ICSE Economic Applications Previous Year Question Paper 2017 Solved for Class 10

- Answers to this Paper must be written on the paper provided separately.

- You will not be allowed to write during the first 15 minutes.

- This time is to be spent in reading the Question Paper.

- The time given at the head of this Paper is the time allowed for writing the answers.

- Section I is compulsory. Attempt any four questions from Section II.

- The intended marks for questions or parts of questions are given in brackets [ ].

SECTION – I [40 Marks]

(Attempt all questions from this Section)

Question 1.

(a) Demand is inversely related to price. Explain. [2]

(b) State two ways in which the government can promote economic development. [2]

(c) What is meant by Joint demand ? Give an example. [2]

(d) Mention two adverse effects of mining on the environment. [2]

(e) Draw and briefly explain a perfectly elastic supply curve. [2]

Answers:

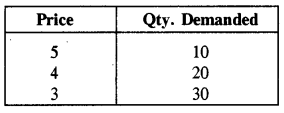

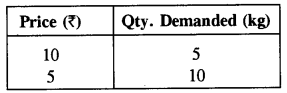

(a) It is the ‘Law of Demand’. It states that other things remaining constant, the amount demanded of commodity decreases with increase in price and increases with decrease in price. This can be explained with the following table and diagram :

(b) Ways in which the government can promote economic development are :

- Increase in Public Expenditure : If public expenditure increases, it will lead to an increase in money supply which will in turn increase the per capita income over a period of time.

- Export Incentives : If exports are encouraged, the net factor income earned from abroad rises which will lead to an increase in Gross National Product (GNP).

- Infrastructure Development : Public sector investment in the infrastructure sector like power, transport and communication, heavy industries, education, etc. paves the way for agricultural and industrial development of a country.

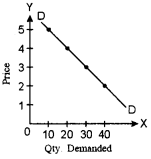

(c) Joint Demand : When several items are demanded for one particular purpose such demand is known as Joint Demand. Demand for complementary goods is also known as Joint Demand. For example, for the construction of the houses, the demand for bricks, cement, masons, labourers, etc., will constitute a Joint Demand. The Joint Demand for coffee is denoted by the given inside line diagram.

(d) (i) Mining leads to the emission of dust, suspended particles and gases which causes air pollution.

(ii) It also leads to the degradation of soil quality, fertility and make it toxic.

(iii) Underground water is also contaminated due to the seepage and infiltration of leached drainage.

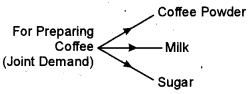

(e) Perfectly Elastic Supply : When there is an infinite supply at a particular price and the supply becomes zero with a slight fall in price, then the supply of such a commodity is said to be perfectly elastic. In such a case Es = ∞ and the supply curve is a horizontal straight line parallel to the X-axis, as shown in fig.

Question 2.

(a) If the price of a commodity increases by 50% and its supply increases by 25 % then calculate the price elasticity of supply following the percentage method. Identify the degree of price elasticity. [2]

(b) State any two factors which determine capital formation in a country. [2]

(c) What is meant by regressive taxation ? [2]

(d) Define Monopoly. Give an example. [2]

(e) What is meant by creeping inflation ? [2]

Answers:

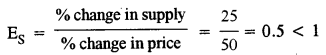

(a) Percentage change in price = 50%

Percentage change in supply = 25 %

According to percentage method,

Here, elasticity of supply is 0.5 which is less than one. So, it is the case of less elastic supply.

(b) (i) Creation of savings

(ii) Mobilisation of savings

(iii) Investment of savings

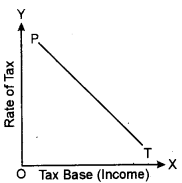

(c) Regressive Tax : A tax will be regressive when the rates of tax decrease as the tax base (i.e., income) increases. Thus, it is direct opposite of progressive tax.

Under regressive taxation, the total amount of tax increases on a higher income in the absolute sense, but in the relative sense, the tax rate declines on a higher income. Hence, relatively, a heavier burden falls upon the poor than on the rich. Ordinarily, taxes on necessaries are regressive in nature because they take away a larger proportion of lower income as compared to higher income.

Therefore, regressive taxes are unjust and inequitable. They do not satisfy the canon of equity. They tend to promote inequalities of income in the society.Fig. shows the case of regressive taxation. Line PT moves downward to the right indicating that the rate of tax decreases as the tax base increases. this form the prices rise imperceptibly over a long period.

