GST Advantages and Disadvantages: Goods and Services Tax (GST) subsumes numerous aberrant charges which were forced by Center and State like extract, VAT, and administration charge. It is demanded on both labour and products sold in the country. After the execution of Goods and Services Tax (GST), the Government got a little input on the benefits and disservices of GST. The GST goes about as a Value-added Tax (VAT) and is planned as a complete backhanded duty demand on assembling deals, and utilization of products just as administrations at the public level. It will supplant all roundabout charges collected on labour and products by the Indian Central and State legislatures. However GST fills in as to be verifiable expense change in India, it additionally incorporates a few bad marks. In this article, let us investigate GST Taxation and manage its benefits and drawbacks.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

- What is GST?

- Advantages of GST

- Disadvantages of GST

- Comparison of GST Advantages and Disadvantages

- FAQ’s on GST Advantages and Disadvantages

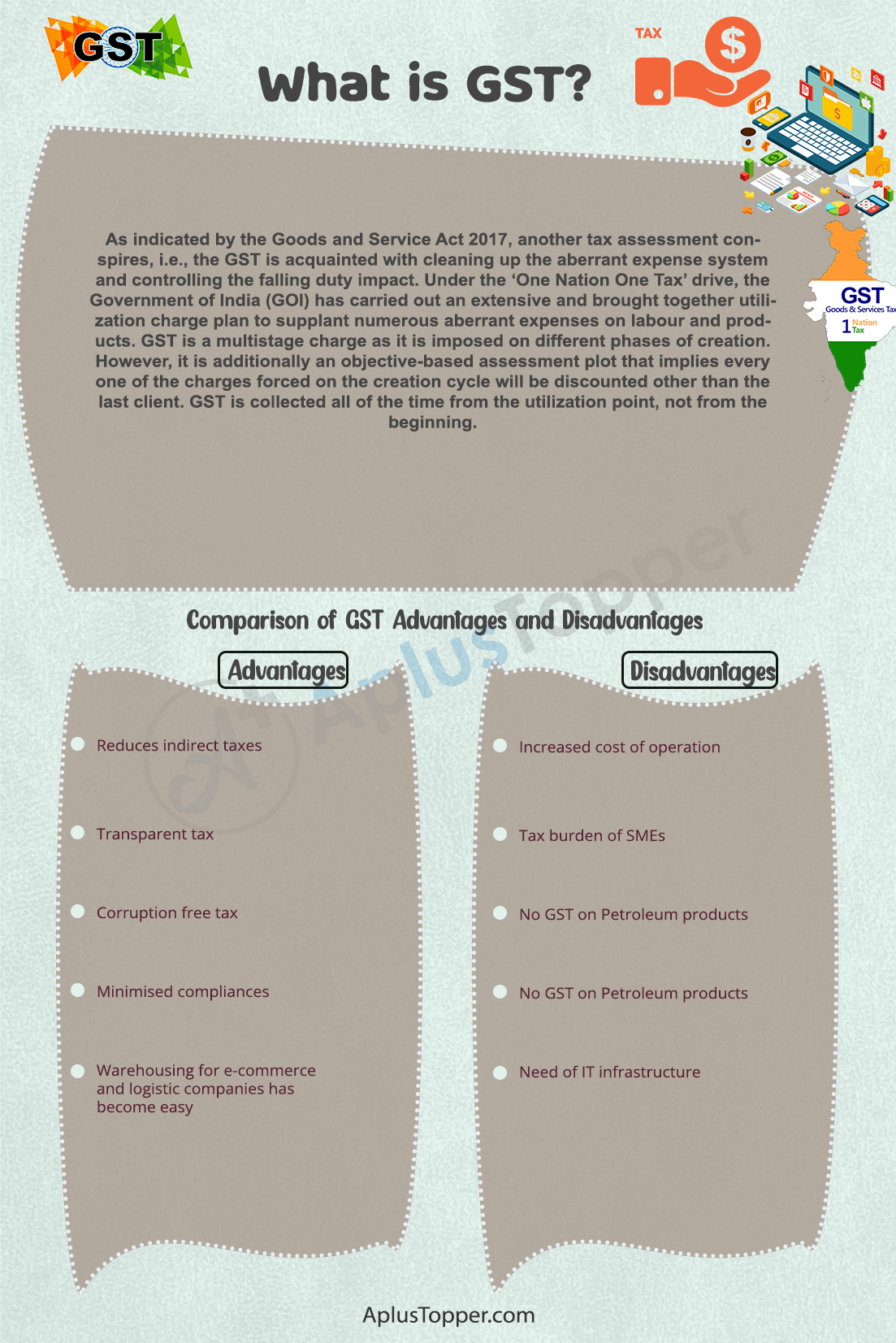

What is GST?

