illustrate your answer with a diagram. [2]

(b) State two factors which affect productivity of land. [2]

(c) Give two differences between recurring deposits and fixed deposits. [2]

(d) What is overdraft facility ? [2]

(e) State any two reasons for the growth of public expenditure in a country like India in recent times. [2]

Answer :

(a) A buyer will buy less commodity with fall in income for a normal good. Such a situation is known as decrease in demand. The given figure represents the situation of decrease in demand. In the figure, OP is the original price at which quantity demanded is OQ. With a fall in income demand decreases to D1 D1.

(b) (i) Natural Factors : Productivity of land is largely determined by its natural qualities, such as fertility, slope of land, climate, chemical and biological properties of the soil.

(ii) Human Factors : Land cannot produce anything by itself. Man has to apply labour on it to produce for himself. Therefore, productivity of land also depends upon the knowledge and training of workers. A wise farmer can take more produce from the same land than an untrained farmer.

(c) (i) Fixed or time deposit account : Cash is deposited in this account for a fixed time period. They are not payable on demand and do not enjoy chequing facilities.

(ii) Recurring deposit account : Under this account a specialised amount is deposited every month for specified period say 12, 24, 36 or 60 months.

(d) Under this borrower is allowed to over draw the current account balance.

(e) (i) Defence : An important factor responsible for increase in public expenditure is the large defence expenditure. The political situation all over the world is uncertain and insecure. The arms race betw een countries and development of sophisticated armaments and nuclear weapons have resulted in massive defence expenditure. In India, the defence expenditure has increased substantially in view of continued aggression by Pakistan and urgency of national security.

(ii) Population Growth : Another factor responsible for the increase in public expenditure is the growth in population. In India, the population has increased at an alarming rate. Growth in population on this scale has increased the demand for various government services like education, public health, transport, administration and maintenance of law and order. It has also increased the demand for various development activities of the government.

Question 4.

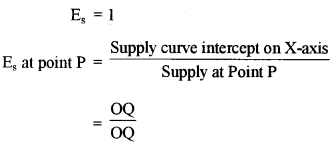

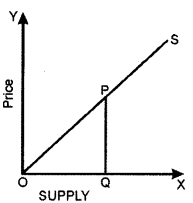

(a) Draw a well labelled diagram showing the price elasticity of supply of a commodity starting from the origin. [2]

(b) What is land in Economics ? [2]

(c) Define supply. [2]

(d) Indirect taxes are regressive in nature. How can they be made progressive ? [2]

(e) The income earned by an entrepreneur is residual in nature. Explain. [2]

Answer :

(a)

This gives us a general property of a straight line curve starting from origin. A straight line supply curv e straight from origin has price elasticity equal to one on all points.

(b) Land is defined to include not only the surface of the earth but also all other free gifts of nature (for example, mineral resources, forest resources and indeed anything that helps us to carry out the production of goods and services, but is provided by nature, free of cost).

(c) The supply of a commodity is defined as the quantity of the commodity which the producers desire to sell to consumers. Thus, the supply is a desired flow. It indicates how much firms are willing to sell per period of time and not how much they actually sell.

(d) Indirect taxes or taxes on necessaries are regressive in nature because they take away a larger proportion of lower income as compared to higher income. Therefore, regressive taxes are unjust in nature. They can be made progressive by reducing the rate of indirect taxes on necessary items like food, clothes, shelter etc.

(e) Income of an entrepreneur is residual in nature as entrepreneur bear risk and reward of risk is profit. Profit is income remaining after deducting all the direct and indirect expenses.

SECTION – B [40 MARKS]

Attempt any four questions from this Section

Question 5.

(a) (i) State the law of demand. [5]

(ii) Briefly explain any two reasons for its occurrence.

(b) Define inflation. Explain its impact on the producers and salaried class. [5]

Answer :

(a) (i) Law of demand states that there is inverse relationship between price and quantity demanded, keeping other factors constant i.e., price of substitutes goods, taste of the consumer, income of the consumer etc.

(ii) Law of Diminishing Marginal Utility : Law of diminishing marginal utility states that as a consumer consumes more and more units of a commodity, the utility derived from each successive unit goes on decreasing. So demand for a commodity depends on its utility. If the consumer gets more satisfaction, he will pay more. As a result, consumer will not be prepared to pay the same price for additional units of the commodity. The consumer will buy more units of the commodity only when the price falls.

