Advantages and Disadvantages of Accounting: The advantages of accounting include Maintenance of business records, Preparation of financial statements, Comparison of results, Decision making, Provides information to related parties, Evidence in legal matters.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is Accounting? Advantages and Disadvantages of Accounting 2021

Accounting is the art of classifying, summarising and recording in a significant manner and in terms of money, events and transactions which are, in part at least of financial character, and evaluating the results thereof.

Accounting is involved with the documentation of financial transactions, then classifying and reviewing those transactions and report the financial information to users.

Accounting can be important for stakeholders of an entity who want to comprehend whether that entity is gaining a profit or incurring losses. Individuals also wish to know whether the capital investment in the business is decreasing or increasing during the period of accounting.

Let’s discuss some of them:

- Advantages of Accounting

- Disadvantages of Accounting

- Comparison Table for Advantages and Disadvantages of Accounting

- FAQs on Pros and Cons of Accounting

Here are a few of the advantages and disadvantages of accounting:

Advantages of Accounting

- Accounting represents Financial Position: Accounting represents the financial position of a particular or group of businesses. The financial performance of the company in the last year is often useful to compare the performance of the other firms.

- Assistance to Manager: An account renders the essential data to the managers in the form of a balance sheet and profit & loss account that benefits decision-making.

- Replaces Memory: Accounting in a systematic and timely manner records all the transactions of an individual/firm. If one requires the information in the future, they can easily obtain the information in books of accounting.

- Benefits in Comparison: The format of accounting for different businesses is the same, so one can efficiently compare their business performance with the performance of other organisations. One can also compare their performance with performance rendered last year.

- Benefits in Calculation of Tax Liabilities: The profit & loss account presents the current year profit so that the individual/firm can effortlessly calculate the tax liability.

- Benefits in Decision-Making: Accounting assists in taking major decisions for the growth of the organisation. Such decisions can include deciding the price of the product or checking over the expenses of employees.

- Serves as an Evidence of Transaction: All the transactions are recorded and listed so that one can utilise the account as evidence if something wrong occurred with the business.

- Maintenance of Records of a Business: All the financial transactions concerning the respective year are recorded systematically in the books of accounts. It is not permissible for management to commemorate each and every transaction for a long time due to their complexities and size.

- Establishment of Financial Statements: Financial statements that include Profit and loss account, Balance Sheet and Trading can be settled easily if there is a precise recording of transactions is maintained. Precise recording of all the financial transactions is extremely crucial for the preparation of the financial statements of the entity.

- Comparison of Results: It facilitates an easy comparison of the financial returns of one year with another year. Also, the management can investigate the systematic recording of all the financial transactions in accordance with the policies of the individual.

- Decision Making: Decision making becomes more straightforward for management if there is a particular recording of all the financial transactions. Accounting information facilitates management to make budgets and coordinate and plan the future activities of various departments.

- Evidence in Legal Matters: The precise and systematic records of the financial transactions function as evidence in the court of law.

- Provides Information to Related Parties: It executes the financial information of the organisation prepared to stakeholders like customers, government, owners, creditors, employees, etc., efficiently.

- Helps in Matters of Taxation: Various tax authorities like indirect taxes, income tax depends on the accounts reported by the management for settlement matters related to taxation.

- Valuation of Business: For precise valuation of the accounting information of the entity’s business can be utilised. Thus, it assists in measuring the value of the entity by utilising the accounting information in the case of the sale of the entity.

- Replacement of Memory: Proper recording of accounting transactions substitutes the requirement to remember transactions.

Disadvantages of Accounting

- Expresses Information of Accounting in terms of Money: Non-financial transactions cannot be furnished effect to in books of accounts. Only transactions of the financial constitution are calculable by the accountant. In fact, financial transactions are manifested in terms of money.

- Accounting Information is based on Estimates: There are a few accounting data that are based on estimates. Thus, imprecision in estimates is conceivable.

- Accounting Information may be Biased: Accountants’ personal influence concerns the accounting information of the entity. Different methods of depreciation methods, treatment of revenue, capital expenses and inventory valuation etc., can be selected by the accountant for measurement of the income of the entity. Hence, due to the lack of objectivity, the income arrived in certain cases might be incorrect.