(d) The term monopoly is derived from two Greek words, namely, ‘Moms’ and “polus’. ‘Monos’ means single, and ‘polus’ means a seller. Thus, monopoly is a market structure in which there exists only a single seller of a product who is the sole producer of the product which has no close substitutes.

For example – we get our electricity supply from one agency, that is, State Electricity Board like Punjab Electric Board in Punjab. Similarly, we travel by railway trains owned and run by the Government of India. All these are examples of monopoly.

(e) Creeping inflation occurs when there is a sustained rise in prices over time at a mild rate, say around 2 to 3 percent per year. It is also known as ‘mild inflation’. This type of inflation is not much of a problem. It is generally known as conducive to economic progress and growth. In

Question 3.

(a) Name the market in which there is a single buyer and many sellers. Give an example. [2]

(b) How does a Central Bank act as a custodian of foreign exchange reserve ? [2]

(c) Define division of labour. Explain one benefit of division of labour. [2]

(d) How does money act as a measure of value ? [2]

(e) What is meant by a demand deposit ? [2]

Answers:

(a) Monopsony is a state of market where there are number of sellers and only one buyer. Railways is an example of such market. Various fan-manufacturing firms supply fans for coaches.

(b) As the custodian of foreign exchange reserves, the central bank performs several functions:

- All the foreign exchange transactions of a country are routed through the central bank. The central bank controls both the receipts and payments of foreign exchange.

- It tries to maintain stability of the exchange rate. For this purpose, it buys or sells foreign currencies in the market to minimise fluctuations in the foreign exchange rates.

- It enforces exchange control regulations prescribed by the government from time to time.

(c) Division of labour means the allocation of different parts of the production process to different workers or to different groups of workers.

Benefit of Division of Labour : Increase in the efficiency of labour : Division of labour increases the efficiency of labour. The worker becomes more specialised if a worker is entrusted with only a part of work in the process of production.

(d) The second fundamental function of money is that it acts as a common measure of value. Just as we use kilogram in measuring weight of a commodity and metre in measuring length of a commodity, similarly, for measuring value of a commodity we take money as a unit of account.

Money serves as a unit of measurement in terms of which the values of all goods and services are measured and expressed. For example, a shirt may cost ₹ 500, a chair ₹ 600, a book ₹ 80, a pen ₹ 15 and so on. When we express the value of a commodity in terms of money, it is known as price. Thus, money has provided a language of economic communication.

(e) Demand Deposits (also known as current deposits) are those deposits which can be withdrawn by the depositor at any time by means of cheques. No interest is paid on such deposits. Rather, the depositors have to pay something to the bank for the services rendered by it. These deposits are generally made by businessmen and industrialists who receive and make large payments. The accounts in which they are deposited are called Current Accounts.

Question 4.

State whether the following statements are true ox false. Give reasons.

(a) Inflation has a favourable effect on producers.

(b) In a perfectly competitive market producers are price makers. [2]

(c) When change in demand is greater than the change in price, it is a case of inelastic demand. [2]

(d) Savings is essential for capital formation. [2]

(e) An increase in the rate of tax with an increase in income is called proportional tax. [2]

Answers:

(a) True. During Inflation, the producers gain in the short period. Usually the cost of production does not rise as fast as the price of their product and so there is an artificial margin of profit.

(b) False. As there are a large number of buyers and sellers of the commodity so neither a single seller nor a single buyer can influence the market price. So producers are price-takers not price makers.

(c) False. When a large change in price does not bring so much change in the demand, the demand is said to be inelastic.

(d) True. The whole process of capital formation depends upon savings.

(e) False. Because in case of proportional tax rate of tax remains constant, though income increases.

PART – II [60 Marks]

(Attempt any four questions from this part)

Question 5.

(a) Define a Perfect market. Explain any four features of a Perfect market. [7]

(b) (i) What do you understand by supply ? How does it differ from stock ? [8]

(ii) What does the Law of Supply state ? List two assumptions of this Law.

(iii) Explain two factors affecting supply other than price.

Answers:

(a) Perfect Market : It is a market situation when there are large number of buyers and sellers and the product is homogeneous. All the buyers and sellers have perfect knowledge of market conditions. There is no restriction on the entry and exit of the firms.