Income Effect : Income effect refers to effect on demand when real income of the consumer changes due to change in price of the given commodity. When price of the given commodity falls, the purchasing power (real income) of the consumer increases. As a result, he can purchase more of the given commodity with the same money income.

(b) It is a situation in which prices of goods and services persistently rise at a fast face.

(i) Impact on Producers : Businessmen (i.e., entrepreneurs, traders, producers, etc.) tend to gain during inflation, because

- prices of their inventories (stock of goods and raw material) go up and thereby- increasing their profits.

- prices rise at a faster rate than the cost of production.

- they are generally borrowers of money for business purposes.

Thus, inflation makes the rich (i.e., the business community) richer.

(ii) Impact on Wage and salary earners during inflation : It is due to the reason that wages and salaries do not increase in the same proportion in which the prices or the cost of living rises. But those workers and employees who have formed strong trade unions stand to lose less in comparison to those who are not organised. Due to inflation, purchasing power of money falls. As a result of it, fixed income earners tend to buy less amount of goods and services than before even when there is a little rise in their wages. In this way, inflation increases the economic burden of those persons who are not in a position to bear it. Therefore, it is rightly called unjust.

Question 6.

(a) (i) Define Public debt. [5]

(ii) What are Redeemable debts ?

(iii) Mention two examples of unproductive debt.

(b) Briefly explain the following with reference to the barter system of exchange : [5]

(i) Lack of common measure of value.

(ii) Lack of standard of deferred payments.

Answer.

(a) (i) When planned expenditure of the Government exceeds the total revenue of the Government then the Government needs to borrow money from individuals and organisations. This is called public debt.

(ii) Redeemable public debt is the debt that the government promises to pay off at some predetermined future date. The government regularly pays interest on this debt. The principal amount is paid back on the expiiy of the due date. Therefore, in case of redeemable debt, the government has to make some arrangement for its repayment. Public debts are normally redeemable.

(iii) • Loan raised for war.

• Loan raised for floods.

(b) (i) Lack of Common Measure of Value : Even if the two persons who want each other’s goods meet by coincidence, the problem arises as to the proportion in which the two goods should be exchanged. The value of a commodity or service means the amount of other goods and services it can be exchanged for in the market. It would have to be expressed not just as one in terms of one commodity but in terms of many commodities and services in the market. If there were 1000 goods and services in the market then the value of each would have to be expressed in terms of 999 others.

There being no common measure of value, the rate of exchange will be arbitrarily fixed according to the intensity of demand for each other’s goods. Consequently, one party is at a disadvantage in the terms of trade between the two goods.

(ii) Lack of Standard of Deferred (Future) Payments : Another drawback of barter system is that it lacks a standard of deferred payments. So credit transactions requiring future payments cannot take place smoothly under barter trading. For example, if a person borrows a cow for a year or two, he cannot return the same because by that time, it would have become old, it may or may not be of the same quality as the original one.

There are three main problems in this context. These are :

- It may create controversy regarding the quality of goods or services to be repaid in future.

- The two parties may be unable to agree on the specific good to be used for repayment.

- Both parties run the risk that the value of goods to be repaid may increase or decrease in future.

Question 7.

(a) Explain the following functions of the Central Bank : [5]

(i) Fiscal agent of the government.

(ii) Advisor to the government.

(b) Explain any five characteristics of land. [5]

Answer.

(a) (i) As a fiscal agent, the Central Bank performs the following functions :

- It manages the public borrowings for the government.

- It collects taxes and other payments on behalf of the government.

- It acts as the government agent to enforce foreign exchange control.

(ii) The central bank also acts as the financial adviser to the government. It gives advice to the government on all financial and economic matters such as deficit financing, devaluation of currency, trade policy, foreign exchange policy, etc.

(b) (a) Land is defined to include not only the surface of the Earth but also all the other gifts of nature.

Four characteristics of land :

- Land is limited in supply: Supply of land is fixed as it is given by nature.

- Gifts of nature: Land is a gift of nature which does not have any cost of production. Land is readily available for any use. However, other agents of production are available . at a cost.

