Advantages and Disadvantages of Cashless Economy: Since the pastimes, India has always been categorized under the niche of a cash-based economy. The government seized all black money, undeclared commodities, and the recent Covid pandemic compelled contactless mortgages and boosted cashless transactions.

The government initially planned the natural route for the cashless economy in 2006 by implementing demonetization in the Indian subcontinent.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

Demonetisation pushed people to opt for cashless transactions due to the scarcity of liquid cash available to the public. The government had confiscated the majority of the black money, and many digital payment platforms came into being, which encouraged people to migrate toward cashless transactions.

Formerly, people were unwilling to accept the method of cashless transactions due to the lack of awareness, safety reasons, insufficient availability of the internet and cell phones, particularly in the rural areas.

The internet and mobile phones have arrived in every house because of the technological reconstruction throughout the last five years, making citizens adapt to the cashless transaction system.

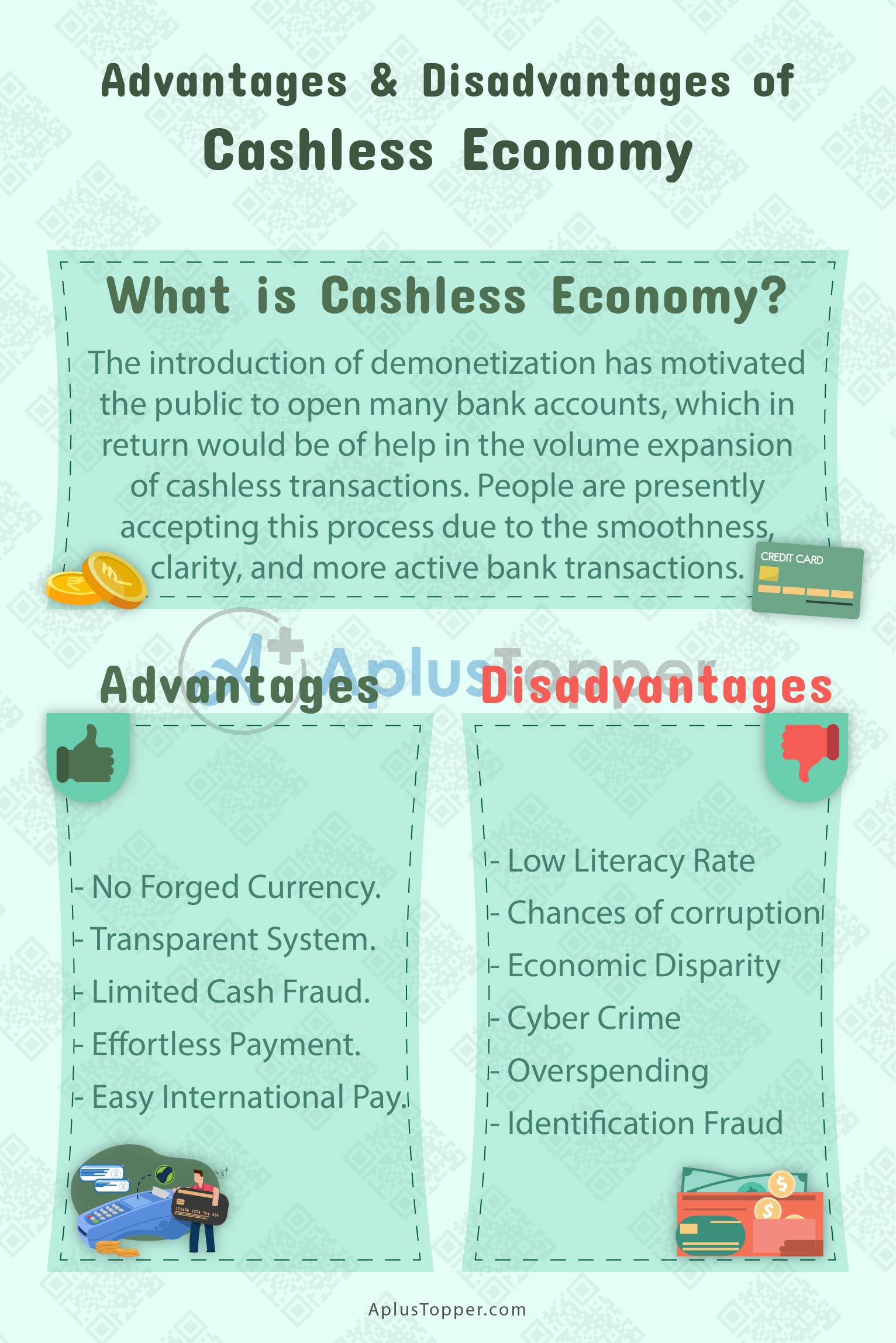

The introduction of demonetization has motivated the public to open many bank accounts, which in return would be of help in the volume expansion of cashless transactions. People are presently accepting this process due to the smoothness, clarity, and more active bank transactions.

One can say that India is undoubtedly prepared to shift to a cashless economic system owing to the change in the point of view of people of the country, evaluation of technology, increased internet amenities, and better government initiatives.