“Perfect competition prevails when demand for the output of each producer is perfectly elastic. ”

– Robinsons

Features of Perfect Competition :

- Large Number of Buyers and Sellers : There exists a large number of buyers and sellers. No individual buyer or seller can influence the demand of product in the market.

- Homogeneous Product : All firms produce homogeneous product. All the sellers have to sell their product at a uniform price. If any of the sellers sells his product at higher price, his product would become out of market.

- No Restriction on Entry and Exit : All the firms are free to enter and exit the market. There is a free mobility of sellers.

- Perfect Knowledge of Market : All the sellers and buyers have perfect knowledge of market conditions. There is a free mobility of buyers and sellers in the market. Factors of production also have free mobility.

- Absence of Selling and Transportation Costs : In the perfect competition, it is assumed that producers and sellers are closely situated and there are no selling and distribution costs.

(b) (i) Supply : Supply means an amount of a commodity which a producer is ready to sell at a particular price and at a particular time. Supply is different from stock. Stock of a commodity is the total amount available with the producer whereas supply is only that part of it which the producers are willing to bring into the market.

(ii) “The law of supply states that other things being equal, the supply of a commodity increases with an increase in its price and decreases with a fall in price. ’ ’

The main assumptions of the law are as follows :

- Price of other related goods should not change.

- Technology of production should not change.

- Cost of factors of production should remain the same.

(iii) 1. Prices of Factors of Production : The supply of a commodity is also influenced by the prices of factors used in the production of that commodity. A fall in the price of factors of production will reduce the cost of production which, in turn, will increase the production and supply due to rise in margin of profits. If, on the other hand, the price of factors of production rises, supply will decrease due to fall in margin of profits.

2. State of Technology : If the producers make use of improved and advanced technology in their process of production, the costs of production will come down. Total supply, thus, will increase. But against it, supply of goods using old and inferior techniques of production will fall. That is why scientific discoveries and their applications to production of commodities are being made.

3. Goal of the Firms : The supply of a commodity also depends upon the goal of firms. Their goal may be profit maximisation or sales maximisation. If their goal is to maximise profits, more quantity will be supplied at a high price. But if the firms want to maximise their sales (as they think that increased supply is a source of status and prestige in the market) more quantity will be supplied even at the same price.

Question 6.

(a) What is meant by urbanization ? Explain four impacts of urbanization on the environment. [7]

(b) With the help of appropriate diagram, explain the meaning of contraction in demand and extension in demand. [8]

Answers:

(a) Urbanization refers to the population shift from rural to urban areas, “the gradual increase in the proportion of people living in urban areas”, and the ways in which each society adapts to the change. It is predominantly the process by which towns and cities are formed and become larger as more people begin living and working in central areas. The United Nations projected that half of the world’s population would live in urban areas at the end of 2008. It is predicted that by 2050 about 64% of the developing world and 86% of the developed world will be urbanized.

Impacts of urbanization on the environment:

- Deforestation : Large areas of forest are being cleared for the formation of towns and cities. It will have adverse impact on environment.

- Increase in temperature : In cities, there is less vegetation and exposed soil, most of the sun’s energy is absorbed by buildings and asphalt leading to higher surface temperatures.

- Decline in water quality : When rain occurs in these large cities, the rain filters down the pollutants such as CO2 and other green house gases in the air onto the ground below. Then, those chemicals are washed directly into rivers, streams and oceans, causing a decline in water quality and damaging marine ecosystems.

- Pollution : Vehicles, factories and industrial units in the urban areas leads to pollution of. air, water and soil.

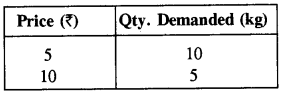

(b) Contraction in Demand

When demand falls due to rise in price, it is called contraction in demand. In the following example, when price is ? 5 per kg, quantity demanded is 10 kg. Now, as the price increases to ? 10 per kg, quantity demanded falls to 5 kg.

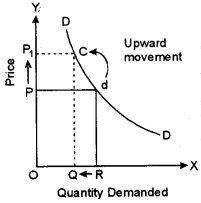

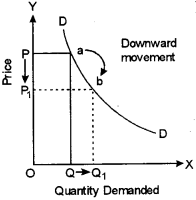

It may also be shown with the help of Fig. When the price is OP, OR quantity is demanded. When the price rises to OP1, only OQ quantity is demanded. It means with a rise in the price of the commodity, less is demanded. Demand, in this case, has contracted from OR to OQ.