- Primary factor of production : Land is a basic factor of production because it cannot produce anything by itself.

- Land has alternative uses: Land can be used for alternative uses such as cultivation, dairy or poultry-farming, rearing of livestock, building of houses, playground etc.

Question 8.

(a) Discuss the risk bearing and decision-making functions of an entrepreneur. [5]

(b) What is Cost Push inflation ? Briefly explain three causes of cost push inflation. [5]

Answer.

(a) (i) Risk-Bearing Function : It is the most important and specific function of an entrepreneur. Every business involves risk. There is no other factor of production except the entrepreneur, who bears risk of the business. The risk is caused by uncertainities attached to production, investment and profits. Another big risk is of technological obsolescence and frequent changes in Government policies. The entrepreneur has to calculate all these risks and then plan the organisation of various factors of production in different proportions.

(ii) Decision-making function : All the vital decisions of business are taken by the entrepreneur. He conceives the idea of a particular business after making an intensive study of the market conditions, business projects and economic viability. He takes all the vital decisions with regard to ‘what to produce’, ‘how much to produce’ how to produce and in what proportion to combine the factors of production.

(b) Cost-push inflation refers to inflationary rise in prices which arises due to increase in costs.

1. Fluctuations in Output and Supply : The wide fluctuations in production of foodgrains has been mainly responsible for price rise. There was a remarkable increase in production of foodgrains during first two plans and supply of foodgrains was good.

But fluctuation in foodgrain production, support prices administered by Government, the tactics of hoarding, adopted by the middlemen and subsequently by the farmers too (utilizing the credit facilities – available from co-operatives and commercial banks), resulted in an increase in price. The power breakdowns, strikes and lockouts result in lower production of manufactured goods. As such both, the primary and secondary sectors recorded a price rise almost dining all the plan periods.

2. Public Distribution System : The defective working of the public distribution system results in an uneven supply of various goods, ultimately affecting the prices of essential commodities by way of artificial scarcity.

3. Rise in Wages : The rise in the general price level raises the cost of living which in turn, leads to demand for higher wages by workers. When the demand for higher wages is met, it will lead to further rise in costs or prices. The fresh rise in prices will again be compensated by giving still higher wages to the workers. This is termed as ‘wage push inflation’.

Question 9.

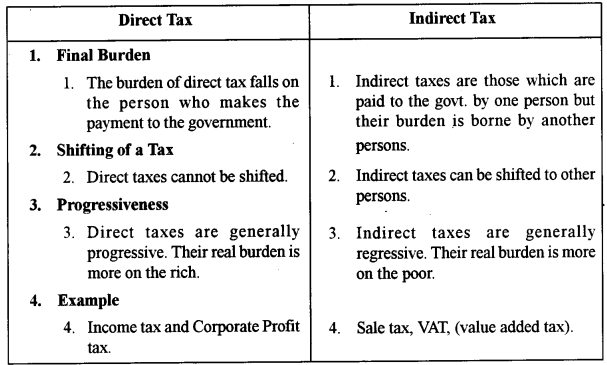

(a) (i) Define Tax. [5]

(ii) Give three differences between direct taxes and indirect taxes.

(b) (i) Define capital formation. [5]

(ii) Briefly discuss the process of capital formation.

Answer.

(a) (i) A tax is a legally compulsory payment imposed by the government. The main differences

between direct tax and indirect tax are given below :

(b) (i) Capital formation refers to net additions of capital stock such as equipment, buildings and other intermediate goods. A nation uses capital stock in combination with labour to provide services and produce goods; an increase in this capital stock known as capital formation.

(ii) There are mainly three stages in the process of capital formation. These are :

(i) Creation of savings

(ii) Mobilisation of savings and

(iii) Investment of savings.

(i) Creation of Savings : Saving is the first stage in the process of capital formation. Savings in a country are made by different individuals. These depends upon several factors like (a) ability to save (b) desire to save and (c) opportunity to save. Ability to save directly depends upon the level of income. The higher the income of people, the more will be their ability to save. Besides income, taxation policy of the government also affect the ability to save.

