Advantages and Disadvantages of Cost Accounting: Today accounting plays a major role in every business life. Every transaction, especially monetary one, is recorded in the books of the organization and is analyzed to improve the efficiency and forecast the future of the business. There are different branches of accounting, namely Management accounting, Cost accounting, and financial accounting. Now let us understand what accounting is?

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is Accounting and Cost Accounting? Advantages and Disadvantages of Cost Accounting 2022

Accounting is a process of classifying, summarising, and recording transactions or events which can be expressed in the form of money and can be interpreted thereof. According to A. W. Johnson; “Accounting may be defined as the collection, compilation and systematic recording of business transactions in terms of money, the preparation of financial reports, the analysis and interpretation of these reports and the use of these reports for the information and guidance of management”. Now let us focus on the very topic that is cost accounting.

Cost Accounting refers to the recording of the transaction related to the cost incurred and income generated by the organization and also helps in making different financial statements and controlling costs. Thus this branch of accounting helps the management to make the company efficient and adopt cost-effective measures. But still, there are certain disadvantages of cost accounting also. Let’s discuss the advantages and disadvantages of cost accounting.

- Advantages of Cost Accounting

- Disadvantages of cost accounting

- Comparative Table for Advantages and Disadvantages of Cost Accounting

- FAQ’s on Advantages and Disadvantages of Cost Accounting

Advantages of Cost Accounting

Below are a few advantages of Cost Accounting. Let’s discuss the advantages briefly

