Advantages and Disadvantages of Mutual Funds: For the majority of individuals, mutual funds are arguably among the most highly regarded financial instruments. As a roundabout but the convenient approach to dealing in the stock market, mutual funds are perhaps the most important financial opportunity for individual investors worldwide!

Mutual funds integrate funds from people and use them to acquire other securities, more often than not bonds and stocks. The mutual fund company’s potentially worth is determined by the performance of the securities it buys.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

Mutual funds are classified into different segments premised on the securities they invest in, their investing goals, and the kind of returns on investment they target.

- What Varieties Of Mutual Funds Are There?

- What are Mutual Funds? Advantages and Disadvantages of Mutual Funds 2021

- Advantages of Mutual Funds

- Disadvantages of Mutual Funds

- Comparison Table for Advantages and Disadvantages of Mutual Funds

- FAQs on Pros and Cons of Mutual Funds

What Varieties Of Mutual Funds Are There?

- Equity Funds

- Fixed-Income Funds

- Index Funds

- Balanced Funds

- Money Market Funds

- Income Funds

- International/Global Funds

- Specialty Funds

- Exchange-Traded Funds (ETFs)

What are Mutual Funds? Advantages and Disadvantages of Mutual Funds 2021

A mutual fund is a component of an investment entity that engages in securities such as shares, money market instruments, and other financial assets by consolidating funds from various stakeholders. Experienced financial administrators supervise mutual funds, allocating assets and endeavoring to yield investment returns or income for the fund’s investors.

The investment portfolio of a mutual fund is carefully constructed and administered to achieve the investment objectives clearly indicated in the prospectus.

The overwhelming percentage of the money in company-sponsored retirement plans is invested in mutual funds.

A mutual fund is something you must take into consideration and decide on incorporating into your financial strategy, whether you are a veteran or first-time investing. Nevertheless, you should really be informed of both the benefits and potential limitations of this financial investment.

Advantages of Mutual Funds

There are a plethora of upsides to why people invest in mutual funds so consistently. Let’s take a closer look at a few of them.

- Liquid assets ensuring easy cash flow: Unless you prefer closed-ended mutual funds, purchasing and selling a mutual fund strategy is very simple and straightforward. When the stock market is extremely high, you can economically sell your open-ended equities mutual fund shares. Keep a close watch on the mutual fund’s exit load and expense ratio.

- Diversity: Another significant perk of mutual funds is that they offer a great deal of diversity. Relying on the scheme’s investing strategy, the aggregated resources have implemented a variety of companies spanning sectors, market capitalizations, and asset classes. As a consequence, a potential loss in one area or asset class is counterbalanced by massive profits in a separate sector or asset class. Diversification significantly reduces the portfolio’s risk exposure.

- Affordable expenditure: The relatively low cost of mutual funds is a powerful incentive. Mutual fund schemes demand as little as 1% – 2.50 percentage in fund administration fees due to the massive markets of scale.

- Accessibility: You may commence investing in mutual funds as inexpensive as Rs 500 each month. Relying on your spending plan, you can contribute in SIPs or lump sums. Whatever your annual income, you must make it a priority to set aside some money for investments, no matter how humble. Identifying a mutual fund that fits perfectly your income, expected returns, investing goals, and risk tolerance are simple and basic.

- Risk Mitigation: Diversification helps reduce risk exposure since most mutual funds engage in somewhere between 50 to 200 alternative assets, depending, of course, on the focus. Various mutual funds that invest in stock indexes have 1,000 or more individual stock holdings.

- Tax efficiency and safety: You can consider investing in ELSS mutual funds, which are tax-saving mutual funds that are qualifying for a tax deduction of up to Rs 1.5 lakh annually, as mentioned in Section 80C of the IT Act of 1961. Despite the reality that Long-Term Capital Gains (LTCG) over Rs 1 lakh are susceptible to a 10% tax, they have absolutely dominated other tax-saving products in recent years.

Disadvantages of Mutual Funds

- Expenses directly associated with administering a mutual fund: The remuneration of the market analysts and fund manager, and even the fund’s operational expenditures, are provided by the investors. When considering a mutual fund, one of the very first factors to closely examine is the total fund management expenditures. Higher management fees do not necessarily imply superior fund performance.