When the rates of income tax and sales tax are high, people will be able to save only less amount than before. Opportunity to save refers to the conditions of peace and security in the country and favourable attitude of the government to motivate people to save.

(ii) Mobilisation of Savings : Capital formation cannot occur unless savings made by people are mobilised for investment purposes. Savings are done by millions of households and firms. It is very important that these savings are mobilised and used for productive and investment purposes. This requires a network of banks and other financial intermediaries who collect these savings and make them available to the producers or investors. Without banks and other financial intermediaries, these savings would remain idle and might not be utilised for productive and investment purposes.

(iii) Investment of Savings : The third and last stage of capital formation is the investment of mobilised savings. Unless mobilised savings are not utilised or invested, there cannot be any capital formation. It is, therefore, necessary that the economy should have an entrepreneurial class which is prepared to bear the risk of business and invest savings in productive channels. The entrepreneurs will, however, get motivated only when

- rate of interest is not very high and

- there are good expectations of profit.

Question 10.

(a) Define and draw the following : [5]

(i) Relatively elastic supply

(ii) Relatively inelastic demand.

(b) Briefly discuss any two quantitative measures adopted by the Reserve Bank of India to control credit. [5]

Answer.

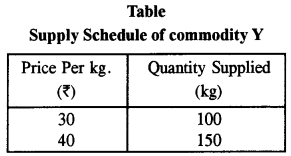

(a) (i) Relatively Elastic : Supply of a commodity will be said to be elastic, if the percentage change in quantity supplied exceeds the percentage change in price. Consider the following supply schedule relating to a producer’s supply of commodity Y.

If we calculate elasticity of supply in the above example, we will find that it is more than one. Let us work it out.

![]()

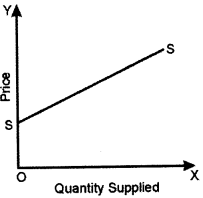

It implies that one per cent change in price leads to 1.5 per cent change in supply. In such a case, supply curve meets Y-axis above the point of origin as shown in Fig. At all points on the supply curve price elasticity will be greater/ than one but its value will be different from point to point.

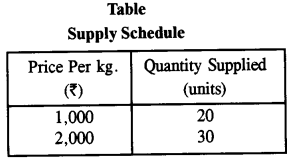

(ii) Relatively Inelastic or Less than Unit Elastic : Supply of a commodity will said to be inelastic if the percentage change in quantity supplied is less than the percentage change in price. Consider the following supply schedule.

Here, percentage change in supply is ![]() which is less than the percentage change in price, i.e.,

which is less than the percentage change in price, i.e.,![]() Elasticity of supply comes to

Elasticity of supply comes to

It implies that one per cent change in price will result in 0.5 per cent change in supply.

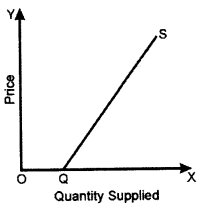

Fig. shows inelastic supply. The supply curve S is an inelastic supply curve which meets X-axis when extended to the right of origin point. At all points of such a straight line supply curve, elasticity of supply will be less than one, but its value will be different from point to point.

(b) 1. Open Market Operation

- Buying and selling of government securities in the market is known as open market operations.

- Open market operations have an impact on the lending capacity of the banks.

- It is an important mean of controlling the money supply.

- During inflation or excess demand situation, the main motive of the Central Bank is to reduce the money supply. To suck excess liquidity from the market the Central Bank sells bonds, government securities and treasury bills.

- Due to low money supply, there is fall in the volume of investment, income and employment resulting in lower demand.

- During deflation the main motive of the Central Bank is to increase the money supply and to increase the money supply the Central Bank buys bonds, government securities and treasury bills.

2. Bank Rate Policy

- It refers to the rate at which the Central Bank lends money to commercial banks as the lender of the last resort.

- The Central Bank advances loans against approved securities or eligible bills of exchange.

- An increase in bank rate increases the costs of borrowing from the Central Bank. It forces the commercial banks to increase their lending rates, which discourage borrowers from taking loans.

- It reduces the ability of commercial banks to reduce credit.

- On the other hand, a decrease in bank rate decreases the cost of borrowing from the Central Bank. It also forces the commercial banks to decrease the lending rates.

- A reduction in lending rate increases the money supply.