In the diagram, there is an upward movement along the demand curve DD from point c to d. Extension in Demand Extension in demand refers to a situation where more quantity is demanded at a lower price. In the following example, when price of commodity is ₹ 10 per kg, demand is 5 kg, but when price falls to ₹ 5, quantity demanded increases to 10 kg.

This is also shown in fig. In the diagram, quantity demanded is shown along the X-axis and price on the Y-axis. When the price is OP, OQ quantity of the commodity is demanded. When the price of the commodity falls from OP to OPj, OQj quantity of the commodity is demanded. It means with a fall in the price of the commodity more is demanded. QQX is the extension in demand. In the figure, there is a downward movement along the same demand curve DD from point a to b.

Question 7.

(a) Define land. State any three factors which determine the productivity of land. [7]

(b) What is meant by a Commercial Bank ? Explain how Commercial banks provide credit facilities through the methods given below : [8]

(i) Cash Credit

(ii) Loan

(iii) Overdraft Facility

Answers:

(a) In economics the word ‘land’ is defined not only the surface of the earth but also other free gifts of nature, e.g., mineral resources, forest resources, anything that helps us to carry out the production of good and services but is provided by nature free of cost.

Factors which determine the pro’ductivity of land are :

1. Fertility of Land : The productivity of land is determined by its natural qualities and its fertility. A flat and levelled land is comparatively more productive than an undulating one. The rich soil is more fertile and productive. However, the agricultural productivity can be improved by proper and extensive use of manure and fertilizers along with adoption of mechanized methods.

2. Proper Use of Land : The productivity of ‘land’ is directly related to its proper utilization. For example, a piece of land situated in the heart of city is more suitable for construction of a house or a market place. If this piece of land is put for farming or agricultural use, its productivity will almost be negligible.

3. Location of Land : The location of ‘land’ affects its productivity to a great extent. For example, the location of land near the market or bus station will result in economy of transportation charges and overall productivity from this point of view will naturally be higher. Similarly, for better agricultural productivity, its location near water resources is desirable.

(b) A commercial bank in an institution that accepts deposits of money from the public, withdrawal by cheque, and uses the money so collected for lending to the household, the firm and the government.

Commercial banks provide credit facilities through the following methods :

(i) Cash Credit : In cash credit, the bank advances a ‘cash loan’ a specified limit to the customer, against a bond or any other security. A borrower is required to open a current account and bank allows the borrower to withdraw upto the full amount of the loan. The interest is charged only on the amount actually utilized by the borrower and not on the loan sanctioned.

(ii) Loans : A loan is a specified amount sanctioned to the credit of a borrower for a fixed period. However, before sanctioning the loan, the bank is required to ascertain and satisfy itself about the ability of the borrower to repay according to the soundness of his scheme or business, and the genuineness of his purpose. Invariably, a loan is granted against some kind of security of assets or personal security of the borrower and the interest is charged on the full amount sanctioned as loan, irrespective of the fact, whether full amount or part of it has been used. In case of loans, the borrower is provided with the facility to repay the loan in installments or as a lump-sum.

(iii) Overdraft Facility : The overdraft facility is allowed to the depositor maintaining a current account with the bank only. According to this facility, a borrower is allowed to withdraw more amount than what he has deposited. The excess amount so withdrawn has to be repaid to the bank in a short period and that too with interest. The rate of interest is usually charged more than that charged, in case of loans. However, the overdraft facility is given only against security of some assets or on personal security of the customer.

Question 8.

(a) What is meant by Monetary policy ? Explain the following : [7]

(i) Bank rate policy

(ii) Open market operations.

(b) What is meant by product differentiation ? To which market is it relevant ? Explain three features of this market. [8]

Answers:

(a) Monetary policy is the policy of the central bank to regulate the availability, cost and use of money for achieving certain given objectives of economic policy.

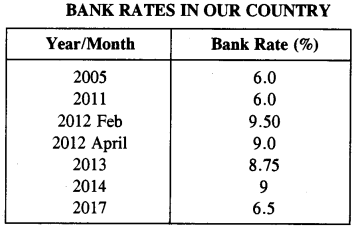

(i) Bank Rate Policy : The bank’rate is the rate at which the central bank gives loans to the commercial banks or re-discounts the approved bills of exchange and securities held by the commercial banks. Through changes in the bank rate, the central bank can influence the creation of credit by the commercial banks. Bank credit these days is,an important component of the supply of money in the economy. Changes in money supply affect aggregate demand and thereby output and prices.

