GST Certificate: A GST Certificate is a certificate provided to individuals who register themselves under GST. Moreover, on procurement of this certificate, these individuals are required to display the same at their place of business. As per law, a business whose annual turnover is more than 40 lakhs is required to register under GST. Please note that the government will not provide a physical copy of this certificate- the individual has to download it from the official GST portal. The deadline for compliance was 31st August 2020, however, it does not include individuals that obtained GST Registration under Section 25 (Normal Registration) and Section 27 (Registration as a non-resident taxable person/ casual taxable person) under the CGST Act.

You can find more about certificates, explore the types used for academic purposes, professional purposes and more.

As stated above, businesses that have a turnover of less than INR 40 lakhs are exempted from applying for a GST Certificate, however, there are certain exceptions to this rule. The following vendor of goods are required to register mandatorily:

- Tobacco and similar goods, ice cream and related products, pan masala, etc,

- Vendors selling within the states of Manipur, Mizoram, Nagaland, Uttarakhand, Sikkim, Arunachal Pradesh, Meghalaya, Telangana, Puducherry and Tripura.

- Cases of compulsory GST Registration

Businesses who are not required to register as per law can also choose to register voluntarily as well. Next, we shall explore how to download the GST certificate from the portal.

GST Certificate Download Process

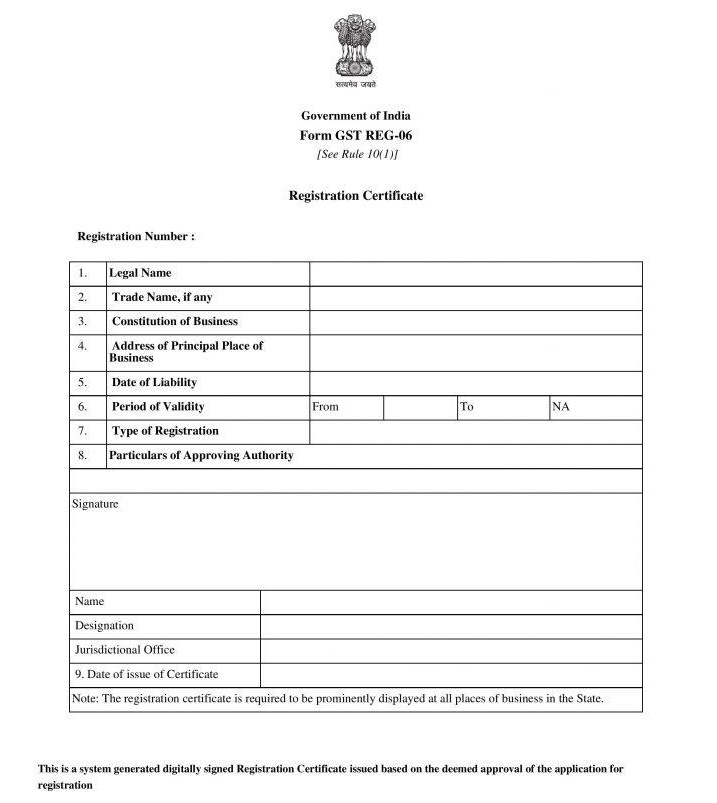

Every registered taxpayer is issued a GST registration certification in Form GST REG-06. This can be downloaded from the official GST Portal. The steps to download the same is as follows:

- Visit GST’s official portal at https://www.gst.gov.in

- You will have to login with your username and password

- Captcha code will have to be entered as a security measure

- After successful login, navigate to “Services” which is located in the header navigation (Top) of the website.

- Next, select “User Services”.

- On doing so, you will be presented with a couple of options – select the “View/ Download Certificate” option

- The downloaded certificate will have relevant details of the business. This certificate is to be displayed prominently in the place of business.

GST Certificate Validity

- The regular taxpayer’s GST certificate does not have an “Expiry” date, hence, it remains valid as long as it is not cancelled or surrendered.

- The casual taxable person/ non-resident taxable person’s GST certificate will have a validity of 90 days. The individual can renew this certificate after the expiration of the validity.

GST Certificate Making Changes/ Corrections

If the GST certificate contains information deemed to be false, the taxpayer can amend by visiting the GST portal and making the required changes. Changes to core fields require approval by the tax officials and only then can the amended certificate be downloaded. Details that constitute core fields include:

- A change in the trade name/ legal name of the business not involving a change of PAN

- Additional place of business (besides the change in-state)

- Principal place of business

- Change / addition of Karta/ Partners/ Managing Directors/ CEO/ Board of Trustees/ Members of managing committee of associations/ or other similar changes.

GST Certificate Process of Making Changes

Changes to the core fields can be made as follows:

- Visit the GST portal

- Log in with your respective credentials

- Select “Services” in the header navigation (top)

- Next, select “Registration” and then select “Amendment of Registration Core Fields”

- Make the required changes in the fields

- Once done, go to the verification section and select the “Verification Checkbox”

- Select the authorized signatory in the option for “Name of Authorized Signatory”

- Fill the name of the place in the “Place” field

- After making the changes, you are required to digitally sign the application using an E-signature or Digital Signature Certificate.

After submission, the applicant will receive updates on the status of their application through email and SMS. If approved, the applicant can then view the approval order (REG 15) as well as download the order through the GST portal. Furthemore, the applicant can also download their newly amended GST certificate from the same portal.

FAQs on GST Certificate

Question 1.

What is a GST certificate?

Answer:

A GST Certificate is a certificate that is provided to individuals who register themselves under GST Act. This certificate is also called the GST Registration certificate. (in Form GST REG-06)

Question 2.

How do I get my GST certificate?

Answer:

If you wish to download your GST Certificate, you must visit https://www.gst.gov.in, then login with your username and password. Next, navigate to “Services>User Services>View/ Download Certificate.

Question 3.

How can I download the GST certificate without login?

Answer:

You compulsorily need to login to download your GST certificate or to make any changes.

Question 4.

What is the validity of the GST Certificate?

Answer:

Please note that the regular taxpayer’s GST certificate does not have an “Expiry” date, hence, it remains valid as long (though it can be cancelled or surrendered) However, the casual taxable person/ non-resident taxable person’s GST certificate will have a validity of only 90 days. The individual can renew this certificate after the date of validity.