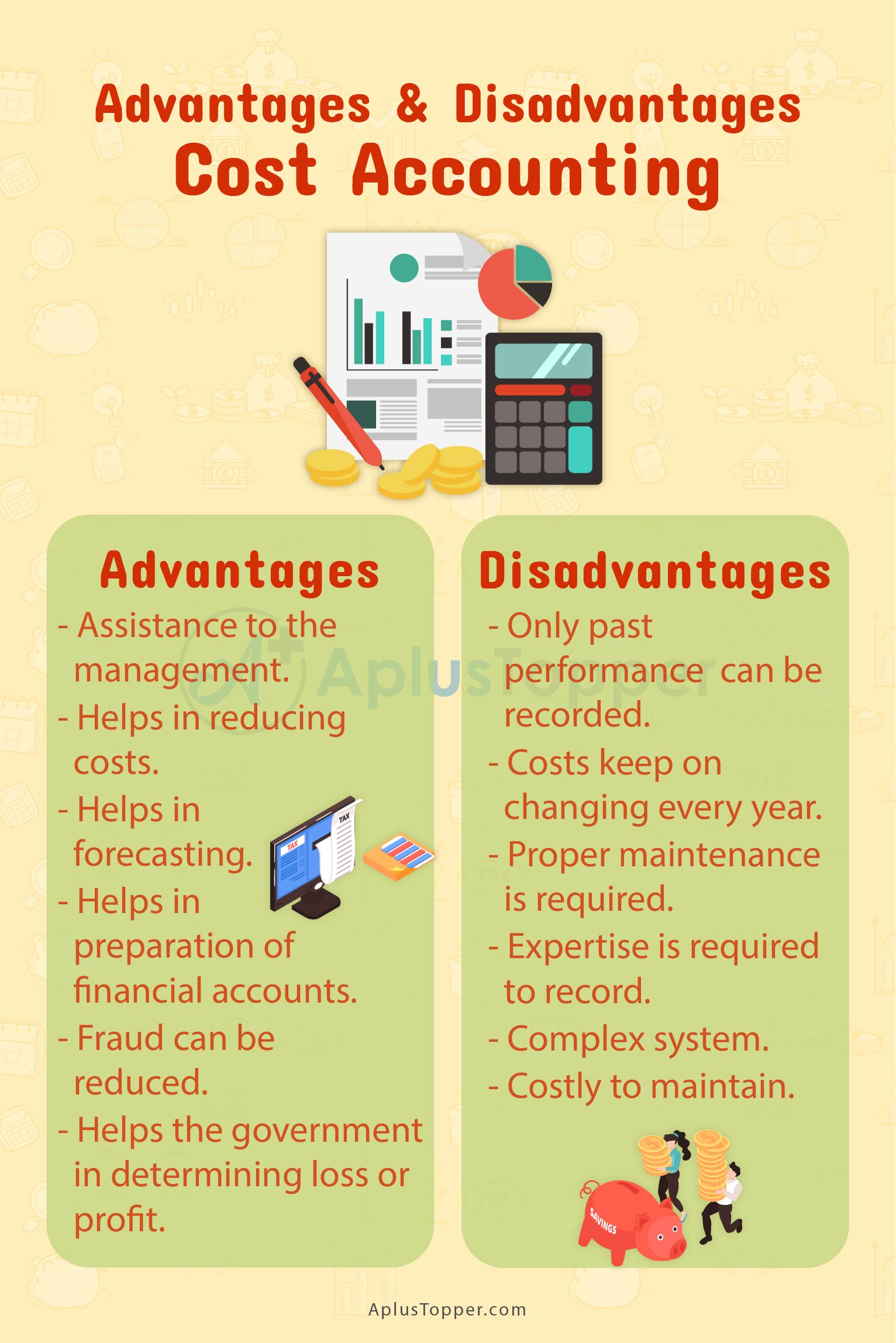

- Assistance to the management: Cost accounting is an aid to management as it helps them to understand the pattern of the cost incurred and how to control it. It also provides information about the income earned during the whole process thus helping them to forecast and manage the resources.

- Helps in reducing costs: As we already discussed it give a platform to management to forecast, evaluate and decide how to control the cost, therefore cost is reduced to a much extent. Also, reduced cost helps to earn more profit.

- 3. Helps in forecasting: The best part of cost accounting is it helps to forecast and take decisions. Experts of accounting have to make certain accounts to get through with the situation of the organization and act accordingly. They can compare and provide cost estimates that help management to make a decision and also help in locating wasteful activities.

- Helps in preparation of financial accounts: Proper estimation of costs helps in preparing the final accounts and estimates whether an organization has profit or loss. Profit and loss accounts and balance sheets are prepared with the historical costs thus financial accounts can easily be made.

- Fraud can be reduced: As there is continuous assessment of cost and management is involved to control the cost therefore chances of fraud can be reduced. Cost accounting runs on a certain principle if deviated the chances of fraud can be detected.

- Helps the government: Government needs information on the company’s financial statement to assess the tax and charge the tax according to the profit gained by the company. If the government finds any error in the company’s financial statement then it may assess the financial statement again and find the fault or fraud happening in the company.

- Helps in determining loss or profit: Cost accounting helps in determining the profit of the company. It’s very essential to determine the profit and losses of the company not only to assess tax but also to provide various pending payments to people whose amount is due.

Disadvantages of Cost Accounting

Let’s discuss the disadvantages of cost accounting briefly.

- Only past performance can be recorded: Cost accounting does not show the current stature of the company as all the data recorded is a historical valuation of transactions taking place. The structure of decision-making relies on the records of a company. Thus only past performances are recorded.

- Costs keep on changing every year: the cost of the raw material, labour, and other materials keep on changing due to different factors thus only estimation can be made regarding costs, and accordingly managers have to make decisions. There are various other variable factors like government policies, economy that make these changes in the cost.

- Proper maintenance is required: To calculate the cost of the company it is required ethical and proper maintenance is a must. Without maintaining proper books of account like sales books, purchase books no one could properly estimate the actual cost incurred and income generated by the company.

- Expertise is required to record: To record the books of account one should have the proper knowledge and mastery in the recording of transactions, identify and summarize in the best possible way so that the user who requires the information from the account can easily understand it. Therefore no person can easily record the transaction if he/she does not have any proper knowledge of the principles of accounting.

- Complex system: The system to record the transactions is a complex process. No one can easily understand the process if they have not learned the steps or learned about accounting. Even for experts it sometimes gets complex to estimate the correct cost.

- Costly to maintain: It’s costly to maintain the books of accounts and requires lots of clerical work to maintain various costing records. For small-scale and medium-sized businesses maintaining the costing account, books become an impossible task.

Comparative Table for Advantages and Disadvantages of Cost Accounting

| Advantages of Cost Accounting | Disadvantages of Cost Accounting |

| Assistance to the management | Only past performance can be recorded |

| Helps in reducing costs | Costs keep on changing every year |

| Helps in forecasting | Proper maintenance is required. |

| Helps in preparation of financial accounts | Expertise is required to record |

| Fraud can be reduced | Complex system |

| Helps the government in determining loss or profit | Costly to maintain |

FAQ’s on Advantages and Disadvantages of Cost Accounting

Question 1.

How is Cost accounting different from management accounting?

Answer:

Cost accounting is the process of maintaining the cost and expenses of the business and how it has to be used for purchases while management accounting is the process of maintaining books for the decision making, evaluating the performance, and cost control.

Question 2.

Why is cost accounting so expensive?

Answer:

Cost accounting involves a lot of clerical work which leads to complexity. Small and Medium-sized businesses can not make such costs to record and undergo loss. Therefore cost accounting is an expensive process.