For example, when the central bank raises the bank rate, the cost of borrowings by the commercial banks from the central bank would rise. This would discourage the commercial banks to borrow from the central bank. This would tend to contract bank credit and hence, would result in the reduction in demand and money expansion. This would reduce prices and check inflation in the economy. On other hand, a fall in the bank rate will cause the reduction in lending interest rates of the commercial banks.

[SOURCE : RBI’s Data Warehouse]

(ii) Open Market Operations : This refers to the purchases or sale of Government securities, public securities or trade bills, etc., in an open market by the ‘Central Bank’. It is the direct method of credit control but it is more effective when big and active market exists for purchase and sale of government securities for short as well as for long periods, e.g. USA and UK.

When the central bank sells securities, the buyers of these securities pay the central bank by drawing cheques from their accounts, thereby reducing the cash reserves of the commercial banks. This would limit the power of commercial banks to create credit, so they will have to reduce their advances and loans, on the other hand, purchase of government securities by the central bank from commercial banks results in an increase in cash reserves of the commercial banks. They can create more credit now. This generally takes place when an economy is in a slow down phase. It does this to slow down inflation.

(b) Product differentiation is a situation where different producers in the market try to differentiate their product (with respect to size, weight, ranking or offering gift etc.) with a view to attract the buyers and exercising partial control over price. It is relevant to monopolistically competitive market.

Features of Monopolistic Competition :

1. A Large Number of Sellers and Buyers : In monopolistic competition, the number of sellers is sufficiently large but not as large as under perfect competition. The sellers are not mutually dependent upon one another. Each of them acts independently and produces an insignificant portion of the total output.

2. Free Entry and Exit of Firms : Firms under monopolistic competition are free to enter or leave the industry at any time. New firms may start producing close substitutes of the product and supply the same in the market. Likewise, in the event of losses, the old firms may quit the industry. It is because of this characteristic, that firms are able to manage only normal profits.

3. Selling Costs : Another important feature of monopolistic competition is that every firm tries to promote its sales through advertisement. Expenditures incurred on advertisement, etc., are known as selling cost. Selling costs are made to persuade buyers to buy a particular brand in preference to other brands of the product. Thus, selling costs tend to shift the firm’s demand curve to the right.

Question 9.

(a) Define money. Explain three contingent functions of money. [7]

(b) What is meant by privatization ? Explain briefly four problems of public sector undertakings in India. [8]

Answers:

(a) According to Dr. Kent, money is defined as “Anything which is commonly used and generally accepted as a medium of exchange or as a standard of value. ”

Contingent functions of money :

(i) Assisting Production Decisions : The main objective of a producer or manufacturer is to maximize his sales revenue or profit. Therefore, he wants to employ such an amount of factors of production (labour, capital and other materials) which help in achieving the goals of profit maximisation while employing any factor, the firm has to make payments to pay wages to the workers, interest to the owners of capital, etc. All such factor payments are made in terms of money. Therefore, money prices of these factors help a firm in taking important production decisions.

(ii) Assisting Consumption Decisions : The main objective of. a consumer is to maximize his utility through consumption of various goods. But the consumption of goods depends on the money-income of the consumer as well as the money-prices of the commodities to be consumed. The consumer has to pay a price for purchasing commodities for consumption. The money-income of the consumer and the money-prices of these commodities to be consumed also influence the consumption decisions of consumers.

(iii) Assisting Distribution of National Income : The owners of various factors of production sell their factors at market prices. Therefore, the owners of labour-power earn money wages, owners of capital earn interest, owners of land earn rent and owners of an organisation earn profits. All these factor-incomes collectively constitute national income Therefore, the distribution of national income among the owners of different factors is also determined by the money prices of such factors.

(b) Privatisation basically implies the process which leads to transfer of ownership of public sector enterprises from the government to the private sector. However, taken in a wider sense, privatisation also implies the process of granting autonomy to the public sector enterprises in decision-making and infusing the spirit of commercialisation in them.