As indicated by the Goods and Service Act 2017, another tax assessment conspires, i.e., the GST is acquainted with cleaning up the aberrant expense system and controlling the falling duty impact. Under the ‘One Nation One Tax’ drive, the Government of India (GOI) has carried out an extensive and brought together utilization charge plan to supplant numerous aberrant expenses on labour and products. GST is a multistage charge as it is imposed on different phases of creation. However, it is additionally an objective-based assessment plot that implies every one of the charges forced on the creation cycle will be discounted other than the last client. GST is collected all of the time from the utilization point, not from the beginning.

Advantages of GST

There are many benefits of GST listed below:

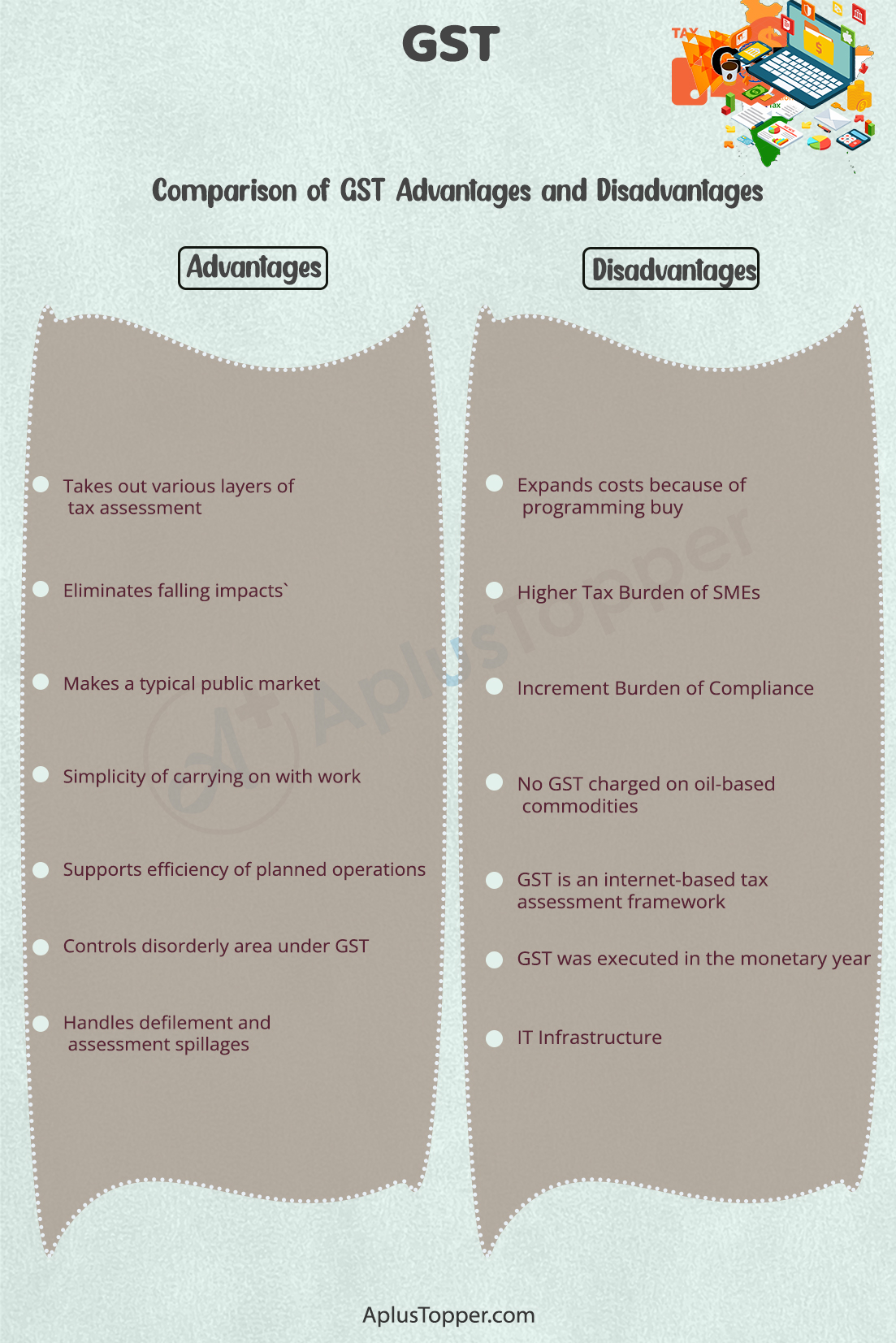

Takes out various layers of tax assessment: The essential advantage of GST Registration is that it incorporates distinctive assessment structures like Sales Tax, Central Excise, Special Additional Duty of Customs, Service Tax, Luxury Tax, and so on into a brought together expense. It nullifies various layers of expense collected on labour and products.

Eliminates falling impacts: Under the current GST system, the last expense is to be paid by the customer over the acquisition of labour and products. Notwithstanding, there is an information tax reduction structure set up to guarantee the falling impact that was clear already is wiped out. GST is forced uniquely on the worth of labour and products.

Makes a typical public market: With the presentation of GST, there has been a huge ascent in India’s duty to Gross Domestic Product proportion that advances monetary productivity over the long haul. The exhaustive assessment prompts consistency among various areas concerning ‘charge on charge’. It destroys monetary contortion and structures a typical public market.

Simplicity of carrying on with work: With online GST processes, from enrollment to return documenting, aberrant assessment consistence has been decreased. This is one of the vital advantages of GST that helps organizations to complete their business activities easily. The significant advantage of GST enrollment for new businesses is that they don’t need to engage in various enlistments like VAT, Service charge, extract, and so forth

Supports efficiency of planned operations: Pre GST organization, the planned operations industry in India needed to keep up with different stockrooms across states to guarantee current CST and state passage charges are kept away from on highway developments. As a GST result, decreased strategies costs have prompted an expansion in business income engaged with the stock of merchandise through transportation.

