Bank Statement Letter: A bank statement letter is usually addressed to the manager of the bank, requesting to issue a bank statement to an individual. A bank statement is essentially a summary of all the financial transactions done by a person or a business entity. Hence, a bank state can be deemed as an important document.

Typically, bank statements are usually issued by most banks to their customers on a monthly basis. As stated before, it lists all transactions, from withdrawals to deposits in various forms (cash, cheque, net banking, etc). These days, customers also have access to the Internet, which makes it so much more convenient for them to check their bank account. However, there are certain times that we need a hardcopy of our bank statement – and the only way to acquire that is to write a written request.

Get Other Types of Letter Writing like Formal, Informal and Different Types of Letter Writing Samples.

Bank Statement Letter Format

Following is a typical format followed when drafting a bank statement letter:

| To, Receiver’s Name Receiver’s Address Date Sender’s Name Sender’s Address Subject Line: Dear Sir/ Madam, [————————–letter body———————————] [————————–letter body———————————] [————————–letter body———————————] Yours Sincerely [Sign] |

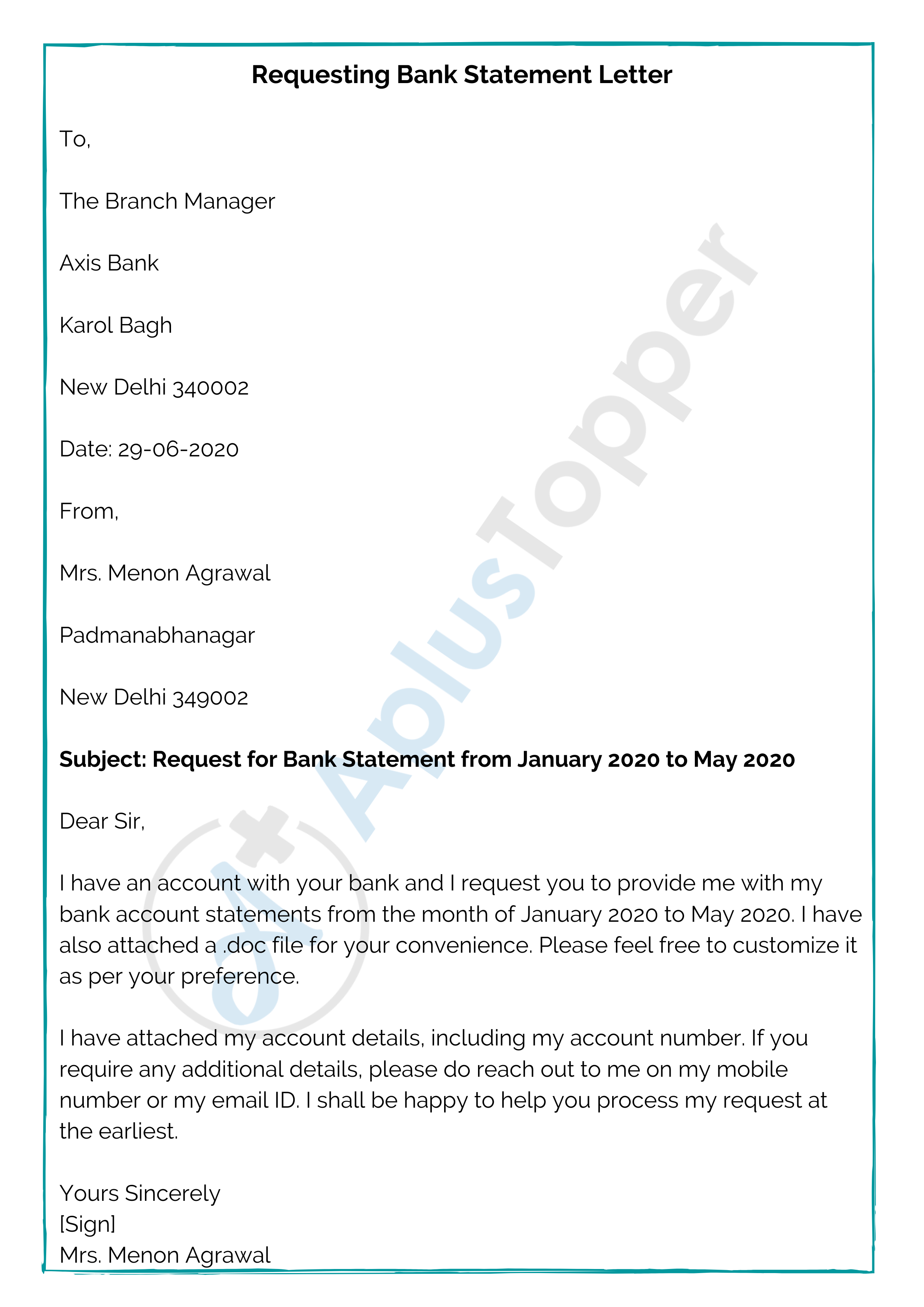

Requesting Bank Statement Letter Sample

Following is a sample letter requesting a bank statement.

