Advantages And Disadvantages Of Budget: A budget is a quantitative expression for a specific period of time. It converts strategic plans into actions. A budget has a particular structure to follow. Budgets are usually broken down for a short period of time. The period can be either monthly or quarterly. It enables one to maintain control over expenditures and helps to make expenses in an organized manner based on the pursuit. A budget may not be confined to monetary expenses only.

A budget is a plan or an estimation of financial expenses over a fixed period of time. This plan may include cash flows, revenues, liabilities, planned scale volume, and other costs. It is based on income and other expenditures. There are various types of the budget as it is not restricted to business alone.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

The main types of budgets are discussed below:

- Sales budget: The purpose of this kind of budget is to predict the performance of a company. It highlights the sales of a company.

- Production budget: The purpose of this budget is to estimate the cost of production of a company.

- Capital budget: The purpose of this budget is to understand if a company is capable of making long-term investments.

- Marketing budget: This kind of budget helps to recognize the expenses of a company on the marketing services.

- Project budget: This budget is to predict the cost of a company’s particular project.

- Revenue budget: This comprises the revenue of a company as well as the expenditures met from the revenue.

- Expenditure budget: This refers to the plan comprising the spending of a company.

- Personal budget: This is a budget for self or personal expenses.

Budgeting and budget are not the same. The process of framing a budget is called budgeting. Whereas, the budget is a formal plan. Budgeting helps in steering the goal of a company or an individual as it is an overall process of managing the expenses to meet a purpose. Whereas, the budget is an integral part of budgeting. Whereas budgeting is done through proper analysis of the budget and that makes budgeting a detailed explanation of how to use the money judiciously.

- Advantages of Budget

- Disadvantages of Budget

- Comparison Table for Advantages and Disadvantages of Budget

- FAQ’s on Advantages And Disadvantages Of Budget

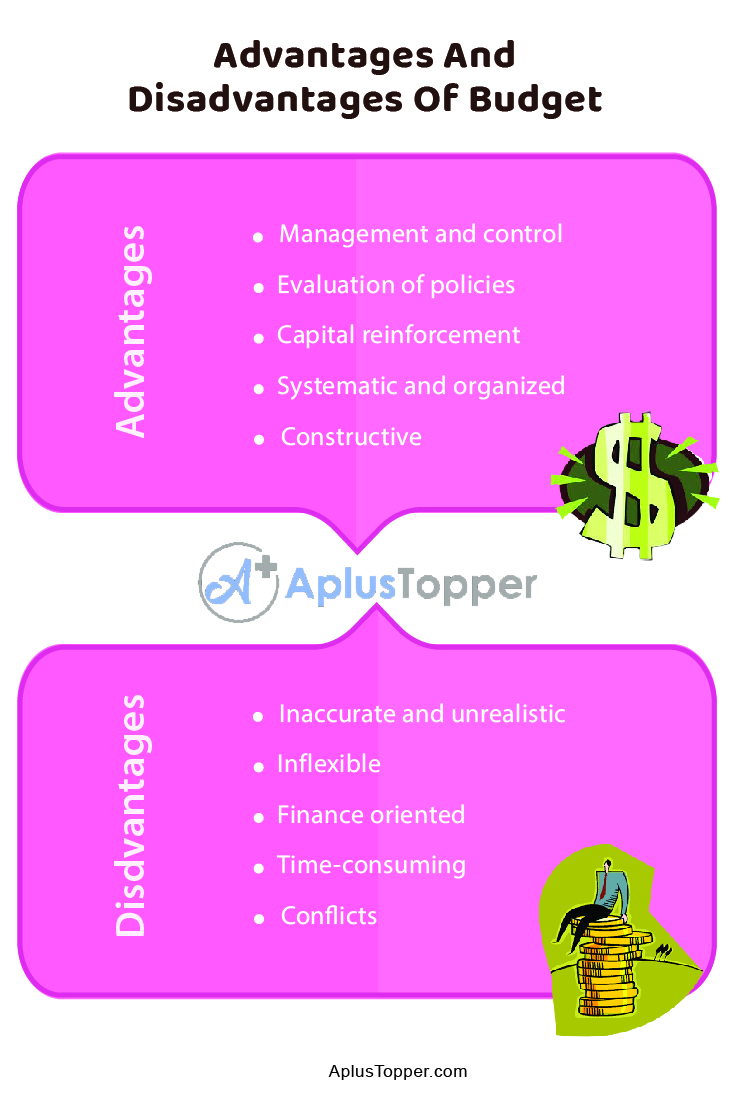

Advantages of Budget

- Management and control: A budget provides a strategic plan of action. It creates a caution over the expenses that can be borne by the institution or an individual. It, therefore, helps to check and make decisions on the basis of their capacity.

- Evaluation of policies: A budget allows an evaluation of the goals and policies which are set as guidelines for taking further decisions over the spending.

- Capital reinforcement: With a good budget a company or an individual can make the best use of their available resources and capital wherever they can be applied for more productivity and profit.

- Promotes competition: A budget can help in effective competition between organizations and individuals if they are well aware of their financial status as well as are able to make an adequate estimation on their activities and operations to earn profits.

- Systematic and organized: The approach of a budget is very systematic and disciplined which ensures a successful study and implementation of the plans and actions of the company or individual.

- Constructive: A budget does not allow any of the resources or money to go wasted as it provides a guideline to follow to make use of them constructively.