- Abuse of Authority by Management: If your management misuses his or her control, churning, turnover, and window dressing may emerge. Unnecessary trading, disproportionate replacement, and trading losers prematurely to quarter-end to balance the books are illustrations of this.

- In a collapsing economy, there is no immediate way to get away: If the market begins to crumble, you can simply sell your investments to safeguard yourself from additional damage. Mutual funds, on the other extreme, have time limits on how and when an investor can demand a withdrawal.

- Inadequate Trade Implementation: If you acquire a mutual fund prior to the actual cut-off time for same-day NAV, you will get the equivalent closing price NAV for your purchase or sale. Mutual funds represent a terrible implementation framework for investors clearly aiming for faster processing timeframes, that might be due to reduced investment horizons, day trading, or timing of the market.

- Money trap: Mutual funds must continue to maintain sufficient money on hand, in particular, to transmit profits to investors who are redeeming their assets. The fund management might potentially sell underlying assets to raise revenue for any other purpose.

As a result, Mutual Funds have a distinct drawback in terms of profitability. When contrasted to 100% of your money positioned in the market, this cash does not make a considerable return in the future and can have a minimal consequence on your outcomes.

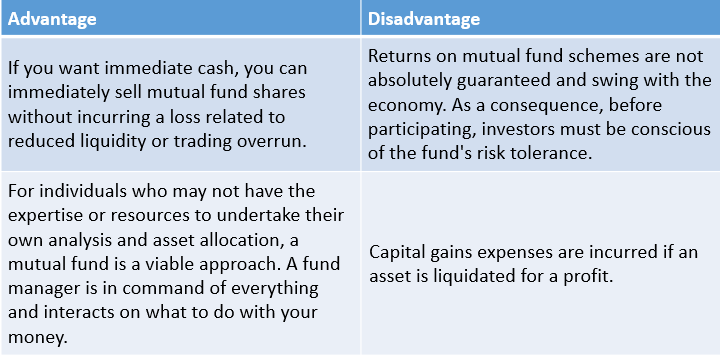

Comparison Table for Advantages and Disadvantages of Mutual Funds

| Advantage | Disadvantage |

| If you want immediate cash, you can immediately sell mutual fund shares without incurring a loss related to reduced liquidity or trading overrun. | Returns on mutual fund schemes are not absolutely guaranteed and swing with the economy. As a consequence, before participating, investors must be conscious of the fund’s risk tolerance. |

| For individuals who may not have the expertise or resources to undertake their own analysis and asset allocation, a mutual fund is a viable approach. A fund manager is in command of everything and interacts on what to do with your money. | Capital gains expenses are incurred if an asset is liquidated for a profit. |

FAQ’s on the Pros and Cons of Mutual Funds

Question 1.

What is the distinction between a sale and a repurchase or redemption price?

Answer:

The price or NAV imposed on a unitholder while participating in an open-ended plan is simply referred to as the sales price.

The cost or NAV at which an open-ended program acquires or redeems its shares from unitholders is known as the repurchase or redemption price. If appropriate, it may also incorporate exit load.

Question 2.

How much income should be put in debt or equity-oriented investment funds?

Answer:

Investors should take into account their tolerance for risk, age, economic state, and other criteria. As previously stated, the plans invest in various types of assets, as mentioned in the offer documents, as well as provide varying cash inflows and outflows. Before selecting a course of action, investors should confer with financial professionals.

Question 3.

Is there an upper cap to how much money I may withdraw out of my investment?

Answer:

The bulk of mutual fund schemes are open-end, suggesting that an investor can withdrawal the whole amount deposited at any moment. Only in rare circumstances, as authorized by the Board of Trustees, do schemes place a constraint on redemption.

Question 4.

Is it true that investing for the long term lowers the risk?

Answer:

Mutual fund investments necessitate a long-term investment commitment. Possessing a suitable time horizon not only enhances your likelihood of having the intended investment returns but also helps reduce your potential danger.