Encumbrance Certificate: When buying a property, an individual must have knowledge about basic, yet important documentation for legal purposes. These important documents are:

- Encumbrance Certificate (EC)

- Completion Certificate (CC)

- Occupancy Certificate (OC)

In this article, we shall take a look at the encumbrance certificate and its related information.

Students can find more about certificates, explore the types used for academic purposes, professional purposes and more.

What is an Encumbrance Certificate?

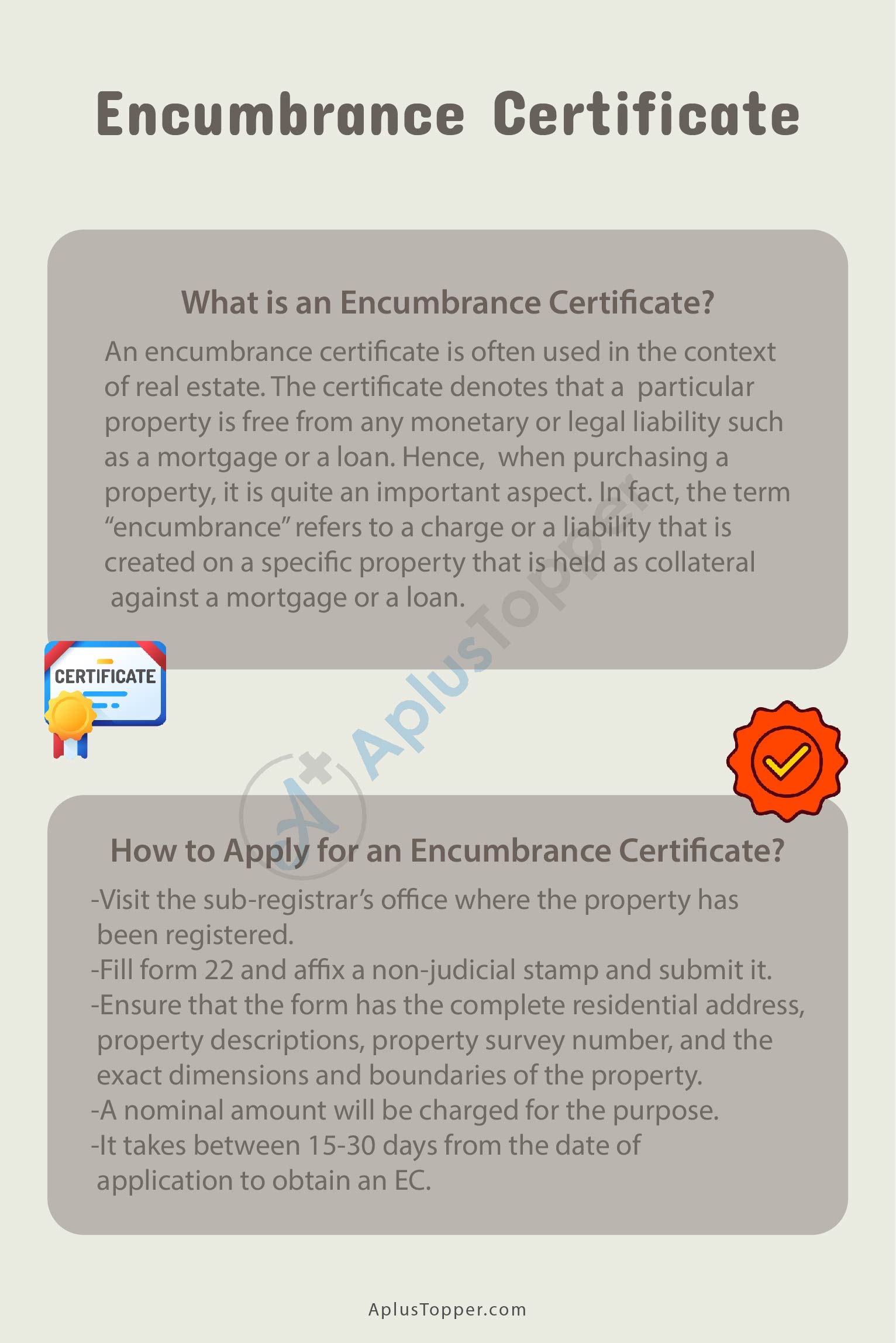

An encumbrance certificate is often used in the context of real estate. The certificate denotes that a particular property is free from any monetary or legal liability such as a mortgage or a loan. Hence, when purchasing a property, it is quite an important aspect. In fact, the term “encumbrance” refers to a charge or a liability that is created on a specific property that is held as collateral against a mortgage or a loan.