What is Cashless Economy? Advantages and Disadvantages of Cashless Economy 2022

If one was to define Cashless Economy, it could be portrayed as a condition in which the flow of cash within an economy does not exist.

Individuals should complete all the transactions via electronic channels like direct debit cards, credit cards, direct debit, electronic clearance, and payment methods such as the IMPS or the Immediate Payment Service, NEFT, or the National Electronic Funds Transfer, and RTGS or Real-Time Gross Settlement in India.

This article aims to explain in great detail the following about Cashless Economy:

- Advantages of Cashless Economy

- Disadvantages of Cashless Economy

- Comparison Table for the Advantages and Disadvantages of Cashless Economy

- FAQS on Pros and Cons of Cashless Economy

Advantages of Cashless Economy

- No Forged Currency: Forged currency values will be declared worthless. People who involve in social evil practices generally tend to accumulate their wealth in cash. With the process of a cashless economy coming into effect, this accumulated cash will be useless due to the note ban. If people invest money in the bank, the government will question them about that particular income source.

- Transparent System: Computerized payments will improve transparency and culpability. The progress of the economy with liabilities can solely take place in a cashless economy.

- Limited Cash Fraud: Theft or fraudulent acts concerning cash will be reduced to the bare minimum. Following the note ban, nobody would dare to steal money, which will promptly hinder the theft since the banks won’t accept that money anywhere.

- Effortless Payment: The cashless transaction guarantees more manageable payment across the nation. For instance, people who desire to transfer money to areas across India can effortlessly do it via the NEFT procedure. With the initiation of digitization, every individual ought to receive digital literacy at some time, therefore easing their troubles in the transfer of money and make transactions more honest.

- Easy International Pay: Exchange of currency is a monotonous job for many individuals who usually reach for international travel. Cashless payment is an excellent option for those people.

There is no need to worry about exchange rates. Citizens only need to possess a valid mobile device with their bank account linked to it.

Disadvantages of Cashless Economy

- Low Literacy Rate: The low literacy rate is one of the top causes for multiple existing issues. Beginning a cashless economy in India or building a digitally literate India is not a simple task. Many places don’t yet have electricity and water. So, computers and the internet are a far cry. A high number of the population is based in most of the rural areas, without these necessities. People in these underprivileged areas rely entirely on cash. They can be deceived if they must rely on someone for online activities.

- Chances of corruption: Despite being one of the points for digitizing financial transactions, one can’t guarantee crime to degenerate. A person exercising a bribe in money might necessitate it in kind instead of cash in the future, such as a mobile phone or a computer system (which is based solely on speculation).

- Economic Disparity: If the standard payment technique gets changed into the cashless system completely, the chances are that purchasing smartphones or devices will become necessary. In a country like India, where many citizens endeavor to provide for their daily food and necessities, purchasing a smartphone is most definitely a luxury these poor sections cannot afford. If cashless acquisition becomes the standard rule, then inequality can be seen in society because not everyone can afford it.

- Cyber Crime: India will have to toughen its cybersecurity because of hacking within banks and private accounts happening globally. Being at its nascent stage in the subject of cybersecurity, a country such as India might be extra vulnerable to very threats.

- Overspending: There is no doubting the truth that cashless transactions are more straightforward to make simply by a mere click; people can execute payments. This advantage of transactions leads to an overspending tendency, particularly among the modern generation.

- Identification Fraud: The risk of identity fraud is one of the significant disadvantages of the cashless economy in the Indian subcontinent. The rate of online fraud is growing with each departing day, expanding the perils of hacking. Not every person is perfectly tech-savvy or exceptionally aware of all the usage of technical gadgets. While attempting to make digital transactions, many people might end up dissipating their personal identity in the online forum of creepy lurkers.

Advantages And Disadvantages Of Cashless Economy In Tabular Form

| Advantages | Disadvantages |

|---|---|

| 1. Convenience and efficiency of transactions | 1. Digital divide, where not everyone has access to digital payment methods |

| 2. Lower risk of theft and loss | 2. Dependence on technology, which can be prone to outages and security breaches |

| 3. Reduced costs of printing, storing, and transporting physical currency | 3. Potential for increased surveillance and privacy concerns |

| 4. Increased transparency and accountability in financial transactions | 4. Possible impact on employment in cash-related industries |

| 5. Potential for increased tax revenues for governments | 5. Possible impact on small businesses that may not be able to afford digital payment infrastructure |

| 6. Easier to track and prevent money laundering and illegal activities | 6. Increased risk of fraud and identity theft |

| 7. Improved access to financial services for underbanked and unbanked populations | 7. Lack of anonymity in financial transactions |

| 8. Encourages financial inclusion and reduces corruption | 8. Possible negative impact on those who rely on cash, such as the elderly or low-income populations |