- Recording of Fixed Assets at the Original Cost: There can be a difference between the current replacement cost and the original cost of a fixed asset due to the change in technology, efflux of time, etc. Thus, the balance sheet may not present the real financial status of an entity.

- Accounts Manipulation: The management or accountant can misrepresent or manipulate the profits of an entity.

- Money as a Measurement Unit changes in Value: Stability in the rate of money is not conceivable. Accounting information will not reveal the true financial position if variations in the price level are not acknowledged.

- Accuracy is Not Guarantee: Accounting registered all the financial transactions with the preceding value. It does not acknowledge the market value or real value of liabilities and assets. The values can be easily manipulated.

- Accounting Disregards Qualitative Element: It recorded all the financial transactions which are presented in the monetary form. But do not acknowledge staff, relations, public relations and emotion.

- Can be Costly for a Small Firm: The small firm does not possess lots of finance, so obtaining a proper account and auditing it from a chartered accountant is very expensive.

- Privacy of firm: There is no privacy for those who develop accounts as it must show all the general public, including their competitors.

Advantages And Disadvantages Of Accounting In Tabular Form

| Advantages of Accounting | Disadvantages of Accounting |

|---|---|

| Helps in financial planning and decision making | Accounting may be time-consuming and require specialized skills |

| Provides accurate and timely financial information for stakeholders | Can be expensive to hire professional accountants or purchase accounting software |

| Helps in budgeting and cost control | May require significant investment in hardware and software |

| Facilitates compliance with legal and regulatory requirements | Accounting can be complex and difficult to understand for non-specialists |

| Enables better tax planning and management | Accounting may be subject to errors or fraud, leading to financial misstatements |

| Provides insights into business performance and profitability | Accounting standards and rules may change frequently, requiring ongoing training and updates |

| Helps in managing cash flow and liquidity | Accounting may focus on historical data rather than future projections |

| Helps in tracking assets, liabilities, and equity | Accounting may not capture non-financial performance metrics such as customer satisfaction or employee morale |

| Enables benchmarking against industry peers and competitors | Accounting information may be subject to confidentiality concerns |

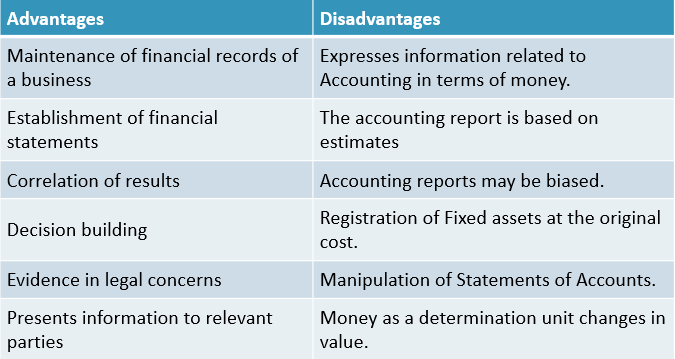

Comparison Table for Advantages and Disadvantages of Accounting

| Advantages | Disadvantages |

| Maintenance of financial records of a business | Expresses information related to Accounting in terms of money. |

| Establishment of financial statements | The accounting report is based on estimates |

| Correlation of results | Accounting reports may be biased. |

| Decision building | Registration of Fixed assets at the original cost. |

| Evidence in legal concerns | Manipulation of Statements of Accounts. |

| Presents information to relevant parties | Money as a determination unit changes in value. |

| Assists in taxation affairs | |

| Business Valuation | |

| Replacement of memory |

FAQ’s on Pros and Cons of Accounting

Question 1.

What are the few benefits of being an accountant?

Answer:

Benefits of Becoming an Accountant

- Accountants Hold a Greater Understanding of Finances.

- The Growing Need for Accountants.

- Possibilities for Advancement.

- The Pay Range for Accountants is Aggressive.

Question 2.

What are the cons of accounting?

Answer:

Cons of an accounting career:

- The education is ongoing. If one becomes an accountant, the learning doesn’t stop.

- The work can appear dull.

- There is an unavailable season.

- The work can be extremely stressful.