Bitcoin Advantages and Disadvantages: In terms of practical application, bitcoin is very similar to other high-risk investments. It means that investing in bitcoin depends entirely upon you and your risk tolerance. It also depends on your investment objectives. Like any other investment, bitcoin also comes with certain limitations, but there are advantages of bitcoin.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is Bitcoin? Advantages and Disadvantages of Bitcoin 2021

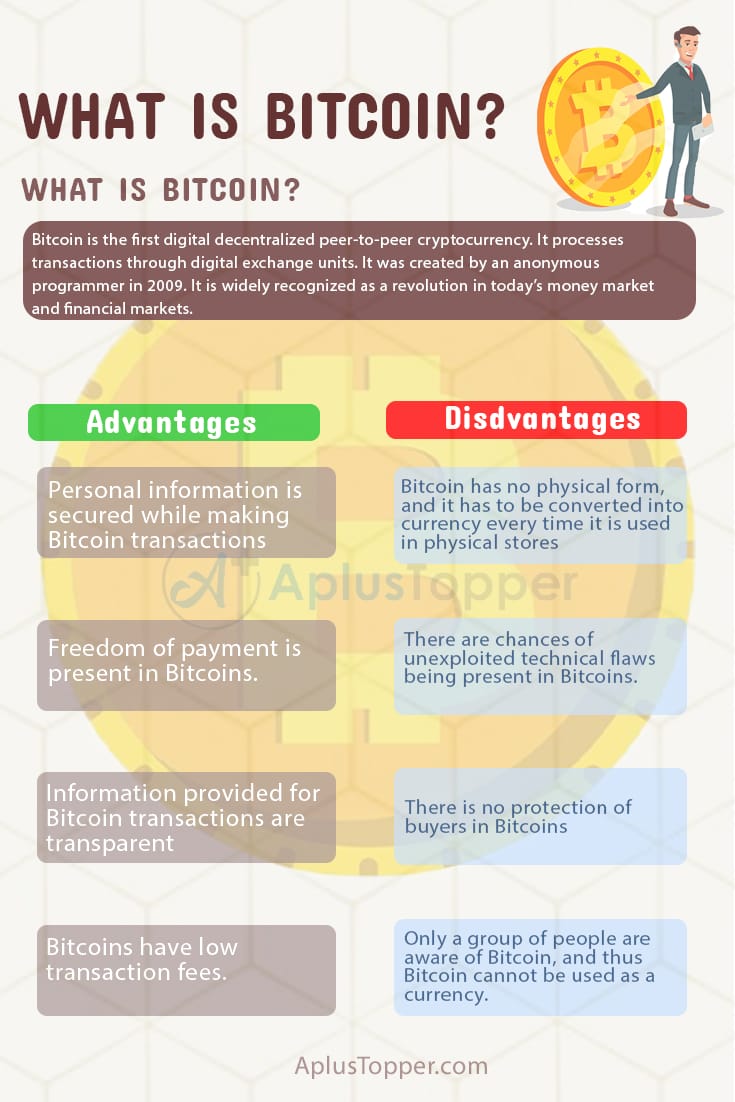

Bitcoin is the first digital decentralized peer-to-peer cryptocurrency. It processes transactions through digital exchange units. It was created by an anonymous programmer in 2009. It is widely recognized as a revolution in today’s money market and financial markets.

Before investing in bitcoin, an individual must be aware of the advantages and disadvantages of bitcoin. This article consists of all the essential advantages and disadvantages you need to know before investing in bitcoin.