Disadvantages of Budget

- Inaccurate and unrealistic: A budget is based on assumptions and judgments. If there is any change in the business plan or implementation the whole prediction over the budget plan will get affected. The results of a budget plan, therefore, are always unpredictable and can be inaccurate sometimes.

- Inflexible: A budget is formed depending on certain policies of an institution or goals of an individual that leads to decision-making. However, if there is any need to review the financial status considering any change in the market there is no way the budget can be altered.

- Finance oriented: The budget does not support the interests and requirements of the people. It is more profit-oriented which is more quantitative while the needs of the people are more qualitative in nature.

- Time-consuming: The process of planning a budget Or budgeting is a time-consuming affair. It needs to consider all possible aspects of an organization or an individual before ensuring any expenditure or spending towards a particular goal.

- Conflicts: The failure of a budget plan can result in a lot of arising tensions and rifts within the company that ultimately get reflected by the inefficient running of the organization

Comparison Table for Advantages and Disadvantages of Budget

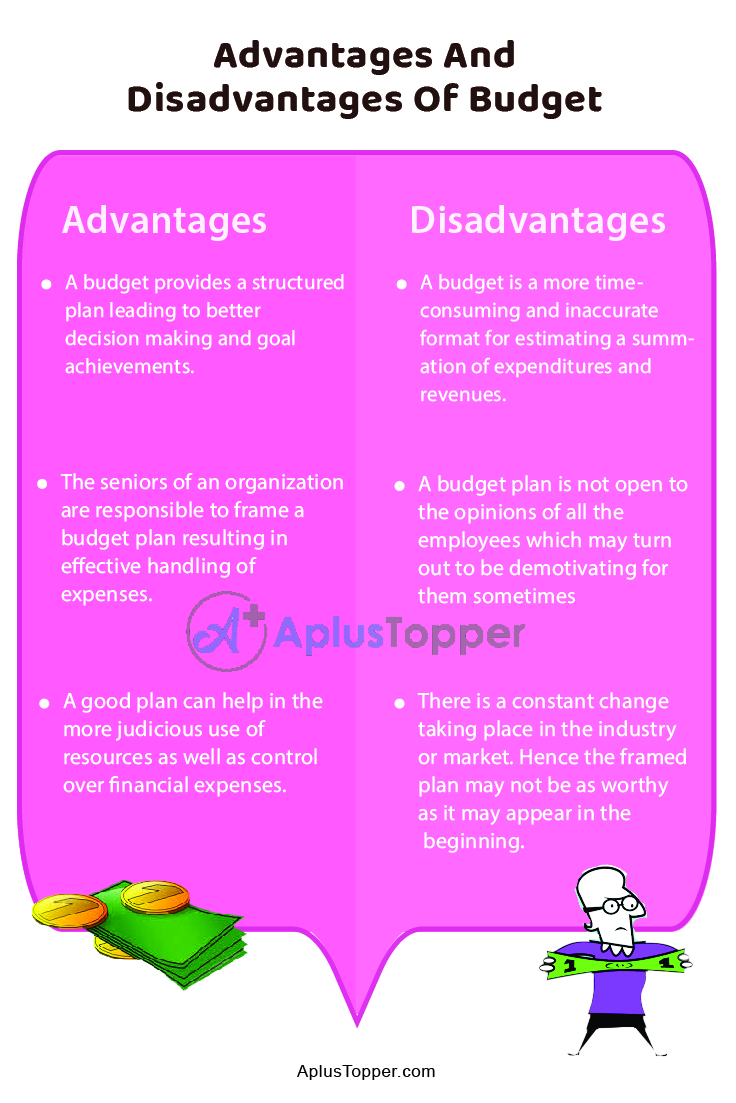

| Advantages | Disadvantages |

| A budget provides a structured plan leading to better decision making and goal achievements. | A budget is a more time-consuming and inaccurate format for estimating a summation of expenditures and revenues. |

| The seniors of an organization are responsible to frame a budget plan resulting in effective handling of expenses. | A budget plan is not open to the opinions of all the employees which may turn out to be demotivating for them sometimes |

| A good plan can help in the more judicious use of resources as well as control over financial expenses. | There is a constant change taking place in the industry or market. Hence the framed plan may not be as worthy as it may appear in the beginning. |

| The budget reflects the coordination between the employees of an organization as it takes them towards the same end. | The target achieved by one department of a company might be found difficult to be achieved by the other departments. |

| A budget assists the business schemes throughout with the best utilization of the available resources. | Sometimes the budgeting might be very costly than the actual business plan which may or may not be affordable by all types of companies. |

| A budget is set on assumptions and predictions as there is scope to change. | If a budget is set at low levels that might bring no benefits to an organization. |

FAQ’s on Advantages And Disadvantages Of Budget

Question 1.

What is the language of budget?

Answer:

The term “Budget” is originally derived from the French word ‘bougette’, which means a leather bag in the French language.”

Question 2.

What are the main types of budgeting methods?

Answer:

Out of many the main types of budgeting methods are Incremental budgeting, Activity-based budgeting, Value proposition budgeting, and Zero-based budgeting.

Question 3.

What is a budget used for?

Answer:

A budget is a strategic plan for achieving a particular goal and making the best use of resources and for judicious expenditures. It helps in financial stability through control and maintenance of financial resources.

Question 4.

What is the key to successful budgeting?

Answer:

The key to successful Budgeting is a consistency to bring in benefits to an organization more.