Comparison Table for Advantages and Disadvantages of Cashless Economy

| Advantages | Disadvantages |

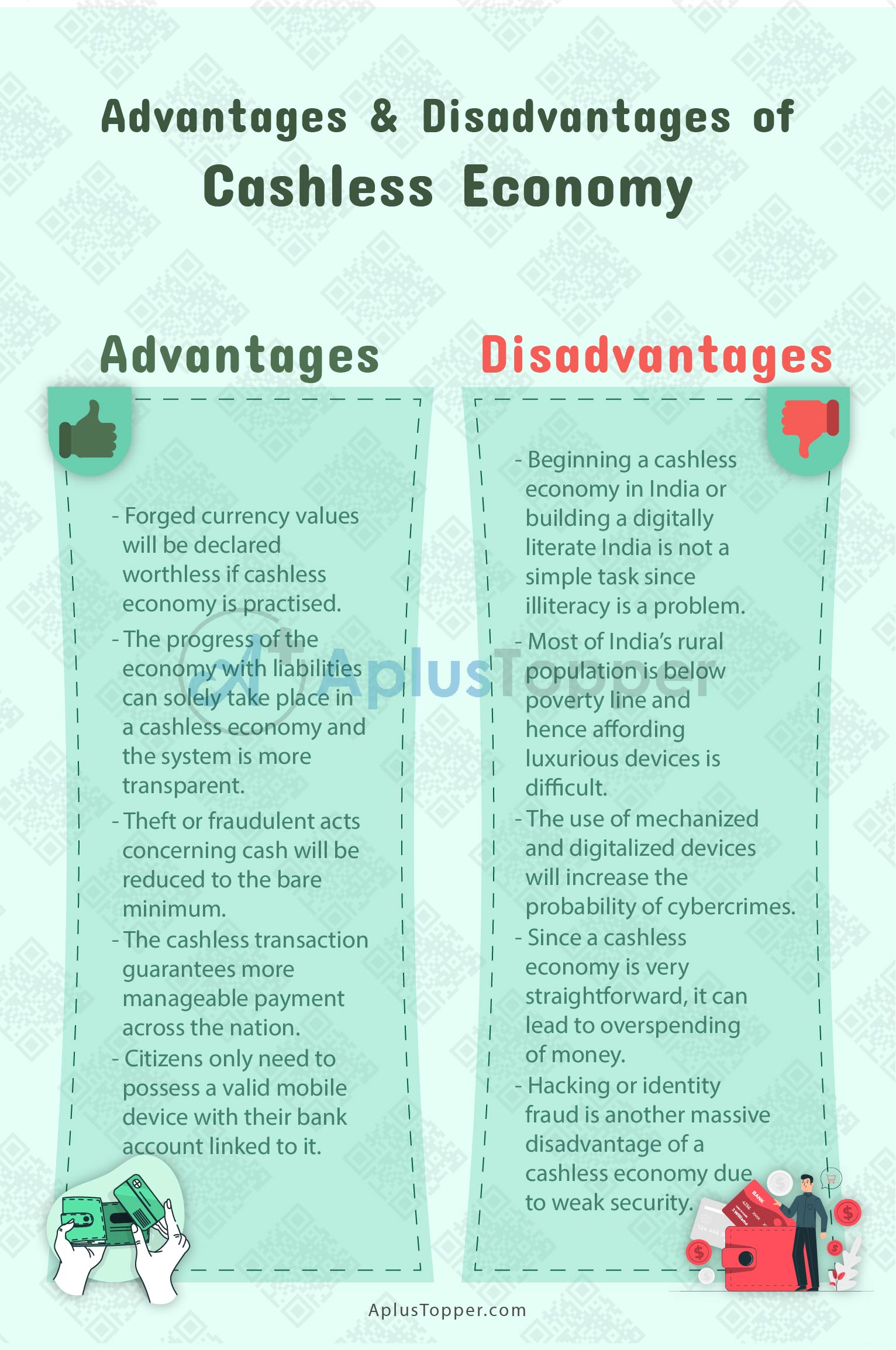

| Forged currency values will be declared worthless if cashless economy is practised. | Beginning a cashless economy in India or building a digitally literate India is not a simple task since illiteracy is a problem. |

| The progress of the economy with liabilities can solely take place in a cashless economy and the system is more transparent. | Most of India’s rural population is below poverty line and hence affording luxurious devices is difficult. |

| Theft or fraudulent acts concerning cash will be reduced to the bare minimum. | The use of mechanized and digitalized devices will increase the probability of cybercrimes. |

| The cashless transaction guarantees more manageable payment across the nation. | Since a cashless economy is very straightforward, it can lead to overspending of money. |

| Cashless payment is an excellent option for those people. Citizens only need to possess a valid mobile device with their bank account linked to it. | Hacking or identity fraud is another massive disadvantage of a cashless economy due to weak security. |

FAQ’s on Pros and Cons of Cashless Economy

Question 1.

Is the Cashless Economy safe?

Answer:

Indian citizens are quite concerned about the leaking of personal information due to hackers. More than 60% of the country thinks that a cashless transaction is not entirely secure since there is a considerable risk of hacking personal data or data breaches.

Question 2.

What does Cashless Economy mean?

Answer:

A cashless economy indicates an economic system where digital transactions such as net/ mobile banking, digital wallets, and paying by debit or credit cards substitute the traditional payment method made through cash.

Question 3.

What are the modes of payment in a Cashless economy?

Answer:

There are three modes of payment:

- Mobile Wallet

- Plastic Money and

- Net Banking