- Advantages of Bitcoin

- Disadvantages of Bitcoin

- Comparison Table for Advantages and Disadvantages of Bitcoin

- FAQs on Pros and Cons of Bitcoins

Advantages of Bitcoin

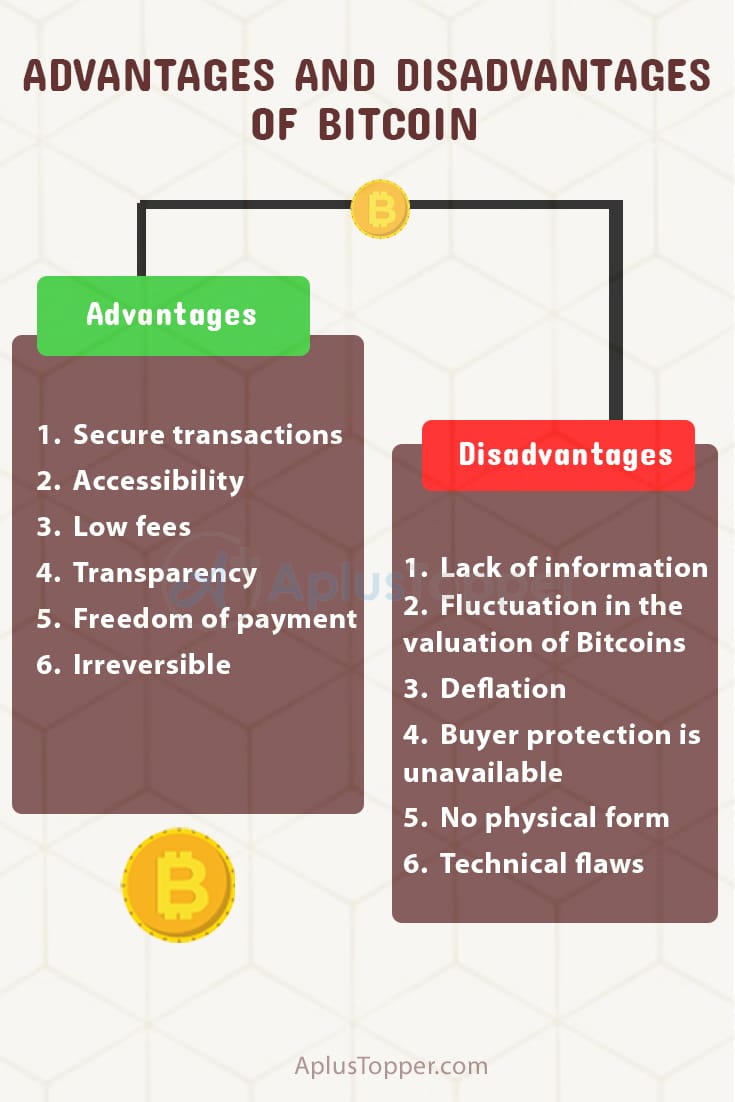

- Secure transactions: Bitcoin users can control their transactions which helps to safeguard their bitcoins for the network. Traders will get notified if they want to charge additional charges. Consumers need to be informed before the traders charge any additional toll. Bitcoin payments can be done and completed without linking any personal information with the transaction. Bitcoin protects against theft of identity since personal information is secured from the eyes of third parties. The encryption and backing up of the bitcoin wallet also ensure proper money safety. Hackers can steal the cryptocurrency if they are aware of the private keys of the wallet. However, with proper security, it is impossible to steal bitcoins. However, there are some reports of hacks while cryptocurrency exchange; there is no report of bitcoin exchange hacks.

- Accessibility: Bitcoin can be sent and received with smartphones and computers. Since traditional banking systems, credit cards, or other payment methods are not required, most people can access bitcoins.

- Low fees: Bitcoins have low transaction fees for purchases that are international. Usually, foreign purchases require exchange costs and fees, but since bitcoins eliminate intermediaries like government involvement, the cost of transactions is comparatively lower than that of other bank transfers. Bitcoin payments charge no commission, but users can include fees for processing transactions faster.

- Transparency: The information provided for Bitcoin transactions is entirely transparent. The completed transactions are visible to everyone with the help of blockchains, but the personal information is completely hidden and secured. Even though the public address is visible, a user’s personal information is not related to it, and hence, safety is maintained.

- Freedom of payment: Bitcoins help to send and receive money anywhere in the world. Users can send money to any place in the world at any time they want. Rescheduling payments for holidays or crossing borders for payments is not an issue with bitcoins since it is an online transaction, and they are much faster too. There is no central authority in Bitcoin, and the users have complete control over their money.

- Irreversible: The transactions in Bitcoins cannot be reversed, and hence they are very safe. Personal information is also not leaked, and safety is maintained there as well. Due to no leakage of personal information, traders are protected from fraudulency. Traders are also able to do business where fraud rates and crime rates are high. That is due to blockchain, where misleading someone is quite very hard.

Disadvantages of Bitcoin

- Lack of information: Many people are still unaware of the existence of Bitcoins and digital coins. Due to this reason, only a small group of people access bitcoins. This creates an issue because complete reliance on Bitcoins as a currency is not feasible. The government may also not allow traders to use Bitcoins as they might want to keep track of the traders’ transactions.

- Fluctuation in the valuation of Bitcoins: Bitcoin values are constantly fluctuating based on public demand. The sites which accept Bitcoin will constantly change their prices according to the fluctuation in Bitcoins. This constant change of price will cause massive confusion, especially for those trying to make refunds since they will now have to figure out the price they will refund. There are still various questions to which the Bitcoin community has no answer.

- Deflation: There will be deflation since the total number of Bitcoins is topped at 21 million. As the total number of Bitcoin increases, the prices of Bitcoins will also rise. The worth of each bitcoin will increase more and more. For rewarding early adopters of Bitcoin, this system is designed. With each passing day, the value of Bitcoins will rise, and it will pose an important question: when to spend. This may cause people to outpour their Bitcoins which will cause the Bitcoin economy to fluctuate very rapidly.