Controls disorderly area under GST: With a straightforward GST instrument, disorderly areas can be effectively directed. A few specific enterprises in India like material and development are exceptionally disorderly and unregulated. With the arrangement of online compliances and installments, the GST framework has become more responsible.

Handles defilement and assessment spillages: With the internet-based office to straightforwardly enlist, record returns, and make installments of duties on the web, the entire duty instrument has become straightforward. The web-based framework keeps a severe mind cheats and avoidance without interfacing with charge specialists. The shift from conventional GST practices to online modes assist with building a defilement free expense organization and is a critical value of GST Registration.

Disadvantages of GST

Being having so many benefits of GST there are many drawbacks too.

Expands costs because of programming buy: Organizations are needed to refresh their current bookkeeping programming to GST programming to proceed with business activities and be GST consistent. This prompts expanded expense of programming to buy and preparing organization faculty to effectively use the new charging programming.

Higher Tax Burden of SMEs: Prior Small and Medium Enterprises were needed to pay extract obligation just on a turnover surpassing INR 1.5 Crore each monetary year. As of now, organizations with a turnover surpassing INR 40 Lacs are obligated to pay GST under the GST organization.

Increment Burden of Compliance: The new GST system expresses that organizations need to compulsorily get GST enlisted in every one of the states they work for their organizations in. This prompts a pointless weight on organizations for monotonous desk work cycles and consistency.

No GST charged on oil-based commodities: The GST Council avoids petroleum and oil-based goods under its organization. These items draw in different charges, for example, focal extract obligation and worth added charge (VAT) collected by states.

GST is an internet-based tax assessment framework: From GST Registration to recording GST returns, the Government has made web-based arrangements for GST. While organizations are bit by bit speeding up computerized arrangements, few organizations are not knowledgeable with developing and cutting edge innovations and arrangements. It very well may be trying for some organizations to embrace a GST structure.

GST was executed in the monetary year: As GST happened on July 1, 2017, organizations followed the old GST system for a couple of months. Organizations might think that it is difficult to conform to the new GST design, and some of them are functional after charge frameworks in equal, prompting consistency issues.