Problems of Public Sector Undertakings in India :

1. Lack of proper planning : Public sector undertakings spend too heavily on construction as well as designing. It is primarily because there is a lack of proper planning. This lack of proper planning results in heavy drainage of funds and thus there is serious financial problem in the wake.

2. Unfavourable input-output ratio : Public sector undertakings are heavily over-capitalised with the result that there is unfavourable input-output ratio. Inadequate planning, inordinate delays in construction etc., are the causes for over-capitalisation.

3. Cost of capital : At present in public sector undertakings cost of capital does not include cost of raising capital of different types and this cost is not reckoned at market price. This results in underestimating the cost of the capital. Consequently, it leads to non-realistic fixing of prices and the underestimating market trends. Even it becomes difficult to estimate the extent of profits and losses as well.

4. Problem of pricing : Another problem of a public sector undertaking is that of fixing the prices of the goods produced. As we know that unless pricing policy is sound even good concerns can run into losses. The public sector undertakings in India are facing serious financial problems as they are not following uniform pricing policy.

5. Problem of raising loans : All public sector undertakings are run with the finance of the Government. Now this has in turn raised many problems. Sometimes Government may feel it difficult to finance public sector undertakings in such cases, if these undertakings depend on capital market, they bound to disturb financial structure of the market.

Question 10.

Read the extract and answer the following :

Labour refers to any physical and mental endeavour undertaken for the purpose of producing a good or a service. In India in 2012 there were 487 million workers, the second largest after China. About 94% of Indian labour is involved in the unorganised sector comprising semi – skilled and unskilled workers ranging from push cart vendors to home based diamond and gem polishing operators. The organised sector includes workers employed in the public sector and the private sector.

(i) Explain any four special characteristics of labour. [6]

(ii) With suitable examples explain three important classifications of labour. [6]

(iii) Define efficiency of labour. Briefly explain the impact of technology on efficiency of labour. [3]

Answers:

(i) Labour has some special characteristics which are not found in other factors of production. They are as follows.”

1. Labour is Perishable : If a worker does not work on a particular day, his labour for that day is wasted. Labour is, thus, perishable. Labour cannot be stored. The labourer has to sell his labour immediately irrespective of the prices (i.e., wages) paid to him. It is because of this feature that labour has a weak bargaining power.

2. Labour is an Active Factor of Production : Land and capital are passive factors, but labour is an active factor of production. Without labour, other factors of production, viz., land and capital, cannot produce anything. Labour is a living organism. Hence, it requires sympathetic treatment.

3. Labour cannot be Separated from Labourer : Land and capital can be separated from their.owners but labour cannot be separated from a labourer. Labour and labourer are inseparable from each other. The labourer will have to present himself at a place where work is going on. For example, it is not possible for a teacher to teach in the school, while staying away at home. Therefore, the worker and his service go together. He cannot sell his labour like land and capital.

4. Labour is Mobile : Labour alone is a factor which is mobile. It can move from one place to another and also from one occupation to another. Other factors of production such as land lacks mobility.

5. Labour Differs in Efficiency : All labourers are not equally efficient. Some labourers are more efficient due to their ability, training and skill, whereas others are less efficient on account of their illiteracy, ignorance, etc.

(ii) On the basis of skill formation, labour can be grouped into three main categories :

1. Skilled Labour : Skilled labourers are those who have specialised training for a particular profession and also have long practical experience of the job. These workers are highly paid. Doctors, engineers, lawyers, etc., fall under this category.

2. Semi-Skilled Labour : Semi skilled workers are those who have only a part of a professional training of their trade but have sufficient experience in that line. The semi-skilled workers are paid comparatively less than the skilled workers.

3. Unskilled Labour : Unskilled workers are mainly employed for carrying out such jobs which do not require any specialised professional skill. Labourers who are employed for construction of houses, coolies, etc., are some examples of unskilled workers. They are poorly paid as their number is quite large in less developed countries like India.

(iii) In simple words, efficiency of labour implies the quality and quantity of goods and services which can be produced within a given time period and under certain conditions. According to Dr. Saxena, “By efficiency of labour we mean the amount of work which a labourer can do within a given time.”

Technology has great impact on the efficiency of labour. With the modem and updated technology, the working efficiency of labour is more and the productive capacity increases. The outdated technology adversely affect the overall output (or the productive capacity) ; even though the worker himself may be highly efficient, but due to outdated technology, he will not be in a position to make use of his talent properly.