- Buyer protection is unavailable: Since transactions in Bitcoins are irreversible, there are chances that the seller does not send the assured goods even after the payment is made, which will be a massive disadvantage for the buyer since they cannot take any action against the seller.

- No physical form: Bitcoins are digital currency and have no physical form. Due to this reason, users are unable to use them in physical stores. For usage in physical stores, they need to be converted to other currencies. A proposal has been made of having cards with bitcoin information stored in them, but there has been no answer for the proposal. Traders will find it challenging to support all Bitcoin cards due to competition, and therefore Bitcoins will have to be converted anyways.

- Technical flaws: Since the Bitcoin system is comparatively new, there could be unexploited technical flaws. If Bitcoins are widely adopted, and a technical flaw is found, then the exploiter will receive tremendous wealth, and the Bitcoin economy will be eradicated.

Bitcoin Advantages And Disadvantages In Tabular Form

| Advantages of Bitcoin | Disadvantages of Bitcoin |

|---|---|

| Decentralized: Bitcoin is not controlled by any central authority, such as a government or a bank. | Volatility: The price of Bitcoin can be highly volatile, which can make it difficult to use as a stable store of value or means of exchange. |

| Anonymity: Transactions can be made without revealing personal information, which can provide privacy benefits. | Lack of regulation: Bitcoin is not regulated in the same way that traditional financial institutions are, which can create risks for consumers. |

| Security: Bitcoin transactions are secured through cryptography, which makes it difficult to counterfeit or double-spend. | Irreversibility: Once a Bitcoin transaction is completed, it cannot be reversed, which can create risks for consumers who make mistakes or are victims of fraud. |

| Accessibility: Bitcoin can be used by anyone with an internet connection, regardless of location or financial status. | Limited acceptance: While the number of merchants accepting Bitcoin is growing, it is still not widely accepted as a form of payment. |

| Low fees: Bitcoin transactions typically have lower fees than traditional payment methods, such as credit cards or wire transfers. | Energy consumption: Bitcoin mining requires significant energy resources, which can have negative environmental impacts. |

| Potential for investment gains: Bitcoin’s price has increased significantly in the past, creating opportunities for investors to profit. | Limited scalability: The current design of the Bitcoin network limits the number of transactions that can be processed, which can create delays and higher fees during periods of high demand. |

Comparison Table for Advantages and Disadvantages of Bitcoin

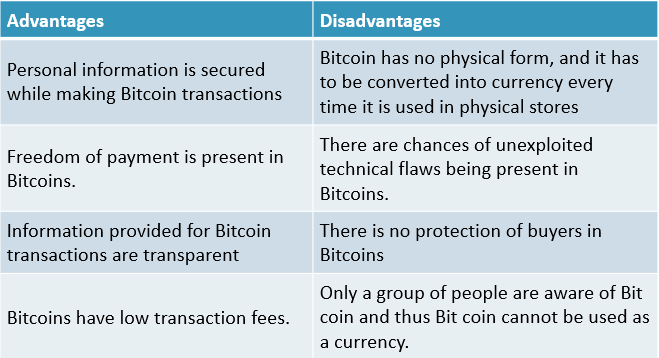

| Advantages | Disadvantages |

| Personal information is secured while making Bitcoin transactions | Bitcoin has no physical form, and it has to be converted into currency every time it is used in physical stores |

| Freedom of payment is present in Bitcoins. | There are chances of unexploited technical flaws being present in Bitcoins. |

| Information provided for Bitcoin transactions are transparent | There is no protection of buyers in Bitcoins |

| Bitcoins have low transaction fees. | Only a group of people are aware of Bitcoin, and thus Bitcoin cannot be used as a currency. |

FAQ’s on Pros and Cons of Bitcoin

Question 1.

Are there any advantages of using bitcoins for transactions?

Answer:

Yes. There are numerous advantages.

The two main advantages are:

- It is a peer-to-peer system, and that eliminates intermediaries.

- It also eliminates the identification information needs for both parties due to its pseudonymous design.

Both the advantages are advanced transactions and eliminate unwanted steps.

Question 2.

Does someone control the Bitcoin network?

Answer:

The Bitcoin network is owned by nobody and is controlled by the users using Bitcoin worldwide. Developers are developing the software, but we can force no change in the protocol of Bitcoin since users have the right to choose their software.

Question 3.

If Bitcoins are lost, what happens then?

Answer:

Lost bitcoins remain in the blockchain just like other bitcoins. However, the lost bitcoins remain dormant because nobody can find the private keys that would enable them to use the lost Bitcoins.