Demonetisation Advantages and Disadvantages: Demonetisation is the name given to dismantling a currency system off of its rank as a legal position recognized by the country laws as a mechanism through which one can settle a public or private debt (in other words, a legal tender).

It occurs whenever there is a shift in national currency. The existing forms of money are extracted from currency distribution and revoked. This current currency is quite often substituted with new coins or notes. Sometimes, a nation fully replaces the old currency with the new money as introduced.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

This demonetisation system is a sudden movement. This method is a legal measure that seeks to remove all kinds of legal tender statuses of the existing currency in any said country.

- What is meant by Demonetisation?

- Primary reasons for Demonetisation

- The Advantages of Demonetisation

- The Disadvantages of Demonetisation

- A Comparison Table for the Advantages and Disadvantages of Demonetisation

- FAQ’s Pros & Cons of Demonetisation

What is Meant by Demonetisation?

Demonetisation is a method adopted by the country’s government to battle inflation and balance the value of the country’s currency by removing legal tenders.

The removal of legal tenders in a country’s currency is a severe interference into the economy since it directly influences the medium of transaction used in any economic transactions whatsoever.

It can assist in stabilizing some present difficulties or create chaos in the country’s economy, primarily if begun abruptly or without proper warning. Nations undertake demonetization for several reasons. The benefits and drawbacks of demonetisation are discussed explicitly.

Primary Reasons for Demonetisation

The primary reasons for countries to commence the demonetisation process are discussed below in brief:

- Governments of countries where the economy faces problems such as inflation often choose to begin demonetisation.

- Acts such as counterfeiting currency and other crimes related to the economy decide to undergo demonetisation.

- Demonetisation also occurs to implement a new currency pattern.

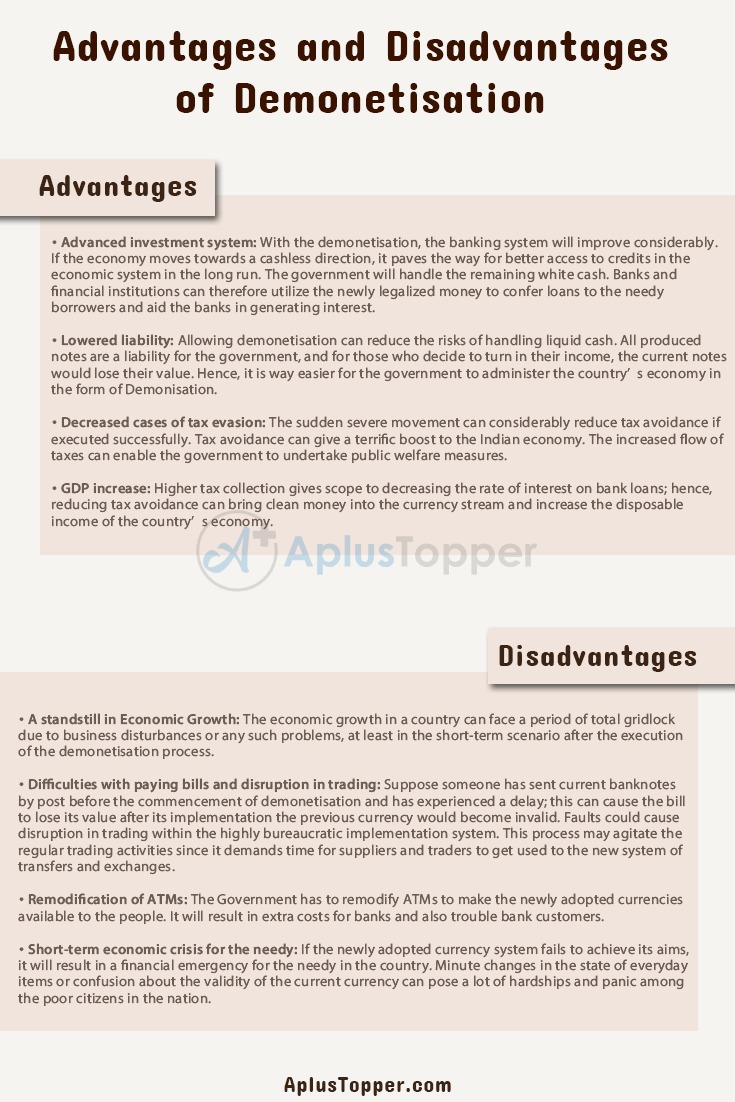

Advantages of Demonetisation

- Diminishing fraudulent practices: The best benefit of demonetisation is the minimization of fraudulent acts in the country. During the process, people with black cash would fear being prosecuted for these crimes while hoarding cash for exchange with banks since individuals would be unable to exchange black money with banks. Hence, it is an excellent way to deal with terrorism or other criminal offenses related to counterfeiting currency.

- Advanced investment system: With the demonetisation, the banking system will improve considerably. If the economy moves towards a cashless direction, it paves the way for better access to credits in the economic system in the long run. The government will handle the remaining white cash. Banks and financial institutions can therefore utilize the newly legalized money to confer loans to the needy borrowers and aid the banks in generating interest.

- Lowered liability: Allowing demonetisation can reduce the risks of handling liquid cash. All produced notes are a liability for the government, and for those who decide to turn in their income, the current notes would lose their value. Hence, it is way easier for the government to administer the country’s economy in the form of Demonisation.

- Decreased cases of tax evasion: The sudden severe movement can considerably reduce tax avoidance if executed successfully. Tax avoidance can give a terrific boost to the Indian economy. The increased flow of taxes can enable the government to undertake public welfare measures.

