Cheque Book Request Letter: A cheque is a negotiable instrument that tells a financial institution to pay an amount from a specific amount in the name of the depositor, maker’s name with that institution. A bank or a financial institution provides cheques to users in the form of a printed booklet, ready for use. Furthermore, a cheque is a bill of exchange, which means the cheques are handed over to a vendor in exchange for goods or services. The individual who receives the cheque deposits it in their account and the funds are transferred once the cheque clears.

However, in today’s day and age, the emergence of credit cards and online banking have made cheques less relevant. One of the reasons why they are not as popular as online banking is due to their holding period. This means a cheque takes anywhere from a day to a week to be cleared. On the plus side, cheques help organisations and companies to track and document payments. Furthermore, cheques do not have any processing fees like credit cards, hence, some individuals prefer to use them. Read on to find out how to request a cheque book from your financial institution.

Get Other Types of Letter Writing like Formal, Informal and Different Types of Letter Writing Samples.

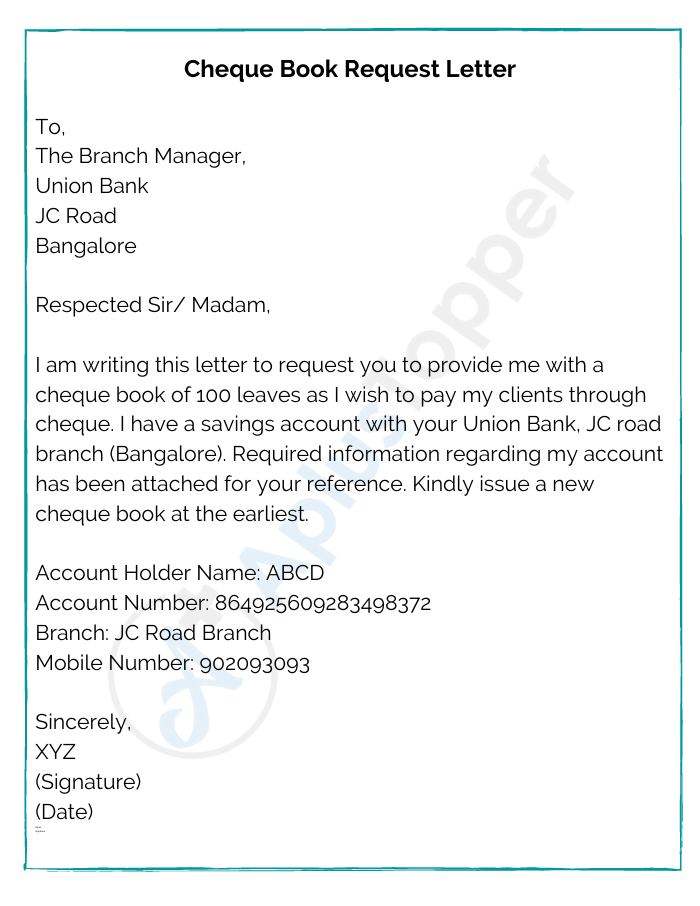

Cheque Book Letter Format

Requests for a cheque book are usually addressed to the local head of a financial institution – which could be the branch manager of a bank. Furthermore, the letter has to include important details, such as:

- Account holder name

- Account number

- Branch

- Any other pertinent information

The format used is formal, hence, ensure that the salutations and greetings used are formal too. Before sending the letter, cross-verify the account number and other relevant details.

Note: DO NOT include sensitive information such as ATM card pin, CVV or net banking credentials. No banks or financial institutions ask for such details.

Cheque Book Request Letter Sample

The following are some common samples used for requesting a cheque book from a financial institution – in this case, a bank.

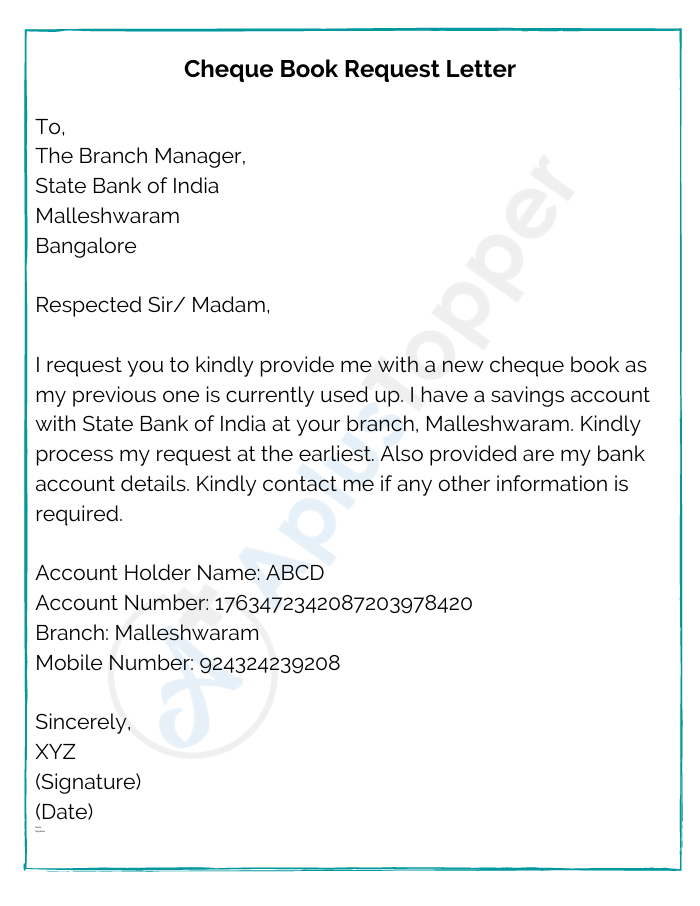

Cheque Book Request Letter SBI

FAQ’s on Cheque Book Request Letter

Question 1.

How do I request a Cheque book?

Answer:

Address a letter to your financial institution stating you need a cheque book. Ensure that relevant details are provided, such as the account holder name, account number and branch.

Question 2.

What are the types of cheque books available for the customer?

Answer:

Banks usually issue two types of cheque books – personalized and non-personalized. There is no difference between the two in terms of value. The personalized cheque book carries the name of the account holder while the non-personalized one does not. If a customer requires a cheque book immediately, they may consider opting for the non-personalized cheque book as it can be provided immediately.