IT Infrastructure: Being an IT-driven framework, GST expects organizations to take on an exceptional foundation and current expense innovation. The e-administration model has been executed by a couple of states as numerous organizations need to redesign their IT framework. Plenty of states utilize the manual VAT returns framework in their business activities that rundown for a significant negative mark of GST.

Preparing of Tax officials: Lacking preparation is given to the Government officials to viable utilization of GST programming and frameworks. This is viewed as one of the disservices of GST.

Advantages And Disadvantages Of Gst In Tabular Form

| Advantages of GST | Disadvantages of GST |

|---|---|

| 1. Simplification: GST has simplified the taxation system by replacing multiple indirect taxes with a single tax, making it easier for businesses to comply with tax regulations. | 1. Initial Implementation Costs: The initial implementation of GST can be expensive for businesses, as they need to upgrade their accounting and IT systems to comply with the new tax regime. |

| 2. Increased Revenue: GST has the potential to increase tax revenue for the government, as it eliminates the cascading effect of multiple taxes and encourages compliance. | 2. Complex Regulations: GST regulations can be complex and difficult to understand, particularly for small businesses and startups. |

| 3. Boost to GDP: GST can boost the country’s GDP by reducing the tax burden on businesses, promoting investment and economic growth. | 3. Impact on Inflation: The introduction of GST can initially cause inflation as the tax rate on some goods and services may increase. |

| 4. Transparency: GST has increased transparency in the taxation system, as it requires businesses to maintain proper records and submit regular returns. | 4. Increase in Compliance Burden: The introduction of GST has increased the compliance burden on businesses, as they need to file multiple returns and maintain proper records. |

| 5. Removal of Trade Barriers: GST has eliminated inter-state trade barriers, making it easier for businesses to operate across state borders. | 5. Increase in Tax Rates: GST can lead to an increase in tax rates for some goods and services, which can impact consumers and businesses. |

| 6. Increase in Competitiveness: GST has increased the competitiveness of businesses by providing a level playing field, eliminating the advantage enjoyed by some businesses due to the differential tax treatment. | 6. Impact on SMEs: GST can have a significant impact on small and medium enterprises (SMEs), as they may find it difficult to comply with the new tax regime due to the complexity of the regulations. |

| 7. Reduction in Black Money: GST has the potential to reduce the generation of black money by encouraging businesses to maintain proper records and comply with tax regulations. | 7. Resistance to Change: The introduction of GST has faced resistance from some businesses and consumers, who may find it difficult to adjust to the new tax regime. |

| 8. Harmonization of Tax Rates: GST has harmonized tax rates across the country, making it easier for businesses to plan their operations and comply with tax regulations. | 8. Impact on Service Sector: GST can have a significant impact on the service sector, as the tax rate on some services may increase under the new tax regime. |

| 9. Encourages Formalization: GST has encouraged the formalization of the economy by bringing more businesses into the tax net and reducing the scope for tax evasion. | 9. Increase in Compliance Costs: The introduction of GST has increased compliance costs for businesses, particularly those operating in multiple states or those engaged in the export of goods and services. |

| 10. Boost to Investment: GST has the potential to boost investment in the country by creating a stable and predictable tax regime, reducing the compliance burden on businesses, and promoting economic growth. | 10. Impact on Consumers: GST can have an impact on consumers, as the tax rate on some goods and services may increase, leading to higher prices. |

Comparison of GST Advantages and Disadvantages

| GST Advantages | GST Disadvantages |

| Reduces indirect taxes | Increased cost of operation |

| Transparent tax | Tax burden of SMEs |

| Corruption free tax | No GST on Petroleum products |

| Minimised compliances | Increased paperwork and compliance |

| Warehousing for e-commerce and logistic companies has become easy | Need of IT infrastructure |

FAQ’s on GST Advantages and Disadvantages

Question 1.

What are the merits of GST?

Answer:

The essential advantage of GST Registration is that it incorporates distinctive assessment structures like Sales Tax, Central Excise, Special Additional Duty of Customs, Service Tax, Luxury Tax, and so on into a brought together expense. It annuls numerous layers of assessment demanded on labour and products.

Question 2.

What are the demerits of GST?

Answer:

The major disadvantages of GST are increased cost of operation and enhanced burden of compliance.