- GDP increase: Higher tax collection gives scope to decreasing the rate of interest on bank loans; hence, reducing tax avoidance can bring clean money into the currency stream and increase the disposable income of the country’s economy.

The economy’s GDP will improve in this way since individuals will gain more power over overconsumption, purchasing, and demand.

Disadvantages of Demonetisation

- Inconvenient for the citizens: Demonetisation can cause major inconvenience to the people of a country. If, at any point, the government chooses to remove specific categories of banknotes from currency circulation but keep the others, it can be bothersome and confusing for individuals. Suppose, when smaller coins are being removed from the currency circulation, and banks fail to provide small changes, it can cause inconvenience to most people to deposit or exchange currency in most banks.

- A standstill in Economic Growth: The economic growth in a country can face a period of total gridlock due to business disturbances or any such problems, at least in the short-term scenario after the execution of the demonetisation process.

- Difficulties with paying bills and disruption in trading: Suppose someone has sent current banknotes by post before the commencement of demonetisation and has experienced a delay; this can cause the bill to lose its value after its implementation the previous currency would become invalid. Faults could cause disruption in trading within the highly bureaucratic implementation system. This process may agitate the regular trading activities since it demands time for suppliers and traders to get used to the new system of transfers and exchanges.

- Remodification of ATMs: The Government has to remodify ATMs to make the newly adopted currencies available to the people. It will result in extra costs for banks and also trouble bank customers.

- Short-term economic crisis for the needy: If the newly adopted currency system fails to achieve its aims, it will result in a financial emergency for the needy in the country. Minute changes in the state of everyday items or confusion about the validity of the current currency can pose a lot of hardships and panic among the poor citizens in the nation.

Demonetisation Advantages And Disadvantages In Tabular Form

| Advantages | Disadvantages |

|---|---|

| 1. Curbs black money and corruption | 1. Initial disruption to the economy |

| 2. Reduces terrorism and illegal activities | 2. Short-term cash crunch for citizens |

| 3. Increases the use of digital transactions | 3. Inconvenience for those without access to digital payment methods |

| 4. Boosts tax revenues for the government | 4. Job losses in the informal sector |

| 5. Promotes financial inclusion and transparency | 5. Large amounts of unaccounted cash may still be hidden |

| 6. Reduces inflation and the informal economy | 6. Costly exercise for the government |

| 7. Improves the credibility of the Indian economy | 7. May not have a significant long-term impact on black money |

| 8. Promotes a cashless society | 8. The gains from demonetization may not justify the costs |

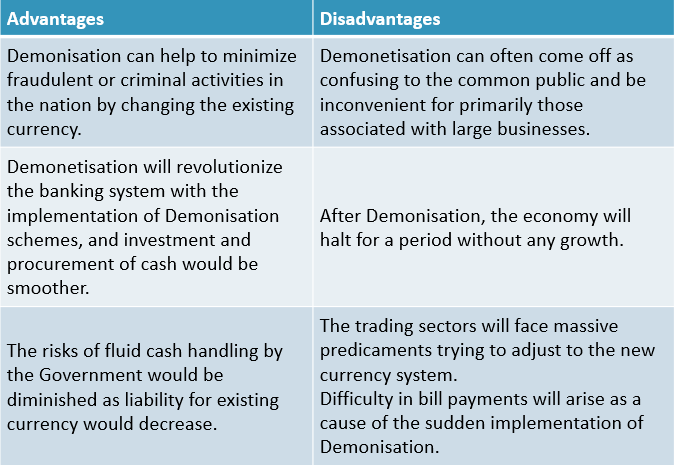

A Comparison Table for Advantages and Disadvantages of Demonetisation

| Advantages | Disadvantages |

| Demonisation can help to minimize fraudulent or criminal activities in the nation by changing the existing currency. | Demonetisation can often come off as confusing to the common public and be inconvenient for primarily those associated with large businesses. |

| Demonetisation will revolutionize the banking system with the implementation of Demonisation schemes, and investment and procurement of cash would be smoother. | After Demonisation, the economy will halt for a period without any growth. |

| The risks of fluid cash handling by the Government would be diminished as liability for existing currency would decrease. | The trading sectors will face massive predicaments trying to adjust to the new currency system. Difficulty in bill payments will arise as a cause of the sudden implementation of Demonisation. |

| Demonetisation can result in a decrease in tax evasion by individuals and ensure the implementation of practical public measures. | Every ATM in the country needs to be remodified to allow the exchange of currency. |

| The Gross Domestic Product would increase with a decrease in tax evasion. | The needy population of the nation will face a fiscal crisis for a while after the implementation. |

FAQ’s Pros & Cons of Demonetisation

Question 1.

Can an individual having torn or damaged banknotes exchange them during demonetisation?

Answer:

In case of damaged notes, individuals can get a full refund only if the section of the banknote having sole significance remains an undivided piece of the currency note and is greater than 80% of the whole area of an undamaged banknote. In other words, the area of major significance should be legible and intact.

Question 2.

Can I exchange the old Rs 500 notes now, in 2021?

Answer:

You can only exchange the old currency notes of Rs 500 or Rs 1000 at the government offices of the Central bank by following the legal guidelines. Know the timings carry a valid identity proof for the exchange procedure to be successful. It is better to take legal documents such as age proof and Aadhaar just in case.

Question 3.

How much cash can I withdraw from my account?

Answer:

From your current account, you can withdraw Rs 10,000 per day and Rs 20,000 in a week. However, new rules have restricted withdrawals from ATMs up to Rs 2,000 per day in the implementation.