Importance/ Need of an Encumbrance Certificate

A homebuyer must obtain an encumbrance certificate for the following purposes:

- Secure legal title over the property

- Ensure the eligibility for obtaining loans from financial institutions

Contents of an EC

An EC contains all the past transactions which are done on the property during the period for which encumbrance certificate is sought. In other words, it contains all the transactions related to the purchase, sale or any other mortgage on the property which are registered with the registrar’s office.

Types of Encumbrance Certificate

Legally, two types of encumbrance certificates can be issued to a buyer. These are categorized on the basis of encumbrance.

- Form 15 (Encumbrance certificate)

- Form 16 (Non-encumbrance certificate)

Form 15: This type of encumbrance certificate is issued if the sale, mortgage or other deeds of the property is registered with the respective region’s sub-registrar. It contains all the property transaction details in the name of the owner for a specific period. Form 15 also includes the nature of encumbrance – such as gifts, lease, partition, involved parties, registration number of the document, etc.

Form 16: Form 16 is issued as a non-encumbrance certificate (NEC). This type of certificate is issued if the property is free from all liabilities for the given period as no transaction has taken place. However, it does not contain any unregistered transactions against the property.

Note: that an EC will reflect transactions that are only registered under the registrar’s office.

How to Apply for an Encumbrance Certificate?

To apply for an encumbrance certificate, an individual must perform the following steps:

Do note that some states such as Tamil Nadu, Karnataka, Telangana, Odisha, Gujarat, Kerala, Puducherry and Andhra Pradesh have the provision to issue computerized EC extracts. Other states without this facility will have to follow the below-mentioned steps:

- Visit the sub-registrar’s office where the property has been registered.

- Fill form 22 and affix a non-judicial stamp and submit the same to the sub-registrar’s office

- Ensure that the form has the complete residential address, property location, property descriptions, property survey number, and the exact dimensions and boundaries of the property. Also, include copies of relevant documents such as the Sale Deed.

- Please note that a nominal amount will be charged for the purpose.

- Usually, it takes between 15-30 days from the date of application to obtain an EC if all the aforementioned steps are done perfectly. However, it might change depending on the sought period.

How Reliable is an EC?

Please be aware that an EC does not record all past property transactions. EC will only contain transactions for a particular period and no other details before or after the sought period. Furthemore, if the property has any pending litigation, it does not reflect in the encumbrance certificate.

Difference Between EC, CC and OC

Purchasing a property is a hectic experience, and buyers usually tend to get confused with the various legal documentation. The most common confusion is between EC, CC and OC. To avoid such scenarios and to ensure clarity, we have summarized the difference between the three:

| Encumbrance Certificate (EC) | Completion Certificate (CC) | Occupancy Certificate (OC) |

| A legal document which denotes that a property is free from monetary or legal liability | A legal document which is issued after the complete construction of the building as per the building plan and other regulations | A legal document that declares that the building is now safe to occupy. It is issued after receiving the CC |

All the aforementioned documents are issued by the region’s respective local municipal authorities.

Conclusion About EC

The following are takeaways you need to remember for EC:

- An EC denotes that a particular property is free from legal and monetary liabilities such as a loan or mortgage.

- To apply for an EC, one has to submit Form 22 along with copies of relevant documents such as address proof, details of the said property, details of its title.

- After application, an individual will be issued one of two types of EC: Form 15 or Form 16.

- The EC will only reflect transactions that are registered with the registrar’s office.

FAQ’s on Encumbrance Certificate

Question 1.

What is an Encumbrance Certificate?

Answer:

An encumbrance certificate denotes that a particular property is free from any monetary or legal liability such as a mortgage or a loan. It is an important document for new property buyers.

Question 2.

Why is an Encumbrance Certificate important?

Answer:

Banks and other financial institutions often demand an EC before providing loans against the property.

Question 3.

How many types of EC exist?

Answer:

Two types of EC exist – Form 15 and Form 16

Question 4.

How to apply for an EC?

Answer:

Fill Form 22 and ensure that all the relevant details of the property are included. EC/ NEC is obtained in 15-30 days from the date of application.

Question 5.

Does an EC show all transactions?

Answer:

No, an EC only shows transactions for a particular period, provided if the same has been registered with the registrar’s office. Hence, once cannot find any other important aspects like pending litigations.