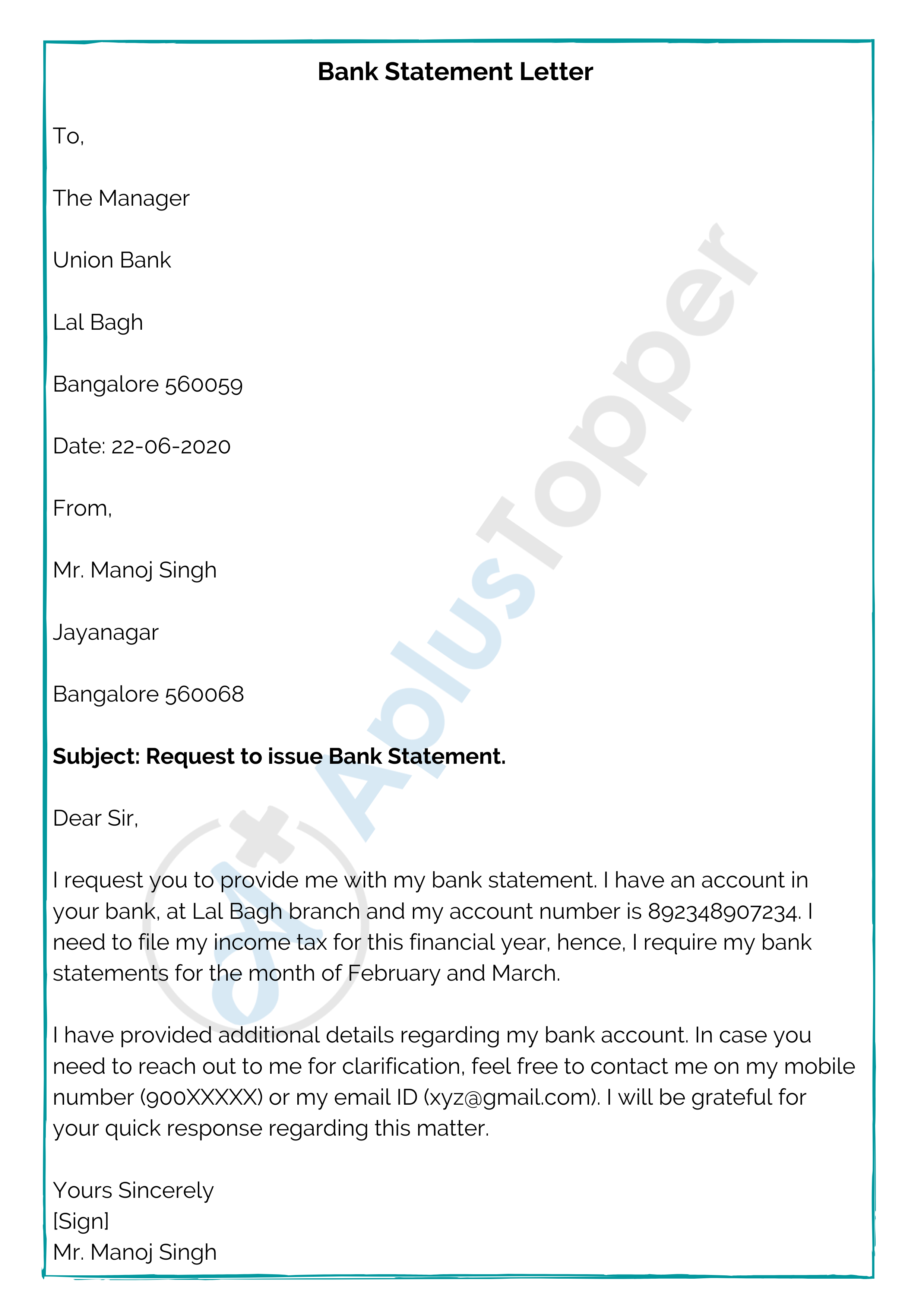

Bank Statement Letter

FAQ’s on Bank Statement Letter

Question 1.

What is a bank statement letter?

Answer:

A bank statement letter is a letter that is addressed to the manager of the bank, requesting to issue the bank statement to an individual/ account holder.

Question 2.

How do I request a bank statement?

Answer:

Address the letter to the branch manager where you have your account. And do ensure to provide all the necessary details.

Question 3.

How do you write a letter to a bank statement?

Answer:

A bank statement letter is usually written by an account holder to acquire a copy of their bank statements. The account holder must address the request letter to the branch manager of the bank where they have the account. Provide details such as the account number, but under no circumstances are you supposed to provide private details such as your credit card/ debit card number, ATM pin or such details.